Although blockchain offers enormous potential, it is not a silver bullet. Instead, it should be considered as part of a wider insurance digitization strategy.

To reap the benefits of blockchain, companies should not attempt to implement the technology on their own. Organizations need to collaborate and create an industry approach that will allow peer-to-peer exchanges that cut out intermediaries and build trust. Technology is already changing the way we do business, replacing the tradition of great monoliths that act alone with firms that function as part of collaborative networks.

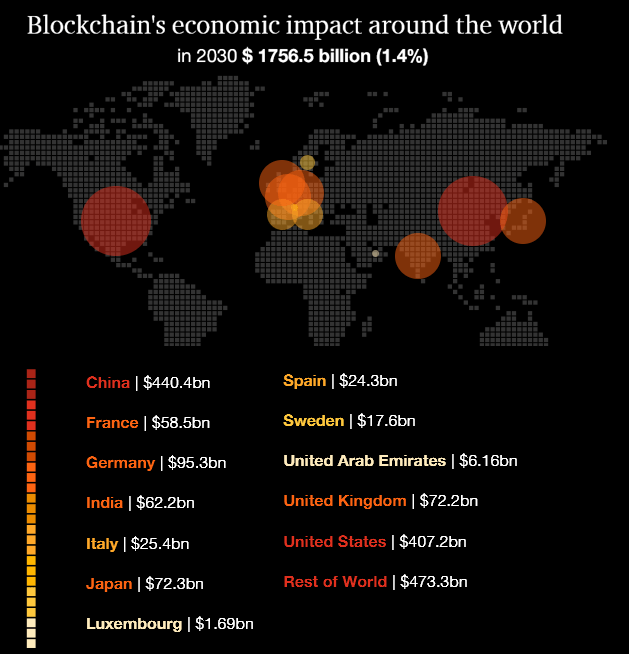

PwC’s economists ranked the top five uses of blockchain by their economic potential, predicting that using blockchain to prove provenance could generate US$962 billion for global GDP over the next decade.

Notably, this was more than double the potential of any other use case. In many ways, this focus on provenance is a sign of the times. With operations thrown into disarray during COVID-19, securing and strengthening supply chains has become a priority — and digital technologies such as blockchain will be critical enablers.

Embracing blockchain will also mean experimenting and establishing a proof of concept. But do not make the mistake of considering it to be a hobby and leaving it in the realm of the enthusiast on your team. Blockchain needs C-suite support and should not be viewed as technology for technology’s sake, looking for a problem to solve.

Insurance companies are using blockchain and smart contracts to automate manual and paper-intensive processes such as underwriting and claims settlement, increasing speed and efficiency, and reducing costs. Blockchain’s faster, verifiable data exchanges help reduce fraud and abuse.

Technological disruption has come to the insurance industry — and the smart risk management strategy is to embrace it. Blockchain is helping the insurance industry radically transform operations by enabling faster verifiable data exchanges, visibility for all parties, and transactions underpinned by pervasive security and trust.

In a survey of supply chain leaders, 37% of those categorized as “digital champions” (companies furthest along in the digital transformation of their operations) reported piloting blockchain solutions, while 33% planned to do so in the next five years.

COVID-19 has exposed weaknesses and gaps in supply chains across the globe, in nearly every industry. As organizations build the resilience to confront these challenges and to meet shifting customer and consumer demands, investing in new technologies has become a critical part of their transformation. If it is deployed responsibly, blockchain can help them respond to disruptions — and can provide the opportunity to bring trust and transparency to their operations.

A lot of blockchain initiatives stall after the first project

One of the main challenges is creating an environment where separate legal entities can work together, and rightly so. Anti-trust laws prevent companies from colluding.

For insurance, the Property & Casualty Model Rating Law was enacted by the National Association of Insurance Commissioners (NAIC) to protect the public against unfairly discriminatory rates. With all this in mind, insurers are very reluctant to provide access to their data — period (key elements of a blockchain).

AAIS, with their membership base, already has the business network of carriers and regulators in place. More importantly, in addition to its responsibilities as a statistical agency, AAIS is the only national not-for-profit advisory organization governed by its member insurance companies.

Blockchain has the potential to cut costs, speed up transactions and promote greater financial inclusion by streamlining cross-border and remittance payments. These powerful innovations will transform payments infrastructure.

Lucy Gazmararian, Crypto and FinTech Advisory, PwC

This means they have the right to use the blockchain data to learn new insights, and share back with insurers.

As an advisory organization and authorized statistical agent, AAIS recognized the potential for emerging technologies to improve the way insurance industry data is collected, managed and reported to regulators. Over the past five years, AAIS invested in a modern infrastructure to support current and future needs of AAIS, its member insurance carriers and regulators.

Blockchain technology is the natural evolution in our data management strategy and solves many of the problems with data transfers and reporting for the insurance industry.

Joan Zerkovich, Senior Vice President of Operations, AAIS

The value of blockchain technology lies in its ability to substantially increase the security, transparency and auditability of data shared across the public internet. Not surprisingly, permissionless blockchain networks are not widely used in the business world due to potential data visibility issues and performance concerns that have been uncovered in some network trials. Permissioned blockchain networks, however, provide a viable alternative. They enable network participants to keep their data secure in their own data center, while controlling how it is accessed and shared with higher levels of security.

Key Benefits of Blockchain

- Greater trust

- Enhanced security

- Greater transparency

- Instant traceability

- Increased efficiency and speed

- Automation

With blockchain, as a member of a members-only network, you can rest assured that you are receiving accurate and timely data, and that your confidential blockchain records will be shared only with network members to whom you have specifically granted access.

A bridge to the future

As a not-for-profit advisory organization serving over 700 property and casualty insurance companies, AAIS needs to develop solutions that fit seamlessly into the IT strategies and data centers for all its members. IBM developed openIDL to help turn time-consuming, expensive regulatory reporting into one of improved data quality and reporting. Its architecture allows carriers to control their data locally in private data stores while regulators utilize smart contracts to query the secured data so that only the answer is returned in a report or dashboard. The transfer of large blocks of data from one data center to another and the associated security risks are eliminated.

The openIDL is much more than a technology platform. While its foundation is built on regulatory reporting practices that ensure a healthy insurance industry and consumer protections, its potential goes much further.

Joan Zerkovich, Senior Vice President of Operations, AAIS

OpenIDL’s open architecture supports future changes in the insurance business model and a new relationship between carriers, regulators and AAIS as a regulatory reporting agency.

Just like the evolution of the internet, there is no way to predict all the potential uses of blockchain technology, but it’s a safe bet that success will depend upon the same factors that made the Internet and the applications we use today successful: open standards, open source software and common communication protocols.

As openIDL achieves its goal of streamlining regulatory reporting, it will virtually eliminate the need for AAIS to facilitate statistical reporting, a role AAIS has had for over 70 years. We embrace this disintermediation as a natural evolution of our industry. Rather than protecting outdated practices, we we can deliver more value to our members by providing network governance along with new analytics and services within openIDL.

Looking ahead, we believe that blockchain technology will evolve much the same way other core, open source technologies have, such as Linux, Apache servers, Kubernetes and others. By leveraging the power of open source, AAIS can focus more on building new applications for our members, than building and maintaining the blockchain technology itself — and that’s better for everyone.

Environmental, social, and governance (ESG) concerns are increasing in prominence on the corporate agenda and gaining attention from investors. But with the rise of ESG has come increased public and investor scrutiny.

Blockchain technology can help by enabling them to verify the source of their materials. Again, the number of sectors that stand to gain from this is broad, from the automotive example above to mining groups to retail.

Companies need to be able to support their ESG claims, to prove they live up to their values, and to demonstrate how they are performing against their wider stakeholder responsibilities.

……………