Decentralized finance (DeFi) has been on an interesting journey since the peaks of the fondly remembered 2020 DeFi Summer.

According Binance Research Report, while numerous tokens have already been in a bear market for many months, developers and builders continue to dedicate time and energy to building the financial systems of the crypto world.

DeFi platforms and builders

With the traditional finance sector a multi-trillion dollar industry, DeFi platforms and builders have sufficient reason and incentive to continue to build in DeFi and vie for a larger slice of the proverbial pie.

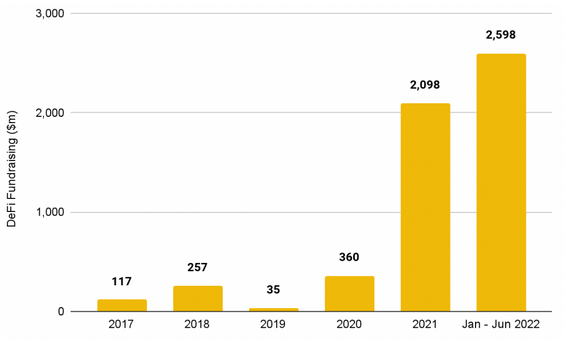

Despite scalability being somewhat limited due to high transaction fees, inconsistent liquidity and security concerns, development is consistent and growing, while fundraising in DeFi continues to hit an all-time high.

In this section, we explore how this central sub-sector of crypto has been developing in the last few months.

DeFi fundraising

Already the largest year on record (US$M)

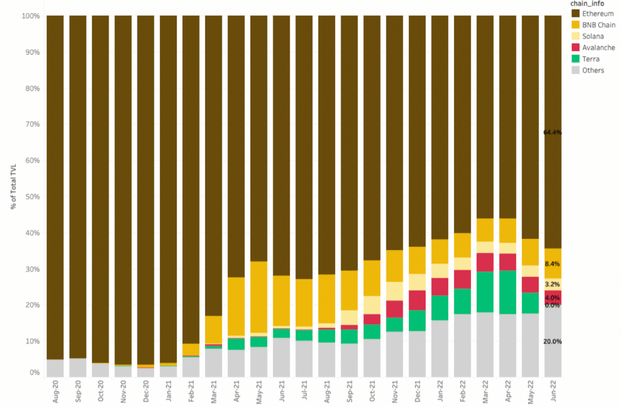

To open our discussion, we can take a top-down view to illustrate how DeFi has been evolving when broken down via chain. DeFi started on Ethereum and most of the largest dApps are still based on the chain.

DeFi TVL for most of the brief history

The first-mover advantage was notable and Ethereum has commanded upwards of 95% of DeFi TVL for most of the brief history of this nascent sector.

Nonetheless, this dominance started to wane throughout 2021, at least in part due to high transaction fees and scalability concerns, and Ethereum has seen its share of DeFi TVL drop from 97% at the start of 2021 to ~63% today.

According Crypto Market Review, looking closer at 2022, the first few months of the year saw a rapid (and in hindsight, an unsustainable) rise in the TVL of the Terra ecosystem, driven largely by the ~20% yields available on their Anchor Protocol.

The peak of this came in April, when Terra, now the second-largest chain by TVL, commanded nearly 15% market share in the DeFi market. What happened after has been covered ad nauseam by the market so we won’t delve any deeper, but will note that the new Terra chain currently ranks below the top 50 chain by DeFi TVL. Two other notable moves have come from the BNB Chain ecosystem and the Tron ecosystem.

BNB Chain, which has ranked second by TVL for over a year (except for a brief period of being usurped by Terra) has seen some sustainable growth this year, increasing market share from ~7% to upwards of ~8%.

Additionally, BNB Chain has been one of the major ecosystems to have offered incentives to Terra developers to migrate over and bring their talent to work on its projects. For Tron, a chain that has largely been absent from top TVL rankings for a long time, the increase in TVL has largely been driven by their USDD algorithmic stablecoin, again offering attractive yields to attract users.

Average monthly DeFi TVL by Chain

Crypto was not spared from the market downturn that also plagued traditional asset classes such as stocks and bonds. Black swan events such as the suspension of fund withdrawals by several centralized lending platforms and the collapse of the algorithmic stablecoin TerraUSD (UST) in the first half of this year contributed to further negative sentiments and worries.

Cryptomarket booms and busts

That said, market booms and busts are not uncommon and are characteristics of market cycles. The market downturn has helped to weed out excesses and the reset in valuations back to more sustainable levels is arguably a positive development for the long-term viability of the ecosystem.

Nonetheless, price action alone is not representative of the health of the ecosystem, nor does it show the full picture of the underlying developments.

As such, in this report, we aim to share a holistic review of the past half-year in crypto by analyzing the latest data, trends, and outlook across different areas of the crypto ecosystem. We remain optimistic about the long-term outlook for crypto since we continue to see further adoption and innovation in the space.

Regardless, having reviewed the underlying trends and developments across different sectors in the crypto ecosystem, one thing is certain – we are in a BUIDL market.

Excesses are steadily being flushed out of the system, and investors are now more rational in terms of capital allocation. Developers continue to improve their products and smart contracts continue to work as programmed.

Rome was not built in a day. Nothing great comes without time, persistence, and hardwork. Challenges and hurdles are not uncommon. Yet, as numerous communities and the great minds in crypto work together to lay the bricks and build the foundation for a decentralized and permissionless future, we remain more optimistic than ever. We look forward to a future with increased freedom of money.

……………