Some experts believe that artificial intelligence (AI) could completely disrupt the insurance industry as we know it. So what does the future hold for insurers? Let’s take a closer look at the impact of AI on the future of insurance. The risks insurers cover and the ways they underwrite, distribute, and manage claims are also changing. In an increasingly digitalized world some risks will become less frequent, while others, like cyber, will gain in importance, and again others may cease to exist.

Technology and new data sources are changing our economy and society fundamentally, and promise to transform the insurance industry as well.

Digitalization is changing the role of insurance, from pure risk protection towards predicting and preventing risks.

What is Artificial Intelligence in insurance?

Although it’s an industry that has proven resistant to change for centuries, insurance is undergoing a digital revolution. With the advent of advanced machine learning algorithms, underwriters are bringing in more information to better gauge risk and offer tailor-made premium pricing.

On the back end, AI is streamlining the insurance process to connect applicants with carriers more efficiently and with fewer errors.

- Artificial intelligence (AI) can help insurers assess risk, detect fraud and reduce human error in the application process. The result is insurers who are better equipped to sell customers the plans most suited for them.

- Customers benefit from the streamlined service and claims processing that AI affords.

- Some insurers think that, as machine learning progresses, the need for human underwriters could become a thing of the past – but that day might be years away.

This rapid change means big things for insurers and applicants alike. Here’s how AI is on the frontier of the insurance industry and where it might be heading in years to come.

Machine learning, specifically natural language understanding (NLU), enables insurers to pore through more abstract sources of information, such as Yelp reviews, social media postings, and SEC filings, pulling pertinent information together to better assess the insurance carrier’s potential risk.

What is AI and how does it work?

The insurance business is one of the most competitive industries and faces multiple challenges. These challenges are not just caused by changing customer expectations and behavior or by the advent of ‘disruptive‘ organizations from outside the industry, although that is a growing concern for quite some time now as well.

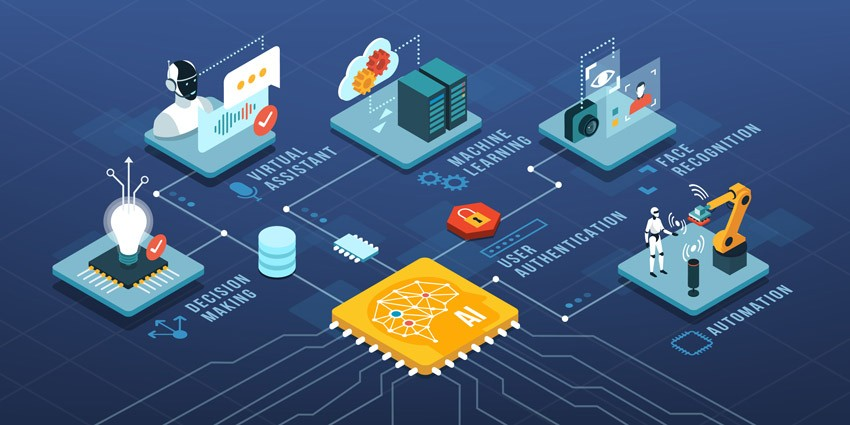

AI is short for artificial intelligence. AI is a branch of computer science that deals with the creation of intelligent agents, which are systems that can reason, learn, and act autonomously.

The phrase “artificial intelligence,” was first used in 1955 by computer scientist John McCarthy, who defined it as “the study and engineering of making intelligent machines.”

In fact, artificial intelligence research deals with the construction of algorithms that allow computers to perform tasks that would normally require human intelligence, such as visual perception, natural language understanding, and decision-making.

In recent years, AI has made significant progress in a number of different domains, including facial recognition, robotics, and machine translation. However, there are still many challenges that need to be addressed before AI can reach its full potential.

For example, current AI systems often lack the reasoning ability of humans and they are also susceptible to biases and errors. As AI technology continues to develop, it’s likely that these limitations will be overcome and that AI will become increasingly important in a wide range of areas.

AI is a wide-ranging branch of computer science concerned with building smart machines capable of performing tasks that typically require human intelligence.

Coupled with alternative data and advanced analytics, AI should have a significant impact across the entire insurance value chain—if it is deployed correctly and those using it are properly trained.

According to Deloitte’s global outlook about Digital and Talent Transformation, AI refers to the simulation of human intelligence in machines that are programmed to think like humans and mimic their actions. The term may also be applied to any machine that exhibits traits associated with a human mind such as learning and problem-solving.

The impact of AI on the insurance industry

The insurance industry has been slow to adopt new technologies, but that’s starting to change. In particular, insurers are beginning to explore the potential of artificial intelligence.

AI can be used in a number of ways, from pricing insurance products and figuring out how to get clients for insurance business to streamline claims processing. By harnessing the power of AI, insurers can gain a competitive edge and improve the customer experience.

One area where AI can have a major impact is underwriting. Currently, underwriters rely on manual processes and antiquated data sources. This often leads to delays and errors.

AI can help to speed up the underwriting process by providing accurate and up-to-date data. This, in turn, will enable insurers to offer more competitive prices. AI can also be used to detect fraud. By analyzing large data sets, AI can identify patterns that may indicate fraud. This will help to protect insurers from losses and improve the bottom line.

Cloud technology should be considered foundational for achieving most digital transformation goals, as a key enabler of workforce, technology, and operational flexibility. At the same time, cloud often provides improved expense management, greater speed of deployment, and more rapid scaling of products.

72% of outlook respondents said they planned to increase spending on cloud, which would boost adoption across the board.

The applications that insurers first started deploying on cloud platforms are systems of engagement such as portals, digital customer engagement channels, and consumer analytics. However, only a small number of insurers have a majority of their systems of record (such as underwriting, policy administration, billing, or claims systems) on the cloud.

That’s likely to change fairly soon, however, as the ability of cloud platforms to seamlessly integrate with insurer vendors and partners makes a compelling case for accelerating the migration of core applications to the cloud.

How Artificial intelligence is helping the underwriting process in insurance?

In the commercial lines, every application posits a new set of risk variables that are becoming increasingly complicated to assess and account for in the risk analysis strategy with precision.

Using artificially intelligent systems that assess an application profile against billions of data points accrued from 3rd party sources, underwriters can now gain visibility into the most relevant risk factors associated with a client profile.

In specialty lines like cyber insurance, gaining complete visibility into the risk exposure of an enterprise’s IT systems and appropriately translating these risks into profitable numbers for the business can be an impossible task for humans.

Small businesses with under $25M in revenue were particularly vulnerable in 2021. We saw a 56% increase in the average claim cost, increasing to $149,000 by the end of 2021. We also observed dramatic increases in the frequency of attacks; small businesses also saw a 40% increase in ransomware attacks and a 54% increase in funds transfer fraud incidents. Small businesses are especially vulnerable to threat actors as they often lack the resources to respond quickly.

While cyber incidents can be equally devastating to businesses of any size, we’ve seen a material uptick in claims targeting small and midsize businesses.

The current commercial insurance sector is symptomatic of inefficient risk management. According to a McKinsey study, this is evident from a 23-28% difference in the loss ratios logged by the top and the bottom quintile of performers.

AI-driven underwriting systems assist the underwriters by accurately quantifying unstructured and qualitative data points – like social media and news feeds, reliable statistics from public sources, and 3rd parties – and convey a comprehensive risk profile to the underwriters in a highly interpretable manner. This can drastically improve loss-ratios and standardize a 360-degree approach to risk analysis across the insurer’s underwriting function.

Use of Artificial Intelligence

AI is increasingly being leveraged to enhance the customer experience while creating efficiencies for the carrier and service team. Chatbots that can intelligently route customers to the best available agent is a popular use, but Artificial Intelligence can do much more. For instance, when a policy is being written, insurers can apply

AI to conduct background research and more closely monitor for red flags. AI is emerging as a valuable tool from a risk perspective as well, providing a more holistic view of customers and helping to determine if there have been any involved with fraud.

The field of artificial intelligence is moving so quickly that even experts are having trouble keeping up with developments. So how can the rest of us get to grips with the dramatic changes that are coming?

In an effort to provide a clearer picture of the state of AI, a team led by Stanford University has compiled the first index to track activity and progress in the field.

The inaugural AI Index begins by telling readers that “without the relevant data for reasoning about the state of AI technology, we are essentially ‘flying blind’ in our conversations and decision-making related to AI”.

AI Detecting fraud

Fraud is a major concern for insurance companies, and AI is a key watchdog in the fight against fraudulent claims. As Samsung notes in a blog post about insurance fraud prevention, it’s all about detecting patterns that might escape human cognition:

French AI startup firm Shift Technology incorporates this technology in their fraud prevention services, which have already processed over 77 million claims.

The cognitive machine learning algorithms have reached a 75% accuracy rate for detecting fraudulent insurance claims. The ML algorithms provide details on suspicious claims with potential liability and repair cost assessments and suggest procedures that can resolve and enhance fraud protection.

The ability of machine learning to assist in spotting suspected fraud is well established, but human-led data science is just as capable so far.

The key difference over time will be one of cost. Professional criminals will keep abreast of industry-leading fraud indicators and adapt their behavior to suit. Human data scientists will need to iterate their analysis over time to keep pace, while machine learning algorithms train themselves over time based on observable changes in the underlying data.

AI Reducing human error

The distribution chain in the insurance industry is winding and complex. A series of middlemen examine information between the insured and the carrier, leading to a lot of human error and manual work that slows the process. However, AI is starting to fix that problem.

Algorithms can reduce the time and number of errors as information is passed from one source to the next. By logging in to a portal and uploading a PDF, the insurer reduces the amount of data entry and reentry and increases the accuracy.

With machine learning, I think we’ll be able to do a much better job giving the consumer that advice automatically. So it’s putting the onus neither on the agent nor on the customer – who frankly doesn’t have the experience or knowledge – but letting the data provide the advice.

AI Claims processing

Insurers exist to process claims and help customers cover them, but claims assessment isn’t easy. Agents must review several policies and comb through every detail to determine how much the customer will receive for their claim. That can be a painstaking process – and AI can help.

Machine learning tools can rapidly determine what’s involved in a claim and forecast the potential costs involved. They may analyze images, sensors and the insurer’s historical data. An insurer can then look over the AI’s results to verify them and settle the claim. The result benefits both the insurer and the customer.

AI Digitization of insurance customer service

The insurance industry is familiar with the new social reality that is taking place. The clients, policyholders, and employees of entities are becoming increasingly digital and, above all, they are more and better informed. Adapting to the situation and meeting new customer expectations, based on (See The Future of Digital Transformation in Insurance), the demand for new services and products, and an improved experience, are probably the biggest industry challenges.

The digital transformation must be based on defining a strategy and the roadmap, and then ensuring the effective execution of the digital initiatives that improve and adapt key aspects of entities’ value chains.

These initiatives must take their surroundings into consideration, but above all, they must adapt to an organization’s degree of digital maturity and the business model defined by the types of clients, distribution channels, products/services sold, internal processes, organizational structure, culture, history, and individual brand features.

More than 50% of customers consult online channels, insurance company websites, comparison platforms, and social media before purchasing an insurance policy.

With the onset of digitalization, entities with traditional customer relationships based on agents and brokers, or direct channels such as call centers, are focusing on digital channels, especially those that use mobile devices, social media, or the expansion of new online features, to provide comprehensive solutions for multi-channel customers (see Insurance Digital Full-Funnel Marketing).

However, the challenge lies in creating an integrated customer experience at all the points of contact with the company (customer journey) by making the necessary adjustments to processes, products, and services, as well as by managing the change in a gradual manner.

Does AI in the insurance industry benefit the consumer?

Widespread industry adoption of a certain technology often reflects the benefits it offers to companies in the sector, sometimes with no obvious effects on the customer. That isn’t the case with insurance industry AI, which does have clear advantages for the customer.

AI-assisted risk assessment can help insurers better customize plans so that customers pay only for what they actually need. It can also minimize human error in the application process, so customers are more likely to receive plans that properly fit their needs. Of course, it can also expand an insurer’s customer service options and streamline the claims approval process. The end result is customers getting what they need.

What challenges will insurers face in adapting to AI technology?

As AI technology continues to develop, insurers will need to adapt to stay competitive. One challenge will be in meeting customer expectations.

A subset of artificial intelligence is machine learning (ML), which refers to the concept that computer programs can automatically learn from and adapt to new data without being assisted by humans. Deep learning techniques enable this automatic learning through the absorption of huge amounts of unstructured data such as text, images, or video.

Mitsui Sumitomo Insurance, for example, utilizes an AI-powered “agent support system” to better identify customer’s potential needs by analyzing internal and external data.

The system has provided agents with 860,000 individual and 80,000 corporate sales leads per month, with agent productivity increasing between 20% and 130%, compared to the conventional sales model.

As customers become more accustomed to the convenience of AI, they will expect insurers to provide similar levels of service. This could mean anything from providing 24/7 customer service to developing new types of insurance products.

How can insurers prepare for the future of AI in the insurance industry?

The insurance industry is already feeling the impact of artificial intelligence. As mentioned above, policy pricing, fraud detection, and claims processing are just a few of the areas where AI is making its presence felt, and this is just the beginning. Insurers who want to stay ahead of the curve need to start preparing for the future of AI in the insurance industry.

One of the key areas that insurers need to focus on is data. AI relies on data to function, so insurers need to make sure they have access to high-quality data sets.

They also need to invest in data infrastructures, such as storage and processing capabilities. Additionally, insurers need to create policies and procedures for managing data responsibly.

Survey indicated that only 24% of respondents were currently training AI and machine learning programs to identify algorithmic biases and ethical dilemmas.

Insurers should be taking more proactive measures to ensure that automated decision-making is equitable and fair to policyholders and stakeholders and does not result in additional compliance and reputational risks.

Another important area for insurers to focus on is talent. Insurers will need to attract and retain talented individuals with experience in AI. They will also need to invest in training for their existing workforce. Additionally, insurers need to create an environment that’s conducive to innovation.

By preparing for the future of AI in the insurance industry, insurers can position themselves for success in the years ahead.

The future of insurance AI

The insurance industry has only begun its foray into AI, and companies are already experimenting with new ways to incorporate it into their day-to-day operations in anticipation of further technological development.

It’s the very early days of AI. For menial, repetitive tasks, we put the computer on it … but we’re a ways away from a computer underwriter. We’re really just augmenting humans at this point.

That’s still a significant change in the industry. Underwriters at Argo Group are now beginning to manage portfolios, rather than review every single submission. The more standard, predictable claims are handled by machine learning algorithms, Breen said, and the human underwriter is essentially fine-tuning the entire process and intervening in cases that need higher-order decision-making.

Even more potential for streamlining the underwriting process. The number of applications a human underwriter is required to handle will significantly drop as machine learning finds its place in the insurance industry.

……………………………..

AUTHORS: Adam Uzialko, Aubrey Moore.