The value of revenues earned worldwide by MGA, MGU and cover-holder groups (a.k.a. delegated underwriting authority / underwriting agency groups) was around USD 17.3 billion, signifying annual growth in this sector of around 19% before adjusting for inflation.

According to an updated ranking and analysis completed by Insuramore, this is substantially ahead of the growth rate of world’s insurance broking sector which, as reported by Insuramore in a related press release on 2024.

Rankings of the world’s leading MGA / MGU / cover-holder groups by total revenues derived globally from delegated underwriting activity across all types of insurance (and reinsurance)

Managing general agents (MGAs) fill key roles in the insurance distribution chain. The more informed investors are about how MGAs function, the better they can recognize opportunities (see Most Important Skills of Insurance Brokers).

As a group, Brown & Brown was ranked first globally in this arena in 2022 having become the first group to generate more than USD 1 billion in annual revenues from this activity.

It has since built on that position during 2024 through the announcement of its intended acquisition of Kentro Capital, parent company of Nexus Underwriting.

In descending order, Brown & Brown is likely to have been followed from second to fifth by Truist Insurance Holdings, Amwins, Ryan Specialty Group and Gallagher, with these top five groups holding a combined market share of just under 20% of global MGA revenues (see Top 15 Insurance Broker Groups by Revenues).

MGA Groups Worldwide by Revenues

| Rank | MGA group | Revenues, $ mn | CAGR, 2Y% |

| 1 | Brown & Brown | 1070,9 | 17,5% |

| 2 | Truist Insurance Holdings | 615,0 | 45,0% |

| 3 | Amwins | 595,0 | 12,8% |

| 4 | Ryan Specialty Group | 582,6 | 30,1% |

| 5 | Gallagher | 566,0 | 41,1% |

| All other MGA, MGU and cover-holder groups | 13905 | ||

| Global total | 17335 |

TOP 5 MGA Groups Worldwide by Global market share

| Rank | MGA group | Global market share, % |

| 1 | Brown & Brown | 6,18% |

| 2 | Truist Insurance Holdings | 3,55% |

| 3 | Amwins | 3,43% |

| 4 | Ryan Specialty Group | 3,36% |

| 5 | Gallagher | 3,27% |

| All other MGA, MGU and cover-holder groups | 80,22% | |

| Global total | 100,00% |

After more than a decade in which private equity has made strong returns by focusing on intermediaries in the insurance sector—notably retail brokerages—attention in the United States and Europe has turned to another compelling niche play: managing general agents (MGAs). Private-equity investment in MGAs has accelerated in the past two years, increasing the competitiveness of each deal and pushing valuations higher.

Investors have been looking to understand how MGAs fit within the insurance ecosystem, how they differ from other insurance intermediaries such as retail brokers and wholesalers, and how MGAs compare with other parts of the ecosystem as an investment opportunity.

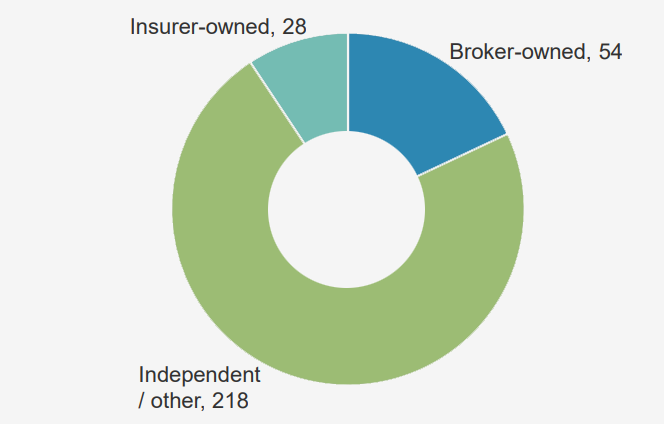

By ownership, 54 of the top 300 groups in this space are classifiable as broker-owned, 28 as insurer-owned and the remaining 218 as independent

Among insurer-owned groups, Insuramore judges that Munich Re generated the highest revenues from proprietary MGA business in 2022 while NSM Insurance Group was the largest independent group.

MGA Groups Worldwide by Type

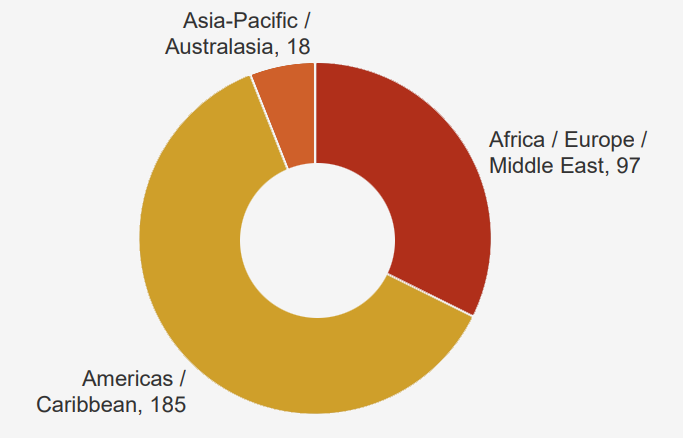

Furthermore, by location of headquarters, with 170 in total and benefiting from the strength of the US dollar against most other global currencies, the US played host to the most MGA groups in the top 300 with the UK (49), the Netherlands (13), Canada (12) and Germany (10) coming next on this count.

As would be expected given the very high industry-wide growth rate, almost all MGA groups experienced an increase in their revenues and 11 of the top 300 are believed likely by Insuramore to have more than doubled their income relative to last two years.

The most rapid year-on-year growth is likely to have been achieved by Acrisure following its acquisition of both Appalachian Underwriters and Volante Global. Cyber insurance specialists such as Coalition, Envelop and Resilience also feature among the groups that more than doubled their revenues.

MGA Groups Worldwide by Region

What is Insurance MGA?

MGAs are insurance intermediaries, but unlike retail and wholesale brokers, they are often granted binding authority from insurance partners. This means they can quote and bind policies that fit within the agreed-upon risk parameters of their insurer relationships.

This feature distinguishes MGAs from other insurance intermediaries. MGAs often further differentiate themselves either by having expertise in nonstandard, niche, or specialty lines of insurance or by having privileged access to specific customer segments.

Role within the value chain

MGAs can play an integral role in the insurance distribution value chain, often sitting between other intermediaries, such as retail or wholesale brokers and insurance companies, providing a unique value proposition for all parties.

MGAs typically have relationships with insurance carriers that focus on more specialized businesses and risks. Thus, retail brokers can expand the number of insurance carriers through which the final client can obtain insurance. MGAs’ expertise in their specialist niches also helps brokers structure risk appropriately for insureds.

MGAs can also make the value chain more efficient, given that they operate without the type of legacy placement platforms seen elsewhere in the sector.

MGAs also tend to have lean operations because they are often smaller, younger, and unencumbered by the operational complexities found at insurance carriers. They may also offer enhanced technology for policy management, quotation, or claims management, making binding and policy management processes more seamless.

For insurance carriers, MGAs provide expertise and underwriting sophistication for specific lines of business, such as cyberrisk (see How Insurers Can Expand the Cyber Insurance?).

They also make market entry easier because insurance carriers can leverage MGAs to enter new markets without having to build their own infrastructure, which typically involves hiring an underwriting team, building new pricing models, sourcing external data relevant to specific risks, and incurring the new development costs associated with an in-house build.

Some MGAs also handle loss-mitigation strategies for insureds and process claims.

Worldwide, there are over 2,500 individual enterprises involved in MGA activity among which around a half are likely to have written premiums of more than USD 10 million in, and regular new launches appear to be sustaining this volume.

Nevertheless, other significant acquisitions in this space that were in the process of being completed during 2024 included those of Envest by Ardonagh Group, BridgeForce by HUB, both Taga and Tay River Holdings by Gallagher, Acquis Insurance Management by NSM Insurance Group, Animal Friends by Pinnacle Pet Group, and Griffin Underwriting Services by Ryan Specialty Group.

In addition, Amynta Group has concluded its acquisition of Ambridge from Fairfax Financial.

Assessing MGA market size

According to McKinsey, the United States and United Kingdom are the two most developed MGA markets. Several MGAs operate in both, which may involve placing US-originated risks in the London market, maintaining London outposts for US MGAs, or expanding London-based MGAs into the United States.

In the United States, there are about 600 MGAs, which collectively place $47 billion in premiums—equivalent to roughly 7% of the overall commercial and personal insurance markets.

There are three types of MGAs in the United States:

- Affiliated MGAs ($26 billion in direct premium written, or DPW) generate premiums while being wholly owned or majority-owned by an insurer. The DPW at these MGAs has been growing at an average of almost 7% annually.

- Nonaffiliated MGAs ($16 billion in DPW) are third parties and can establish relationships with multiple insurers. The DPW at these MGAs has been growing by about 3%.

- Crop MGAs ($5 billion in DPW) are niche MGAs that participate in the Multi-Peril Crop Insurance Program (MPIC), which is tied to the agricultural sector.

In the United Kingdom, there are more than 300 MGAs placing more than 10% of the United Kingdom’s £47 billion in general insurance premiums. Lloyd’s is the largest global market for MGAs; Lloyd’s had 76 syndicates managed by 50 general agencies.

Accordingly, MGAs perform certain functions ordinarily handled only by insurers, such as binding coverage, underwriting and pricing, appointing retail agents within a particular area, and settling claims.

Typically, MGAs are involved with unusual lines of coverage, such as professional liability and surplus lines of insurance, in which specialized expertise is required to underwrite the policies.

However, MGAs also write some personal lines business, especially in geographically isolated areas (e.g., western Oklahoma, North Dakota) where insurers do not want to set up a branch office. MGAs benefit insurers because the expertise they possess is not always available within the insurer’s home or regional offices and would be more expensive to develop on an in-house basis.

MGA, MGU and cover-holder revenues are defined as fees and commissions earned fromunderwriting / program administration (and related activities, such as claims management) byentities with the authority to underwrite or bind insurance (or reinsurance) risk in any class andthat do this exclusively or mainly on behalf of unaffiliated carrier partners. Such entities that areinsurer-owned and that are believed to place risks exclusively or mainly with parent or sisterunderwriters (i.e. affiliated entities) are excluded from the analysis. Revenues from wholesale orother broking / agency activity that do not meet this definition of MGA, MGU or cover-holderbusiness are also not in scope.

Top 300 MGA / MGU / cover-holder groups by this measure segmented byownership type and by home region as shown in the charts overleaf.

Edited & Fact checked by