Berkshire Hathaway has reported pre-tax losses related to Hurricane Ian of $3.4 billion for the third quarter of 2022, as the company’s insurance and reinsurance units fell to an underwriting loss of $962 million.

The Q3 2022 insurance underwriting loss has widened from the $784 million loss reported for the prior year period, as GEICO, Berkshire Hathaway Primary Group, and Berkshire Hathaway Reinsurance Group all recorded underwriting losses for the period.

For Berkshire’s insurance and reinsurance operations, the quarter was marked by significant catastrophe events, including Hurricane Ian at a cost of $3.4 billion. After-tax, the Hurricane Ian loss stands at $2.7 billion.

Berkshire notes that its insurance underwriting results were negatively hit by increases in private passenger automobile claims frequencies and severities, somewhat offset by the favourable impact of higher foreign currency exchange rate gains, and stronger life and health reinsurance results.

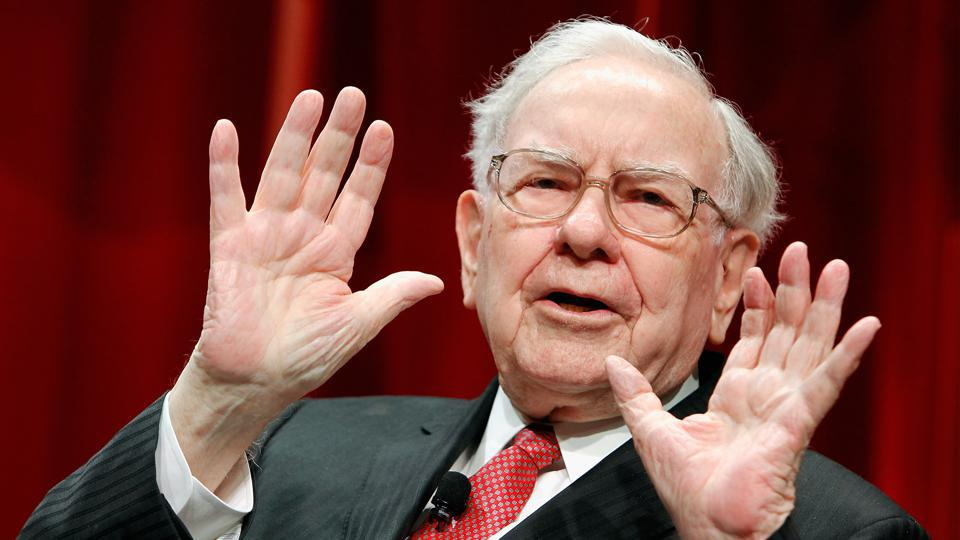

At GEICO, Warren Buffett’s auto division, the underwriting result declined to a loss of $759 million for Q3 2022, as loss and loss adjustment expenses increased by more than 12% to $1 billion, including $600 million from Hurricane Ian.

The primary insurance business performed better in the quarter, although its underwriting loss widened from $23 million in Q3 2021 to $281 million in Q3 2022. Here, losses from catastrophes in the quarter totalled $660 million, driven by Hurricane Ian.

Of the re/insurance businesses, Berkshire Hathaway Reinsurance, which includes General Re (GenRe) and National Indemnity (NICO), reported the smallest underwriting loss at $110 million for Q3 2022, making it the only segment to improve year-on-year against a Q3 2021 underwriting loss of $708 million.

Within the reinsurance business, the P&C operation experienced losses from catastrophes of $1.9 billion, primarily from Hurricane Ian. Additionally, the P&C reinsurance unit benefited from reductions in estimated ultimate liabilities for losses occurring in prior years of $833 million.

The P&C reinsurance business saw premiums written increased by over 11% to more than $4.5 billion, with this part of the reinsurance group actually reporting a small underwriting gain of $23 million, with a combined ratio of 99.4%, compared with 106.8% a year earlier.

Life and health reinsurance division produced an underwriting gain of $67 million for Q3 2022, although losses for retroactive reinsurance and periodic payment annuity more than offset these gains, leading the overall reinsurance underwriting loss of $110 million.

Berkshire Hathaway Reinsurance has recorded an underwriting gain of more than $1 billion for the first nine months of 2022, which is a huge improvement on the loss of roughly $1.3 billion in 9M 2021. This positive performance is driven by the P&C business, which, for 9M 2022, has produced an underwriting gain of $1.4 billion.