U.S. life insurers’ commercial real estate (CRE) exposure is predominantly via commercial mortgage loans, with more modest exposure to commercial mortgage backed securities (CMBS) at less than 5% of cash and invested assets, with equity real estate not a meaningful allocation, according to Fitch Ratings.

Mortgage loans comprised 13% of U.S. life insurers’ portfolios, approximately 85% of which were commercial mortgage loans (CML)

These loans are largely high-quality and diversified, with 90% of CMLs rated CM1 or CM2 on an NAIC basis, along with de minimis troubled mortgages and an average loan-to-value ratio of 54%.

Insurers’ ratings are likely to be resilient to a moderate fall in commercial real-estate (CRE) values, Fitch Ratings says in a report, although a systemic crisis would put greater pressure on individual issuers with larger exposures (see Largest Life Insurance Companies in U.S.).

U.S. & European Life Insurers’ portfolios

Life insurers’ portfolios are more conservatively positioned currently than entering the GFC, based on key risk metrics, during which cumulative aggregate default rates for our large-rated insurers was 4.4% (see US Commercial Insurance Revenue Growth).

U.S. life insurers had 13% of their aggregate investment portfolios in mortgage loans, or 1.6x capital, which is above historic levels of 8%-12% but stable yoy

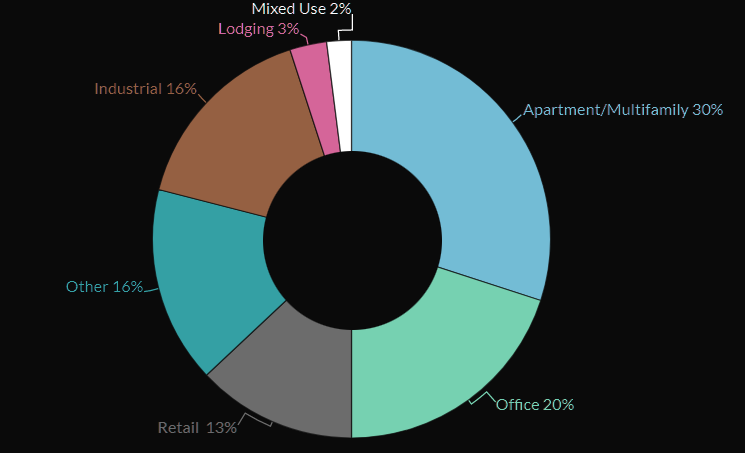

Office and retail valuations are likely to drop further over the medium term, with office most pressured by reduced occupancy. U.S. insurers have continued to de-emphasize these subsectors, and are focusing on multifamily and industrial.

Fitch expect continued negative NOI growth for office properties in 2023, with office loan delinquencies within Fitch’s rated CMBS universe to double to 3.5% to 4% at end-2023 versus 1.8% in May.

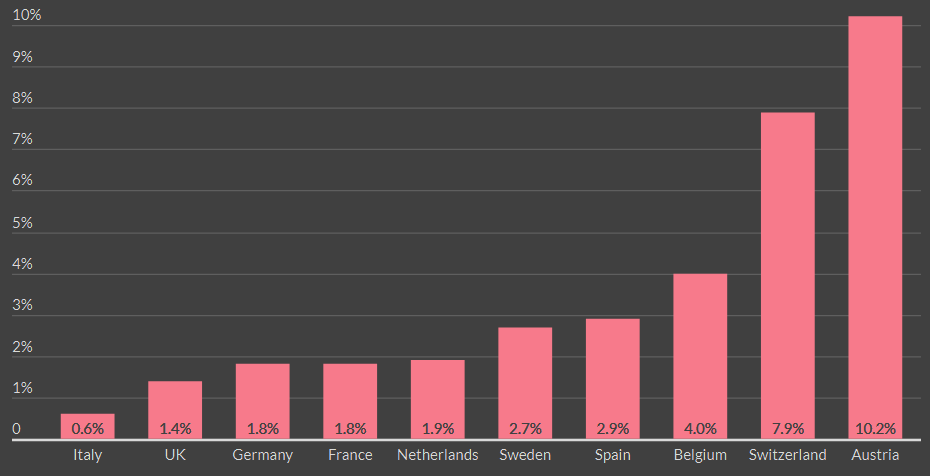

Assuming an arbitrary full write-down of European insurers direct CRE holdings, system-wide this would only lead to a 7% depletion in insurers aggregate capital base.

However, the impact of reduced valuations would be far higher for Swiss, Austrian and Belgian insurers (see Private Equity & Venture Capital Investment in FinTech).

The direct CRE exposures in these markets are around 48%, 25%, and 21% of their capital base, respectively, compared with just under 13% for the UK, under 8% for the Netherlands and 6% for Germany.

U.S. Life Insurer Commercial Mortgages by Type

Largest Exposures Include Multifamily, Office and Industrial

Life insurers are generally conservative lenders with strong track records and diversified exposure by geography and property type.

Deterioration across property types and growing recessionary risks

Deterioration across property types and growing recessionary risks will contribute to modest growth in mortgage loans over the near term. Single-family origination growth will slow to moderate levels in 2H23 and 2024 due to higher interest rates, which are slowing demand amid deteriorating economic conditions.

European insurers’ CRE exposure was 4.1% of aggregate assets of EUR11.5 trillion, with direct CRE investment exposure of EUR202 billion, or 1.8% of total assets.

Under EU Solvency II rules, CRE has a relatively high 25% capital charge, which can reduce demand and depress valuations.

CRE assets cannot be used to hedge interest rate risk further limiting CRE asset concentrations (see hot to Implement ESG Investment Strategy).

European life insurers have to raise the capital they must hold under Solvency II to cover the risk of a surge in lapses. In the case of Italian life insurers, this led to a capital shortfall and regulatory intervention.

It states that Europe’s insurers support the EU’s ambitious sustainability agenda and are committed to continuing to contribute and to build towards the transition to a more sustainable society, and to play their role in achieving the targets of the EU Green Deal.

Sustainability is a key element of the Solvency II review and insurers are supportive of changes that can help to clarify how sustainability risks, including climate-change risks, are appropriately integrated into the Solvency II framework, insofar as this is not already the case.

European insurers have sufficient ratings headroom to weather a moderate fall in CRE values, although a systemic crisis would put greater pressure on individual issuers with larger exposures. We estimate that EU insurers’ aggregate capital base would decline by 7%, assuming a full write-down of direct CRE holdings.

European Life Insurer Direct CRE Investments

Proportion of Investments, Excluding Unit-Linked

European insurers’ direct CRE exposure is highly concentrated, with 10 insurance groups accounting for 77% of the exposure. Indirect exposures, which include all forms of lending and equity holdings in real estate investment vehicles, are more widely distributed, with the same insurers only accounting for around 37%.

U.S. and European life insurers are subject to asset

U.S. and European life insurers are subject to asset write-downs in real estate portfolios. While Fitch does not view capital for U.S. life insurers to be overstated, it may be for some European issuers.

Valuations of EU firms’ investment properties did not decline in tandem with quoted instruments, such as long-duration bonds and equities, despite widespread rises in long-term interest rates.

However, insurers generally have ample liquidity and are therefore unlikely to have to sell real estate assets at distressed valuations. Most insurers that invest directly in real estate have a long holding period.

…………………….

AUTHORS: Jamie Tucker, CPA, CFA – Senior Director, Life Insurance Fitch Ratings, Manuel Arrivé, CFA – Director, EMEA Insurance Fitch Ratings, Laura Kaster, CFA – Senior Director, Fitch Wire North and South American Financial Institutions