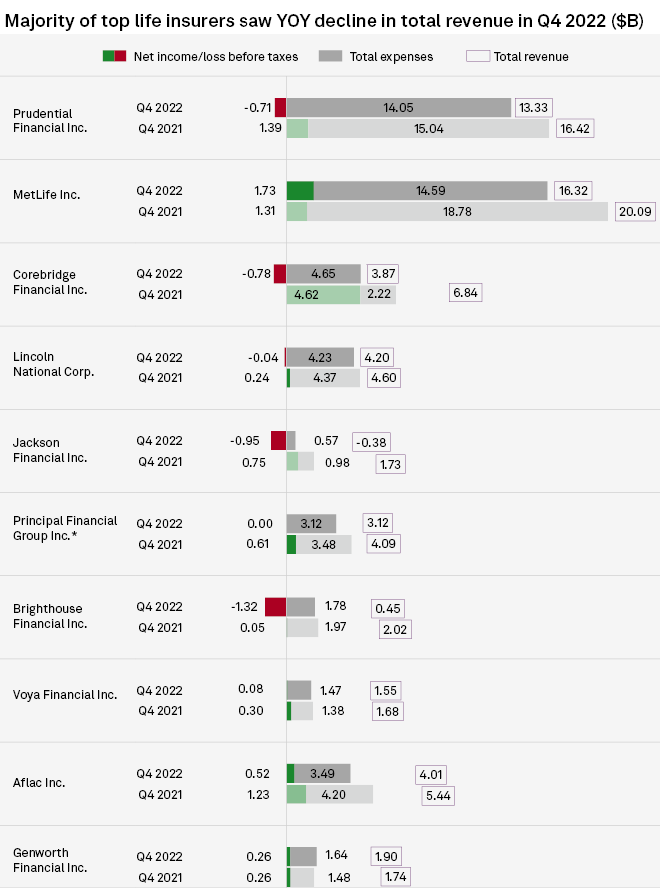

Most of the leading US life insurers experienced a year-over-year drop in total revenues in 2023.

Genworth Financial Inc. was the only exception among the group, booking $1.90 billion in total revenue in the fourth quarter, an increase from $1.74 billion in total revenue in the year-ago period.

During Genworth’s most recent earnings call, CEO Thomas McInerney said the company is making progress on a multi-phased go-to-market strategy for its long-planned, less capital-intensive senior care services business, part of which is supposed to be piloted during the first half of 2023.

Portfolio revenues also dropped among the vast majority of the largest US life insurers during the fourth quarter of 2022.

However, MetLife Inc. saw its portfolio revenue grow slightly to $4.98 billion in the fourth quarter of 2022, from $4.91 billion in the fourth quarter of 2021. MetLife also booked the highest amount of net investment income from the group for the quarter at $5.18 billion.

During MetLife’s fourth-quarter earnings call, CEO Michel Khalaf said the company was open to M&A opportunities and expressed confidence in the insurer’s philosophy around capital deployment despite the risk of a potential recession.

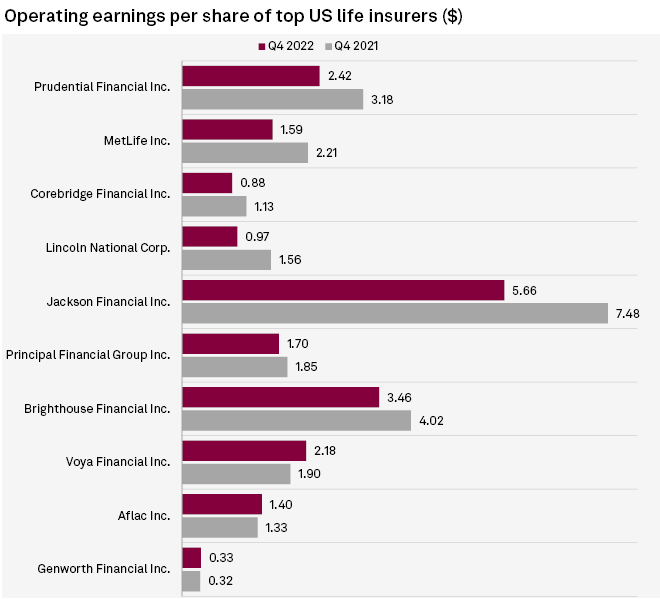

Earnings were lower in the fourth quarter for most life insurers in the group, with only a handful showing improvement.

Prudential, the largest among the group, had $2.42 in operating earnings per share in the fourth quarter of 2022, a decrease from $3.18 in the fourth quarter of 2021. Meanwhile, Aflac saw EPS growth with $1.40 booked in the period, up from $1.33 in the year-ago quarter.

…………….

AUTHORS: Hailey Ross, Kris Elaine Figuracion – S&P Global Market Intelligence analytics