Banking regulators’ recent speeches, guidance and policy statements have made their stance on cryptocurrency clear: digital assets are a threat to the safety and soundness of the banking industry, and banks should proceed with caution.

Though the agencies have yet to issue formal, proposed rules regarding banks’ involvement in crypto activities, industry experts told S&P Global Market Intelligence that regulators have made their opinions clear.

Over the past few years, and especially in recent months following the recent volatility of the crypto space, regulators have signaled that digital assets pose a risk to the safety and soundness of the banking system.

As such, most banks are taking the cues they have received and are hesitant to play in that space, attorneys and analysts told.

“The federal banking regulators have now said, consistently across the board, that ‘We think it’s questionable whether crypto activities in the cryptocurrency space are safe and sound for banks,'” said James Stevens, co-leader of the Financial Services Industry Group at Troutman Pepper.

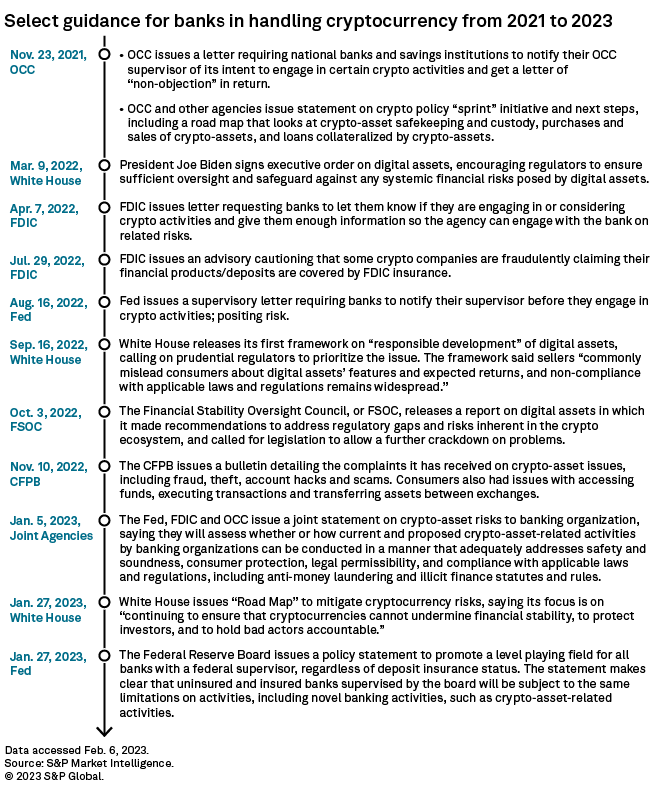

Regulators have provided some guidance regarding banks’ involvement in crypto in recent years, but following the fallout of crypto companies such as FTX Trading and the subsequent impact to the overall crypto industry, the agencies are increasingly working together to ramp up their efforts to provide guidance.

Most recently, Federal Reserve Governor Christopher Waller sent a sharp warning to banks interested in engaging in cryptocurrency activities.

“Banks considering engaging in crypto-asset-related activities face a critical task to meet the ‘know your customer’ and ‘anti-money laundering’ requirements, which they in no way are allowed to ignore,” Waller said.

“A bank engaging with crypto customers would have to be very clear about the customers’ business models, risk-management systems and corporate governance structures to ensure that the bank is not left holding the bag if there is a crypto meltdown.”

Waller’s comments come after a yearlong stretch of actions tightening regulatory oversight of banks’ participation in the crypto market.

In January, the Office of the Comptroller of the Currency, the Fed and the Federal Deposit Insurance Corp. teamed up to caution banks in a joint statement that many crypto activities are “highly likely to be inconsistent with safe and sound banking practices.”

Prior to the joint statement, the FDIC, the OCC and the Fed have all separately instructed banks to fully disclose their crypto activities and work with the agencies on any progress forward, with the OCC requiring companies to get a “non-objection” letter before engaging in certain activities.

In a separate policy statement Jan. 27, the Fed said both insured and uninsured banks will be subjected to limits on certain activities, including those associated with crypto-assets.

The fact that financial agencies now are moving together to address their crypto concerns is significant, attorneys told S&P Global Market Intelligence. It also is noteworthy that the White House announced Jan. 27 the culmination of an administrationwide, yearlong focus on mitigating cryptocurrency risks, noting “the imperative of separating risky digital assets from the banking system.”