NFT marketplaces must be proactive in risk management to mitigate these repetitional risks and issues. Sanctions screening solutions are also becoming increasingly essential for NFT-based platforms. The hype around non-fungible tokens (NFTs) doesn’t seem to be calming down. But it still isn’t clear how exactly businesses can benefit from this technology and whether it’s reasonable to launch an NFT project to gain a competitive advantage. Elliptic data-driven analysis into the prevalence of money laundering, terrorist financing, scams and sanctioned entities finds that these financial crimes represent a small but notable portion of overall non-fungible token (NFT)-related trading activity.

Elliptic`s report provides and explains the trends summarized above to understand the nature, origin and scale of these select financial crime risks. Guidance is also provided on regulatory matters concerning NFTs and the utilization of blockchain analytics to detect, investigate and prevent exposure to illicit activity. The report is intended for all stakeholders engaging with NFTs. It provides red flag indicators and recommendations to improve the safety, security and enjoyment of partaking in this rapidly growing industry.

NFT or Non-Fungible Tokens is based on Ethereum-Blockchain Technology. It is a unique digital representation of an item, which can be in the form of an image, video, or audio. It provides the owner of the digital item a unique and clear proof of ownership. As NFTs are unique, they are not replicable similar to an individual game character, artwork, or collectible.

NFT as a market is growing as NFT marketplace such as Opensea currently has listed more than 24 million tokens. As per Forbes, trading in NFTs in 2021 reached $23 billion. The market registered new highs in 2021, with an NFT called “Beeple’s the First 5000 Days” being sold for over $69 million. Growth in the market follows the boarding of the NFT bandwagon by celebrities and global brands such as Nike and Visa investing in the domain. Besides artwork, NFT can be used in multiple sectors, such as Real Estate, to accelerate the verification and transfer ownership by using smart contracts.

What are NFTs?

NFT stands for non-fungible token – a blockchain-based asset that can have specific properties and value. They differ from fungible cryptoassets such as Bitcoin, Ether or Tether, which are interchangeable with any other unit of the same asset (e.g. one Bitcoin has the same value as any other Bitcoin).

Fungible assets can be analogized as a pile of 25 cent coins, which will have the same value regardless of how rusty or shiny they are. NFTs, however, are more akin to Pokémon cards. These have a different retail value depending on the unique characteristics of the Pokémon character. While an ungraded Weedle #69 (Pokémon Base Set) may be worth a few dollars at most, a 1999 First Edition Shadowless Holographic Charizard could fetch well over $100,000.

A Brief History of NFTs

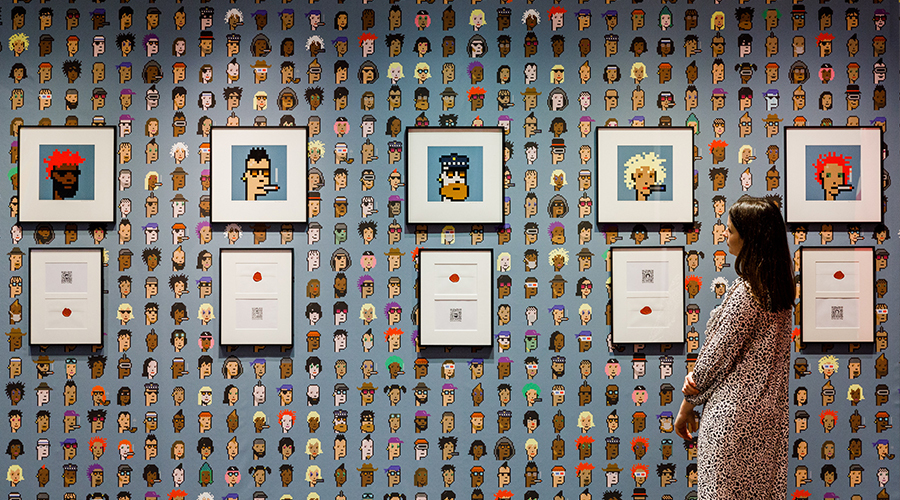

Despite being popularized in 2021 with the growth of NFT collections such as CryptoPunks and Bored Ape Yacht Club2 – the origins of non-fungible tokens can be traced back to 2012/13. This is due to some early thinking in the Bitcoin community with the idea of “coloring” Bitcoins – or parts thereof – to enable them to represent different values or metadata.

A whitepaper with this idea was created by Ethereum Co-founder Vitalik Buterin and an early implementation of this was the Counterparty marketplace, which sold early-NFT versions of trading cards and memes linked to the Bitcoin blockchain.

However, where the concept of non-fungible cryptoassets really started to grow was in 2017 with the CryptoPunks collection – 10,000 24-bit artworks created by a modification of the ERC20 standard.

According to NFT Market Size Report, at the end of 2017, the Ethereum blockchain was brought to a standstill with the introduction of the ERC721 standard, with the CryptoKitties project – digital collectible and breedable cats – being the first to get mainstream attention and adoption. By December 2017, over 25% of transactions on the Ethereum blockchain were related to the buying and selling of these digital cats.

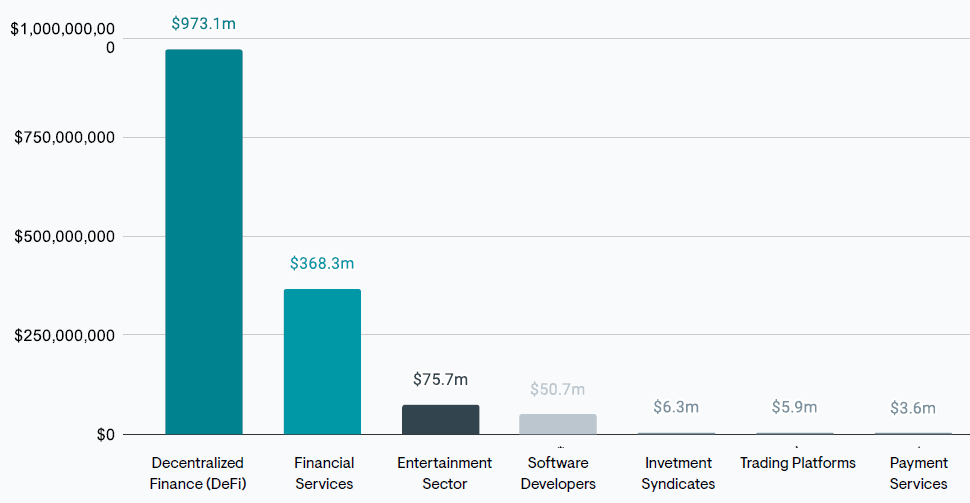

ETH investments into NFTs originating from different sectors (Q4 2017-Q2 2022)

ERC stands for Ethereum Request for Comment. They are official specifications and implementation details for a piece of functionality on the Ethereum blockchain. Each ERC starts life as an Ethereum Improvement Proposal (EIP) which is discussed and peer reviewed before it may make its way into an official ERC. The number represents the unique identification number for the proposal.

The key elements and components of NFTs

- Blockchain — A decentralized ledger across a peer-to-peer network that handles and stores transactions and allows for executing smart contracts. The most popular blockchain platform for NFT projects is Ethereum.

- Smart contracts — Programs that execute automatically when predefined conditions are met. Smart contracts enable parties who do not know each other and decentralized participants to conduct fair exchanges without intermediaries.

- Blockchain address — A unique identifier for a user to send and receive assets. It usually consists of a number of alphanumeric characters generated from a pair of public and private keys.

- Cryptocurrency wallet — A place where a user can securely keep their coins and tokens. Crypto wallets help to securely exchange and store NFTs.

How NFTs work

The ERC721 contract was proposed in January 2018 to provide functionality above and beyond the existing ERC20 standard for fungible cryptoassets – notably the introduction of non-fungible tokens. To create a new NFT, creators deploy a new ERC721 contract and specify collection-level information as well as creating the ability for individual NFTs within the collection to have unique properties through metadata.

One alternative to the ERC721 standard that is growing in popularity is the ERC1155 standard, which allows for efficiencies such as batch transaction processing and the ability to create both fungible and non-fungible tokens from one ERC1155 contract.

Both are common across Ethereum and Ethereum-compatible blockchains such as Binance Smart Chain, Polygon and Avalanche. However, there are also NFT standards across other blockchains such as FA2 on Tezos, Tron’s TRC-721, Flow’s representation as resource objects, Cardano’s use of PolicyIDs and metadata for native NFTs, and Metaplex’s Solana standard.

A new token standard ERC-4907 reached the final stages of development; one which will allow the user to loan out their non-fungible token (NFT). Before the ERC-4907, every time you transferred the NFT, you lost your ownership. But by splitting up ownership and usage rights, it’s now possible for NFTs to be loaned out and rented in permissionless ways.

ERC-4907 adds a new role in the NFT standard, splitting who is the owner and who is the user of an NFT – making “renting” possible. The renter can use the NFT until the loan period expires, automatically sending the NFT back to its owner.

To be sure, rentable NFTs are not yet officially available. Reaching “final” status means that the Ethereum proposal, or project aiming to improve the Ethereum blockchain, can no longer be updated. Other builders can now incorporate that proposal into smart contracts without fear of the developers later changing it.

NFT Use Cases

A popular use for non-fungible tokens is developing communities or online prestige through profile picture projects (PFPs). However, there are use cases beyond this social media trend. Some of the popular trends include digital artwork, metaverse functionality, exclusive membership/ticketing and gaming.

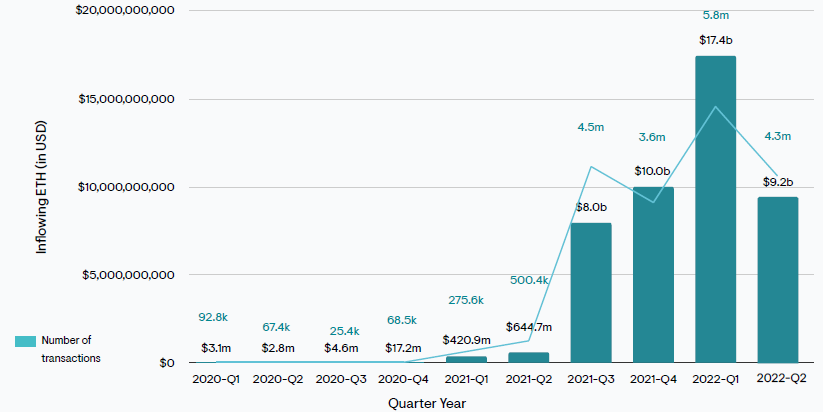

ETH flowing into select Ethereum-based NFT platforms by quarter year

1. NFT Digital Artwork

Two challenges that artists who create digital artwork face are proving authenticity of their pieces, and preventing copy-cat creators using their imagery and passing it off as their own. However, by linking their digital artwork to a non-fungible token on an immutable blockchain, the artist can cryptographically prove that the piece comes from their official collection (a contract they have created).

There is a booming digital art space involving non-fungible tokens with over three million pieces traded and a total value of over $2 billion.

This market saw a notable increase in 2021, and this is thought to be partly accounted for due to the inability for art collectors to physically purchase pieces during the COVID-19 pandemic.

The record for the most expensive NFT sold was broken most recently on March 11th 2021, when an artwork named Everydays: The First 5000 Days by artist Mike Winkelmann – aka Beeple – sold for $69.3 million.

In early December 2021, digital artist Pak sold 312,686 units of his collection The Merge to just under 29,000 collectors for $91.8 million. Many NFT marketplaces have introduced verified collection functionality – similar to the blue checkmark on Twitter – to prove collection authenticity.

Digital art impersonation is, however, becoming an increasingly prevalent issue for NFTs. The largest NFT marketplace OpenSea said in January 2022 that over 80% of NFTs minted using its tool were “plagiarized works, fake collections and spam”

2. NFT Fundraising

NFTs have featured prominently in the Ukrainian government’s cryptoasset financing efforts to counter the Russian invasion beginning on February 24th 2022. Crypto fundraising campaign UkraineDAO sold an NFT of the Ukrainian flag for $6.75 million – becoming the 10th most expensive NFT sale at the time. The proceeds were then donated to the government and numerous other charities.

Over 840 NFTs – mostly worthless but including a Cryptopunk and numerous other prominent projects – were donated to the government as of May 17th 2022. These were then auctioned through a dedicated site run by the Ukrainian Ministry of Digital Transformation. The Ukrainian Cyber Police also began minting NFTs to finance resistance efforts. NFT donations stopped after May 18th and did not resume throughout June and July 2022.

3. Metaverse Assets

Blockchain technology will play a key role in the Metaverse, along with other emerging technologies such as artificial intelligence (AI) and virtual reality (VR). In futurism and science fiction, the metaverse is a hypothetical iteration of the Internet as a single, universal and immersive virtual world that is facilitated by the use of virtual reality (VR) and augmented reality (AR) headsets.

NFTs are a foundational building block for ownership within metaverses – digital worlds which foster social interaction through new digital technologies. While many use fungible ERC20 tokens for their native cryptoassets, the digital land which metaverse participants can own and build on – along with the digital wearables used to dress up avatars – are NFTs.

Technology consulting firm Gartner has predicted that by 2026, 30% of organizations from the real world will be ready to offer metaverse related goods and services, while 25% of people will spend at least one hour a day immersed in it. This is, therefore, likely to be a growing use case for NFTs.

The Blockchain Metaverse’s goal is to provide people with an augmented reality experience that, in many ways, may surpass physical reality in terms of experiences and opportunities.

The first involves leveraging non-fungible tokens (NFTs) and cryptocurrencies to create blockchain-based metaverse startups. People can buy virtual land and create their own settings on Decentraland and The Sandbox platforms.

The second group uses the metaverse to describe virtual worlds in general, where people might meet for business or enjoyment.

The relationship between the metaverse and GameFi must be well established for the GameFi economic model to work. GameFi draws in the gaming crowd for the experience, and the metaverse makes them spend using the gaming/ecosystem tokens.

Beyond direct monetary incentives, GameFi offers the prospect of digital assets ownership in virtual worlds that players devote a large portion of their time on and the potential for interoperability by bringing those assets across different virtual worlds.

4. NFT for Exclusive Membership or Tickets

A growing trend is using NFTs to provide access to exclusive Discord channels, online private members clubs or real-life events. These include exclusive travel clubs where NFTs act as passes to private jets, exclusive hotel booking and private yachts. Other examples include NFTs granting membership to exclusive restaurants, cocktail/cigar lounges and private meeting/dining spaces.

5. NFT Gaming

The Gaming Market was valued at over $198 billion in 2021, and is expected to reach a value of $340 billion by 2027. There are now several popular blockchain based games such as Axie Infinity and Aavegotchi, which utilize NFTs for playing characters. Furthermore, traditional gaming houses – such as Ubisoft – have integrated NFTs within their more traditional gaming concepts.

However, the traditional gaming community hasn’t unilaterally embraced the introduction of NFTs with open arms. EA Games and Team17 are just some gaming companies that have backpedalled on introducing NFTs into their games after a strong user pushback. The chart below shows the growth of Axie Infinity, one of the most popular blockchain-based NFT games, by amount of ETH invested by players over time.

The number of GameFi projects has continued to rise and reached 1,551 games as of June 2022. However, slowing growth is evident as month-over-month growth tapered to low single-digit growth rates, clocking 2.5% in June 2022.

The broad overall negative market sentiment likely contributed to this decline as market participants take a breather from blockchain activities and the number of new game launches slow.

Total capital investments in GameFi exceeded over US$4.1B in first-half 2022, contributed by a behemoth US$2B raise by Epic Games. This represents a 38% increase when compared to second-half 2021.

The key takeways:

- Over $8 million of illicit funds has been laundered through NFT-based platforms since 2017 – representing 0.02% of trading activity originating from known sources.

- However, a further $328.6 million (0.81%) originates from obfuscation services such as crypto mixers. A proportion of this may reflect proceeds from illicit activity.

- Over $100 million worth of NFTs were publicly reported as stolen through scams between July 2021 and July 2022, netting perpetrators $300,000 per scam on average. July 2022 saw over 4,600 NFTs stolen – the highest month on record – indicating that scams have not abated despite the crypto bear market.

- May 2022 saw the highest confirmed value of NFTs stolen through scams, at just under $24 million. However, actual numbers are likely to be higher, as thefts are not always publicly reported.

- Social media compromises – particularly of NFT project Discord servers – have surged in 2022, accounting for 23% of all NFTs (close to 5,000, worth around $20 million) stolen this year. The growing availability of tailored malware that can bypass multi-factor authentication is likely to be partially responsible.

- There is a growing threat to NFT-based services from sanctioned entities and state-sponsored exploits. This has been emphasized by the $540 million heist from Axie Infinity’s Ronin Bridge by North Korea’s Lazarus Group and the possession of NFTs by the US-sanctioned Chatex cryptoasset exchange. Digital assets worth more than $160,000 originating from sanctioned entities have been used to purchase NFTs.

- Tornado Cash, a US-sanctioned mixer, was the source of $137.6 million of cryptoassets processed by NFT marketplaces and the laundering tool of choice for 52% of NFT scam proceeds before being sanctioned by OFAC in August 2022. Its prolific use by threat actors engaging with NFTs further emphasizes the need for effective sanctions screening by NFT platforms.

How can NFT be used in business?

Businesses already leverage blockchains to ensure the reliability of supply chain data. NFTs can also be used as digital footprints to track products through their entire lifecycle and help you prove the authenticity of products to win your customers’ trust.

NFTs are not only about buying and selling GIFs but also about creating new business opportunities. In particular, NFTs offer new ways to fund projects, trade money, and invest in digital assets.

Currently, we can outline two main approaches for businesses to use NFT technology:

- Develop an NFT marketplaces and make money from service fees. NFT marketplaces allow NFT creators to sell their digital tokens and users to browse a selection of items for sale and make purchases. Marketplaces vary depending on the blockchain platforms they use and the type of digital items they list, since NFTs can represent digital works of art, musical recordings, and even tweets.

- Create and mint your own NFT tokens. Minting NFTs has a variety of business use cases.

1. Drive attention to your brand. Some companies launch an NFT initiative for marketing purposes or to improve the value of their services and business. Either way, you can achieve significant brand promotion and increase your chances of attracting new customers.

2. Bring transparency to your product lifecycle. NFTs can also be used as digital footprints to track products through their entire lifecycle and help you prove the authenticity of products to win your customers’ trust.

3. Gain additional revenue. A series of NFT items can be a source of extra profit. For example, you can sell digital art based on your brand logo, products or services, and mascots. When selling such NFTs, some businesses provide buyers with discounts or free products to encourage sales. Or you can sell brand-related NFTs as tickets to special community meetings.

4. Secure data and transactions. NFTs inherit the blockchain’s ability to store records and data securely, yet ensure its transparency. You can leverage the uniqueness of each token to guarantee data immutability and record accuracy.

5. Attract investments. You can use NFTs to gather funds for launching new projects. The Antara movie is a groundbreaking example of using NFTs for crowdfunding in the film industry. In January 2022, the Antara producers announced a pre-sale of the Antara Movie NFT, which will be the first NFT that allows buyers to partly own the rights to a Hollywood film.

With that in mind, let’s explore how exactly businesses can use NFTs by discussing the key tasks this technology can help you accomplish.

…………………

AUTHORS: Eray Arda Akartuna – analyst Elliptic, Matthieu Nadini – data scientist Elliptic, Chris DePow – Senior Advisor for Financial Institution Regulation & Compliance at Elliptic, Tara Annison – Head of Technical Crypto Advisory Elliptic