In a year of upheaval caused by geopolitical tensions, the ongoing pandemic and an uncertain economic climate, CEOs continue to face evolving challenges and opportunities. With swirling changes across the industry, KPMG surveyed 134 insurance CEOs, to gather their insights and perspectives on the industry and economic landscapes over the next 3 years.

Insurers continue to adapt to new technologies and cyber security strategies, and CEOs pinpointed operational risks and emerging/disruptive technology risks as the top two threats to their organization’s growth over the next 3 years. This is a shift from 2021, when they felt regulatory and tax risks were the greatest threats.

The CEO Outlook draws on the perspectives of 1,325 global CEOs across 11 markets to provide insight into their 3-year outlook on the business and economic landscapes.

The survey also reveals shifts in strategy and viewpoints from the KPMG CEO Outlook Pulse Survey, conducted ahead of the Russian government’s invasion of Ukraine.

Compared to our 2021 survey, insurance CEOs also expressed increased optimism about growth for the economy and the industry, but fewer felt optimistic about their company’s own growth prospects.

The economic outlook

While 90% of insurance CEOs believe a recession is likely in the next 12 months, 53% believe it will be mild and short and 79% of those CEOs have plans in place to deal with it.

When asked about their most pressing concern for their organization today, pandemic fatigue, economic factors (including rising interest rates, inflation and an expected recession) and emerging/disruptive technology came out on top.

Although insurance CEO confidence is high overall compared to all the CEOs surveyed, signs of headwinds are starting to show and they are preparing for this accordingly.

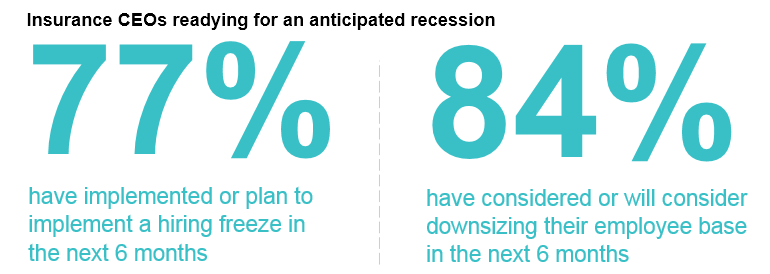

Insurance CEOs are readying themselves and their organizations to weather current geopolitical and economic challenges, while exploring how they can mitigate recessionary impacts to plan for economic disruption. In the coming 6 months, 50% say they are planning to bring overseas operations back to a local level or even in-house to cope with geopolitical challenges. They are also considering or will consider downsizing their employee base in the short-term and putting a hiring freeze in place.

A sense of optimism

Although insurance CEOs are readying for a recession, many also report feeling optimistic about growth prospects over the next 3 years for the global economy and the insurance sector overall. 72% indicated they feel either confident or very confident about the global economy’s growth potential, a slight increase from 70% in 2021. What’s more, 90% said they feel confident or veryconfident about the sector’s growth prospects, compared with 84% in 2021.

Amid their optimism are further signs of early headwinds. More of the insurance CEOs indicated confidence for growth prospects in their industry versus their own company (87%). This is a shift from 2021, when 93% of insurance CEOs said they felt optimistic about their company’s growth prospects.

Geopolitical uncertainties will likely continue to impact strategies, with 92% of insurance CEOs discontinuing their working relationship with Russia and 87% pausing or planning to pause their digital transformation strategy. These uncertainties have also impacted CEOs’ confidence in terms of the growth prospects of their companies — with 87% of those surveyed expressing confidence, a decrease of 6% points from 2021.

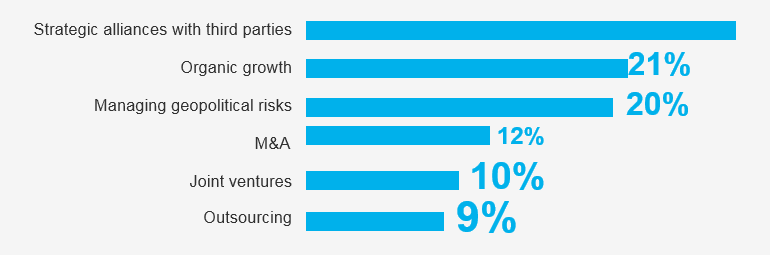

Important strategies for achieving growth objectives over the next 3 years

Shifting M&A appetite

Strategic alliances (28%), organic growth (21%) and managing geopolitical risks (20%) top insurance CEO lists of the mostimportant strategies for achieving organizational growth objectives over the next 3 years.

Despite this decrease, 59% of CEOs said their appetite for M&A is high and that their companies are likely to undertake acquisitions that will significantly impact their business.

This trend of increased M&A activity is more apparent in the insurance sector, versus 47% among all global CEOs.

Significantly fewer insurance CEOs named mergers and acquisitions (M&A) as one of their top strategies compared to the 2021 Outlook.

Risks to growth

As insurers continue adapting to new technologies and cyber security strategies, operational risks and emerging/disruptive technology risks were identified as major barriers to growth. Due to the ongoing global challenge of volatile unemployment levels, internal unethical culture risks increased significantly to 13%, compared with 1% in 2021.

Tax risk may no longer be one of the top two concerns for insurance CEOs, but a majority still find their companies are under increased pressure due to changing tax requirements.

In fact, 77% of CEOs believe that their organization is under extra pressure to increase reporting of their global tax contributions — and that the proposed global minimum tax regime possesses a significant concern to their organization’s goals.

As insurance CEOs continue to transform how they and their organizations do business, the vast majority (83%) recognize there’s a strong link between whether members of the public trust a business and how an organization’s tax approach aligns to its values.

Risk to growth over the next 3 years

Technology helping to drive growth

Insurance CEOs are directing digital investment to areas of their business that drive growth, with 77% of insurance CEOs saying they havea strategy in place to drive digital transformation in order to remain relevant and stay ahead of the competition.

But they also recognize that the necessary digital transformation acceleration of the past few years has led to burnout — and 83% agree this needs to be addressedbefore CEOs can continue their transformation journeys.

In line with this thinking, fewer insurance CEOs say they need to be quicker to shift investment to digital opportunities and divest in those areas where they face digital obsolescence — 72%, a decrease from 75% in 2021.

Digital transformation has become more expensive in recent years. This is reflected by the 54% who are placing more capital investment in buying new technology as opposed to developing their workforce’s skills and capabilities. This is a reversal from 2021, when 49% were investing more in new technology and 51% into their workforce.

When asked their top barriers to digital transformation, the top response was deciding on the right technology. This struggle shows itself in the 78% of CEOs who agree that partnerships are critical to staying resilient and continuing their pace of digital transformation (an increase from 65% in 2021).

Now more than ever, investment should be prioritized in those areas that help drive growth — and potentially slowed or reconsidered on efforts that may be considered non-critical. In uncertain times, businesses may want to focus their digital investments on impactful and measurable opportunities that are most likely to support their strategic goals.

Cyber security

Continuing the advancement of progress underpinned by technology, insurance CEOs are working to strengthen their cyber security strategies to build robust relationships with stakeholders. The vast majority agree that a strong cyber strategy is critical to gain trust from key stakeholders (82%). What’s more, 84% see information security as a strategic function to help them gain competitive advantage.

Growing experience of the challenges of cyber security is also giving insurance CEOs a clearer picture of how prepared — or unprepared — they may be.

More CEOs say they are prepared for a cyber attack — 59%, up from 48% in 2021, and 76% say protecting their partner ecosystem and supply chain is equally important as building their organization’s cyber defenses.

Recent geopolitical volatility has significantly increased the risk of companies of all sizes being hit by cyber attacks. The rapid increase, as well as the increasing difficulty of detecting such attacks, calls for automation and innovation when dealing with cyber incidents.

Further, according to industry experts, in the future there will be a rise in the number of cyber attacks as well as their complexity. Thus, it’s crucial for insurance CEOs to realize the criticality of having robust cyber security and focus on firming up their capabilities.

Accelerating ESG’s impact

Insurance CEOs increasingly see the importance of ESG initiatives, especially when it comes to how ESG improves financial performance, meets stakeholder expectations and attracts a strong talent pool. This year’s survey shows a marked jump in demand from stakeholders — employees in particular — for increased transparency.

More insurance CEOs agree that ESG programs improve financial performance (44%), an increase from 40% a year ago.

Internal and external stakeholders are increasingly looking to organizations for more in-depth disclosures and a proactive approach to integrating diversity, equity and inclusion. In fact, 28% of insurance CEOs indicated that employees and new hires are demanding greater ESG reporting and transparency. This is a significant increase from 3% in 2021.

CEOs increasingly understand that businesses embracing ESG are best able to secure talent, strengthen their employee value proposition, attract loyal customers and raise capital. ESG has gone from a nice-to-have to integral to long-term financial success.

- 59% of insurance CEOs see stakeholderdemand for increased reporting and transparency on ESG issues up a significant extent (up from 48% in August 2021).

- 81% believe stakeholder scrutiny onsocial issues will continue to accelerate (up from 60% in August 2021).

- 22% indicate stakeholder skepticismaround greenwashing is increasing (up from 12% in August 2021).

Since July 2021, more than 29 leading insurers signed up to the United Nations-convened Net Zero Insurance Alliance. Under this alliance, insurers have committed to transitioning all operational and attributable greenhouse gas emissions (Scope 1, 2 and 3) from their insurance and reinsurance underwriting portfolios to net zero by 2050.

In the CEO Outlook, insurance CEOs highlighted their greatest barriers to achieving net zero:

- 28% feel the insurance industrysuffers from a lack of experts who are ready to tackle sustainability issues.

- 23% consider the lack of internalgovernance/controls to operationalize the path to net zero as a barrier.

- 22% highlight the complexity ofdecarbonizing their supply chains as a major hindrance to reaching their net zero goals.

Thirty% of insurance CEOS say telling acompelling ESG story is their biggest challenge in communicating ESG performance to stakeholders. This challenge includes meeting the ESG reporting needs of different investors and stakeholders, and the lack of rigor within their own organizations for reporting on ESG performance.

Investment in tools such as ESG measurement and governance is increasing, though — 64% of insurance CEOs have committed to allocating more than 6% of revenue to make their organization more sustainable.

49% of them say they’ll invest between 6 and 10% of revenue. This is almost doubled from 2021, when 25% of insurance CEOs said the same thing.

ESG has become an intrinsic business imperative. Just as Rome wasn’t built in a day, ESG is an ongoing journey. A strong and consistent ESG strategy could help differentiate an organization from its competitors. Delaying key ESG efforts could make businesses reactive instead of proactive, and ultimately result in greater costs to business and customers. Instead, insurers can lead the way with greater transparency, resilience and sustainability.

Ramping up IDE progress

Across sectors there’s broad alignment on inclusion, diversity and equity (IDE), but there is growing concern about the pace of progress. For starters, 74% of insurance CEOs believe IDE progress has moved too slowly in the business world, and 74% also believe scrutiny of IDE performance will continue to increase over the next 3 years. Awareness is key, and CEOs have an important role to play in helping drive the IDE agenda in the years to come.

Seventy-eight% of insurance CEOsbelieve they have a responsibility to drive greater social mobility in their organizations, which involves how you invite everyone into and structure your organization — meaning businesses must invest in their people in a new way.

Workforce resilience

As insurance CEOs consider how they support and attract talent, they’re focusing efforts more on technology and their organization’s employee value proposition.

Though they are considering reducing employee headcount in the next 6 months, insurance CEOs are more positive over the longer term — 87% say they’re planning to increase the size of their workforce over the next 3 years.

What’s more, 24% said the employee value proposition to attract and retain talent is their top operational priority for achieving 3-year growth objectives. Almost three-quarters of insurance CEOs (74%) agree that retaining talent with the pressures of inflation/ rising cost of living is top of mind. With the ongoing labor shortage, companies should do everything they can to hold onto talent while addressing economic, competitive and demographic realities.

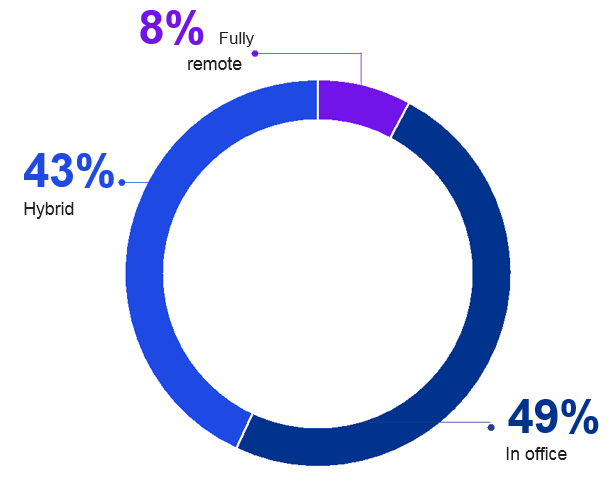

Evolving perspectives on ways of working

Hybrid/remote working has had a positive impact on hiring, collaboration and technology investments over the past 2 years — but almost half of insurance CEOs (49%) see in-office as the go-to corporate working environment over the next 3 years.

This could make it difficult to attract employees, as many have decided a hybrid or work-from-home model is better for them.

Making the short-term decision to downsize or bring people back into the office full-time could have significant long-term consequences.

Therefore, organizations should aim to be more employee-focused, actively listening and sharing empathetic communications to tackle rising attrition rates and bring in new workplace technology to make working in a hybrid environment seamless and convenient. Insurance CEOs need to make sure their people have purposeful interactions when they are in the office, and now is the time to experiment and see what works best as far as determining the optimal working structure over the long-term.

CEOs envisioning the future working environment for corporate employees

Insurance CEO priorities

The KPMG 2022 CEO Outlook highlights long-term optimism in CEOs despite short-term challenges brought on by geopolitical concerns and a potential recession.

Prepared to weather economic difficulties, CEOs are confident in their companies’ resilience and growth prospects.

As insurance CEOs ready their organizations for an expected recession, here are some steps they can take to help ensure resilience

Technology

- Bring your people and technology together: Organizations have invested so much in digital transformation that they need to make sure their people adopt these technologies and use them to their full potential.

- Assess current technology systems and platforms: Insurers should evaluate whether their current technology platforms and architecture are fit-for-purpose, and decide if they should adapt, hollow out, create a digital skin or twin, or replace and re-platform current systems to better align for future needs.

- Work with partners to drive value: With CEOs increasingly interested in partnerships, identifying, integrating and managing third parties effectively can help increase speed to market, reduce costs, mitigate risks and supplement capability gaps in delivering the customer promise. Drive open innovation by engaging closely with digital platforms, ecosystems and startups. These partnerships would serve as key enablers for enterprise transformation strategies.

- Get closer to customers: Orchestrating compelling customer experiences requires companies to begin with the customer and work backwards, taking an outside-in perspective to reverse-engineer and shape what the experience should be; then, they should adopt an inside-out view to define how the experience should be delivered.

- View cyber security as a strategic function: Cyber security is no longer seen as only an IT issue; it’s a fundamental business operation imperative. The exponential increase in cyber attacks, coupled with the difficulty of detecting an attack in a timely manner, calls for automation and innovation in dealing with cyber incidents.

Talent

- Experiment with ways of working: As organizations launch return-to-office plans, it’s important for CEOs to develop working structures that suit their people. It’s time to experiment and see what works best. Active listening, empathetic communications and a commitment to finding the right balance over the long term will be key.

- Tell your ESG story: A business’s ESG approach is increasingly seen as a differentiator when it comes to attracting and retaining talent. With many CEOs saying they’re struggling to tell a compelling ESG story, it’s important for them to articulate for stakeholders the steps they’re taking to address ESG in their organizations.

- Build, don’t follow: Organizations and their employees are changing, and leaders need to reinvent the enterprise workforce. The old talent management playbooks are out of date, and the challenge is that there aren’t new ones to replace them — yet. The way forward involves strategies that include reinventing the workforce, focusing on the social side of ESG, leveraging analytics and designing a nurturing experience.

ESG

- Include ESG in all aspects of the organization: ESG management and governance will likely need to become part of the business-as-usual strategy. CEOs should ensure it’s embedded into their organization’s financial ambition and vision.

- Recognize ESG’s impact on financial performance: ESG has become integral to long-term financial success. CEOs increasingly agree that ESG programs improve financial performance, which includes being able to secure talent, strengthen employee value proposition, attract loyal customers and raise capital.

- Invest in real-time technologies: CEOs should monitor deeper into their supply chain (i.e. at the third and fourth levels). Global supply chain leaders are starting to double down on investing in technology — including real-time, end-to-end analytics — to identify where issues exist and improve visibility across the entire value chain.

- Take the lead on IDE: CEOs can play a powerful role in helping lead and drive the IDE agenda in the years ahead. It’s important to normalize and create a culture of IDE across organizations to attract and retain new employees.

……………..

AUTHORS: Mark Longworth – Global Head of Insurance Advisory KPMG, Simona Scattaglia – Global Insurance Technology Lead KPMG, Roger Jackson – Global Head of Insurance KPMG, Ram Menon – Global Insurance ESG Lead KPMG International