Following are five D&O mega trends companies should watch for and guard against in 2023, according to Allianz Global Corporate & Specialty (AGCS) financial lines and D&O experts.

Billions of dollars of premiums are collected annually for D&O insurance but the profitability of the sector has suffered in previous years because of increasing competition, the growing number of lawsuits and rising claims frequency and severity. Underwriting results have been negative in many markets around the world, as event-driven litigation, collective redress developments, regulatory investigations and higher defense costs have taken their toll.

What is D&O Insurance?

Directors and Officers insurance (D&O insurance) policies offer liability coverage for company managers to protect them from claims which may arise from decisions and actions taken as part of their duties. Today’s increasingly complex legal environment means businesses face a heightened prospect of liabilities and litigations, often driven by “adverse news events”.

Companies usually purchase D&O insurance because lawsuits are expensive, and the costs associated with them are rising. Moreover, if companies do not have a good D&O insurance program in place it is unlikely that they will be able to attract top managerial talent, given the potential risks involved.

D&O insurance reimburses the defense costs incurred by board members, managers, and employees in defending against claims made by shareholders or third parties for alleged wrongdoing. D&O insurance also covers monetary damages, settlements, and awards resulting from such claims.

If the company cannot indemnify its directors, officers, or employees for amounts resulting from these claims, D&O insurance will step in to directly pay those costs – protecting the individual’s personal assets. If the company indemnifies the individual for such costs, D&O insurance will reimburse the company for such indemnity. The D&O policy will also provide some coverage for the company itself if it is sued.

D&O Insurance Structure

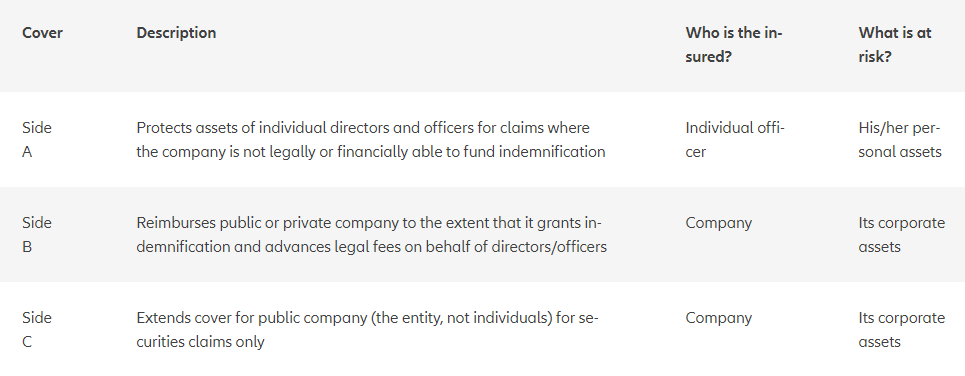

The structure of a D&O insurance policy depends on which of three insuring agreements are purchased (ABC policies are generally chosen, as these are standard form policies for publicly listed companies; for private or non-profit companies, only AB policies would be useful).

5 MEGA TRENDS OF D&O

- Uncertain insolvency outlook continues to concern

- SPACs exposure grows for D&Os

- Market, climate change and digital issues for financial services companies

- Heightened US litigation risk for non-US domiciled companies

- Increased risk of shareholder derivative suits under Caremark

D&O Insurance covers current, future and past directors, as well as non-executive directors, subsidiaries, and officers of a company. The risk scenarios we cover include prospectus liability, pension trust liability and employment practices liability. And in specific cases, such as securities claims, the cover can be extended to cover the company itself.

D&O insurance can also be used to recover defense costs and financial losses, as well as costs incurred by administrative, investigative and criminal proceedings.

1. Uncertain insolvency outlook continues to concern

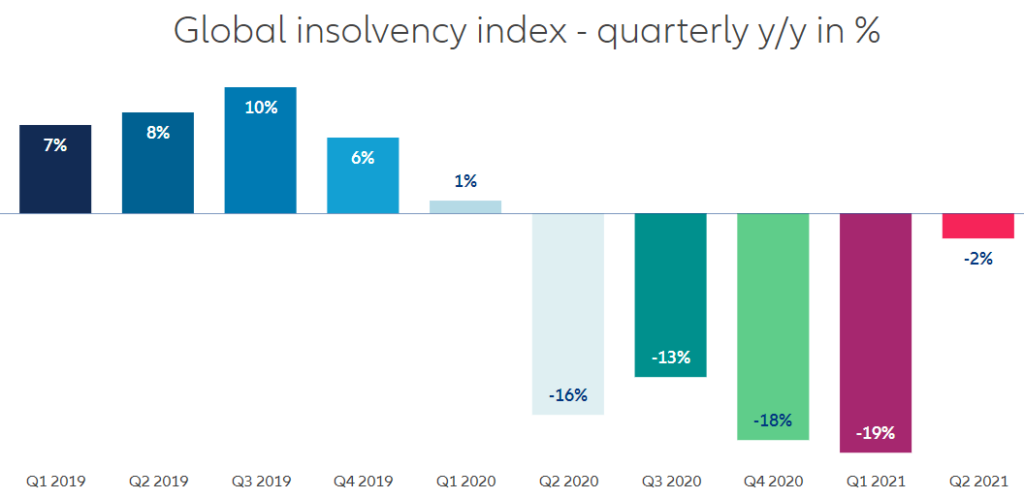

Many different projections were made during 2020 about the impact Covid-19 would have on the global economy, particularly with regards to anticipating an increase in the number of insolvencies. Those predicting a decrease in the number of insolvencies by the end of 2020 were in the minority, but this is, in fact, what happened. The Euler Hermes Global Insolvency Index ended 2020 with a -12% y/y drop, following a steady decline through the year.

The withdrawal of support measures for companies set the stage for a gradual normalization of business insolvencies. The Global Insolvency Index is likely to post a +15%y/y rebound in 2022, after two consecutive years of decline.

From a D&O underwriting standpoint, this recent trend on insolvencies could eventually lead underwriters or insurance buyers to expect a relaxing of terms and conditions next year compared with what the expectations were for 2022 a year ago. However, the reality is that large state interventions took place in many countries to support companies, preventing a liquidity crisis. Therefore the impact of the phasing out of these measures still remains a concern for D&O underwriters.

While the first signs of this relaxation in governmental supporting measures are already underway around the world, significant uncertainty remains around potential new future virus dynamics, vaccination rates, the general macroeconomic environment and the response of central banks, and, equally, what the impact of these factors will be on capital markets.

Historically, insolvency is a major cause of D&O claims as insolvency practitioners look to recoup losses from directors. There are many ways that stakeholders could go after directors following insolvency, such as alleging that boards failed to prepare adequately for a pandemic or for prolonged periods of reduced income.

At the same time recent bankruptcy cases can remain in D&O underwriters’ memories for a long time. Prominent examples in 2021 are US bankruptcy filings, such as drillship owner Seadrill Limited and retail property owner Washington Prime Group, Inc. Meanwhile, the near-collapse of Chinese property giant Evergrande generated headlines.

2. SPACs exposure grows for D&Os

Although Special Purpose Acquisition Companies (SPACs) have been around for decades, 2022 was a breakout year. This surge grew into a high-octane investment in early 2023, accounting for more than 50% of newly publicly-listed US companies. During the first half of 2023, the number of SPAC mergers, both announced and completed, more than doubled the full year total of 2022 with 359 SPAC filings, garnering a combined US$95bn raised.

The number plummeted to 61 filings in the US with only $11.9bn raised. The slowdown is considered mainly a result of pronouncements by the Securities Exchange Commission (SEC) to increase scrutiny on SPACs, for example, by issuing new accounting rules now classifying SPAC warrants as liabilities instead of equities.

It is a different story across the rest of the world. The growth of SPACs in Europe may not match the scale of the US boom, but there is still a growing expectation that it will increase. There are only limited obstacles presented by EU capital market laws, even though SPACs in the EU face some challenges because of strict company law requirements. In the Asian financial hub, the market is slowly gaining momentum with a significant uptick in companies in China, Hong Kong and Singapore as a new route to accessing capital markets.

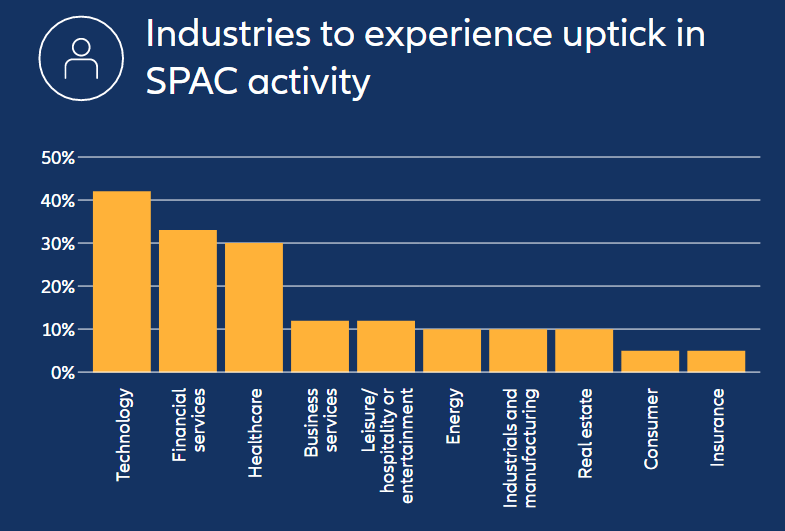

SPACs, also known as ‘blank check companies’, represent a faster track to public markets with a less arduous path for companies looking to go public. Advantages and conditions fueling the growth of SPACs over traditional Initial Public Offerings (IPOs) include smoother procedures, less regulatory and process burdens, shorter timelines to complete a merger with target companies (60 to 90 days versus six to 12 months between the initial filings and the public offering for traditional IPOs), low interest rates and an increased availability of capital sources. So far the SPAC boom has been largely concentrated in high-growth industries such as technology, financial services and healthcare.

3. Market, climate change and digital issues for financial services companies

The financial services industry continues to face multiple challenges in terms of risk management. On the financial side, markets are likely to become more volatile with the increased risk of asset bubbles and inflation rising in different parts of the world.

The general assumption is that monetary policies will harden, while there remains uncertainty regarding economic recovery levels in view of rising energy prices and supply chain disruptions.

The impact of China, with its struggling real estate market and its regulatory interventions in sectors such as technology, should not be underestimated.

At the same time, important international initiatives are underway to develop more sustainable, resilient and circular economies in response to the challenges posed by climate change and global warming.

Recent natural catastrophe events such as wildfires in Southern Europe and California and floods in Germany, the US and China have emphasized the importance for regulators to focus on climate change and the impact on credit risk (including stress tests). More and more banks and insurers are expected to assign individual responsibility for overseeing financial risks arising from climate change, while investors are paying closer attention to the proper disclosure of the risk that it poses for the company or financial instrument they invest in, as demonstrated by a number of recent actions.

4. Heightened US litigation risk for non-US domiciled companies

A surge of new lawsuit filings, the recent openness of certain courts to extending long-arm jurisdiction, and a possibly record-breaking settlement announced, point to heightened US litigation risk for directors and officers of non-US domiciled companies.

In recent years shareholders increasingly have sought to avail themselves of US courts to bring derivative actions on behalf of non-US domiciled corporations.

A group of plaintiffs’ firms has brought around a dozen derivative lawsuits in New York State courts on behalf of shareholders of non-US companies seeking to hold directors and officers legally and financially accountable for various breaches of duty to the corporations they have been engaged to serve.

While not without precedent, such suits were uncommon previously. Even when filed, derivative suits brought on behalf of non-US companies generally met resistance from US courts and were dismissed on jurisdictional and other grounds. However, certain recent court decisions make clear that under the right circumstances, US courts are willing to entertain such lawsuits.

Among the reasons given in the past by US courts to dismiss a derivative suit against a non-US company was the failure of plaintiffs to comply with a requirement in the subject company’s home jurisdiction – that the plaintiffs first apply for, and be granted, leave from a local court before pursuing a derivative claim. Such requirements typically don’t exist in the US. However, in a series of decisions over the past four years, courts in New York have ruled that such requirements are procedural rather than substantive.

5. Increased risk of shareholder derivative suits under Caremark

In 1996, in In re Caremark Int’l, the Delaware Chancery Court in the US set the standards for claims against corporate directors for lack of board oversight. In a derivative action, shareholders of health services company Caremark International Inc., alleged that the company’s directors, in neglecting to effect sufficient internal control systems, had breached their duty of care.

In a derivative action, shareholders of health services company Caremark International Inc., alleged that the company’s directors, in neglecting to effect sufficient internal control systems, had breached their duty of care.

It was because of this, the civil action alleged, that Caremark employees were able to commit criminal offenses that resulted in the company having to make reimbursements to various private and public parties of more than $250mn. The court determined that boards of directors have a duty to ensure that the corporation’s reporting system is adequate to assure that appropriate information comes to the board in a timely manner. Failure to do so can mean that individual directors have liability for corporate failures.

Coverage is usually for current, future, and past directors and officers of a company and its subsidiaries. D&O insurance covers the individual for acts performed or omitted while in that position with the company.

This means that even if the individual is no longer a board member, if a claim is made during the policy period against them for alleged wrongdoing as a board member, they will still be covered under the policy in force while the claim is made. D&O insurance policies do not cover deliberately fraudulent or criminal actions.

Larger clients with subsidiaries in other countries need an international insurance solution to protect management interests globally. Some countries require companies to take out insurance from a locally-admitted insurer. However, other jurisdictions will allow a master policy to be issued in another country that covers local exposures. On international insurance programs, D&O coverage is typically provided through a global master policy that harmonizes the global protection, along with locally admitted policies to address the specific country exposures where necessary.

Larger programs with limits over $30mn are usually too large for one insurer and require a group of insurers to share the risks. In this case, the primary or lead insurer will handle the wordings, advise on setting up an international insurance program (see below) and settle claims.

The primary insurance carrier provides the “primary layer” of D&O coverage, for example, $30mn. Once the primary limit of liability is exhausted by payment of loss, the next layer kicks in, up to a certain amount, and so on. As the first policy to respond to a claim, the primary insurer carries the greatest risk exposure, therefore primary policy premiums are higher and typically reduce higher up the tower.

Another way to risk-share is through proportional coinsurance, also known as quota share. With this arrangement, insurers will essentially split an excess layer, and the premium is proportionally allocated depending on each insurer’s percentage of the risk. Claims would be settled likewise.

………………………..

Edited by Tetiana Mykhailova — CFO Beinsure / Commercial Director Finance Media