IFRS 17 is the newest IFRS standard for insurance contracts and replaces IFRS 4 on January 1st 2022. It states which insurance contracts items should by on the balance and the profit and loss account of an insurance company, how to measure these items and how to present and disclose this information. The IFRS 17 requirements could result in accounting mismatches and volatilities in profit and loss—a direct consequence of the insurer’s reinsurance management strategy and contracts entered into today.

Analysts at S&P Global Ratings have warned that ratings actions could be taken if insurers and reinsurers make significant changes to their risk appetite or capitalization strategies following the implementation of IFRS 17 in 2023.

With IFRS 17’s anticipated mandatory effective date of 1 January 2023 moving ever closer, all types of businesses, not just registered insurance businesses, need to start evaluating the impact of the Standard now.

International Financial Reporting Standards (IFRS) 17 will reshape insurance accounting from January 1st in a move that aims to improve reporting transparency.

Overall, S&P believes the move will make it easier to identify and compare how insurers and reinsurers generate profits and handle risk, and does not expect the accounting change itself to trigger rating actions.

But it added that ratings could be affected via “second order effects,” depending on how individual companies respond to the implementation of the new rules.

What does IFRS 17 mean for insurance companies?

IFRS 17 requires a company to measure insurance contracts using updated estimates and assumptions that reflect the timing of cash flows and any uncertainty relating to insurance contracts. This requirement will provide transparent reporting about a company’s financial position and risk.

Is IFRS 17 applicable to non insurance companies?

However, IFRS 17 specifies some scope exclusions that generally relate to contracts typically issued by non-insurance entities, for example, warranties provided by a manufacturer, dealer or retailer in connection with the sale of goods or services to a customer.

Specifically, IFRS 17 introduces new elements to account for the risk component of insurance contracts: the risk adjustment and contractual service margin (CSM).

For non-life insurers, S&P expects to regard both the risk adjustment and the CSM as audited reserve margins, and it may give credit in its capital assessment where an insurer’s loss reserves are determined to be in surplus.

S&P explained that the risk adjustment represents an insurer’s compensation for accepting an insurance liability, as the amount and timing of the cash flows associated with a liability are not known at the time it is taken on.

The CSM indicates how much profit an insurer expects to earn over the remainder of the contract.

Under IFRS 17, insurers would set up a CSM reserve, thus bringing insurance accounting in line with the general IFRS principal that profits should be recognized as they are earned.

S&P also expects that the implementation of IFRS 17 will change reported shareholders’ equity for many insurers, which will impact its financial leverage calculations.

Introduction IFRS 17 Insurance contracts

More than 20 years in development, IFRS 17 represents a complete overhaul of accounting for insurance contracts. The new standard applies a current value approach to measuring insurance contracts and recognises profit as insurers provide services and are released from risk. Introduction IFRS 17 Insurance contracts.

The profit or loss earned from underwriting activities are reported separately from financing activities.

Detailed note disclosures explain how items like new business issued, experience in the year, cash receipts and payments, and changes in assumptions affected the performance and the carrying amount of insurance contracts. Introduction IFRS 17 Insurance contracts.

Insurance contracts combine features of both a financial instrument and a service contract. In addition, many insurance contracts generate cash flows with substantial variability over a long period.

To provide useful information about these features, IFRS 17:

- combines current measurement of the future cash flows with the recognition of profit over the period that services are provided under the contract;

- presents insurance service results (including presentation of insurance revenue) separately from insurance finance income or expenses; and

- requires an entity to make an accounting policy choice of whether to recognise all insurance finance income or expenses in profit or loss or to recognise some of that income or expenses in other comprehensive income.

The key principles in IFRS 17

- identifies as insurance contracts those contracts under which the entity accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder;

- separates specified embedded derivatives, distinct investment components and distinct performance obligations from the insurance contracts;

- divides the contracts into groups that it will recognise and measure;

- recognises and measures groups of insurance contracts at:

- a risk-adjusted present value of the future cash flows (the fulfilment cash flows) that incorporates all of the available information about the fulfilment cash flows in a way that is consistent with observable market information; plus (if this value is a liability) or minus (if this value is an asset)

- an amount representing the unearned profit in the group of contracts (the contractual service margin);

- recognises the profit from a group of insurance contracts over the period the entity provides insurance contract services, and as the entity is released from risk. If a group of contracts is or becomes loss-making, an entity recognises the loss immediately;

- presents separately insurance revenue (that excludes the receipt of any investment component), insurance service expenses (that excludes the repayment of any investment components) and insurance finance income or expenses; and

- discloses information to enable users of financial statements to assess the effect that contracts within the scope of IFRS 17 have on the financial position, financial performance and cash flows of an entity.

IFRS 17 includes an optional simplified measurement approach, or premium allocation approach, for simpler insurance contracts.

IFRS 17 establishes principles for the recognition, measurement, presentation and disclosure of insurance contracts issued, reinsurance contracts held and investment contracts with discretionary participation features an entity issues.

Insurance contracts are contracts under which the issuer (insurer) accepts significant insurance risk from another party (the policyholder) by agreeing to compensate the policyholder if a specified uncertain future event (the insured event) adversely affects the policyholder. Other important definitions are 1) Reinsurance contracts and 2) Investment contracts with discretionary participation features.

Some non-insurance components (embedded derivatives, distinct investment components and distinct (i.e., non-insurance ) goods or services) should be separated and accounted for using other IFRSs. Other important items are 1) financial guarantee contracts and 2) fixed-fee service contracts.

A set, or series, of insurance contracts with the same or a related counterparty, may achieve, or be designed to achieve, a single overall commercial effect. In order to report the substance of such contracts, it may be necessary to treat the set or series as a whole. Introduction IFRS 17 Insurance contracts.

The level of aggregation deals with grouping individual insurance contracts for the purposes of recognizing losses when a group of contracts is onerous and the timing of the recognition of profits arising from a group of profitable contracts. Introduction IFRS 17 Insurance contracts.

An insurance contract is initially recognized when the coverage periods begins or when the company concludes that the contract is onerous. Introduction IFRS 17 Insurance contracts.

When the obligations are extinguished or upon some contract modifications.

An entity should measure the contractual service margin on initial recognition of a group of insurance contracts at an amount that results in no income or expenses arising from:

a. the initial recognition of the fulfillment cash flows;

b. the derecognition at the date of initial recognition of any asset or liability recognized for insurance acquisition cash flows; and Introduction IFRS 17 Insurance contracts

c. cash flows arising from the contracts in the group at that date.

The insurer should remeasure the contracts using updated assumptions about cash flows, discount rate, and risk. The effect of changes in estimates relating to future service is recognized in the periods in which the service is actually provided.

The general model measures a group of insurance contracts as the sum of the following ‘building blocks’:

- Fulfilment cash flows, comprising Introduction IFRS 17 Insurance contracts

- An unbiased and probability-weighted estimate of future cash flows

- A discount adjustment to present value to reflect the time value of money and financial risks

- A risk adjustment for non-financial risk

- A CSM representing unearned profit an entity will recognise as it provides service under the insurance contracts in the group

IFRS 17 distinguishes between insurance contracts with and without direct participation features. The general model is modified for insurance contracts with direct participation features—those contracts are measured applying modified requirements referred to as the ‘variable fee approach’. Introduction IFRS 17 Insurance contracts

The premium allocation approach is a simplified form of measuring insurance contracts in comparison with the general model. Use of the premium allocation approach is optional for each group of insurance contracts that meets the eligibility criteria.

A reinsurance contract is an insurance contract issued by one entity (the reinsurer) to compensate another entity for claims arising from one or more insurance contracts issued by the other entity (underlying contracts). IFRS 17 requires a reinsurance contract held to be accounted for separately from the underlying insurance contracts to which it relates.

An insurance contract is onerous at the date of initial recognition if the fulfilment cash flows allocated to the contract, including any previously recognised acquisition cash flows and any cash flows arising from the contract at the date of initial recognition in total are a net outflow.

What does IFRS 17 state?

IFRS 17 establishes the principles for the recognition, measurement, presentation and disclosure of insurance contracts within the scope of the standard. The objective of IFRS 17 is to ensure that an entity provides relevant information that faithfully represents those contracts.

What is the main difference between IFRS 4 and IFRS 17?

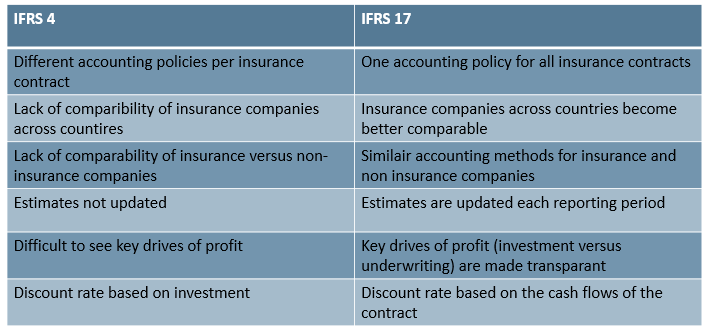

The key difference between IFRS 17 and IFRS 4 is the consistency of application of accounting treatments to areas such as revenue recognition and liability valuation. Under IFRS 4, entities were free to derive their own interpretations of revenue recognition and calculation of reserves.

IFRS 17 explains how you should account for insurance contracts and the connected events. Currently this is explained within IFRS 4, but there are several problems with IFRS 4.

Within IFRS 4 it is hard to compare profitability between insurance companies and between an insurance company and companies within other industries. This is mainly because with IFRS 4 insurance companies can use old parameters for calculating their financial results and positions while they can also take a profit when the product (the insurance coverage) is not yet delivered. Another problem with IFRS 4 is that the real profit drivers are not visible.

Does IFRS 17 apply to US companies?

Even for countries, such as the US, where IFRS 17 is not adopted as the standard for valuation of insurance contracts, many insurers will be impacted through their foreign subsidiaries.

IFRS 17 Standard history

In March 2004 the International Accounting Standards Board (Board) issued IFRS 4 Insurance Contracts. IFRS 4 was an interim standard which was meant to be in place until the Board completed its project on insurance contracts. IFRS 4 permitted entities to use a wide variety of accounting practices for insurance contracts, reflecting national accounting requirements and variations of those requirements, subject to limited improvements and specified disclosures.

In May 2017, the Board completed its project on insurance contracts with the issuance of IFRS 17 Insurance Contracts.

IFRS 17 replaces IFRS 4 and sets out principles for the recognition, measurement, presentation and disclosure of insurance contracts within the scope of IFRS 17.

In June 2020, the Board issued Amendments to IFRS 17. The objective of the amendments is to assist entities implementing the Standard, while not unduly disrupting implementation or diminishing the usefulness of the information provided by applying IFRS 17.

Other Standards have made minor consequential amendments to IFRS 17, including Amendments to References to the Conceptual Framework in IFRS Standards (issued March 2018) and Definition of Material (Amendments to IAS 1 and IAS 8) (issued October 2018).

………………………..

Edited by Tetiana Mykhailova — CFO Beinsure / Commercial Director Finance Media