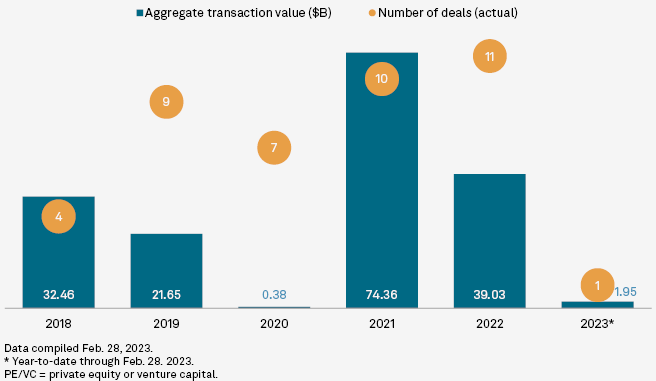

The value of global private equity deals with sovereign wealth fund investment fell by nearly half. Transactions with sovereign wealth fund investment totaled $39 billion across 11 deals in 2022, compared to $74.36 billion across 10 deals a year earlier, according to S&P Global Market Intelligence data.

A sovereign wealth fund (SWF), sovereign investment fund, or social wealth fund is a state-owned investment fund that invests in real and financial assets such as stocks, bonds, real estate, precious metals, or in alternative investments such as private equity fund or hedge funds.

Sovereign wealth funds invest globally

Most SWFs are funded by revenues from commodity exports or from foreign-exchange reserves held by the central bank.

Some sovereign wealth funds may be held by a central bank, which accumulates the funds in the course of its management of a nation’s banking system; this type of fund is usually of major economic and fiscal importance.

Other sovereign wealth funds are simply the state savings that are invested by various entities for the purposes of investment return, and that may not have a significant role in fiscal management.

The accumulated funds may have their origin in, or may represent, foreign currency deposits, gold, special drawing rights (SDRs) and International Monetary Fund (IMF) reserve positions held by central banks and monetary authorities, along with other national assets such as pension investments, oil funds, or other industrial and financial holdings.

The assets of the sovereign nations that are typically held in domestic and different reserve currencies (such as the dollar, euro, pound, and yen).

Such investment management entities may be set up as official investment companies, state pension funds, or sovereign funds, among others.

There have been attempts to distinguish funds held by sovereign entities from foreign-exchange reserves held by central banks. Sovereign wealth funds can be characterized as maximizing long-term return, with foreign exchange reserves serving short-term “currency stabilization”, and liquidity management.

Many central banks in recent years possess reserves massively in excess of needs for liquidity or foreign exchange management. Moreover, it is widely believed most have diversified hugely into assets other than short-term, highly liquid monetary ones, though almost no data is publicly available to back up this assertion.

Sovereign wealth fund-backed private equity deals

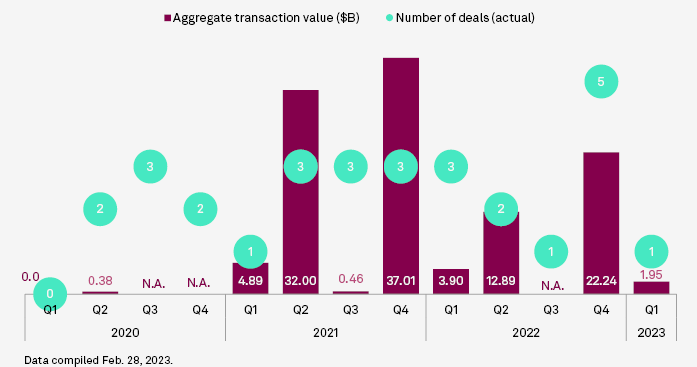

The size of these deals also decreased year over year. In 2021, the three largest transactions were valued at $32 billion, $20.01 billion and $17 billion, while 2022’s top deal was below $12 billion.

Global M&A investments with sovereign wealth fund

The fourth quarter of 2022 saw the highest deal volume and value for the year, with five transactions totaling $22.24 billion. But the quarter’s deal value was down 39.9% from $37.01 billion in the corresponding period of 2021.

M&A investments with sovereign wealth fund, 2020-2023

Deal shift

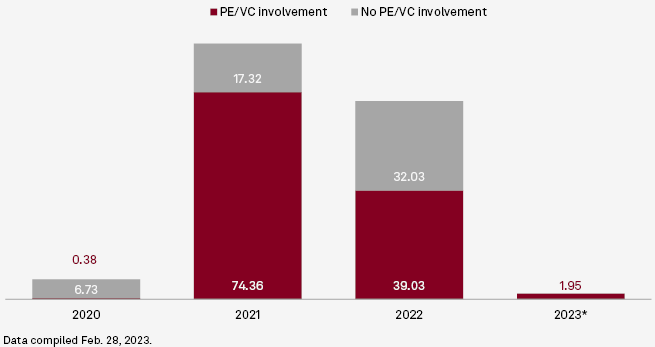

Sovereign wealth funds appear to be pivoting away from private equity deals. 2022 was far stronger for non-private equity deals with sovereign wealth fund involvement compared to the previous year. Aggregate value for these deals grew 84.9% to $32.03 billion in 2022 from $17.32 billion in 2021.

Across all M&A backed by sovereign wealth funds, companies in the U.S. and Canada were the main target with an aggregate transaction value of $50.79 billion. Europe amounted to $14.14 billion, while Asia-Pacific and Middle East transactions totaled $3.41 billion and $2.72 billion, respectively.

Sovereign wealth funds from the Middle East reported the highest number of overall deals in 2022, with investments in 31 transactions. Sovereign wealth funds from Asia-Pacific participated in 21 deals.

Global M&A investments with sovereign wealth fund, PE/VC involment

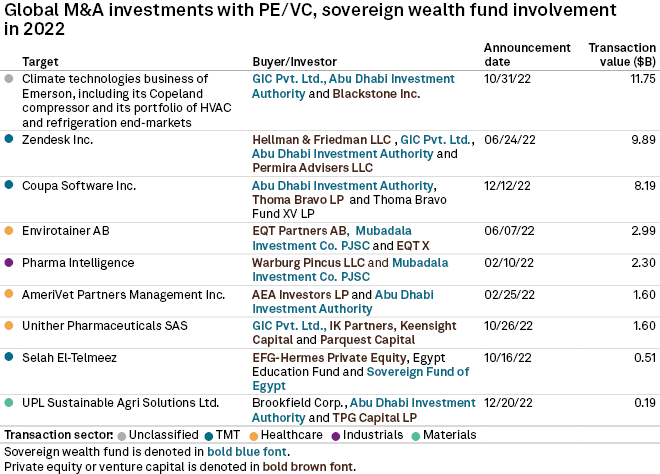

Largest deals with sovereign wealth fund

The pending acquisition of a 55% stake in Emerson Electric Co.’s climate technology business by Blackstone Inc.; Abu Dhabi Investment Authority, or ADIA; and GIC Pte. Ltd. for $11.75 billion was the largest sovereign wealth fund-backed private equity transaction in 2022. The deal includes a $9.5 billion cash consideration and a $2.25 billion debt consideration.

The second-largest deal involved GIC and ADIA in partnership with Hellman & Friedman LLC and Permira Advisers LLC, which acquired application software company Zendesk Inc. from an investor group for $9.89 billion in November 2022.

Next was ADIA and Thoma Bravo LP working together on the $8.19 billion buyout of business spend management platform Coupa Software Inc.

SWFs are typically created when governments have budgetary surpluses and have little or no international debt. It is not always possible or desirable to hold this excess liquidity as money or to channel it into immediate consumption.

This is especially the case when a nation depends on raw material exports like oil, copper or diamonds. In such countries, the main reason for creating a SWF is because of the properties of resource revenue: high volatility of resource prices, unpredictability of extraction, and exhaustibility of resources.

There are two types of funds: saving funds and stabilization funds. Stabilization SWFs are created to reduce the volatility of government revenues, to counter the boom-bust cycles’ adverse effect on government spending and the national economy.

Savings SWFs build up savings for future generations. One such fund is the Government Pension Fund of Norway. It is believed that SWFs in resource-rich countries can help avoid resource curse, but the literature on this question is controversial.

What are private equity deals?

Private equity (PE) refers to capital investment made into companies that are not publicly traded. Most PE firms are open to accredited investors or those who are deemed high-net-worth, and successful PE managers can earn millions of dollars a year.

How does private equity find deals?

How do private equity firms source deals? PE firms usually source deals through existing portfolio companies, deal sourcing platforms, investment banks, and referrals.

What are the 4 main areas within private equity?

Equity can be further subdivided into four components: shareholder loans, preferred shares, CCPPO shares, and ordinary shares. Typically, the equity proportion accounts for 30% to 40% of funding in a buyout. Private equity firms tend to invest in the equity stake with an exit plan of 4 to 7 years.

What is an example of a private equity deal structure?

A private equity deal structure example of this is when a company dealing with home appliances is willing to expand its business and has a 100,000-dollar cash flow every year. The company can be liable to get a loan of 180,000 dollars to support its development after being leveraged to its annual earnings.

How does a PE firm make money?

Private equity firms buy companies and overhaul them to earn a profit when the business is sold again. Capital for the acquisitions comes from outside investors in the private equity funds the firms establish and manage, usually supplemented by debt.

Why do companies sell to private equity?

A private equity firm can help streamline operations and modernize a company, which cuts unnecessary costs and increases revenue. Founders receive some liquidity at the time of sale. Unlike other options like venture capital or a public offering, founders get cash at the time of sale.

What happens when a company goes private equity?

When a publicly traded company becomes a privately held company, the public company’s shares are purchased at a premium by the investors buying the company. The company is delisted from the stock exchange where its shares formerly traded.

What is the difference between M&A and private equity?

The two acquirer types operate along different and distinct approaches toward ownership: in acquisitions, private equity players act as professional investors, whilst industrial buyers operate in M&A transactions as organizational integrators.

…………………

AUTHORS: Muhammad Hammad Asif – Private equity insights and market pulse S&P Global Market Intelligence, Annie Sabater – Data Associate S&P Global Market Intelligence

Fact checked by Oleg Parashchak