Aon’s Global Risk Management Survey illustrates today’s traditional and emerging corporate risk portfolio. Inflationary pressures associated with supply chain issues, such as costs of materials, labour and logistics are mounting, with companies considering a number of solutions to maintain revenue and profitability.

For instance, oil and gas producers and food manufacturers will be the most impacted by inflation, largely due to Russia and Ukraine having dominant positions as major exporters of key raw materials across these industries.

As businesses and economies emerge from the pandemic, the way we identify, analyze and make decisions about risk has changed. The impact of the COVID-19 pandemic has demonstrated the interconnected nature of the risks organizations have to tackle. A risk in one part of the world has consequences in another.

The Survey collates responses of over 2,300 risk managers from 16 industries, spread across varying territories and company sizes.

Other industries may need to change business models as a result of subtle changes in trading behaviours. As each nation becomes more focused on developing domestic production to avoid geopolitical risks, transportation and logistics companies will likely need to evolve to accommodate a lower demand for international trade but growing interest in national logistics solutions.

With ESG becoming an increasingly prominent topic on corporates’ risk agendas, significant resources are being allocated to dedicated ESG teams across multinational corporations to develop risk management strategies. With increased awareness and potential scrutiny from employees, customers and stakeholders, businesses could incur significant costs to adhere to ESG Strategy & Standards.

In order to meet public expectations, thousands of companies have exited from or paused Russian operations. Those that continue to conduct business in Russia face potential reputational damage in the affected region, which could lead to economic repercussions (for example a decline in business due to global boycotts). Corporates are also spending significantly more on due diligence and compliance reviews to ensure any direct or indirect relationships with Russia are identified and replaced.

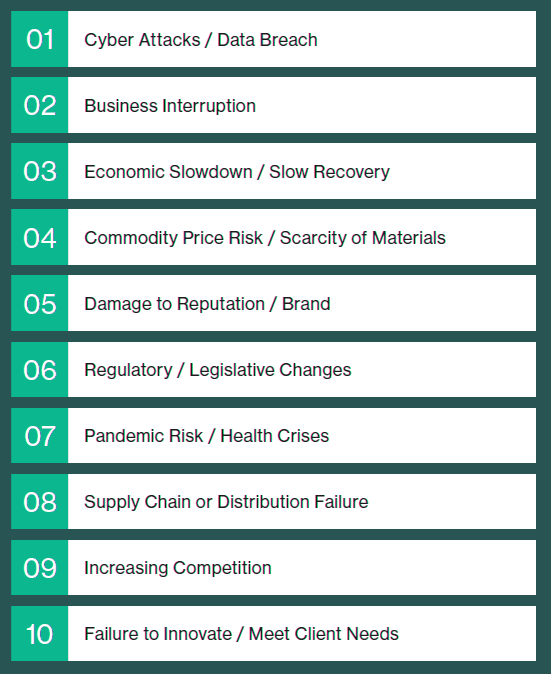

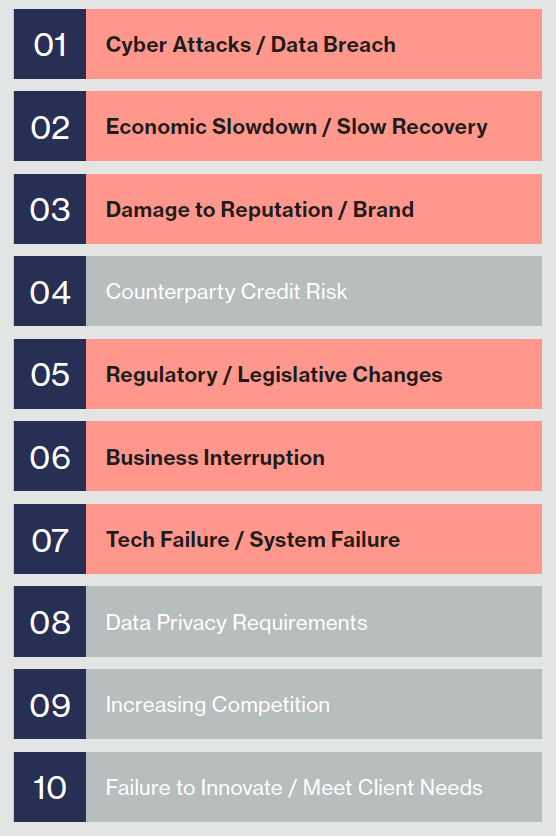

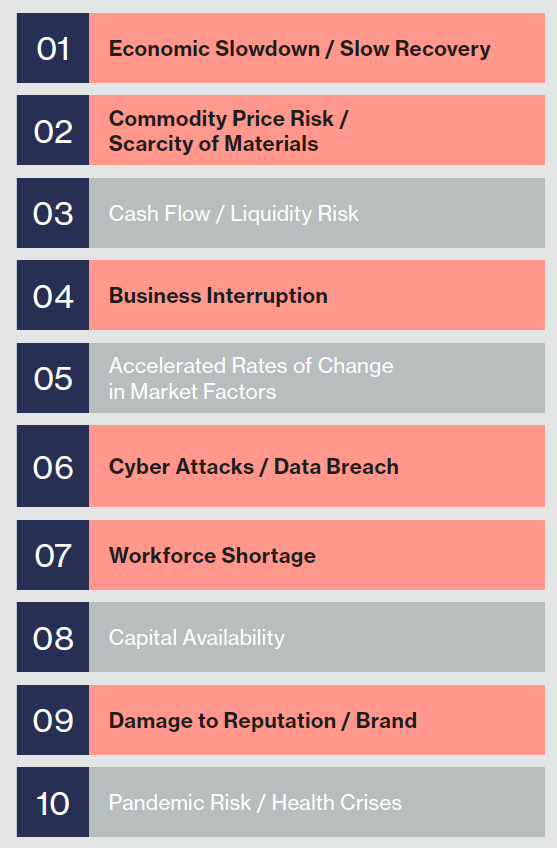

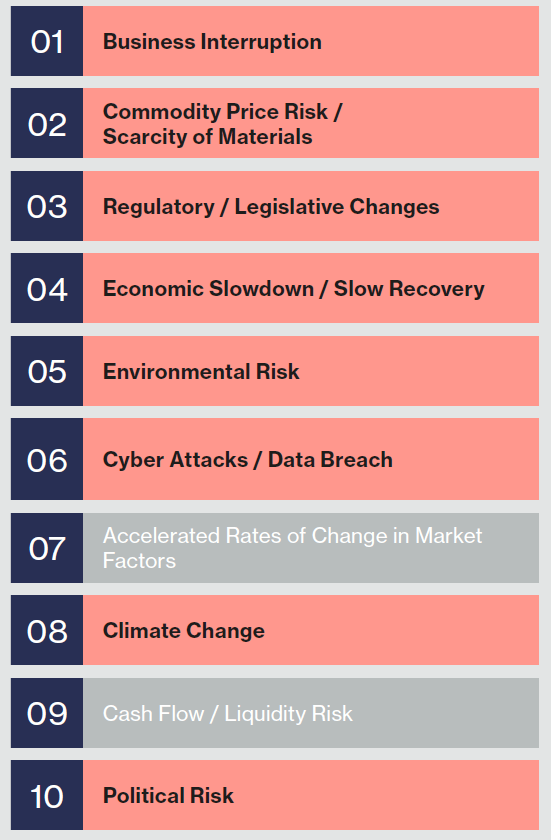

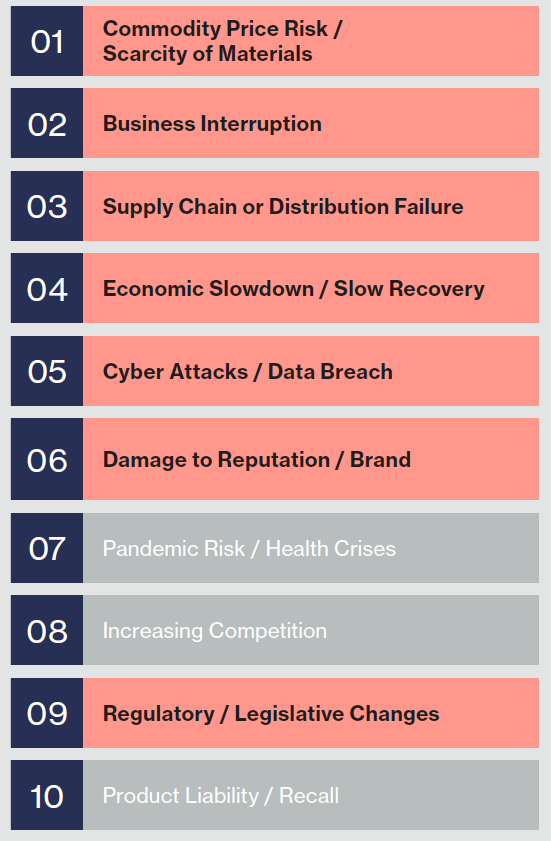

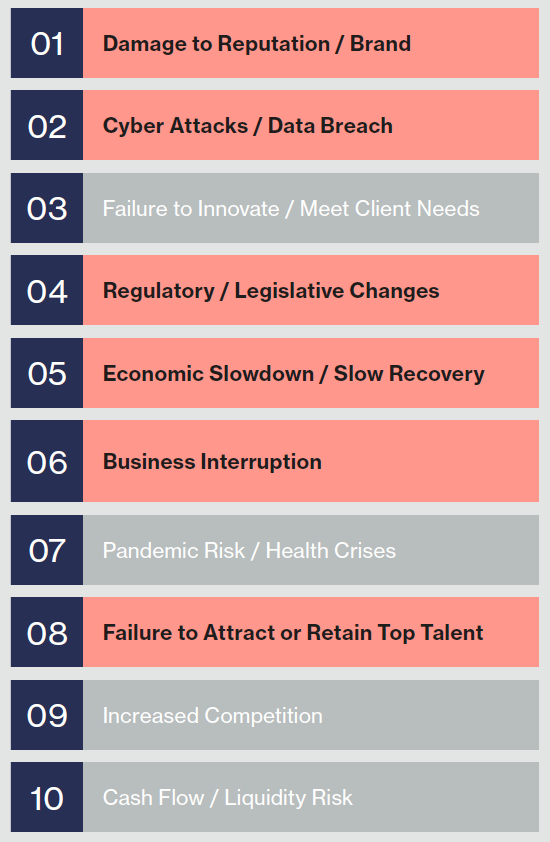

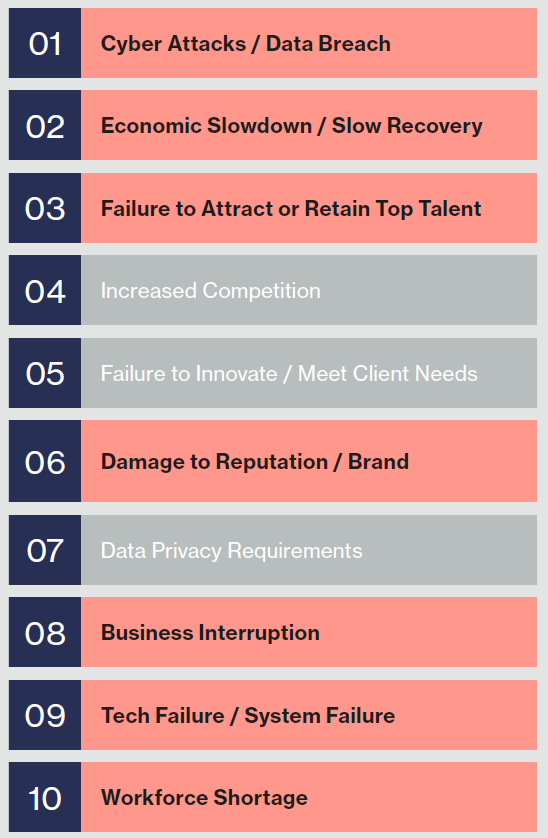

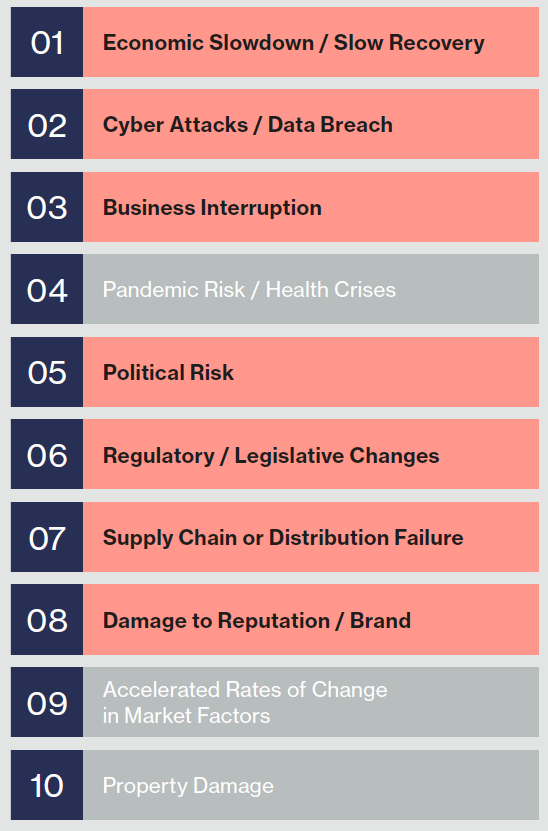

Respondents selected and rated 10 top risks that their organizations were facing

The following analysis breaks down the results of this survey by industry sector and considers how each sector’s risk profile has changed as a result of the conflict in Ukraine. Risks highlighted in bold indicate risks that will be further amplified by effects of the crisis.

Top 10 Global Risks: Banks and financial institutions

Global insurance premium: $138bn

Risks in Bold are likely to be further amplified by effects of the Ukraine crisis

Short term:

Banks are currently weighing the balance between meeting ESG objectives and maintaining profitable business. Most ESG funds are exposed to technology stocks, which have experienced notable volatility throughout the crisis. “Non-ESG” funds typically contain some exposure to oil and gas markets which has experienced accelerating price increases over the past months.

Leading investors such as Warren Buffet have publicised immediate plans to invest more heavily in the energy sector to benefit from market inflation. Amid the crisis, traders have also been left stuck with unsellable Russian shares and bonds, while derivatives linked to them have been left in a state of limbo.

Banks are facing two key ongoing challenges in light of the conflict – balancing both ESG and profitability goals and reconsidering where business operations ought to continue. However, some opportunities have emerged, such as growing interest in a multi-purpose cryptocurrency market.

Medium term:

Some parts of the banking industry have seen new opportunities emerge due to the conflict. There has been an influx of cryptocurrency in the dark web to enable Ukrainians to trade amongst themselves and with international companies more effectively, supporting Ukrainian conflict efforts, and helping migrants and refugees move money.

Digital currencies have also been used for humanitarian purposes – ‘techno-natives’ have helped the Ukrainian government raise over $100 million in crypto donations. Cryptocurrency could become a more popular alternative for local currencies, especially in areas of conflict.

Top 10 Global Risks: Construction and manufacturing

Many construction projects’ budgets were set pre-Ukraine although inflation was already impacting building materials and the wider supply chain. The conflict has caused more uncertainty, increased inflation and supply chain disruption and brought further labour shortages.

Global insurance premium: $115bn

Contractors and manufacturers will need to consider the extent to which their insurance policies provide the protection they need. In the longer term, taking risk in-house through captives or self-insurance may become increasingly prominent.

Therefore, many pre-crisis projects have had to reassess their viability at the planning, design or tender stages, thereby requiring restructuring around budget availability and contract certainty around the inflation risk.

Manufacturers with a production site in affected regions may face significant challenges and potential losses from supply chain issues and from a business continuity perspective.

Short term:

The Western allied democracies could look to push on with climate transition, raising the demand for renewable energy projects. However, a number of raw materials that are key to renewable builds are typically exported in scale by Russia (e.g. nickel is commonly used for battery storage products), thus increasing the pressures on manufacturing of products such as semiconductors.

As a result, a number of manufacturers have turned their attention to supporting defence efforts – weapons production may be seen in a more positive light by the public as support of Ukraine defence companies can be viewed as social benefit.

Medium to long term:

Smaller construction firms face the risk of insolvency as a result of inflationary pressures. With a typical bidding process for a particular construction project lasting up to 2 years, businesses are anticipating elevated long-term effects on inflation and therefore avoiding bidding altogether. Interest rate rises also present a sizeable hurdle for infrastructure projects – many that were due to come online this year have been paused due to rising inflation.

Top 10 Global Risks: Energy

Global insurance premium: $43bn

Refineries are currently enjoying a significant increase in profits due to price hikes that have been exacerbated by supply constriction pressures on top of demand surge as the world exited the pandemic.

However, they remain conscious of the need to detach from Russian imports and restructure their businesses in order to incorporate renewable solutions.

As such, as well as their partners across the value chain, they are mapping out their supply chains in detail and considering how to permanently disconnect from Russian business.

Short term:

Several organisations across the West are reverting back to traditional classes of energy (e.g. coal) to meet short-term domestic energy demands. Consequently, there are reputational damage risks associated with ramping up thermal energy production in a pro-ESG environment.

Energy companies are benefitting from rising oil prices, experiencing a significant windfall in profits. While this can support efforts to transition to renewables, higher profits also lead to greater tax revenues for governments that will be looking to fund other elements of the economy, such as addressing the food crisis.

Top 10 Global Risks: Food and beverages

Global insurance premium: $80bn

With Ukraine and Russia both being significant exporters of raw food ingredients such as wheat, the crisis has exposed fragilities in supply chains and identified the need for other economies to diversify.

Short term:

When sourcing ingredients from multiple international suppliers, countries may need to become more vigilant with food safety requirements due to the risk of lower quality harmful products entering food networks. Some corporations have chosen to continue operations in Russia in order to support citizens with essential goods.

This has led to reputational backlash risk amongst employees, stakeholders and customers who argue that corporations are only continuing operations for commercial gains.

Top 10 Global Risks: Public sector and healthcare

Global insurance premium: $79bn

Governments will need to consider several fiscal stimuli decisions, such as encouraging investment in renewables, and budget spending focused on defence. In an escalated scenario, governments would face a further burden on healthcare costs to treat citizens involved in military efforts.

Short term:

There are some immediate impacts which governments will need to consider – due to risk of famine and food shortages there could be rising public tensions and political instability, especially in developing countries. This may well be heightened by inflationary pressures which could lead to national riots.

Medium to long term:

While proactively dealing with these threats, government entities will need to develop cyber resilience in anticipation of potential attacks. Following WannaCry in 2017, healthcare facilities are already taking steps to strengthen their cyber security capabilities and governance to avoid such situations again.

Top 10 Global Risks: Technology

Global insurance premium: $21bn

With Chinese and Indian technology companies likely to benefit from the conflict through unmet demands from the West, many companies will look to offer new food and renewables technologies amid growing interest in these critical markets.

Short term:

Due to a shift in competitive dynamics as sanctions persist against Russia, Chinese and Indian companies are presented with an opportunity to fill the gap and develop business in the West.

Medium to long term:

The technology industry may shift focus to supporting other businesses who are adversely impacted to a large degree by the conflict (see Key Technology Strategies for Insurance Companies). For instance, there is likely to be growing attention associated with renewables and food technologies with public and private investment growing in order to drive innovation in these critical industries. However, the creation, dissemination and use of technology could be under increasing scrutiny, including access to services, chip manufacturing and data protection.

Top 10 Global Risks: Transportation and logistics

Global insurance premium: $178bn

Economies are identifying new trading routes in light of the conflict. However, we may see long-term reduced trading activity globally as countries target self-sufficiency, especially across energy and food markets.

Short term:

The Ukraine crisis has disrupted key trade routes – blockades imposed on Black Sea ports have halted the activities of dozens of ships. Meanwhile, Ukrainian and Russian mariners amount to around 15% of the global shipping workforce.

In the short term, this is likely to reduce the availability of skilled labour in the industry, with businesses having to attract (and invest in training) a new labour force.

In the aviation industry, aircraft lessors have been greatly impacted by the confiscation of planes in Russia, with the Russian leadership nationalising aircraft stuck in the country. From a financial perspective, lessors are well protected, whereas their capital providers could be negatively affected with billion-dollar assets stranded in Russia in an industry that was already crippled by the effects of the pandemic.

Another short-term risk that organisations face is the increased frequency of cyber attacks, both due to the potential scale of disruption to supply chains and their relatively immature cyber security solutions as compared to other industries (e.g. financial institutions).

Medium term:

With Russia excluded from Western trade, new routes are emerging between Russia and Asia, and between the West and Gulf or Central America, as companies seek to sustain import levels of energy, food, and raw material commodities for business continuity. Although new routes are forming, nations are also looking at ways to achieve some degree of self-sustainability. Transport and logistic services could be struck with a potential loss of demand in the short term due to deglobalisation.

Global multinational companies are looking at ways to develop domestic production and manufacturing to limit exposures to international risks such as conflict.

In the medium to long term, we could see reduced activity from ships and increase in demand for train and motor trade (both national and transregional). The magnitude of impact on the aviation industry is less profound, as sanctions do not have a big impact on airlines.

Long term:

Independence from global markets is also emerging with regards to energy security. Gas-dependent countries are realigning to traditional energy classes such as coal in order to continue meeting domestic demand. In the long term, they may look to develop sustainable renewable solutions.

As such, there may be a potential reduced need for oil and gas transportation in the future and a corresponding decrease in demand for transport and logistic services. The aviation industry has learned lessons from the pandemic, particularly in relation to disaster planning. Larger airline organisations, especially national airlines, are more resilient to the impacts of the crisis due to their contribution to their economies.

………………………..

AUTHORS: Rory Moloney – Chief Executive Officer Aon Global Risk, Dr. Grant Foster – Managing Director Aon Global Risk Consulting, Kieran Stack – Chief Commercial Officer Aon Global Risk Consulting