The 2022 has been as eventful as they come. On one end, geopolitics and global macro conditions have left economists at their wits’ end and obliterated most markets, while on the other, developments in the crypto and blockchain space continue at an unprecedented and truly unrelenting pace.

While many have seen large portions of their investments marked down by double-digits multiple times in the last few months, we must keep in mind that this is part of economic cycles and the BUIDLing continuing in the background is at a pace that is largely unmatched across history.

Economic conditions have worsened

According Binance Research Report 2022, economic conditions have worsened since the start of the year. Issues such as persistent inflation, high commodity prices, and tightening monetary policies have contributed to a more challenging investing landscape.

US stocks have recorded their worst first half in more than 50 years. The S&P 500 index fell more than 20.6% and the Nasdaq composite index declined almost 30% in the 2022.

Across sectors, only Energy stocks performed well during the period (up more than 30% for S&P 500 listed stocks) while Consumer Discretionary performed the worst, being down more than 30%.

Crypto was not spared from the market downturn that also plagued traditional asset classes such as stocks and bonds. Black swan events such as the suspension of fund withdrawals by several centralized lending platforms and the collapse of the algorithmic stablecoin TerraUSD (UST) in the first half of this year contributed to further negative sentiments and worries.

The market downturn has helped to weed out excesses and the reset in valuations back to more sustainable levels is arguably a positive development for the long-term viability of the ecosystem.

Nonetheless, price action alone is not representative of the health of the ecosystem, nor does it show the full picture of the underlying developments. As such, in this report, we aim to share a holistic review of the past half-year in crypto by analyzing the latest data, trends, and outlook across different areas of the crypto ecosystem. We remain optimistic about the long-term outlook for crypto since we continue to see further adoption and innovation in the space.

L1 Development

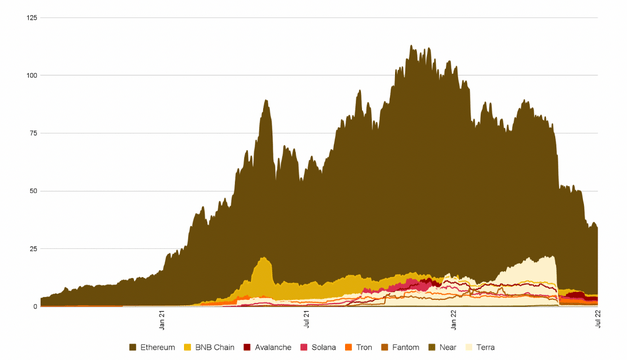

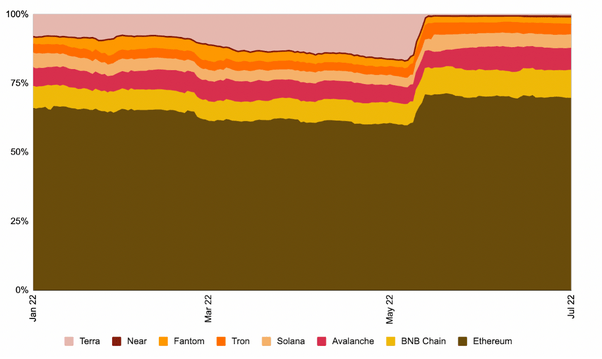

Competing Layer 1 (“L1”) protocols have innovated with new consensus algorithms, blockchain architectures, and execution environments, but how did they perform this year? 2022 has been a turbulent year for crypto. Total Value Locked (“TVL”) of L1s declined throughout the year, and Ethereum has been losing market share to alternative L1s. Market share of Ethereum (in terms of TVL) fell from 96.91% in January 2021 to 62.43% by the end of 2021, and dropped further to 59.01% by June 2022. On the other hand, BNB Chain’s TVL dominance was only 0.78% beginning of 2021 and grew to 7.02% ending 2021 and 8.66% ending June 2022. It is noteworthy that over the last year, BNB Chain has had one of the most resilient and stable performances.

Throughout last year and this, L1s kept on fighting for market share, trying to scale, grow and win in the ongoing multichain battle. Each L1 has tried to gain market share by innovating and trying to solve the “trilemma” of decentralization, security, and scalability.

L1 TVL declining throughout the first half of 2022 (US$B)

Looking closer at the market share across L1s in 2022, the downfall of Terra is probably the most noteworthy event, with other chains like BNB Chain and Ethereum absorbing their TVL. Due to the issuance of the algorithmic stablecoin USDD, the Tron network also saw an increase in TVL from US$4.3B on May 2nd (the day USDD launched) to around US$6.3B on June 8th. However, with the de-pegging of USDD on 13th June, TVL came down to around US$4B at the time of writing. Despite ongoing competition among L1s, we note that Ethereum is still the market leader by a significant margin.

TVL distribution amongst L1s in 2022 shows significant impact from the Terra fallout (US$B)

Conclusion

H1 2022 was eventful, to say the least. Polkadot parachains have proven their limits with only limited slots, Polygon experienced congestion, Terra de-pegged and exacerbated the market turmoil, Ethereum announced its testnet merge, and so much more. The list can go on forever.

This year was another year of interoperability, with the old vision of “every blockchain for themselves” slowly fading. A multi-chain future is also indicated by Ethereum slowly losing its market dominance while alternative L1s gain market share.

Perhaps the world may not be ready for full decentralization, but there have been stepping stones in getting there this year. Scaling is slowly happening, and different approaches will position the different L1s to each have their strengths and weaknesses. While Avalanche is bringing online new subnets, Ethereum is targeting rollups – in the end, it remains to be seen which approach works the best.

L2 Development

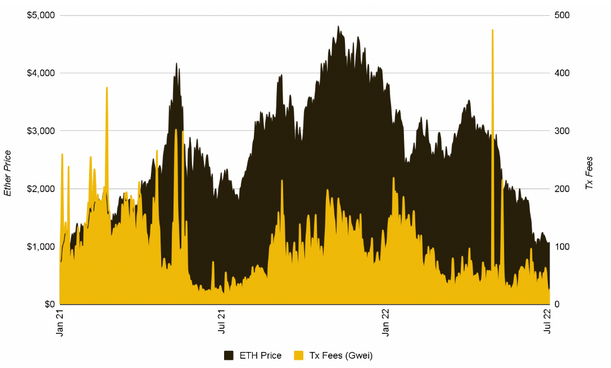

The challenge of scalability within L1 platforms has transitioned from a distant and theoretical limitation to one that desperately needs to be tackled in the current market climate. This fundamental issue, perhaps most notably illustrated by the exorbitantly high fees in the Ethereum ecosystem, has given rise to what is maybe one of the key crypto narratives in 2022: layer 2 (“L2”) scaling solutions. In this section, we discuss the increasingly visible integration of L2 solutions within dApps across the space, the leading L2 projects and their upcoming or rumored tokens, and the possible trajectory of the broader L2 network landscape.

L2 Fees and Increasing dApp Integration

To open our discussion, we can have a quick look at how transaction fees have continued to spike, even in a relatively quiet market, and thus have necessitated a move towards L2. Given that Ethereum’s ecosystem remains the largest by TVL and number of dApps, we can use it as a proxy for our general discussion.

Average Ethereum transaction fees have spiked even as Ether price fell

Nonetheless, even in their current “high fee” state, for anyone who has used L2 protocols, the reduction in transaction fees is both notable and somewhat relieving. It is no surprise that we have seen widespread deployment of dApps on L2 protocols across almost all major categories, including DEXes, lending, bridges, and yield protocols.

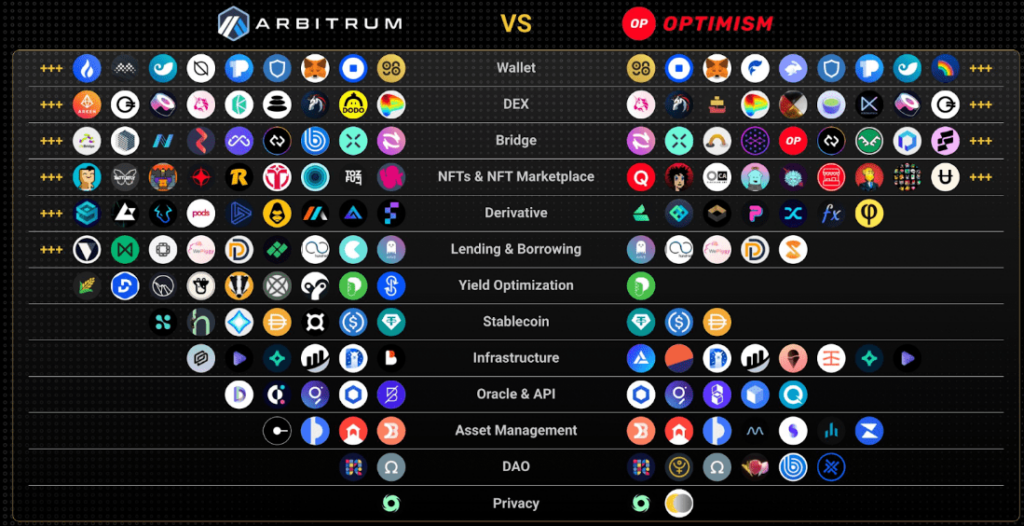

Optimism and Arbitrum, two of the largest players in the space (both utilizing optimistic rollup technology), have seen a massive uptick in usage, with nearly 150 dApps being deployed on them in aggregate.

This includes the top dApps in the space, including the likes of Uniswap, Curve, and Aave, among numerous others.

In fact, it is slowly becoming more apparent that being deployed on L2 is more the norm rather than the exception, and it is becoming more clear that not deploying on L2 simply prices out a significant number of retail users – a market that is crucial to capture for any dApp looking to gain true adoption. With this in mind, and the trend we have seen so far in 2022, L2 deployment appears on track to become more and more ubiquitous as we enter the second half of the year and it would not be surprising to see most, if not all, of the top ranked dApps being deployed on some form of L2.

A comparison of dApps on Arbitrum and Optimism; two of the largest and most popular L2 solutions

What are the other chains doing?

While our attention has primarily been focused on the Ethereum ecosystem and its L2 solutions, we would be remiss if we did not mention the scaling protocols that other notable chains have been developing. While these protocols have their individual nuances, ultimately, they aim to scale the base chains and provide app-specific scaling solutions. Avalanche has launched two Subnets thus far, as discussed earlier in the L1 section of the report. On the BNB Chain side, the first deployment will be three dApps by META Apes, Project Galaxy, and Metaverse World, as well as integrations by leading infrastructure partners such as Ankr, Celer, Mathwallet, Multichain, NodeReal, and Pyth Network. Polygon’s Supernets appear to be in a slightly earlier stage of development. The level of developer and builder engagement that these ecosystems can get on these scaling solutions will be an interesting story to follow and may very well contribute to the siphoning of TVL from Ethereum that we have observed in the last 18 months.

Conclusion

To conclude the section, we evaluate a narrative that has run so hot in the last couple years but has perhaps lost some steam in recent months; the alt-L1 narrative.

The bull cycle of 2020-2021 very clearly showed us how simple it looks to build something that may look like Ethereum or BNB Chain, but how difficult it is to build economic security, monetary premium or attract a strong set of builders and developers and maintain a solid ecosystem.

Many chains thought they had the answer and could work past the “trilemma”, but the reality is that as soon as the market started trending downwards, many chains either failed, stagnated, or currently remain in an unreliable state, illustrated by sustained periods of downtime. Furthermore, while price moves are not something we remain too focused on, given our long-term mindset, it shouldn’t be ignored that most L1 platforms are down 85-90% from their recent all-time highs.

So the question becomes, do we continue to see builders trying their hands at building another L1? Or have developers learned their lessons and might transition to alternative technologies? We remain biased towards the latter.

One key aspect of building an L2 is that you are able to leverage the security of the base chain and essentially not worry about it. This is key. At its most basic level – L2s are significantly less capital intensive to build and expand upon when compared to creating an entirely new chain.

With the success of Optimism and Arbitrum and the tremendous valuations that projects like StarkNet are now commanding in the private market, combined with the relative ease and speed of building a L2, a scenario of “L2 mania” doesn’t seem too far-fetched at all. If the trajectory continues as we see it now, at some point L2s will become the most significant users of block space. At that stage, when both builders and investors see that L2s are not only scaling solutions, but are also actively adding to the security of the base chain, that is when L2 activity is likely to start hitting the next level. The conclusion is simple; the next bull cycle can easily see a proliferation of L2 solutions in the market. This might very well lead to the next meaningful onboarding of users into the crypto space as we continue on the long road towards mass adoption.

Stablecoin Development

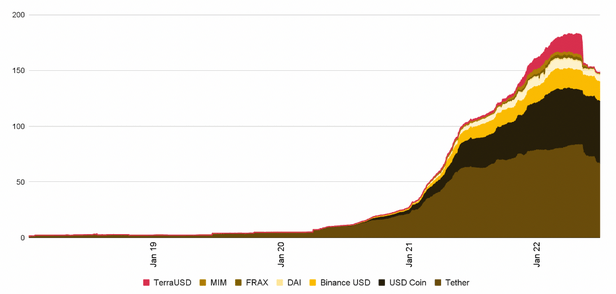

2020 and 2021 have been crazy years for the stablecoin market. They exploded in size and, following the growth of DeFi stablecoins, found more and more use-cases within the crypto landscape. Within just a few years, they became a central backbone of further crypto adoption but also continued to be further scrutinized by regulators to find a balance between consumer protection and crypto adoption.

Stablecoin Market Capitalization grew by over 3000% since January 2020 (US$B)

Zooming into 2022, we can see that growth was a lot more moderate than in the previous two years. While stablecoins grew steadily throughout the first few months of the year, with investors moving their assets out of volatile cryptocurrencies into presumably less volatile stablecoins.

The correction we witnessed in the first half of 2022 is a stark reminder that markets do not only go up. The last two years saw a historical level of euphoria in the crypto space and when coupled with the ultra-loose monetary policies prevalent across most of the world, investing seemed a lot easier than what it actually is. However, many projects built during these years now face a reality check.

We remain convinced that this market correction is healthy for the long-term success of the industry and while some projects might fail, others will use this opportunity to continue improving upon their existing infrastructure, code, mission, and so on. Bear markets are times to build and create sustainable growth and that is what we have been seeing in many parts of this extremely diverse crypto landscape. Be it in L1s, L2s, GameFi, or even regulation – we have witnessed crucial developments in all of these areas in the first half of this year.

Only when the tide goes out do you discover who’s been swimming naked.

Warren Buffet

The collapse of some of the previously most respected companies and projects have forced investors to go back to the drawing board and reevaluate how they assess companies. While painful for many, these are the critical building blocks of any budding market and the liquidation of some of the companies today may turn out to be a necessary evil that reduces risks of further contagion down the road.

Regardless, having reviewed the underlying trends and developments across different sectors in the crypto ecosystem, one thing is certain – we are in a BUIDL market. Excesses are steadily being flushed out of the system, and investors are now more rational in terms of capital allocation. Developers continue to improve their products and smart contracts continue to work as programmed.

……………