The first step to building resilience against flood risk in a wetter world is to increase understanding of the peril. Today risk assessors use a wide set of tools ranging from sophisticated flood hazard maps to fully probabilistic risk models, but more can be done.

The research shows that flood risk is particularly exposed to urbanisation and other human impacts to our environment, deserving particularly close attention to keep models up to date.

The industry is also well placed to invest in projects that improve flood defences. Insurers and reinsurers have liabilities that typically stretch out for decades, and as a result, we are always on the lookout for quality investments with long durations. This makes major infrastructure projects that protect against flooding a good match.

Swiss Re believe that flood risk is insurable. Risk assessment capabilities in the industry have advanced tremendously in the past decade. The task is to make use of these newly gained risk assessment techniques for flood, using the same rigor as applied to other dominant perils like hurricane or earthquake risk.

According to Swiss Re Institute Report, re/insurers can be central players in narrowing still large flood protection gaps around the world, both as long-term investors in sustainable infrastructure and mitigation strategies, and by extending the reach of flood covers, including parametric solutions.

For this to happen, flood should be afforded the same attention as primary perils with regard to quality of exposure and claims data. Flood risk assessment and modelling need to be more rigorous.

Of the economic losses, USD 270 billion was attributable to natural catastrophes. In addition to a devastating earthquake in Haiti that, sadly, claimed more than 2 000 lives, there were more than 50 severe flood events across the world, as well as tropical cyclones, episodes of extreme cold and heat, and severe convective storms (SCS).

Insurance covered USD 119 billion of last year’s economic losses, the fourth highest on record, of which USD 111 billion was compensation for damage resulting from natural catastrophes.

Insured losses have been elevated over the last five years due to recurring high-loss secondary peril events such as SCS, floods and wildfire. However, peak perils have also featured prominently, including Hurricane Ida, the costliest industry event of 2021 with insured losses of USD 30–32 billion.

Coming after a dip in 2012–2016, however, the higher insured losses of 2017–2021 signal a return to long-term growth trend of 5–7%, rather than a step-change up in claims. While we do not see a new norm of higher loss growth rates, regular occurrence of multi-billion insured loss outcomes from secondary peril events is new.

Role for insurers: make flood risk assessment more rigorous

To strengthen resilience against flood increased understanding and awareness of the peril is required, similar to that of primary perils. In its many manifestations, flood is a complex peril to model. The influence and interplay of the anthropogenic environment on the physical processes creates additional modelling challenges when compared to other natural catastrophes.

In the last decade, the industry has progressed modelling of the multiple drivers of flood risk, capitalising on advances in academic research, computing capabilities and a growing ecosystem of modelling companies.

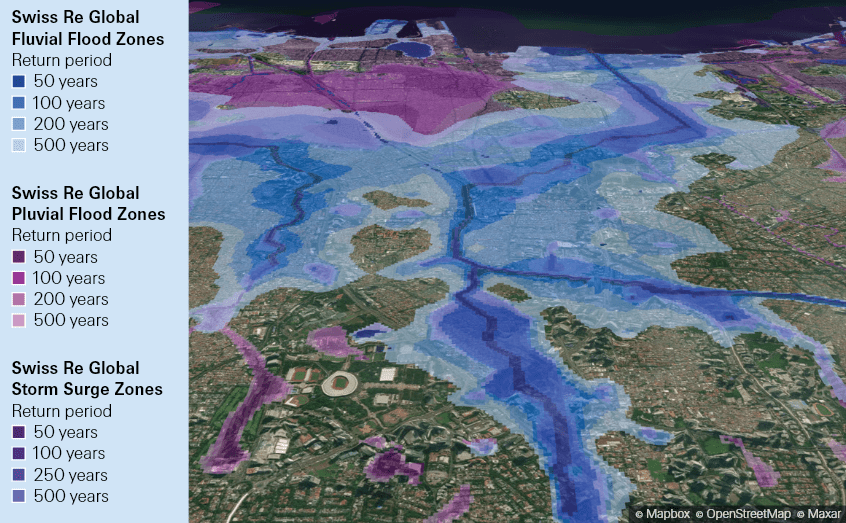

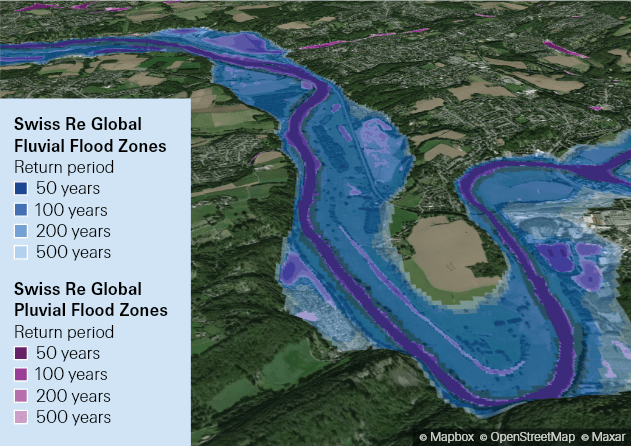

According to Natural & Man-Made Catastrophe Loss Outlook, an important first step has been the evolution of sophisticated flood risk maps providing granular detail for all major flood types, with high resolution and accuracy. Which compares the actual footprint of the Bernd flood in Germany in July 2021 captured by remote sensing, with the Swiss Re Global Flood Zones for fluvial and pluvial risk.

91% of the entire flood footprint is captured in the Flood Zones, displaying their capabilities for risk selection and land-use decisions.

Remote-sensed Bernd flood footprint

Remote-sensed Bernd flood footprint, compared to Swiss Re Global Flood Zones, fluvial and pluvial in Hattingen region

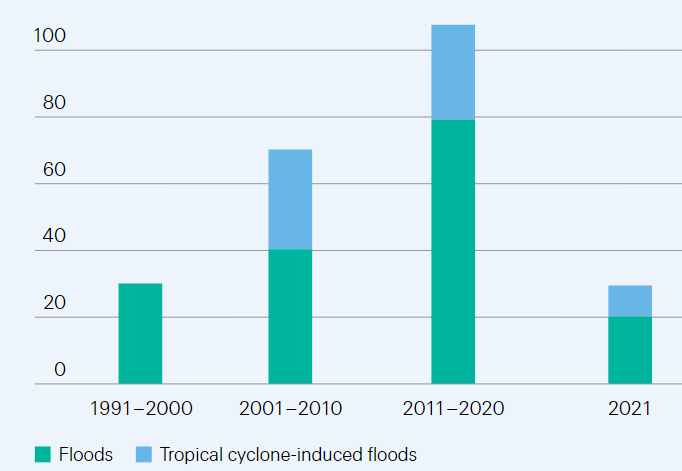

Another step forward has been the development of fully probabilistic catastrophe models. These link physical hazards with loss outcomes and encompass the entire range of statistically possible flood events and asset-specific vulnerabilities. A recent improvement has been the incorporation of tropical cyclone-induced flooding in a tropical cyclone model, that can explicitly simulate events like Hurricane Ida in 2021.

The increased availability of catastrophe models around secondary perils has been largely driven by smaller modelling companies taking advantage of Oasis, an open-source modelling framework that fosters the interoperability of models and model components. This open-source ecosystem facilitates collaboration and knowhow exchange, helping close any local and regional model gaps more rapidly.

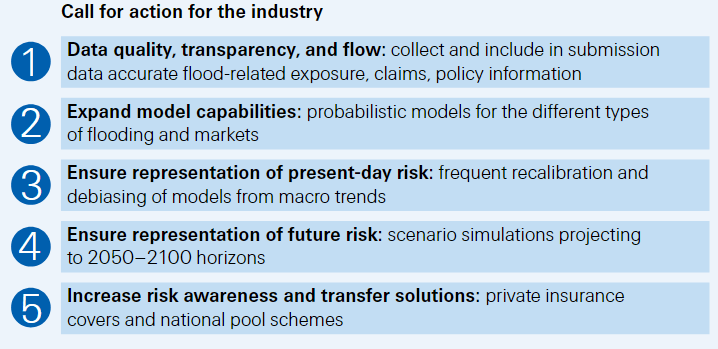

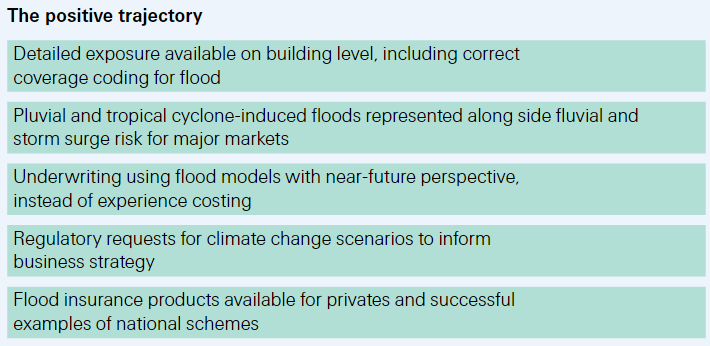

Despite the progress made, industry modelling capabilities for flood risk are still less rigorous than for primary perils, in particular with regard to data quality, transparency and flow.

Given the scale of loss potential and its upward trend, we believe flood needs to move up the industry agenda and be afforded the same attention as primary perils.

The industry should pursue more granularity by using latest tools and techniques to make use of high-quality and high-resolution data and reproduce the many factors influencing flood risk and associated outcomes. Improving data flow by explicitly capturing and sharing flood specific exposure and policy information is a key first step in this direction. High quality risk information should be a standardised inclusion in the submission data flows where permissible.

Monitoring is the second key component by increasing granularity and historic consistency of claims reports and loss statistics.

Swiss Re believe flooding is and will remain insurable, provided modelling remains abreast of ever-changing conditions with respect to temperature warming, urbanisation, land-use changes and other social and macroeconomic trends.

Models need to move away from using past loss experience as a proxy for present-day risks. Optimising the granularity of data sets available today, the models should actively simulate today’s dynamic risk scenarios, and continually update inputs as conditions change. Technology and the basic elements are available. Now it is about calibrating the models to the evolving risk. A robust and trusted risk assessment is a key to maintaining and advancing flood insurability, and to avoid surprise losses.

Global insured losses from floods, and estimated insured losses from tropical cyclone-induced floods

The industry should also be more responsive to new insights and scientific evidence when repricing risks. Further there should be more effort to improve communication of the flood risk realities of different locations within the industry, governments and agencies, to help design more effective mitigation plans.

Industry calls to action to maintain insurability of flood risk

Role for insurers: help close flood infrastructure gaps

A fundamental requirement to mitigate flood risk is the availability of so-called “grey infrastructure”, namely flood defences such as levees, dams, retention basins, flood barriers and drainage systems. In advanced markets, much of the existing flood defence infrastructure was built more than 50 years ago, and is now near or beyond end-of-lifetime.

Huge investment is needed to keep the structures functional and/or to retrofit them to ensure they remain effective in meeting the challenges of current-day climate and hydrology conditions.

Integrated flood risk management solutions that look at the overall water allocation in a river catchment area should also be part of the solution, together with implementing stronger building codes and land-use planning.

Grey infrastructure has been the traditional approach to mitigate flood risk. However, current energy, transport, building and water infrastructure make up more than 60% of global greenhouse gas emissions. To achieve the 2030 agenda for global sustainable development, new and existing infrastructure needs fundamental transformation.56 New nature-based or green infrastructure solutions can reduce flood risk by enhancing infiltration, while also being more sustainable.

As urban populations grow, so do their infrastructure needs. This is an important consideration in ever-growing megacities in emerging markets, where the share of urban population is forecast to increase from 54% in 2020 to 63% in 2040, translating into an additional 1.5 billion urbanites.

Closing the infrastructure gap is an opportunity for insurers in their capacity as long-term investors.

For example, in the emerging markets, assuming the private sector were to step in and cover 75% of the existing infrastructure gap, and 25% of the total identified spend, we estimate an investment opportunity of close to USD 1 trillion annually over the next 20 years.

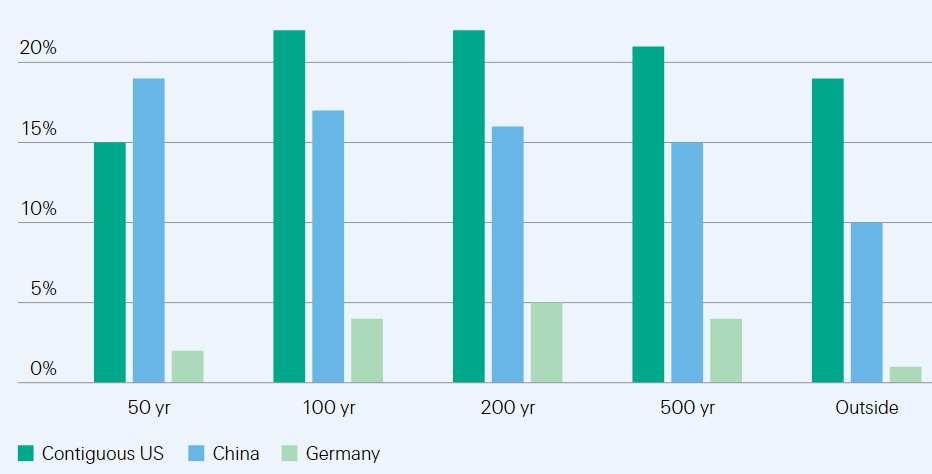

Growth rate of population exposed to inland flooding at different return periods

Insurers are well positioned to offer support as part of their search for investment yields to match their long-term liabilities. Infrastructure projects including flood defences can meet that need, while offering additional benefits of regional and asset class diversification, and opportunities to invest in environmentally and socially-responsible projects.

Closing the infrastructure gap offers other upside for insurers also: new infrastructure fosters additional economic and, in turn, premium growth.

By underwriting risks inherent in the construction and operational phases of green infrastructure projects, insurers can support the sustainability agenda and gain access to new and emerging risk pools.

Role for insurers: closing the flood protection gap

Insurance cover is another key factor in building economic and social resilience to flood risk. Even with the knowledge that flooding can inflict heavy losses, flood insurance penetration remains low.

According to sigma records, 83% of the global economic losses from flood events over the past 10 years were uninsured. Still, the creation of a flood insurance market is a sustainable opportunity, and it should keep the positive trend seen in some advanced markets, becoming more widely available and affordable while also offering incentives for risk reduction.

In many countries, flood cover is available for purchase from private sector insurers. Many advanced economies also have national property insurance flood programmes, involving the public and private sectors, such as the UK’s Flood Re scheme.

The specifics of national programmes vary greatly. For instance, in Norway private sector insurers are mandated to offer flood insurance while in Spain, the responsibility lies with the public sector. In both cases, however, purchase of flood insurance is voluntary.

In France, by comparison, the purchase of flood insurance, available from the private sector, is mandatory for homeowners. Other countries adopt an approach that lies somewhere between the two, making cover quasi-compulsory, such as when flood insurance is a pre-requisite for a mortgage application.

This is the case with the National Flood Insurance Program in the US. To add to the range of permutations, in some markets flood insurance is available as a stand-alone product, and in others it is bundled together with cover for other perils.

The varied features influence the premiums that homeowners pay and, ultimately, flood insurance penetration rates. Bundled products typically show significantly higher pick-up rates.

This accounts for relatively higher penetration rates in Spain, where bundled products are provided by the public sector, and in France where insurance cover is mandatory and bundled products are offered by the private sector.

Traditional indemnity flood cover is one form of protection that insurers can offer. But the range of solutions is much broader, including parametric reinsurance, micro-insurance and insurance-linked securities.

For example, the local authorities in the region of Guanajuato in Mexico and the state of Nagaland in India introduced parametric flood insurance to ease the burden on public finances from heavy rainfall disaster relief expenditure.

The cover pays out when rainfall exceeds certain levels that in turn can lead to severe flooding. The solution helps the state government cover the emergency expenses incurred as a result of the heavy rainfall, but which are not covered by traditional indemnity programmes (eg, emergency shelters, food and medicine for affected families, immediate infrastructure repairs, etc).

Flood risk can and should be managed using the available large spectrum of physical, social and economic means.

Concerted action across the entire risk management chain involving all key stakeholders – government, the insurance industry and consumers – is crucial. Specifically, the insurance industry can assess the risk with sophisticated tools, and help make mitigation infrastructures financially sustainable.

That said, even with risk reduction measures in place, residual flood risk remains. Here the role of the industry is to design affordable and practical insurance products in order to transfer the financial risks that flooding presents away from businesses and homeowners.

…………………………

AUTHORS: Lucia Bevere – Senior Catastrophe Data Analyst, Swiss Re Institute, Federica Remondi – Flood Lead, Swiss Re Institute