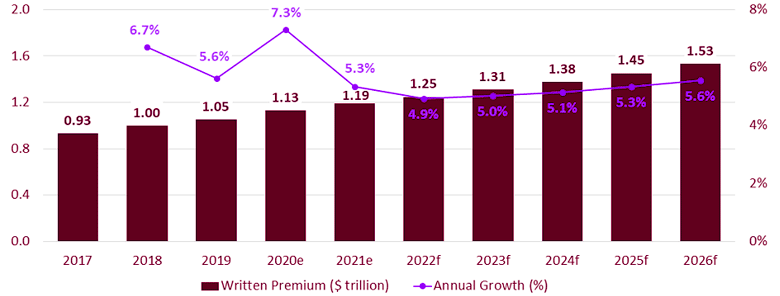

The personal accident and health (PA&H) insurance industry written premium sales in North America are projected to grow from $1.2 trillion in 2021 to $1.5 trillion in 2026 at a compound annual growth rate (CAGR) of 5.2%, backed by an increase in health insurance awareness and rising healthcare costs, due to the COVID-19 pandemic.

Personal Accident and Health Insurance Market

According to GlobalData Report, found that the US is the leading and most advanced healthcare market globally and accounts for 97% of North America’s PA&H insurance premiums. Supported by the recovery in employment, easing of travel restrictions, and double-digit enrolments in the Medicaid program, which increased the demand for PA&H policies. The US’s PA&H insurance industry grew by 5.3% in 2021.

A prime focus area for PA&H insurers will be the changed abortion rules and regulations in North America following the US Supreme Court’s decision to overturn Roe v Wade.

With 50% of the US states expected to enact the ruling, insurers will have to amend their policies to accommodate this change.

The ruling will also have an impact on both individual and corporate travel policies as people will look to access out-of-state healthcare services. The full impact of the ruling is expected to be realized over the next year. Overall, the US PA&H insurance market is expected to grow at a CAGR of 5.2% over 2021–2026.

Canada accounts for a 1.6% share of the regional PA&H premiums. Rising healthcare costs have created demand for private insurance to supplement healthcare services not covered by public health schemes such as prescription drugs, dental, vision, and hospitalization.

The growing popularity of packaged plans covering multiple risks under one plan is expected to emerge as a prominent insurance driver. Over 2021–2026, the PA&H insurance market in Canada is estimated to grow at a CAGR of 5.9%.

Mexico accounted for the remaining 1.4% share in the regional market. It is the fastest growing market with 19.3% growth in 2021 as pandemic-driven insurance awareness helped increase health insurance demand. The industry is expected to grow at a CAGR of 8.1% over 2021–2026.

North America Personal Accident and Health Insurance industry premium and annual grow, 2017-2026F

In addition to the rise in healthcare costs, digitalization in healthcare, increased uptake for telehealth services propelled by the pandemic, and mental health awareness also supported the growth of PA&H insurance in the region.

Prominent insurers such as Anthem, United Health, Atena, and Cigna in the US offer telehealth services in their policies. While in Mexico, BBVA Bancomer, in partnership with Bupa Mexico, launched ‘your private doctor’ in 2021, the first fully digitized health insurance.

The emergence of hybrid virtual-in-person models focusing on specific care such as mental health and physiotherapy are also expected to see greater integration with private health insurance. An example includes Amazon Care services, covering virtual and inpatient services that can be serviced through private health insurance with applicable copay/ coinsurance and deductible as per the plan.

The North American PA&H insurance market is expected to continue to grow over the next five years and see more development encompassing digitalization and customization to address the rising medical costs.

However, regulatory developments related to the recent ruling on abortion ban and recession concerns from the ongoing Russia-Ukraine crisis could further impact its growth.

What are the key personal accident & health insurance market trends?

The rise in popularity of health and wellness trends propelled wearable devices as tailored solutions into the mainstream, giving insurers access to detailed biometric and activity data from policyholders, allowing insurers to improve underwriting accuracy, prevent claims and increase customer engagement.

Technological advancements are allowing insurers to customize requirements through which a personalized insurance proposition can be presented to enhance customers’ experience.

AI, natural language processing, predictive analytics, and machine learning are a few technologies that insurers are adopting to provide hyper-personalization with behavior-based insurance products to customers.

Regulatory development, such as the General Data Protection Regulation, to an extent, is expected to support the uptake of insurance policies that incorporate wearable tech, boosting consumer confidence in the security of personal data storage.

What is the regional-level outlook of the global personal accident & health insurance market?

The key regions in the global PA&H insurance market are North America, Europe, Asia-Pacific, South & Central America, and Middle East & Africa.

PA&H insurance market in North America

North America dominated the global PA&H premiums in 2020 with the US leading the global market. Reduced healthcare claims and medical costs due to delayed or cancellation of many healthcare procedures offset any unprecedented rise in healthcare claims related to COVID-19 in the US.

PA&H insurance market in Asia-Pacific

The Asia-Pacific PA&H insurance industry’s growth in 2021 was driven by economic recovery and increased insurance awareness. Across Asia-Pacific, the integration of online healthcare services in insurance policies and personalized insurance propositions using wearable devices has gained traction in 2021.

PA&H insurance market in Europe

Europe’s PA&H insurance is expected to have recovered in 2021. Across the region, insurers are focusing on preventive healthcare for the early detection and treatment of medical conditions to minimize large claims.

PA&H insurance market in the Middle East & Africa

The COVID-19 pandemic increased the demand for private health insurance solutions in the region, due to rising awareness and the implementation of mandatory covers. The revival in the tourism sector is also expected to support the growth of PA&H insurance in the region over the next five years.

PA&H insurance market in South & Central America

The COVID-19 pandemic boosted the demand for health insurance solutions in the region. Higher demand incentivized insurers to innovate their solutions to increase their market share.

What are the key lines of business in the global personal accident & health insurance market?

The key segments in the global personal accident & health insurance market are non-categorized life personal accident & health, life travel, life personal accident, life health, non-categorized general insurance personal accident & health, general insurance travel, general insurance personal accident, and general insurance health/ stand-alone health.

Health insurance business of general insurance and stand-alone health insurers accounted for the largest share in PA&H insurance in 2020 and was followed by the health insurance business of life insurance.

Which are the leading companies in the global personal accident & health insurance market?

The leading companies in the global PA&H insurance industry are UnitedHealth Group, Anthem Inc, Humana Group, Centene Corporation Group, HCSC Group, Ping An Insurance Company Of China Limited, CVS Health Corporation, Kaiser Foundation Group, Guidewell Mutual Holding Corporation, and Independence Health Group.

……………………

AUTHOR: GlobalData