The UK life insurance market will continue to maintain strong capitalisation despite the government’s proposals to loosen Solvency II (S2) rules to release capital for insurers to invest more in long-term assets, according to Fitch Ratings.

UK Life Insurers to maintain strong capital

Andrew Bailey, Governor of the Bank of England, recently told a parliamentary committee reviewing the proposals that GBP14 billion could be released. Bailey added that, for a firm just meeting the minimum S2 requirements, this could equate to an increase in the probability of failure over a one-year period from 0.5% to 0.6%, a relative increase of 20%.

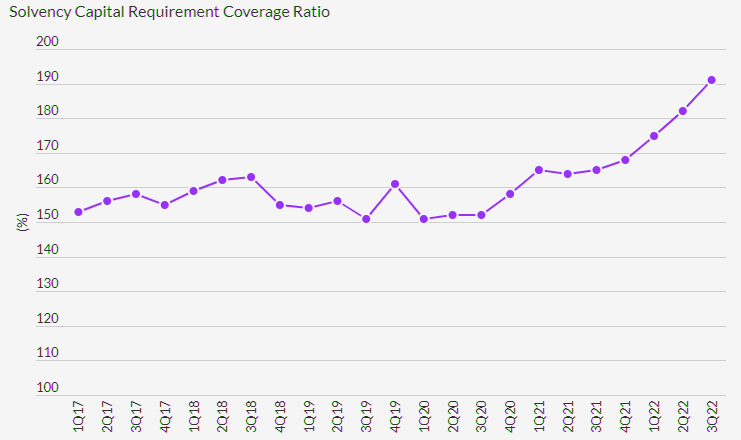

Most insurers maintain S2 ratios well above the minimum requirements, which implies a much lower probability of failure than 0.5%.

Moreover, while we expect insurers to deploy some of the capital freed up by the S2 reforms into long-term investments, attracted by the prospect of higher returns, we believe they would stay within their existing risk appetites and avoid depleting their capital enough to jeopardise ratings. With solvency ratios at record highs, most insurers have strong capital headroom in their ratings.

UK Insurance Sector Solvency at Record High

The government has proposed two main changes to S2

The government has proposed two main changes to S2 to encourage insurers to invest more in long-term assets, such as infrastructure, to boost the economy.

- The first is to reduce the ‘risk margin’ in line with the European Commission’s S2 reforms. The risk-margin formula represents the cost of capital for unhedgeable risks.

- The second change is to widen the eligibility criteria for ‘matching adjustment’ assets whose yields can be used to determine the discount rate for annuity liabilities – a largely UK-specific consideration.

The matching adjustment currently allows insurers to take credit for the illiquidity premium earned on assets held to maturity, provided the assets deliver expected cash flows that are fixed in nature.

The Prudential Regulation Authority would be given additional powers to vet insurers’ claims for matching adjustment credit.

Under the proposals, assets with prepayment risk or construction phases would be eligible as matching adjustment assets.

This would significantly increase the supply of long-term assets, particularly in infrastructure, that insurers may want to invest in. One of the main challenges from a policy standpoint has been that insurers’ infrastructure investments have been confined to established projects with fixed cashflows.

Enabling insurers to invest in early-stage projects could stimulate investment in the sector, but would add risk.

The eligibility criteria for matching adjustment assets would also be widened to include assets with ‘highly predictable’ cash flows rather than just those with fixed cash flows. This could further increase the supply of potentially attractive assets (see BlackRock`s Global Macroeconomic & Invest Outlook).

However, insurers often worked around the existing requirement by restructuring assets to create fixed cash flows. In such cases, the new criteria would simply remove the frictional cost of restructuring rather than increasing the supply of underlying assets.

In addition, the government has indicated that assets without fixed cash flows may be given less matching adjustment credit in the liability discount rate, which could limit their attractiveness.

UK Government promises that scrapping of certain EU rules for insurers in Solvency II reforms

The UK Government has received widespread approval from the insurance and reinsurance industry after Chancellor Jeremy Hunt promised that scrapping of certain EU rules in Solvency II reforms will unlock tens of billions of pounds of investment across a range of sectors.

The government’s long-awaited Autumn statement, following a tumultuous period for the UK economy, saw the Chancellor commit to making the country into the world’s “most innovative, dynamic and competitive global financial centre.”

Part of this goal, he added, would involve unlocking billions of pounds from insurance firms by adapting the financial services regulatory framework to the UK’s new position outside of the EU.

This will include changes to the risk margin for long term life insurance firms and a broadening of the ‘matching adjustment’ eligibility criteria.

These plans were welcomed by leaders at the Association of British Insurers (ABI), among others, with ABI Director General Hannah Gurga noting that the changes to Solvency II would enable UK insurers to play “an even greater role” in the government’s levelling up agenda, and in transitioning to net zero.

Meaningful reform of the rules creates the potential for the industry to invest over £100bn in the next ten years in productive finance, such as UK social infrastructure and green energy supply, whilst ensuring very high levels of protection for policyholders remain in place.

More broadly, it will encourage a thriving and competitive industry which will ultimately benefit the UK economy, the environment and customers.

UK Solvency II Easing Still Unlikely to Affect Insurer Ratings

The UK government’s proposals to ease capital requirements under post-Brexit reforms of Solvency II are still unlikely to prompt life insurers to increase their risk appetites enough to affect their ratings.

The proposals will free up well over GBP10 billion of capital and incentivise the UK life sector to invest more in long-term assets, such as infrastructure, to boost the economy.

We expect life insurers to deploy some of their capital accordingly, seeking higher returns. However, as we noted in February, we believe they will stay within their risk appetites and avoid depleting their capital enough to jeopardise ratings. Most UK life insurers have strong capital headroom in their ratings.

The proposed reduction in regulatory capital requirements will give insurers scope to take on more risk.

In particular, a lighter regulatory capital burden associated with long-duration liabilities will make illiquid credit assets more attractive to hold. Annuity providers view such assets, when held to maturity, as a good match for their annuity liabilities.

Assuming the proposals go ahead broadly as set out, we estimate that the UK life sector could allocate up to GBP200 billion to illiquid investments over the next ten years.

The sector’s exposure to illiquid assets has been growing steadily but we expect it to remain moderate, even given the government proposals.

However, a significant decrease in the credit quality of insurers’ investment portfolios, or a significant increase in asset concentration risk, would clearly be credit-negative.

The EU is also proposing to ease the Solvency II capital burden associated with long-duration liabilities, with proposed reforms that could release significant amounts of regulatory capital for investment and give a boost to European life insurers’ growing interest in assets with environmental, social and governance (ESG) characteristics.

…………………..

AUTHORS: Willem Loots – Senior Director, Insurance at Fitch Ratings, Fedor Smolyakov, PhD, PRM – Director, Insurance at Fitch Ratings, David Prowse – Senior Director at Fitch Wire

Fact checked by Oleg Parashchak