The world economy is undergoing paradigm shifts that will have profound long-term policy implications. Global economic growth is set to slow sharply and inflation rates are at multi-decade highs.

According Swiss Re Institute Report “World insurance: inflation risks front and centre”, the latter result from a confluence of factors, including the high levels of fiscal stimulus pumped into the economy at the height of the COVID-19 crisis, disruptions to global supply chains and soaring energy and commodity prices due to the war in Ukraine.

Economic slowdown and the high-inflation environment

We believe several major economies face inflationary recessions in the coming 12–18 months.

Economic slowdown and the high-inflation environment will weigh on insurance markets. Slowing growth typically leads to lower demand for insurance.

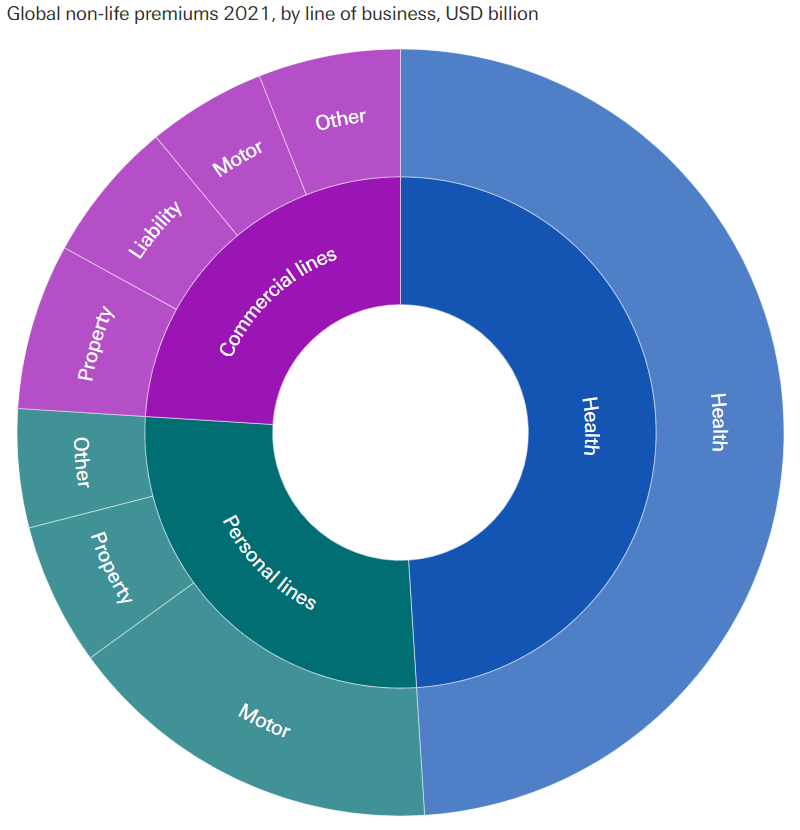

The main inflation impact will show in rising claims costs, more in non-life than life insurance in which policy benefits are defined at inception. We expect property and motor to be most impacted in the near term. In construction, supply disruptions and labour shortages have led to an increase in repair and rebuilding costs, and in turn higher claims. In motor, claims costs have risen as shortages of parts have kept the prices of new and used vehicles historically high.

Accident, motor liability and general liability business will also be impacted, with high inflation feeding through into bodily injury claims. To counter the negative impact of rising claims costs on earnings, insurers need to understand the drivers of inflation, and action balance sheet and reserve management steps accordingly.

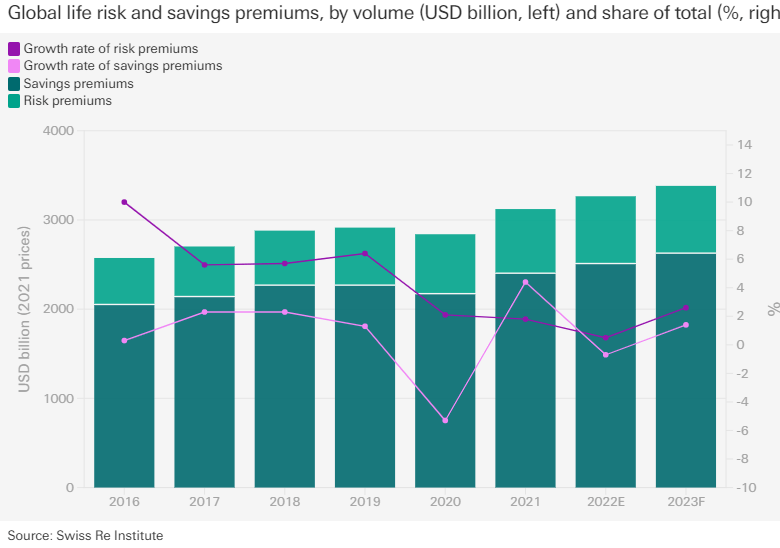

Swiss Re estimate strong 6.1% nominal growth in total premiums (non-life and life) in 2022. In real terms, that translates into near flat growth (+0.4%). Further, we forecast that in nominal terms, global premium volumes will surpass the USD 7 trillion mark by the end of this year for the first time ever.

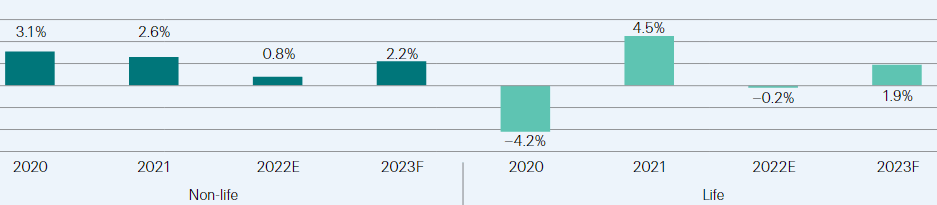

Insurance premium growth forecasts

At the aggregate level, we expect a stalling of global insurance premium growth this year will be followed by a stronger but still below-trend performance in 2023.

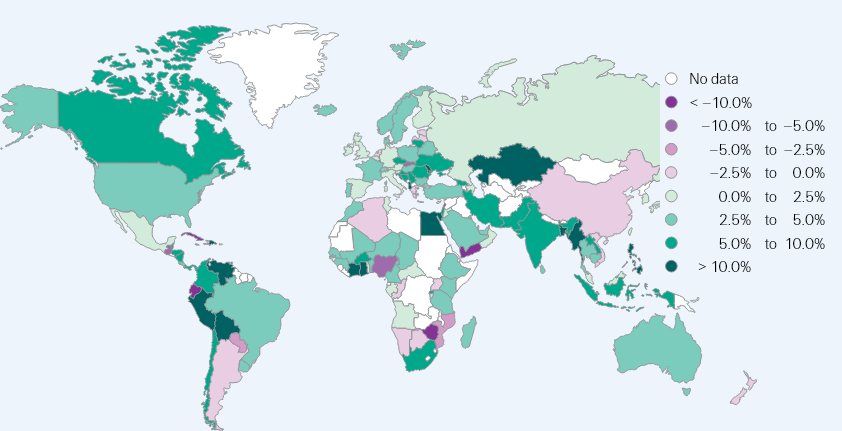

This is based on our expectation of more rate hardening in non-life to counter high inflation and strong premium growth in emerging markets. At this level, volumes will be 17% higher than at the onset of the COVID-19 crisis, reflecting the resilience of insurance markets over the course of the pandemic.

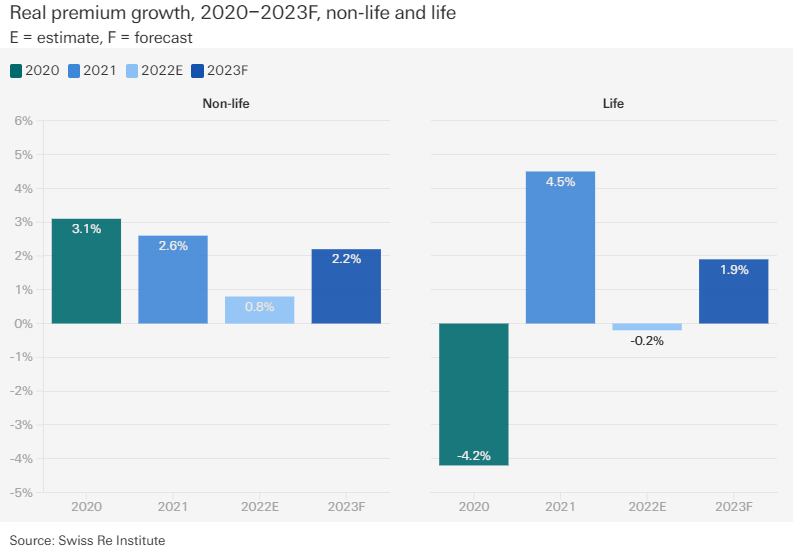

In the non-life sector, we expect inflation of exposure values and rate hardening will boost premium growth, notably in North America and Europe. In real terms and globally, however, we estimate that premiums will rise by 0.8% this year. For 2023, we forecast that global non-life premiums will grow by 2.2%, based mostly on ongoing rate hardening, notably in commercial lines of insurance business. Premium growth in emerging markets will likely outstrip that in advanced economies this year and next, with estimated real growth of 3.0% in 2022 and 4.2% in 2023. A main driver will likely be strong demand for short-term health insurance, this on the back increased awareness of health security in the wake of the pandemic experience.

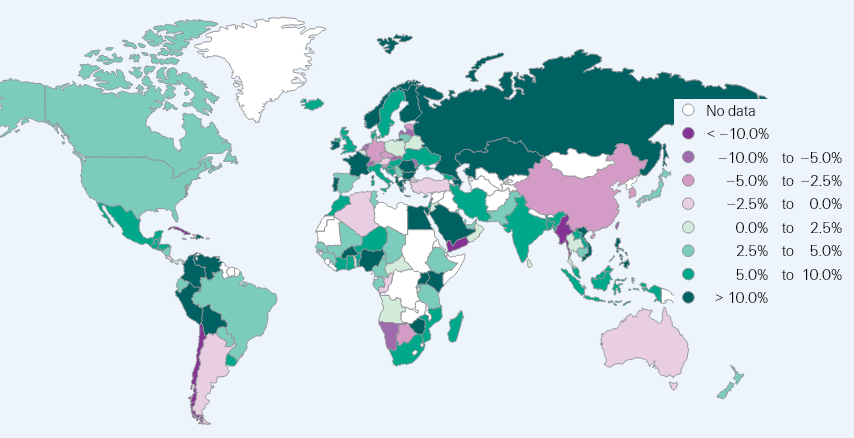

Non-life real premium growth

Non-life sector profits will come under pressure this year: we project a sector return on equity (ROE) of around 5-6% in 2022, down from 6% in 2021, with a rebound to 6.6% in 2023 as underwriting results and investment yields improve.

Economic slowdown and multi-year high inflation will reduce premium income in real terms and increase claims costs. However, a silver lining to the inflation crisis is that interest rates are heading up. This will boost investment returns over the longer term as non-life insurers’ bond portfolios gradually roll over into higher yields.

In life, we estimate that global premiums will contract slightly by 0.2% in real terms in 2022. Saving premiums, which represent more than three quarters of the life sector, will likely suffer from volatile financial market conditions and falling disposable incomes. However, medium-term tailwinds are well anchored.

Heightened risk awareness post-pandemic is driving demand for protection-type products, and insurers are changing their business models to be digital-ready. Further, higher interest rates will support demand for guaranteed savings products.

Life real premium growth

We see global life premiums rising by 1.9% in real terms in 2023, with improvement in both advanced and emerging markets. We expect moderate improvement in life sector profitability this year, based on rising interest rates.

A more significant boost to investment returns will show through over the medium to longer term, as the long-term fixed-income assets in life insurers’ investment portfolios assets start to turn over. Additionally, while COVID-19 related claims will likely linger in 2022, the severity of claims may subside as the world adjusts to living with the virus.

According to the latest Global Insurance Report, 2022 was expected to be another bumper year for the insurance industry, but the invasion of Ukraine has dashed those hopes.

Premium income is likely to grow by roughly 1pp slower than originally assumed as the war takes its toll on economic activity and confidence, even as inflation supports the top line. Global premium income to grow by +4.8% in 2022, with life and p&c insurance developing almost in step (+4.9% and +4.6% respectively). This figure must be considered against the backdrop of a global inflation rate of 6.2% this year.

Major economies are facing inflationary recessions

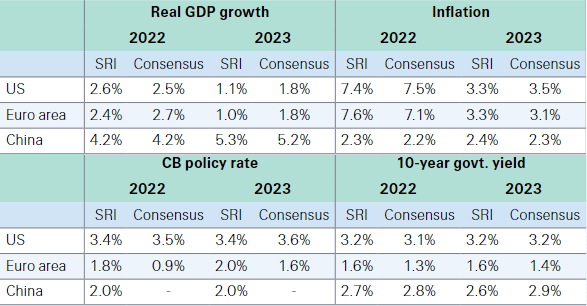

Persistent inflation and accelerated monetary policy tightening will soften growth significantly over the next 12–18 months. We are below consensus on the 2023 growth outlook for the US and euro area, and see downside risk to our euro area forecast

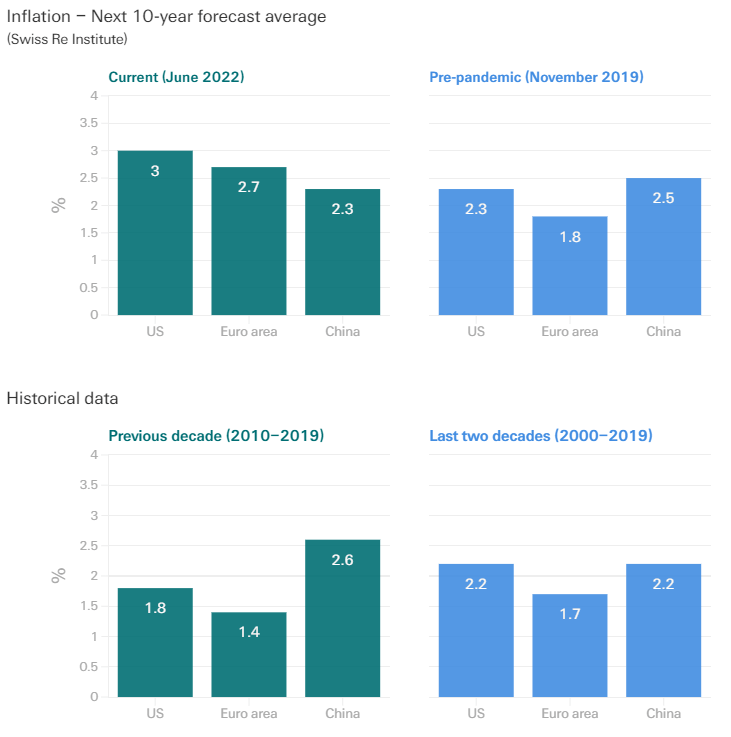

Inflation to remain higher for longer

The main macroeconomic development of the last 12 months for most major economies has been soaring inflation. We expect high inflation to remain for longer, and forecast higher rates of inflation for the 2020s decade than in the previous 10 years. In the case of China, we believe structural factors such as increased productivity and rising digitisation, among others, will lead to lower trend inflation relative to the previous decade.

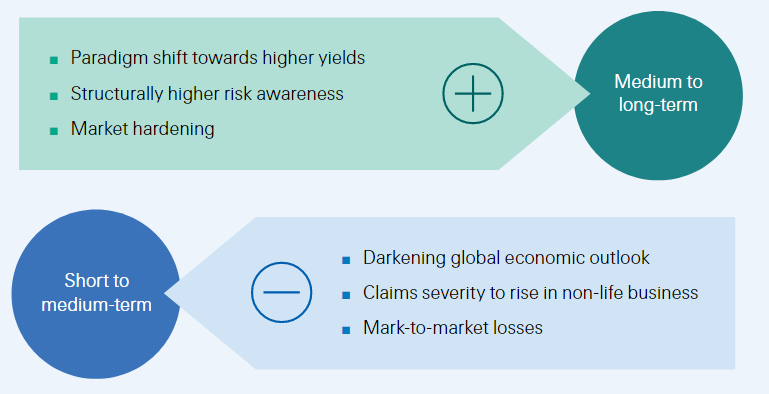

Tailwinds and headwinds for insurers

These will impact premium growth rate and investment returns, and thus both sides of the balance sheets

The global economy is slowing sharply and inflation is at multi-decades highs: we anticipate what we call “inflationary recessions” in many major economies over the next 12-18 months. Central banks are hiking interest rates, targeting price stability over economic growth. In our view, this is a notable positive to the current challenging conditions, on two fronts. It will help ward off 1970s-style stagflation. It also signals the end of the era of financial repression. For insurers, rising interest rates are a silver lining to the current inflation crisis, with investment returns set to improve.

Growth and inflation outlook

The global economy faces a recession-like growth environment

Global Insurance growth is slowing and will likely continue to do so over the second half of this year due to tighter financial conditions and multi-decade high levels of inflation. We forecast global real GDP growth of 3% in 2022 and 2.6% in 2023, both below consensus.1 Risks remain skewed to the downside as monetary policy becomes more restrictive, commodity prices remain elevated and volatile, and COVID-19 restrictions in China carry on choking demand by continuing to disrupt global supply chains.

A web of risks is drawing economies towards inflationary recessions. Persistent inflation and accelerated monetary policy tightening will weigh on growth in major economies over the next 12–18 months.

The Fed in particular may struggle to avoid a sharp slowdown. We forecast US growth of 2.6% in 2022 and 1.1% in 2023, below consensus for the latter.

In Europe, we believe the economy’s resilience in the year-to-date has delayed rather than deflected a more serious slowdown on account of the war in Ukraine and the related energy and cost-of-living crisis. We see downside risks to our full-year 2022 euro area growth forecast of 2.4% due to likely energy supply shortages in the autumn/winter. We expect Europe to fall into recession by the winter, if not earlier. For China, we recently reduced our growth forecast for 2022 to 4.2% from 5.1% due to ongoing COVID-19 lockdowns.

Inflation forecasts for selected economies

The invasion of Ukraine: a global stagflation-like shock

The net macroeconomic effect of the conflict in Ukraine has been a stagflation-like shock: slower growth and higher inflation. Insurers continue to assess exposure and liabilities to Ukraine & Russia. The aggregate value of planes stuck on Russian territory following the nation’s invasion of Ukraine could even surpass the claims stemming from 9/11.

The GDP of Russia and Ukraine combined accounts for less than 2% of global GDP, but the ripple effects of the war go far beyond their borders.

We see five main transmission channels:

- disruptions to supply chain and sharply higher energy and commodity prices;

- tighter financial conditions;

- dented investor and consumer sentiment;

- disruptions to the global banking and financial system;

- disruption to trade flows.

We estimate that relative to our pre-war scenario, the decrease in 2022 global real GDP growth due to the conflict will be of 1.35 percentage points (ppt). For inflation, we estimate an increase of 2.6 ppt.

The process is particularly costly for emerging markets, which have been living with central bank tightening since mid-2021. This has come in an attempt to stabilise local currencies ahead of the start of the eventual tightening cycle in advanced markets. Now emerging markets face the drag of 12 continuous months of increasingly stringent financial conditions, and likely more of the same for another year as they navigate the pace at which the Fed and the ECB seek to rein in inflation.

A new interest rate regime, or in other words the end of the negative interest rates experiment, is a silver lining for the insurance industry also. Insurers will, over time, benefit from higher investment returns that will help offset the higher claims they are liable for.

Moreover, for non-life insurers, empirical analysis shows a strong correlation between nominal interest rates and the combined ratio in non-life. The low-rate environment of the past decade meant that non-life insurers’ underwriting results have been under pressure, even though the industry profited from mark-to-market gains in risky assets and fixed income investments. For 2023, the anticipated increase in interest rates will ease pressure on underwriting side. For the G8 markets and on a median basis, we estimate that underwriting margins will need to rise by 4–5 ppt in order to meet ROE expectations. That compares with an underwriting gap of 6–9 ppt previously.

Life insurers are more interest-rate sensitive than non-life given their higher asset leverage. The long-dated nature of their contracts creates the possibility of asset and liability mismatch.

Given that life insurance guarantees are usually set at the point of sale, the falling interest rates of the past decade have significantly affected the return gap of existing in-force policies.

The rise in nominal interest rates is an important tailwind for the industry. However, it will not be strong enough to fully offset current challenging capital market and inflation conditions. As such, we believe underwriting discipline should remain a main point of focus.

………………………

AUTHORS: Fernando Casanova Aizpun – Senior Economist Swiss Re Institute, Li Xing – Head Insurance Market Analysis Swiss Re Institute, Roman Lechner – P&C Economic Research Lead Swiss Re Institute, Rajeev Sharan – Senior Economist Swiss Re Institute