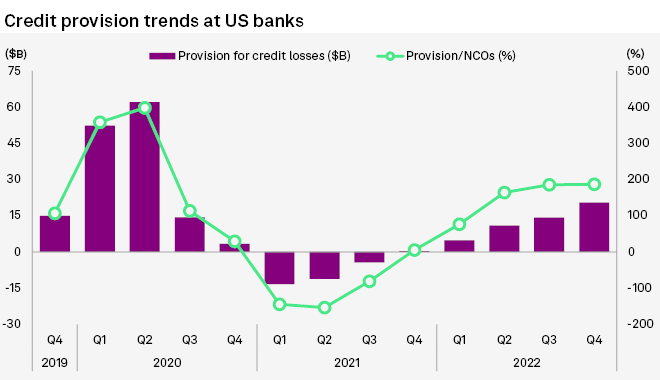

Provisions for expected credit losses at U.S. banks increased for the seventh consecutive quarter in the last quarter of 2022, reaching $20.37 billion during the period, according to S&P Global Market Intelligence data.

The fourth-quarter 2022 total represents a more than 43% increase from positive provisions of $14.23 billion a quarter earlier.

The upward trend began in the second quarter of 2021 and has persisted as the Federal Reserve raised interest rates to combat inflation and markets brace for a possible recession.

Rising provisioning trend

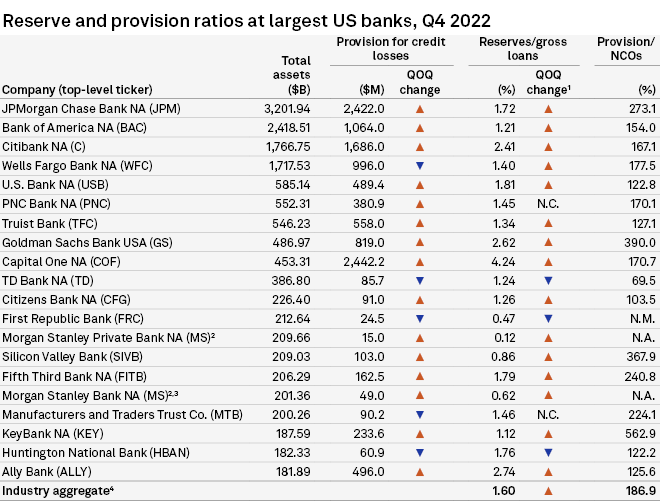

Provisions for credit losses trended upward at most of the 20 largest U.S. banks in the fourth quarter, with 15 reporting quarter-over-quarter increases and only five reporting sequential declines.

JPMorgan Chase & Co., the largest U.S. bank based on total assets as of Dec. 31, 2022, reported a fourth-quarter 2022 provision of $2.42 billion, up from $1.16 billion in the linked quarter. The company’s ratio of reserves as a percentage of gross loans also increased quarter over quarter to 1.72%.

The net reserve build of $1.4 billion was driven by updates to the firm’s macroeconomic outlook, which now reflects a mild recession.

In the event of a recession with unemployment reaching 6%, Chairman and CEO Jamie Dimon said the company would need an additional $6 billion in reserves.

Fifteen of the 20 largest banks in the U.S. reported quarter-over-quarter increases in their reserves as a percentage of gross loans at the end of 2022, while three reported decreases and two reported no change.

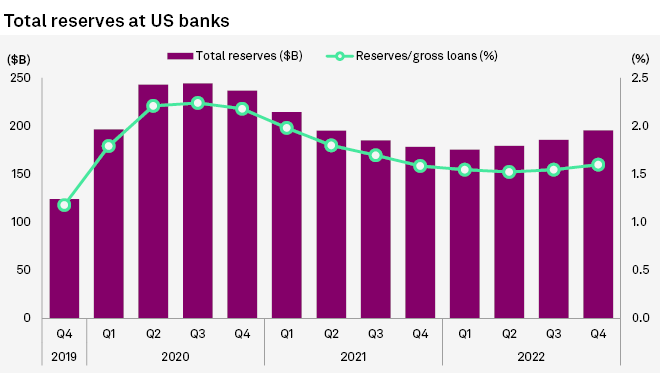

Total reserves tick up

Total reserves at U.S. banks rose slightly in the period, marking the third consecutive quarter-over-quarter increase after a long-term trend of declines dating back to the end of 2020.

The industry booked $195.3 billion in total reserves in the fourth quarter of 2022, up from $185.56 billion in the linked quarter. Reserves as a percentage of total gross loans increased slightly to 1.60% from 1.55%.

…………………….

AUTHORS: Alex Graf, Gaby Villaluz – S&P Global Market Intelligence data