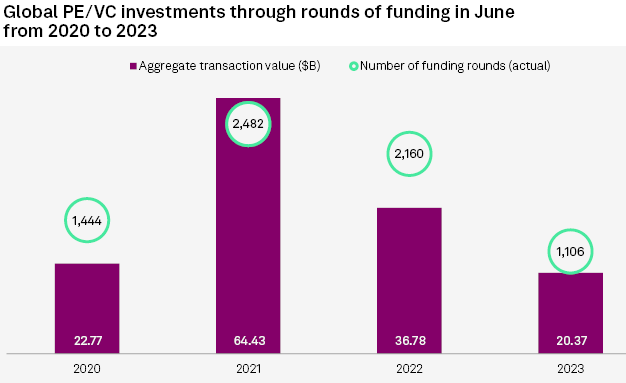

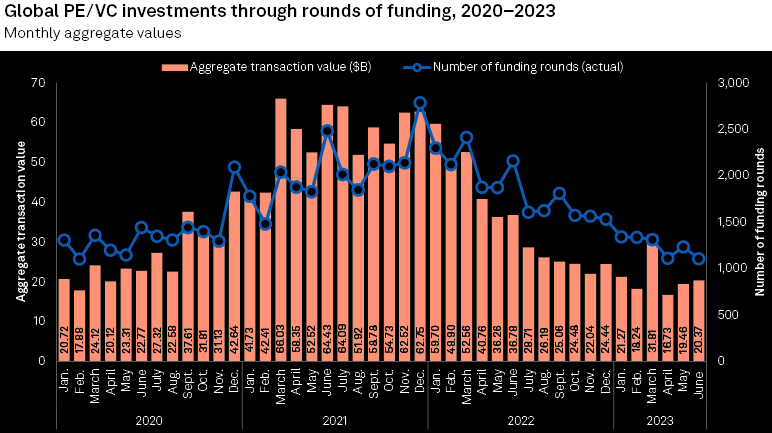

Venture capital investments worldwide dropped 44.6% to $20.37 billion in June from $36.78 billion in the same month in 2022, according to S&P Global Market Intelligence data.

The number of funding rounds declined 48.8% to 1,106 from 2,160 a year earlier and was down more than 10% from 1,234 in the previous month.

The total investment value in June slightly improved from May, when $19.46 billion was raised, the latest Market Intelligence data shows.

Private Equity & Venture Capital Investment in FinTech and payments companies in Europe has been dwarfed by the $10 billion put into US companies in the first five months of the year.

By comparison, total private equity investment in European fintech and payments companies stood at $1.1 bn in the year to May 31.

The volume and value of global private equity and venture capital entries got off to something of a weak start from January 2023. Deal value stood at $25.32 billion, down 62.1% year over year from $66.88 billion

Global PE/VC investments

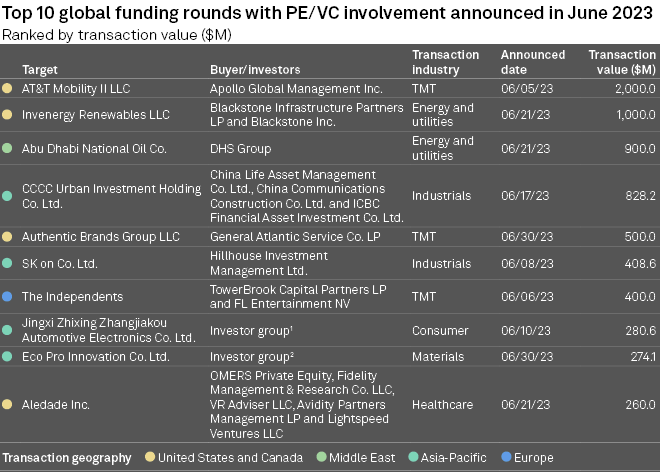

Largest funding rounds

Apollo Global Management Inc.s $2 billion investment in preferred equity securities of AT&T Mobility II LLC was the largest funding round globally in June. The AT&T Inc.-owned business will use the funding to partially replace $8 billion of its outstanding preferred interests (see Investment in InsurTech).

The next-largest transaction was a $1 billion funding round for Invenergy Renewables LLC, with investment from Blackstone Inc.’s fund, Blackstone Infrastructure Partners LP.

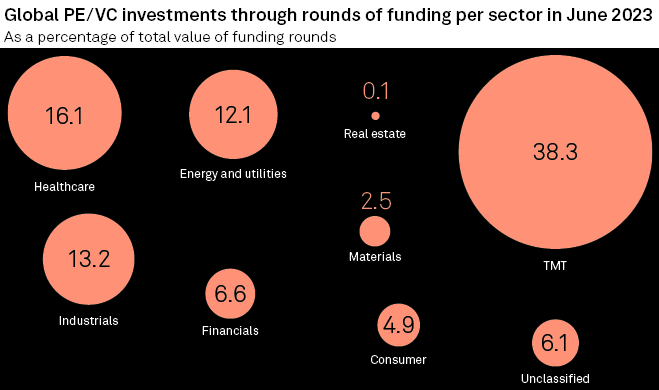

Investment by sector

The technology, media and telecommunications industry dominated global venture capital investments in June, attracting 38.3% of the funding round total. It was followed by the healthcare sector, which accounted for 16.1% (see Venture Capital Investment in Web 3.0, Blockchain & Crypto Startups).

The volume of funding rounds in June was the lowest monthly tally so far in 2023 and the second-lowest since January 2020.

Venture capital investment is a subset of private equity (PE) wherein venture capitalists provide capital to startups for expanding their businesses.

These capitalists get ownership stake, become an integral part of the decision-making process in the company, and offer technical and managerial expertise, network access and other support for making the startup business successful.

Venture capital investment is gaining popularity as it provides above-average returns to investors and helps in spurring advancements.

Countries with favorable regulatory frameworks, as well as industries with a higher level of innovation, have witnessed substantial growth in venture capital investment activities in recent years.

At present, the market is experiencing growth on account of the growing number of startups, in confluence with the increasing investments from mutual funds and banking institutions in venture capital. Apart from this, the expanding investment activities in diverse industry verticals, such as healthcare, biotechnology, agriculture, and media and entertainment, are also strengthening market growth.

Furthermore, venture capitalists are utilizing algorithms and machine learning (MI) for identifying startups with a higher growth potential to make better investment decisions.

However, the market growth is significantly impacted by the global spread of the coronavirus disease (COVID-19) and consequent lockdowns imposed by governments of a number of countries. Therefore, various organizations and their operational activities have come to a sudden halt. In view of this, venture capitalists are modifying their plans to survive the rapidly changing market conditions. The industry is anticipated to grow again once normalcy is regained.

…………………….

AUTHORS: Muhammad Hammad Asif, Annie Sabater – S&P Global Market Intelligence