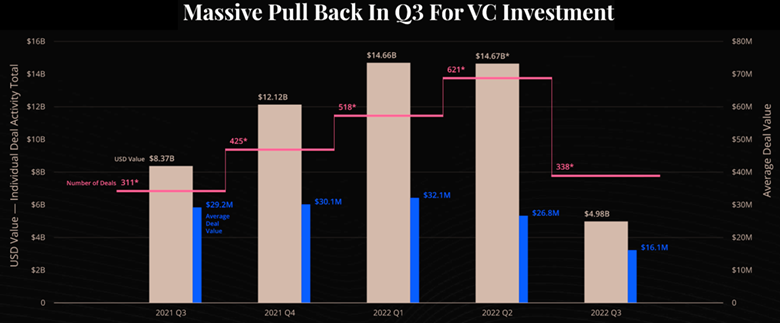

The second quarter saw a stable overall level of investment in Web 3.0, Blockchain & Crypto Startups, but many signs pointed to a decrease in venture capital inflows were on the way. The quarter’s results confirmed this, as there was a massive drop of over 66% in capital inflows, dropping from over $14 billion in Q1 to just under $5 billion in Q2, according to Cointelegraph Research.

It should be no surprise, as cryptocurrency and the blockchain space do not exist in a vacuum and are still subject to the same market conditions as traditional finance.

It’s true that all markets are down. However, there are signs of life in the crypto industry.

But there are positive signals from different indicators in the crypto industry, which may perhaps not mark the return of a bull run but may flash.

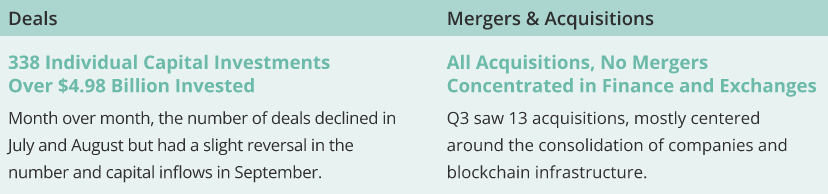

- The total number of individual deals by VCs in Q2 reached 338, a decrease of 45.6% from the previous quarter.

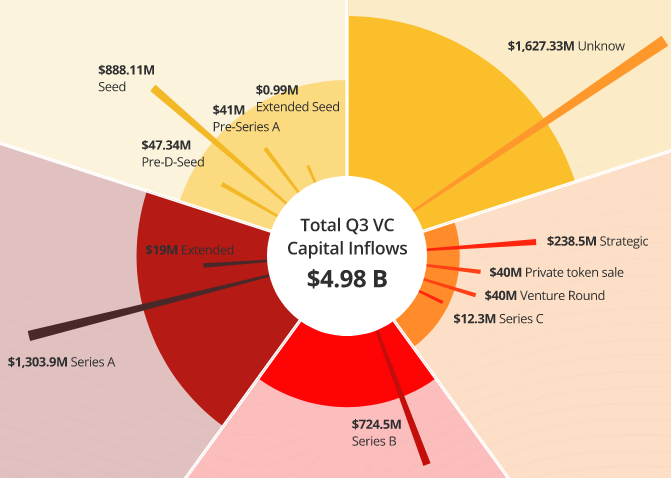

- Total capital inflows also decreased to $4.98 billion, an almost 66% decrease from Q2.

- While Web3 makes up 150 deals or 44.4% of the total individual deal activity.

- Seed rounds and Series A saw the most amount of capital inflows, with $977 million and $1.32 billion, respectively. However, there were 72 individual deals labeled “unknown,” which likely encompasses debt financing and other business operations that would not cause negative speculation in a bull market but may cause unneeded negative attention in the market’s current situation.

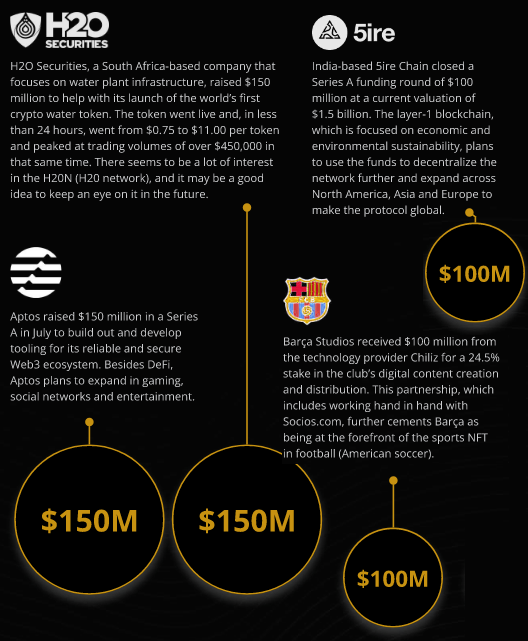

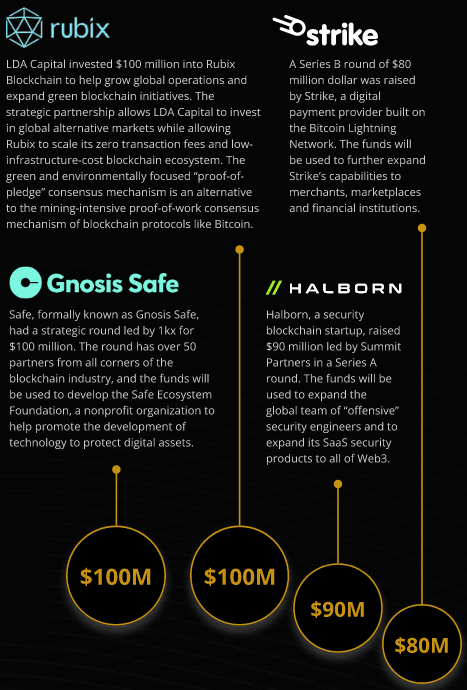

- The top 10 deals in Q2 may have used the term “Web3,” as it is a hot buzzword of the day, but upon analysis, most of these investments were about building other sectors. These deals ranged from $300 million to $80 million with a focus mainly on infrastructure, GameFi, NFTs and digital asset exchanges.

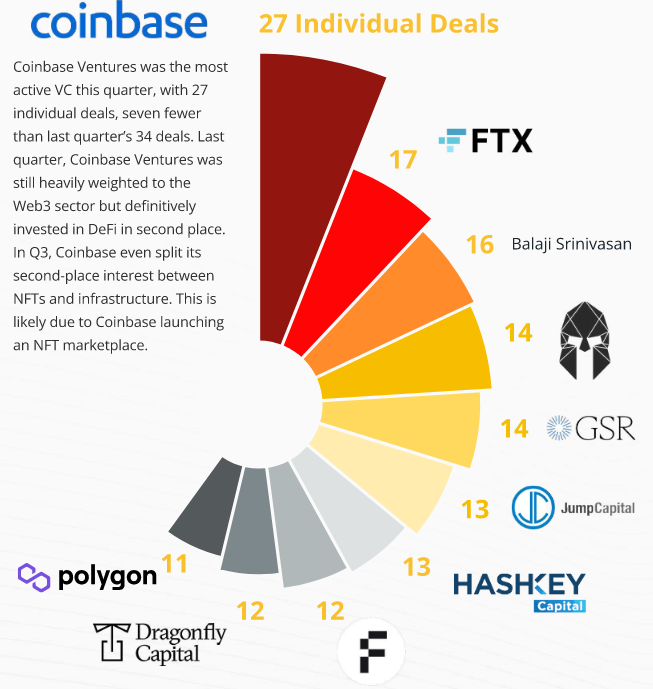

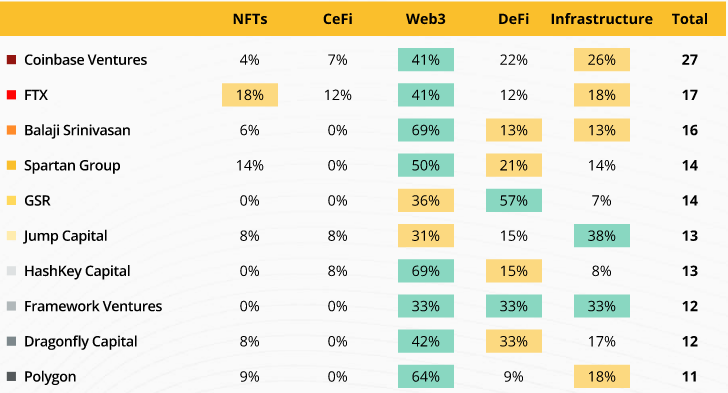

- 9 of the top 10 most active VCs concentrated their funds on the Web3 sector, which, again, can cloud the true focus area of the funds. Most of these Web3 deals are really infrastructure, GameFi and metaverse plays.

- A $9-billion fund launched by Sequoia Capital looks to expand tech startups in China. This trend of expanding blockchain and related industries in differing Asian markets is shared by several of the largest VC funds to launch in Q2.

- It is likely that due to non-inflated valuations of companies, this also influences the overall aggregate numbers of capital investment by VC in the blockchain space in Q2.

Pull Back For VC Investment

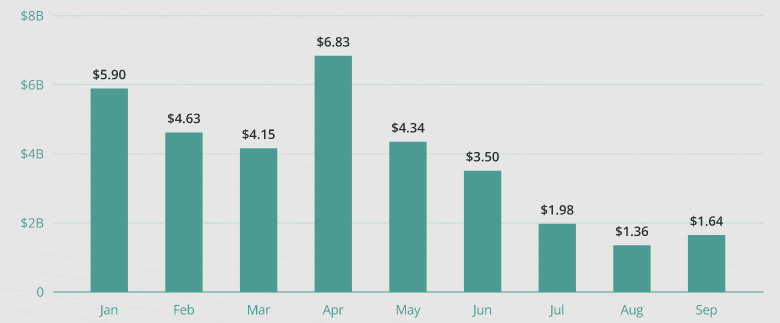

For VC funding, this may be seen in the fact saw $1.64 billion of capital inflows from August’s potential local bottom of $1.36 billion.

One month is not a trend, but a 20.6% increase is not insignificant, and as the rest of this report shows, there is still building going on in the bear market in many surprising ways.

Venture Capital Investment Per Month

Insights to the Blockchain and Crypto Space

Average Deal Value and Number of Deals Decreased

The average deal value shrank from $26.8 million in Q2 to $16.1 million this quarter. The number of deals fell to 338, a decrease of 45.6% from the previous quarter. In both cases, the downward trend in capital inflows into the blockchain space continued with $1.98 billion in July followed by $1.36 billion in August. September, however, went up to $1.64 billion.

July And August Kept Going Down, But September Showed a

Positive Change

September saw a 20.6% uptick in capital investments from August, not an insignificant change in direction in VC interest. While it may be too early to definitely tell if this is a potential reversal, this may be another indicator of a bottom to the market, as VC involvement is widely considered a local lagging indicator.

What Happens With These Massive Funds’ Treasuries?

As we have shown over the past two reports, there have been massive funds created by the likes of Andreessen Horowitz (a16z) for $4.5 billion and others who have all this capital ready to deploy into investment somewhere.

Interestingly, a16z was not one of the most active investors in this report.

Does this suggest that Q4 will have a potential spike in VC capital inflows?

*The number of deals and totals for these five quarters may be higher due to undisclosed amounts of investment from private investors.

They Might Use the Buzz Word “Web 3.0,” But… The Top 10 VC Deals Are Really Infrastructure

We Will Break Down Web 3.0 Next, But…

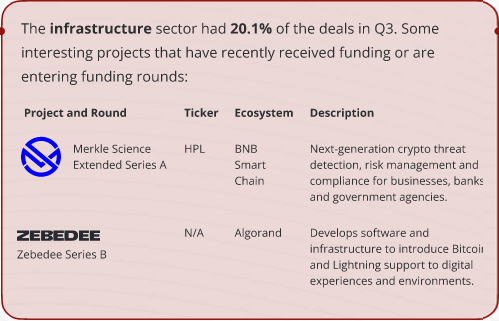

Infrastructure Is The Second Sector Of VC Investment

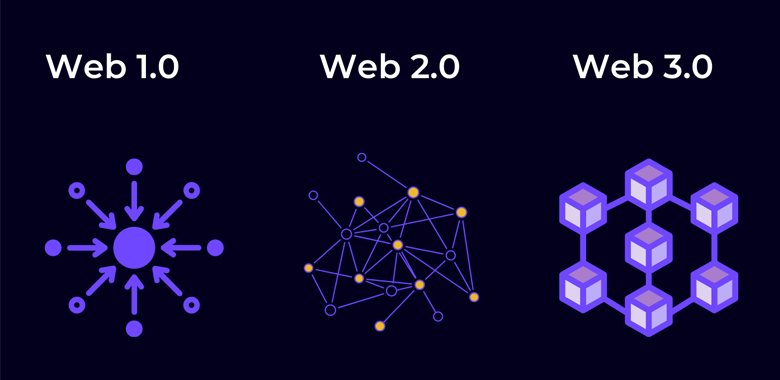

What Makes Up Web 3.0?

Web3 “refers to a wide variety of topics generally dealing with evolving access for

individuals to decentralized, open-source, permissionless applications rather than

through intermediaries on the current centralized internet.”

Breaking down the 138 deals over the last three months that fell into the classification of Web3, it is no surprise to anyone keeping up with the industry that the sub-categories of this sector are Gaming (34 individual deals) and Metaverse (13 individual deals). The issue is that the more granular of an analysis that is done into each deal, the more an argument can be made to put a deal into one bucket over another. However, some surprising other sub-categories popped up upon further inspection.

Infrastructure (nine deals) and Tooling (eight deals)

Infrastructure and Tooling could easily fall under the major sector of infrastructure outlined in other places in this report. When diving into each of these deals, it is apparent that these are often more directly related to interconnectivity across all of Web3 as opposed to the major sector classification, which focuses more on specific applications of infrastructure.

In any case, it is a positive sign to see further groundwork being invested in for the future of the blockchain space.

Data (seven deals) and Identity (seven deals)

Interestingly, Data and Identity were the focus of multiple deals during Q3. Not only is data storage an important sector in need of further capital investment, but analytical tools and security are in constant need of development and funding. Additionally, as the globe moves into a more immersive Web3 environment, decentralized identification is going to increasingly become a hot-button topic, and it is apparently already catching the attention of some investors.

Marketplaces (five deals) and Rewards (five deals)

While marketplaces could also easily be lumped in with the major sector of infrastructure as outlined in other sections of this report, in many of these cases, the marketplaces being discussed are more broadly applicable to the entire space itself rather than having a specific application.

How to incentivize human action through the blockchain and Web3 as we move forward is in the tokenomics creation of every project. The five deals focused on how rewards can help to further incentives participation in this growing but still nascent industry.

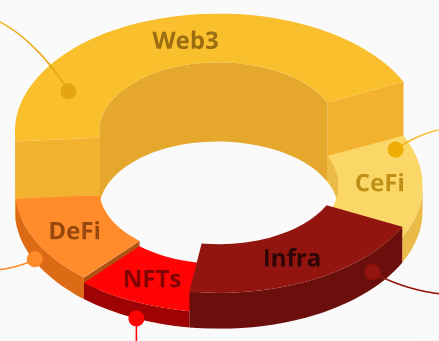

Q3 Sees No Change In Direction From Q2 As Web 3.0 Again Garners The Most Interest From VCs

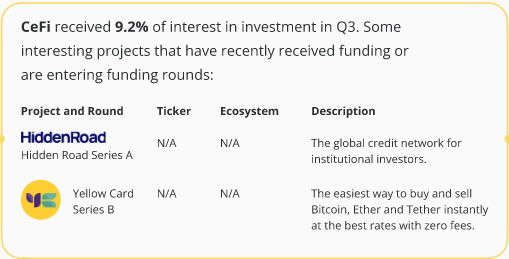

Web3 was the most invested sector of the crypto market in Q3 of the top 10 most active VC firms. The second place was tied between DeFi and infrastructure (not surprisingly).

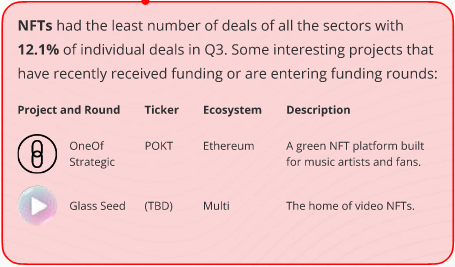

The number of individual deals dramatically dropped overall in Q3 to 338 in total, down from 621 in Q2. Even for centralized exchanges like Coinbase and FTX, CeFi remains the least popular sector for investment, with NFTs seemingly dropping off in popularity from the heights in 2021 and early 2022.

Web3 is seemingly the buzzword for subsectors like GameFi, metaverse, marketplaces, tooling, art, media and education.

Breaking them into separate buckets may be premature, as these segments have not fully matured yet to be staples of market analysis to stand up on their own. Of course, with the rapid change in the cryptoverse, that could change rapidly.

Percentage of Individual Investments Per Active Investor

Despite Bearish Market Trends, VCs Fund More Than Just Emerging Markets

Major Focus on China and Asian Markets: Several firms, such as Sequoia, Qiming and

Insignia, are looking to expand into the Asian markets. With an increase in demand for crypto and blockchain tech products and services, the addressable market can have a high level of ROI if timed correctly. One firm making a move at this time would be one thing, but several moves across different firms start to flash a positive signal.

Reduction In The Number Of Deals & Capital Inflows

Pre-Seed and Seed Rounds: Activity 179, Total $977.4M

While experienced a sharp drop in capital inflows and VC activity, there were still 149 deals with over $888 million in Seed rounds alone. While not the bulk of the VC inflows during the quarter, it still signals interest by VC firms to look into the future of this space.

It is likely that funds and other institutions are waiting to deploy capital at a more risk-appropriate time. However, they also risk being involved with startups that are looking to innovate in bear markets and change the game once things begin to ramp up again.

Series A: Activity 54, Total $1,322.9M

It is likely that the bear market conditions have slowed down the traction of previous startups in the crypto space, as only 53 individual deals for Series A rounds.

While there are companies transitioning to some later stages of firm development, ready to establish market share, it is hard to do so with a diminished marketplace.

It may actually be better for certain companies to stay and build stronger infrastructure while they can before taking the leap forward going to market. It may be analogous to rushing with excitement into an empty room. Better to have a strong foundation and go to market when appropriate.

Series B: Activity 11, Total $724.5M

Series B may have had the fewest individual rounds. The areas of scaling, product commercialization, marketing and cultivating consumer interest garnered the most amount of investment capital at over $724.5 million.

Expansion: Activity 22, Total $330.8M

Expansion rounds mostly consist of mergers and acquisitions, strategic plays, debt financing, and treasury diversification. The second quarter had 53 individual deals and capital inflows of $2.69 billion, and this fell to 22 deals and capital inflows of $330.8 million.

Most of the activity by VC was strategic, with 18 individual deals with over $238 million of investement.

It is a great time for VCs and firms to find partners now while market sentiment is down and to prepare for the market sentiment to turn around.

Other: Activity 72, Total $1,627.33M

Usually, this breakdown includes debt financing, post-IPO and other sub-categories, which are normally acceptable areas of investment in a firm’s business cycle.

However, it is likely that during this economic downtrend, reporting of these activities was likely classified as “unknown” not to spook investors and the market or provide a signal that can be interpreted negatively.

…………………

AUTHORS: Michael Tabone – Sr. Economist at Cointelegraph, Demelza Hays – Head of Research at Cointelegraph, Nikita Malkin – Research Analyst at Cointelegraph

Edited by