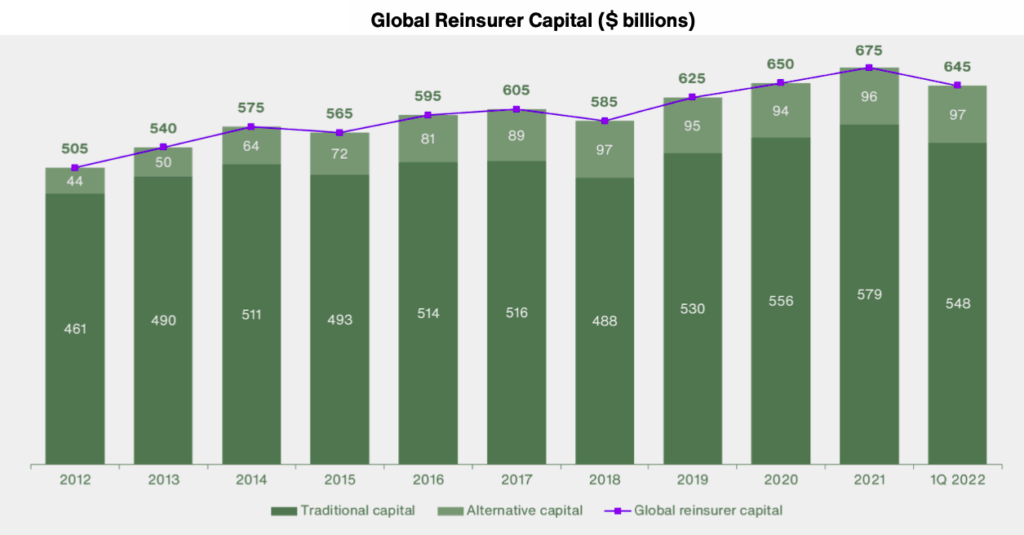

Global reinsurer capital fell by $30bn from the end of 2021 to the end of the first-quarter of 2022. In a statement that this was driven mainly by unrealised losses on bonds, linked to rising interest rates.

Aon has estimated that the equity of traditional reinsurers declined by around five percent to $548bn over the three months to March 31, 2022. It also said that underwriting results were were undermined by volatility in the financial markets, linked partly to Russia’s invasion of Ukraine.

Alternative capital, however, increased slightly to $97bn, as investors recognized the value of diversification and increased margins amid more turbulent financial markets.

Interest rates rose to counter growing inflationary pressures, resulting in unrealized losses on bond portfolios, while weak stock markets reflected the deteriorating economic outlook.

Last September, global reinsurer capital totalled $660bn at 30 June 2021, following growth in both traditional and alternative capital. That figure, which represents a $10bn increase versus the end of 2020, was calculated based on a broad measure of the capital available for insurers to trade risk with.

Industry capital decreased in the first quarter of 2022, driven principally by unrealized losses on bonds, linked to rising interest rates. Total reinsurer capital stood at $645bn at March 31, a $30bn reduction relative to the end of 2021

said Joe Monaghan, global growth leader at Aon Reinsurance Solutions

Traditional equity capital rose by $7 billion to $563 billion over the first six months of 2021, driven by retained earnings.

Reinsurer capital had rebounded to its pre-pandemic high of $625bn by the end of Q3 2020, aided by continued capital market recovery and capital raises, reports insurance and reinsurance broker Aon.

At the end of the third-quarter of 2020, traditional reinsurance capital reached a new high of $533bn, representing growth of around 0.6% from the $530bn reported at the end of 2019.

by Yana Keller