As important as insurance is, there are significant risk exposures and losses that are not covered by insurance but could be. Protection gaps exist in every country – emerging, developing and developed.

But they are greater in emerging and developing economies, where the consequences of uninsured risks can be even more severe and long-lasting, because of the lack of personal or state resources to meet these losses. Sadly, we see these consequences play out almost every day across the world.

There are many reasons why protection gaps exist and in many instances are growing. These include the need for the insurance sector to focus even more carefully on the needs of consumers and think more imaginatively about the risk-financing and risk-mitigation products and services it can provide.

But the power of governments to help close these protection gaps is also essential. Climate change and the recent experiences of the COVID-19 pandemic have driven a surge in risk awareness. With this has come a corresponding need for and appreciation of better protection systems. Insurance has a critical role to play here in boosting the development of new solutions and systems to help match rising expectations.

According to Insurance Development Forum and The Geneva Association Report, have collaborated to produce this report, which addresses the role a country’s laws, regulations and broader government policies can have in facilitating or hindering the development of a robust and secure insurance market; that is, an insurance market that can support individuals, companies and the government itself in harnessing the skills and capabilities of the insurance sector to reduce losses and provide financing for the losses that do occur (see Top Ranking the World’s Largest Insurance Markets).

Over the past few decades, the economies of many emerging markets have grown rapidly, lifting millions out of poverty and creating a rising middle class.

Insurance is critical to economic development as it enables economic activity by protecting lives, livelihoods and assets against insurable risks. Insurance also acts as a shock absorber of adverse events, provides critical risk mitigation services and helps attract private capital to economies.

An increase in climate-change-related events, COVID-19 and other catastrophes have heightened people’s sense of vulnerability. For that reason, it is of great concern that insurance penetration in emerging markets remains low. As a result, many of the individuals, households and businesses in the 14 markets covered in this study remain exposed to the risk of falling back into poverty and financial ruin.

Many individuals, households and businesses in emerging markets remain unprotected and exposed to the risk of falling back into poverty and financial ruin in the event of misfortune (see Global Insurance Markets Trends).

Based on an analysis of the legal, regulatory and broader government policy environments in 14 markets, this report finds that a common set of main factors influence the development of insurance market development across these markets. They include whether there is sufficient political prioritisation of insurance, the level of financial (including insurance) literacy, the effectiveness and efficiency of insurance regulation and supervision, risk awareness and a lack of trust among customers.

To understand and address the drivers of underinsurance in emerging markets, it is important to look at how public policy and regulatory incentives and barriers can impede the development of insurance and its contribution to sustainable economic development.

Government policies can have a profound impact on an individual’s access to appropriate and affordable insurance. This is sometimes done by introducing compulsory schemes, which create sufficiently large risk communities and risk pools.

This of course cannot be done by insurance regulators alone, but requires collaboration across government entities at different levels. In addition, mandatory schemes can mitigate adverse selection by standardising premium rates across risk types, enabling the cross-subsidisation of higher-risk policyholders with the premiums from lower-risk policyholders. Such schemes can be accompanied by premium subsidies for low-income households.

For good customer outcomes, mandatory insurance schemes need to be accompanied by an adequate market conduct regulatory framework. Public-private partnerships (PPPs) can be another powerful remedy in emerging markets.

They can leverage existing public-sector infrastructure to enable wider distribution of insurance products, roll out products more quickly and realise benefits from pooling and diversification. Government-subsidised insurance programmes can also promote insurance penetration. In India, the Pradhan Mantri Fasal Bima Yojana (PMFBY) PPP scheme, which was mandatory until 2020, made crop insurance one of the biggest segments in the country’s non-life insurance market.

Public-private partnerships (PPPs) in emerging markets can be a powerful remedy by leveraging existing public-sector infrastructure to enable wider distribution of insurance products, as well as roll out products more quickly and realising benefits from pooling and diversification.

Insurance penetration of markets

| Country | 2005 | 2021 | 2005-2021 |

| Argentina | 2.18% | 2.17% | -0.01% |

| Brazil | 2.60% | 4.10% | 1.50% |

| Chile | 3.38% | 4.05% | 0.66% |

| Colombia | 1.91% | 3.06% | 1.15% |

| India | 3.48% | 4.20% | 0.72% |

| Indonesia | 1.37% | 1.93% | 0.57% |

| Mexico | 1.57% | 2.58% | 1.02% |

| Morocco | 2.37% | 4.49% | 2.12% |

| Nigeria | 0.34% | 0.30% | -0.04% |

| Peru | 1.32% | 2.02% | 0.71% |

| Philippines | 1.25% | 1.77% | 0.52% |

| South Africa | 13.49% | 13.66% | 0.17% |

| Thailand | 3.30% | 5.33% | 2.03% |

| Vietnam | 1.18% | 2.29% | 1.11% |

The rationale for regulatory intervention in insurance markets

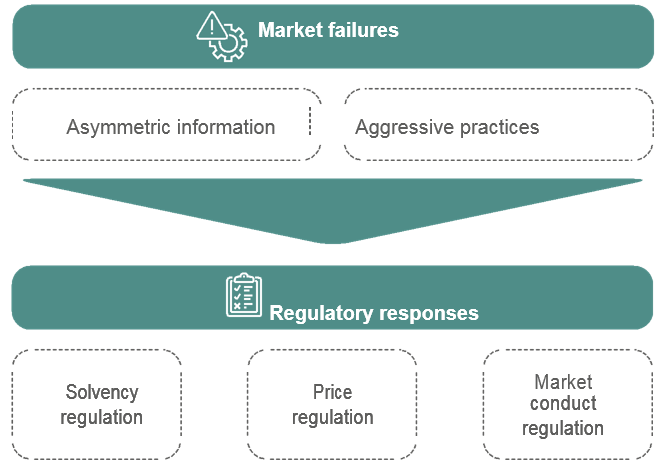

The basic rationale for insurance regulation as indicated in the previous section is the remediation of market failures and protection of policyholders and consumers. Market failures that call for regulatory intervention include, among others, the asymmetric distribution of information between insurance customers and insurers as well as the impact of insolvency.

Against this backdrop, the following section examines the basic economic principles that should govern the regulation of insurance and employs these principles in assessing various regulatory tools.

Market failures in insurance

Insurers in emerging markets may engage in aggressive market practices that could harm customers – especially households and individuals with low levels of financial literacy and difficulty judging the financial risk of insurers and terms of insurance contracts. Another potential manifestation of this behaviour is the possibility that insurers engage in anti-competitive practices to restrict competition. This behaviour could result in barriers to entry and excessively high prices, both of which stifle insurance market development.

Governments could remedy this type of market failure through appropriate and proportionate market conduct regulation, antitrust measures or price regulation to ensure that the prices charged reflect competitive market conditions.

If, however, high insurance prices are due to elevated levels of risk with regulators trying to enforce lower prices, this might do more harm than good by discouraging insurance supply and innovation.

Asymmetric information problems in the form of adverse selection and moral hazard also tend to be more pronounced than in more mature insurance markets. There, insurers can use effective underwriting, pricing, and deductibles and exclusions to keep adverse selection and moral hazard to acceptable levels. But in less mature markets, loss data and estimates are not as easily available.

Regulatory approaches to market failures

Solvency regulation

Insurers generally have greater levels of information regarding the riskiness of their portfolio than their customers. It would be (prohibitively) costly for policyholders to redress this imbalance, especially in low-income and low financial literacy environments. Solvency regulation helps signal the financial health of an insurance company to the market, which is particularly relevant because most consumers do not have the requisite expertise to conduct a financial review of their insurance carrier.

Solvency regulation is designed to protect the overall stability of insurance markets. Regulators are concerned about ‘contagion’ where a spike in insurer insolvencies could undermine policyholder confidence in financially healthy carriers, with incalculable consequences. In emerging markets where trust in financial institutions is still nascent and fragile, insurer insolvencies represent major setbacks for market development.

Price regulation

According to Klein, there are two potential reasons for regulation of insurance prices. The traditional explanation is predicated on solvency concerns. Individual insurers may be tempted to engage in detrimental or even ruinous price competition, which forces other market participants keen to retain their share of the business into predatory pricing and a destructive ‘race to the bottom’. In the USA this view underpinned uniform prices in property and casualty insurance developed by industry-rating organisations, until the 1960s.

Another reason could be the public’s preference for regulatory policies to cap insurance prices in line with social norms or objectives. This helps to explain why insurance prices are regulated in some circumstances, such as when governments compel customers or firms to buy certain types of insurance. However, price regulation can create harmful market distortions; for example, in markets where they do not reflect the true risk exposure. In many mature insurance markets, however, such regimes have disappeared. In this case, both life and non-life insurance markets tend to be highly competitive in terms of their structure and performance.

In emerging markets, price and product regulation is more prevalent given the local insurance industry’s lower maturity, in terms of not only capital strength, risk management and pricing expertise, but also availability of data and effectiveness of supervision. But in these countries, too, there is a clear trend towards price and product liberalisation, for example in China and Malaysia, on the back of increasingly sophisticated risk-based solvency regimes.

Market conduct regulation

While price regulation has become less prominent, market conduct regulation is gaining in relevance. This kind of regulation covers insurer market practices, such as product design, marketing and claims adjustment, and addresses the negative consequences of asymmetric information. The economic case for such regulation is obvious, with the bargaining power between insurers and their customers unequally distributed. There are constraints on customer choice due to, for example, low levels of financial literacy, which can make some customers vulnerable to aggressive marketing and claims practices of insurers and their agents, even in competitive markets.

Economic rationale for regulatory intervention in insurance markets

In emerging markets, there is also abundant evidence that customers are often less equipped to understand insurance and other financial products, and can be misled by high-powered sales campaigns. India is a case in point.

At the beginning of the century, life insurers pursued aggressive unit-linked growth strategies in the absence of customer-oriented conduct regulation. This led to severe incidents of mis-selling with significant losses to customers. In 2011, regulatory constraints were imposed on the sale of unit-linked insurance policies.

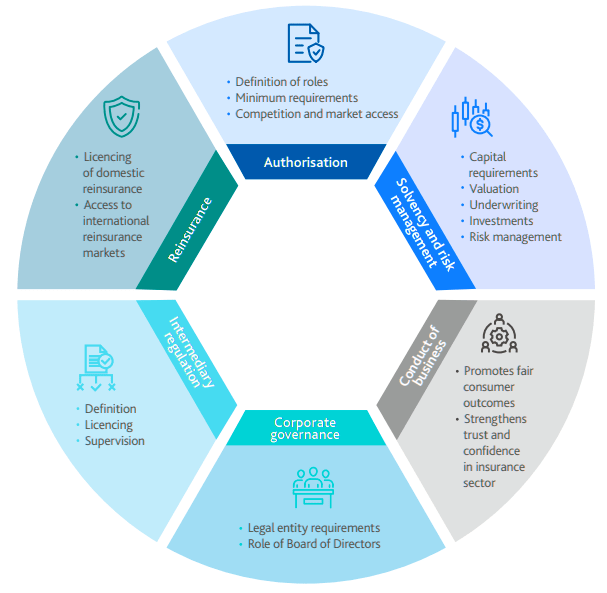

Core elements of effective regulation and supervision in emerging markets

As outlined in the previous section, an appropriate insurance regulatory system is critical to harnessing insurance for economic and societal development in emerging markets. A conducive regulatory environment would simultaneously ensure the financial strength of insurers and intermediaries, promote healthy levels of competition, encourage innovation in risk assessment and risk pricing, facilitate access to all forms of reliable capital, and provide necessary market conduct and product regulation.

There is a particular need for adequate regulation in light of ‘the inverted production cycle of insurance’ where premiums are paid upfront. This adds to the importance of consumer protection, especially in low-income markets. Although the time span between the collection of premiums and the settlement of claims is relatively short (i.e. 1–2 years) in most non-life insurance activities, it can extend to decades in certain life and non- life insurance segments.

This is why insurance markets will only be able to grow, flourish and fulfil their economic role in the economy, if policyholders believe and trust that insurers will actually be able and willing to make payouts when insured events occur.

There is a general consensus that the primary duty of insurance regulators is to protect the interests of policyholders. The execution of this role has two different dimensions: first, the prudential aspects where regulators focus on the risk carrier’s ability to pay individual claims, even very large losses, as they come due.

The second is the conduct dimension, which addresses the performance of re/ insurers in carrying out their duties to customers and other stakeholders. A third possibility, which is currently a topic of debate within regulatory circles, revolves around the role of insurance in enhancing financial inclusion, whether through public, private or hybrid mechanisms.

Hexagon of insurance legislation and regulation in emerging markets

Reinsurance regulations

As reinsurers typically do not deal directly with the policyholder, the consumer-protection-driven reasons for insurance regulation apply less to reinsurance companies. In addition, reinsurance as a business-to-business transaction does not typically require specific regulation of policy forms and contract wordings.

However, the cross-border nature of most reinsurance transactions has driven the rise of specific regulations to protect the interests of domestic ceding companies. In this context, it is worth highlighting that reinsurance benefits economies and societies by providing risk diversification on a global scale.

The global nature of many reinsurers allows them to offset large risks in one region against risks (different or the same) in other regions. In earthquake-prone regions such as Chile and New Zealand, the majority of insured earthquake losses are paid by foreign reinsurers, without which these risks would be uninsurable.

Research has shown that in countries where a relatively larger share of risk is transferred to international reinsurance markets, economies recovered more quickly in the aftermath of the event.

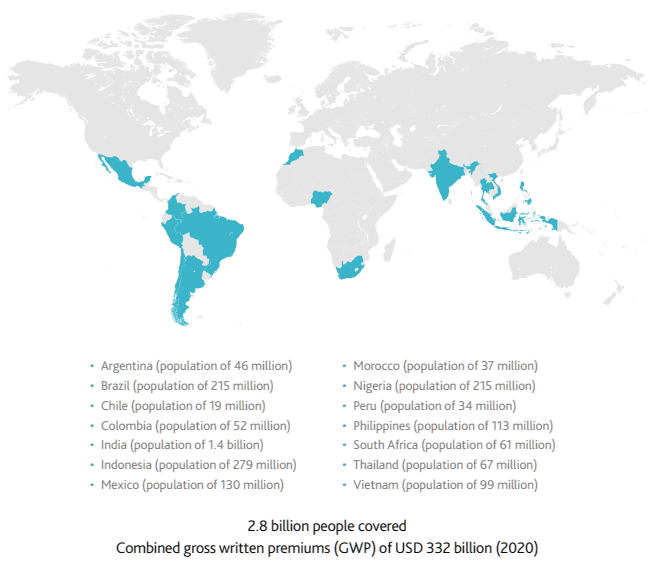

Insights from 14 countries

The theoretical part of the report was enhanced by 31 interviews to apply the core elements of the taxonomy of insurance regulation to the practical realities in emerging markets. Interviews were conducted with experts and executives of nine insurance companies, seven national insurance associations and one broker, as well as 11 representatives of the regulatory community and one representative of a development bank.

The interviewees represent emerging economies across Latin America, Africa and Asia, with market selection based on population size and insurance penetration.

The featured markets, representing USD 332 billion of direct life and non-life premiums, are as follows:

- Latin America: Argentina, Brazil, Chile, Colombia, Mexico and Peru

- Africa: Morocco, Nigeria and South Africa

- Asia: India, Indonesia, the Philippines, Thailand and Vietnam

Interview questions revolved around the following themes: general barriers to insurance market development, specificities of the regulatory framework, government policies and the legal framework.

Influences on market development can be classified into supply-side and demand-side factors. On the demand side, financial literacy, affordability and trust are among the most critical, whereas access to markets, capital and risk appetite, as well as underwriting expertise, drive insurance supply.

Public policies as well as insurance-specific regulation shape both supply and demand-side factors. Regulatory frameworks need to be aligned with the level of market maturity.

In addition, sufficient resources and skills are required to conduct effective supervision. Our research found that these conditions are not always met, which in large part can be attributed to an insufficient understanding of insurance markets at a political level, as that is where resource allocation decisions are made.

On the demand side, affordability issues can be addressed through microinsurance as well as premium subsidies. For this reason, the practical section of this report takes a deep dive into public policies and initiatives to address these barriers. Identified supply-side barriers relate to the legal, public policy and regulatory environment that shapes the behaviour of insurers.

This can affect their ability to innovate both in terms of products they bring to the market as well as the types of distribution channels to reach customers.

Countries in scope

The role of regulation in insurance market development

The previous section identified many of the attributes of an enabling legal and regulatory environment for insurers. But laws and rules ‘on the books’ alone are not sufficient. When the implementation of regulatory frameworks is not sufficiently robust or sensible, it dilutes their good intentions.

The importance of adequate implementation is underscored by a recent World Bank paper, which states: ‘to secure the benefits of risk-based approaches to foster development, implementation processes are at least as important as risk-based formulas. Implementation issues are often the result of inadequate resources, capacity and capabilities, not least caused by insufficient support at the political level.

The success of pursued enhancements largely depends on the extent to which implementation is carried out in a tailored, consultative and professional way. The pace of change needs to be matched by improved technical capabilities on the part of the regulator.

If these conditions are not met, ambitious intentions could lead to unintended consequences, a misallocation of resources and ultimately have a negative effect on insurance penetration levels.

Understaffing and insufficient training may also cause practical deficiencies in the implementation of regulatory reforms. The result in many jurisdictions is weak enforcement of core regulations and laws, which mainly exist on paper. As discussed earlier, many markets have adopted risk-based capital (RBC) frameworks, but when regulator capacity is severely constrained, regulatory approaches tend to remain stringent and rules based rather than principles based.

Risk-based solvency regimes are fine, but many regulators and insurers in those markets lack proper understanding of what it means. Often they say they want Solvency II, without understanding what responsibilities they must fulfil as well as the costs

Arup Chatterjee, Principal Financial Sector Specialist, Asian Development Bank

In addition to their core mandates of policyholder protection and financial stability, a number of insurance regulatory authorities also have an insurance market development remit.

However, such a mandate is often seen in the narrow sense of developing products for the low-income population. In turn, other important aspects are neglected, such as responding to the evolving risk-protection needs of rapidly growing middle classes and the development of a well-functioning insurance market, with more organic capacity to meet the needs of a wider range of customer segments.

Risk-based solvency regimes are progressively being implemented across the globe, including in emerging economies. Capital frameworks may spur or restrict insurance supply.

Under risk-based frameworks, capital charges depend on the underlying risk profile of the insurer, typically leading to lower capital charges for insurers with lower risk profiles and strong risk management capabilities. Previous research conducted across Latin American markets indicates that insurance penetration improves following the implementation of a risk-commensurate capital framework.

Rate and form regulation, and innovation in insurance markets

Many regulatory authorities aim to ensure in advance that new products entering the market are viable and prices are set in an actuarially sound manner. At the most stringent extreme of the spectrum lie models requiring prior product authorisation and rate (i.e. premium) regulation.

More moderate regimes are based on ‘file & use’ whereby a product can be launched directly after registering it. Earlier research has indicated that the pre-approval requirement for new products makes it difficult for insurers to ‘issue new products that adapt to the specific circumstances of the moment and new needs of customers’.

Our interviews confirm this: the approval requirement is problematic as is the time needed, as it can range from several months to more than a year.

Insurers in markets with less stringent regulatory approaches to rate and form, such as India and Morocco, indicate that their regimes positively affect innovation and the insurers’ abilities to meet customer needs.

Microinsurance regulation

Through microinsurance, many emerging economies have undertaken efforts to bring insurance protection to segments of the population that are underserved and unable to afford standard insurance products. Microinsurance can be defined as ‘a financial arrangement designed to protect low-income people against specific perils in exchange for regular premium payments proportionate to the likelihood and cost of risk involved’.

To facilitate the supply of microinsurance, several governments have introduced dedicated microinsurance regulatory frameworks that have different requirements, such as lower capital and reporting requirements, and special licencing schemes.

These frameworks aim to incentivise the provision of microinsurance, which would, considering the low premiums and high cost of distribution, be less feasible under existing regulatory frameworks.

Although many such initiatives have had a tremendous impact in reaching the most vulnerable in emerging economies and boosting their resilience, our interviews suggest that the success of microinsurance schemes has been mixed. This is because microinsurance regulatory regimes do not always address all of the challenges, such as licencing, product approval and distribution.

As mentioned before, regulatory authorities may pursue market development goals in addition to protecting insurance customers and ensuring financial stability. A related objective is ‘the protection of those that cannot access insurance’ which can be seen as part of the remit to promote financial inclusion. This is obviously crucial in the context of microinsurance.

In jurisdictions where financial inclusion is a government policy goal, the insurance regulatory authorities take the development of inclusive insurance seriously and adopt a more holistic approach to developing microinsurance frameworks.

In the markets covered in this report, premium subsidies are most common for agricultural insurance. Several public-private partnerships between the government in India and the insurance sector have led to subsidised agricultural insurance schemes, which have succeeded in making agricultural insurance one of the most important business lines in the non-life sector.

Other markets with subsidies include Chile, Morocco, Peru and Thailand. Although Mexico used to have a subsidy programme for agricultural insurance, this program was cancelled following government questions about its impact. A new subsidy scheme is being developed with the help of the IDF.

Executives in Colombia and the Philippines have called upon their governments to establish subsidy schemes to better reach the vulnerable.

Insurance Market access barriers

Foreign insurers also provide a mechanism for transferring some of the risks outside of the country, mainly through globally active reinsurers, which has proven to be particularly beneficial to countries that are prone to natural catastrophes, and is increasing in relevance in light of emerging global risks, including pandemics and cyber and supply-chain disruptions.

Foreign insurers can serve markets primarily through the establishment of local operations. This can take several forms.

Establishment via a subsidiary involves the creation of a new domestic insurer or the acquisition of an existing domestic insurer. Except for ownership, such subsidiaries are legally identical to other domestic insurers and therefore subject to host-country regulation. branch office, on the other hand, is not a stand-alone insurer, but an extension of a foreign insurance company that is subject to regulatory oversight by the regulator in the foreign jurisdiction.

Most developing countries limit foreign insurer market access to protect and nurture the local insurance industry. Even when markets are accessible, foreign-owned insurers may experience an unlevel playing field.

Branch offices pose particular challenges because as risk-bearing entities, host-country rules typically require local investment of assets backing local liabilities. In addition, a substantial guarantee fund – similar to minimum capital and surplus requirements for domestic insurers – may be mandated. For foreign insurers, such rules fragment assets and decrease overall capital efficiency.

Another market access issue arises with the rapidly developing use of insurance linked securities and related capital markets solutions to provide risk-bearing capacity to insurance markets.

These products mainly use parametric triggers. The additional risk capacity and the dynamics of parametric covers can deliver significant benefits in the form of more attractive pricing, speed and efficiency in claims handling and fraud prevention.

They have been used for a variety of risks, from large commercial risks to crop insurance policies for small family farms, as well as for sovereign and sub-sovereign risks and private sector risks. These new market players and products need to be accommodated within the relevant regulatory regimes.

Reinsurance can be especially beneficial in helping to develop an insurance market. Large reinsurers that operate on a global basis provide the vast majority of reinsurance capacity. They have the financial strength and underwriting expertise to support both the growth of nascent markets and development of innovative products.

Due to their global diversification, reinsurers increase capacity and reduce cost for catastrophic events, as well as help to alleviate financial stability risk as catastrophe risks are not concentrated domestically. For reinsurance to be able to play its economically and societally beneficial role, reinsurers need a regulatory and legal environment that allows for the provision of cross-border services without unreasonable hurdles.

Recommendations for policymakers, regulators and insurers

Insurance is vital to economic development, and robust re/insurance markets are critical to economic growth, making societies more resilient by protecting lives, livelihoods and assets. As stated by the UN Conference on Trade and Development: ‘Insurance is not merely a characteristic of economic growth; it is a necessity.’

Despite the clear benefits of insurance, massive protection gaps still exist, with insurance penetration rates low in emerging markets when compared to more mature markets.

Part of the problem stems from the difficulty in quantifying the importance of insurance for economic and societal prosperity. As a result, the insurance sector does not always receive the necessary attention and appreciation from policymakers.

For governments / policymakers

- Consider closer collaboration with the insurance regulator and insurance sector, and take a more holistic approach to risk management, including disaster risk management at the national level;

- Provide regulatory authorities with a clear mandate (including market development) and appropriate resources, including adequate funding, training and technical support in designing, implementing and enforcing insurance laws and regulations;

- Dismantle overly burdensome market-access barriers to insurers and reinsurers to reap the full benefits of competition, innovation and global risk diversification;

- Make the improvement of financial literacy at all levels of society a policy priority, for example by integrating financial education in core school curriculums, as increased risk awareness and understanding are likely to significantly increase the demand for insurance products;

- Rebuild or establish subsidy schemes and tax incentives with a view to effecting sustainable changes to insurance purchasing behaviour.

For regulators

- Embrace an insurance market development mandate in addition to policyholder protection and maintaining financial stability;

- Adopt a more holistic approach to insurance market development, catering to both low-income segments (through microinsurance) and the middle class;

- Take a more active role in educating policymakers on the economic and social value of insurance;

- Engage in active dialogue with the insurance industry on how to build a better insurance market for the country, including:

- Relaxing or abolishing rate and form control to foster insurance product innovation

- Accommodating (with appropriate regulations) insurance-linked products and coverage with parametric triggers

- Supporting and facilitating the use of technology and data analytics to better serve consumer needs

- Enabling digital and alternative forms of distribution to allow insurers to reach more customers in remote areas cost effectively

- Implement risk-based regulations that are minimally intrusive and applied in a proportionate manner, and evolve to meet changing markets needs and capabilities;

- Support initiatives to enhance financial literacy and risk awareness, partnering with the industry and other government agencies.

For insurers

- Take responsibility in educating policymakers and other government officials on the role of insurance in protecting societies, supporting economic development and increasing resilience;

- Engage with regulators in an open, constructive manner to discuss market issues and possible solutions;

- Take a proactive role in raising risk awareness and financial literacy;

- Focus on the insurance needs of specific market segments and deliver simple and cost-effective products that are needed.

Achieving the appropriate level and quality of legislation and regulation is a challenge, especially in emerging market environments. Based on an extensive review of existing research and in-depth expert and executive interviews, we have developed recommendations which we believe deserve universal consideration.

At the same time, additional research efforts are required to examine the effects of specific policy and regulatory measures on insurance market development metrics, such as penetration levels and protection gaps.

………………….

AUTHORS: Dennis Noordhoek – Director Public Policy & Regulation Geneva Association, Bill Marcoux – Member of the Operating Committee and Chair of Law Regulation & Resilience Policies Insurance Development Forum, Kai-Uwe Schanz – Deputy Managing Director and Head of Research & Foresigh Geneva Association