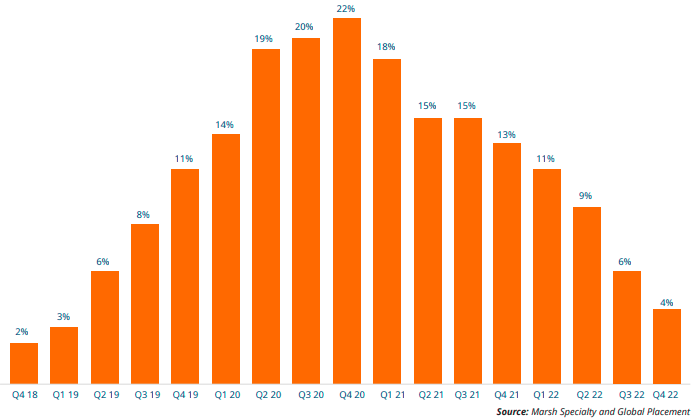

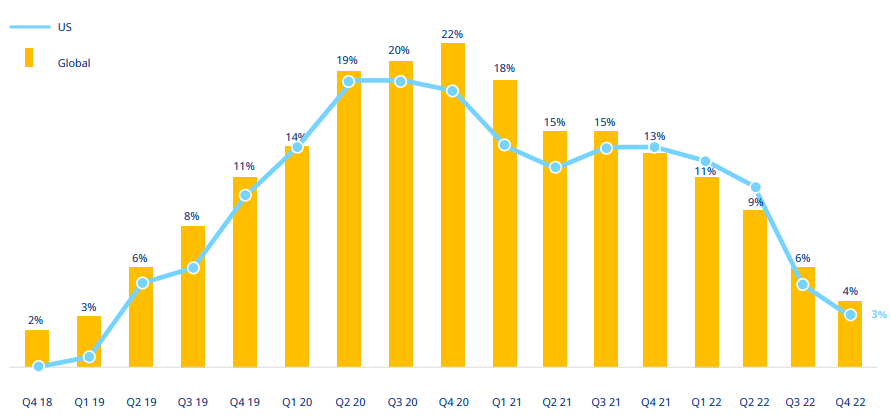

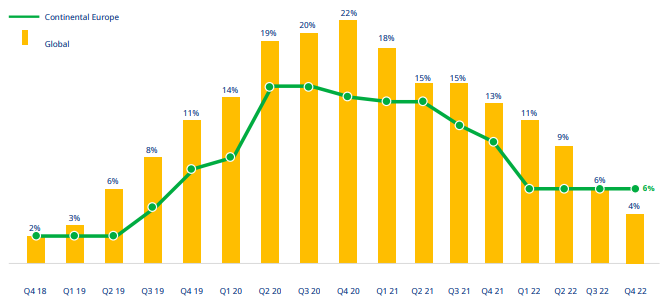

Global commercial insurance pricing rose 4% in the fourth quarter of 2022, compared to 6% in the prior quarter, according to the Marsh Global Insurance Market Index. The overall pace of pricing increases slowed for the eighth consecutive quarter; increases peaked at 22% in the fourth quarter of 2020.

The fourth quarter was the twenty-first consecutive in which composite pricing rose, continuing the longest run of increases since the inception of the index in 2012.

The quarter’s pricing moderation was driven largely by a 6% decrease in financial and professional lines and the continued moderation in cyber pricing.

Global insurance composite pricing change

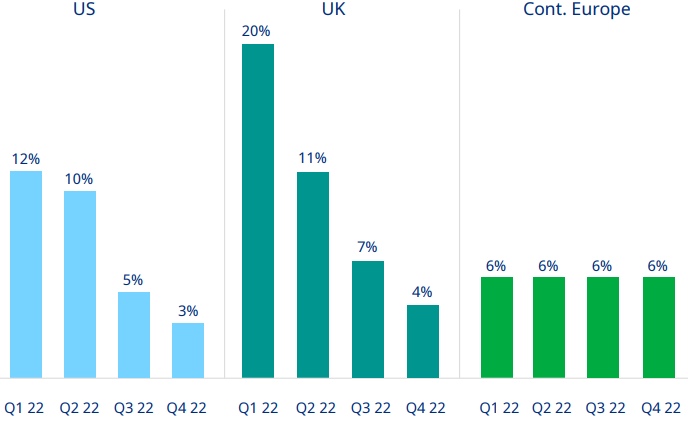

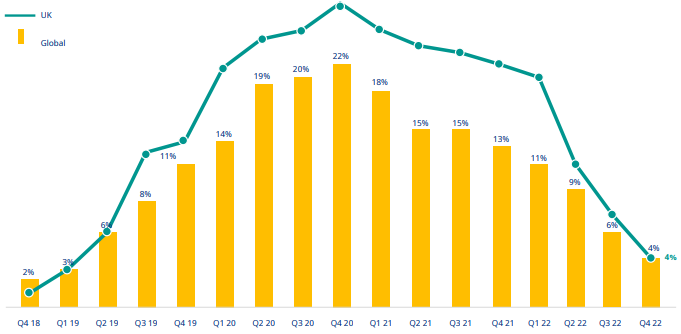

Regionally, composite pricing increases for the fourth quarter were as follows:

- US: 3%

- UK: 4%

- Europe: 6%

- Latin America and the Caribbean: 7%

- Asia: 2%

- Pacific: 5%

Composite insurance pricing change — by region

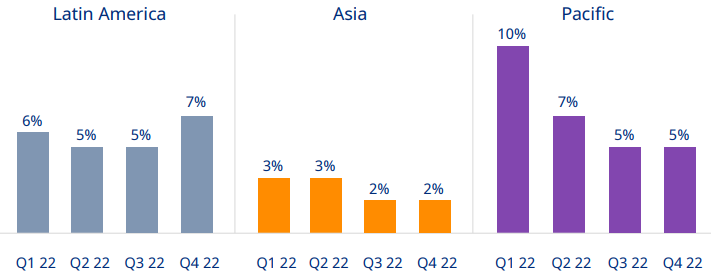

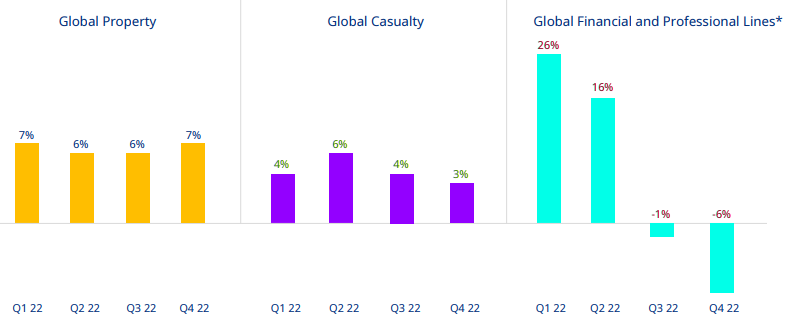

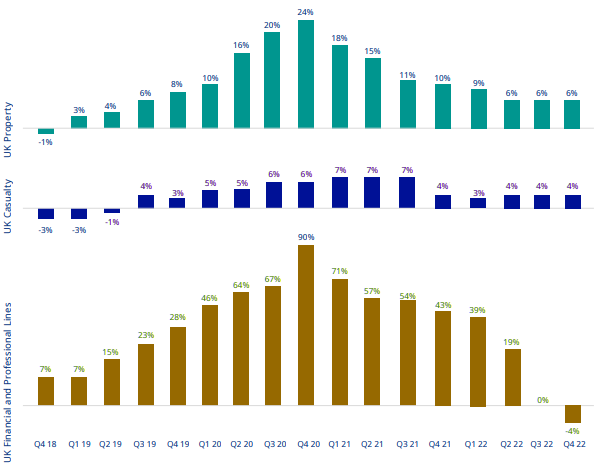

Composite insurance pricing change — by major coverage line

Pricing for the four major insurance product lines were:

- Property: +7%

- Casualty: +3%

- Financial and professional lines: -6%

- Cyber: +28%

US pricing: Financial and professional lines decrease; property and casualty rise

Insurance pricing in the fourth quarter of 2022 in the US increased by 3%, compared to 5% in the prior quarter.

Property insurance pricing increased by 11% in the fourth quarter, up from 8% in the third quarter and the twenty-first consecutive quarter in which pricing rose (see Global Natural Catastrophe & Hazard Review).

Total insured values increased by 10%, on average, in the fourth quarter. The pricing increases experienced by clients were largely driven by challenges in the reinsurance market leading up to the January 1 treaty renewals.

US composite insurance pricing change

The bifurcation in renewal results continued. Best-in-class risks — with limited named windstorm exposure and stable capacity from the incumbent insurer — typically experienced better results. Generally, clients that experienced higher increases were affected by losses and/or were predominantly located in high hazard catastrophe (CAT) zones, such as the Gulf of Mexico and the Atlantic coast.

US composite insurance pricing change — by major coverage line

In light of global inflation trends, underwriters continued to focus on valuation. Insurers maintained discipline regarding terms and conditions including deductibles, non-physical damage, cyber, communicable disease exclusions, and time element extensions.

Casualty insurance pricing increased 1%, compared to 3% in the prior quarter; excluding workers’ compensation, the increase was 3%.

Insurers are carefully monitoring the impact of inflation, court systems reopening, the increased number of vehicles on the roads post-pandemic, and recent hurricanes (see TOP 50 P&C Insurance Companies in U.S.).

Casualty pricing continued to be driven by workers’ compensation, which has helped moderate the average rate increases. Incumbent insurers proactively offered improved terms as a way to keep existing clients from marketing their program. Excess liability pricing rose 6%, compared to 7% in the prior quarter. Insurers continued to monitor the severity of claims given what they perceive as recent large losses with questionable underlying liability.

Financial and professional lines pricing decreased 10% in the fourth quarter, compared to a decline of 6% in the third quarter.

Directors and officers D&O liability insurance pricing for publicly traded companies declined by 14% in the fourth quarter, compared to a decline of 9% in the third quarter. Post-transaction renewals, such as those coming one or two years out from an IPO, led the pricing decreases. Competition was strong from both new insurers and legacy markets as they sought a strong finish to 2022. Retentions decreased for approximately 10% of clients.

Fiduciary markets continued to be challenged by adverse judgments, although pricing was generally flat compared to a 2% increase in the third quarter. Defense costs, settlements, and plaintiffs’ counsel fee awards continued to drive insurer losses on Employee Retirement Income Security Act of 1974 (ERISA) 401k plan excessive fee litigation.

An uptick in other ERISA allegations has insurers expressing concern that the fiduciary line is becoming unpredictable. Some insurers continued to increase minimum retentions for larger plans. Controls/401k plan risk management is key to obtaining coverage.

Cyber insurance pricing increases moderated to 28% in the fourth quarter, compared to 48% in the third quarter as new entrants to the market increased capacity.

In some cases, increased competition and favorable cybersecurity controls resulted in flat renewals or reductions (see TOP 15 U.S. Cyber Insurance Companies & Groups). Claim frequency declined, while severity remained high. Privacy claims increased, including those related to online tracking and other consumer protection issues. Systemic exposures, including those related to war, continued to be a concern.

UK pricing: Financial and professional lines decline, cyber pricing moderates

Insurance pricing in the UK increased 4% in the fourth quarter, compared to 7% in the third quarter.

Property insurance pricing increased 6%, the same as in the prior quarter. Property insurance pricing continued to plateau, making a somewhat less volatile environment for clients.

The market was competitive for low- to medium-hazard industries, but pricing challenges remained for those with major losses or a challenging occupancy or process, such as food production, warehousing, or waste recycling.

UK composite insurance pricing change

Insurers focused on the inflationary environment around claims, including by increasing pricing if exposure bases were not correctly reviewed.

Casualty insurance pricing increased 4%, the same as in the prior two quarters. There was a slight reduction in the pressure to increase pricing in the quarter, influenced by existing long-term agreements (LTAs), remarketing exercises, and restructuring of programs.

UK composite insurance pricing change — by major coverage line

For auto liability, the average cost of a claim increased by 7% to 11% over the past year, primarily due to the cost of parts and service, which is indicative of vehicle materials and technology becoming more sophisticated and requiring specialists.

Electric vehicles continued to impact the auto insurance market, with insurers citing repair costs that are 20% to 75% higher than cars with combustion engines.

Financial and professional lines pricing declined 4% after being flat in the third quarter.

D&O pricing declined, with decreases generally in the 10% to 15% range. D&O pricing was influenced by factors including an increase in market capacity and a lack of premium-generating M&A activity.

Program savings were largely driven by excess layer reductions. Financial institutions (FIs) continued to experience rate reductions between 5% and 10% as insurers sought to increase their business and the market saw new entrants, increasing competition. New capacity in commercial crime coverage entered the market, moderating pricing increases and stabilizing buying conditions.

Cyber insurance pricing increased 34%, compared to 66% in the third quarter (see Cyber Insurance Trends in 2023). As losses continued to improve, the cyber insurance market trend was toward a moderation in pricing increases and somewhat broader coverage. Some industries, such as manufacturing, experienced higher rate increases than others. Competition increased in the cyber market in the second half of 2022, from both new and existing insurers in the UK and internationally.

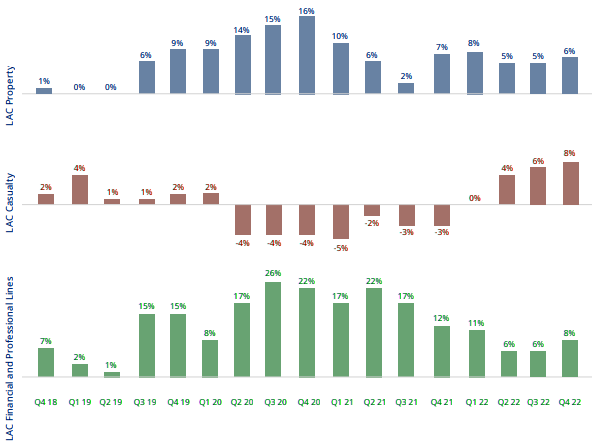

Latin America and Caribbean pricing: Casualty pricing increases for third consecutive quarter

Insurance pricing in the fourth quarter in the Latin America and Caribbean (LAC) region increased 7%, compared to 5% in each of the prior two quarters).

Property insurance pricing increased 6%, compared to 5% in the previous quarter; it was the seventeenth consecutive quarter of increase. Pricing increases up to 10% continued across the region when facultative capacity was required, with the highest rise in CAT-exposed areas.

Latin America composite insurance pricing change

Property CAT is a concern across the region. Insurers exhibited strict underwriting discipline and asked for more and better information.

Casualty insurance pricing increased 8%, compared to 6% in the prior quarter. Pricing increased across the region, particularly in Brazil, Colombia, and Chile. Larger organizations generally experienced higher increases and limited capacity compared to smaller ones.

Insurers were selective in deploying capacity for product liability exposures in the US and Canada, as well as for energy, chemicals, fertilizers, and other high-risk exposures.

Latin America composite insurance pricing change — by major coverage line

Financial and professional lines pricing rose 8%, compared to 6% in the prior quarter, marking the third consecutive quarter of single-digit increases.

D&O and FIs saw new capacity enter the market, as well as an openness by insurers to reviewing exposed risks, competitive rates, and increased appetite. Insurers generally looked to grow their professional indemnity business, and typically were open to reviewing risks and offering competitive terms and conditions. For single project professional indemnity (SPPI), insurers continued to demonstrate a conservative approach.

Cyber insurance pricing increased 33% in the fourth quarter, a lower rate of increase than had been seen for several quarters. Competitive terms and moderating rate increases signaled a greater willingness from insurers to underwrite cyber coverage. Industries that faced significant rate increases included financial institutions, manufacturing, and technology.

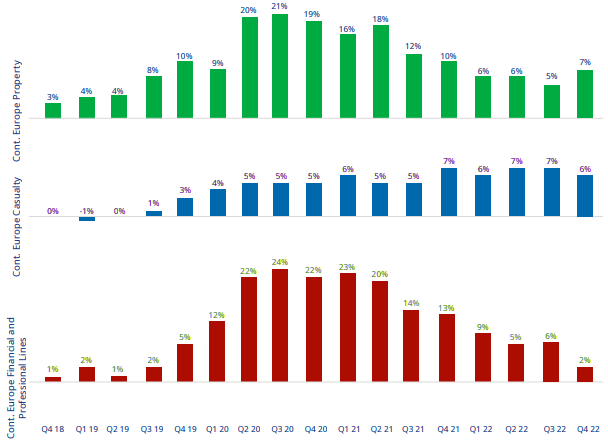

Continental Europe pricing: Cyber insurance pricing moderates

Insurance pricing in the fourth quarter in Continental Europe (CE) increased 6%, the same rate of increase as in the prior three quarters.

Property insurance pricing rates in CE rose 7%, compared to 5% in the prior quarter.

Hurricane Ian and other catastrophe losses created uncertainty around capacity and put upward pressure on CAT pricing. The inflationary environment also drove property pricing increases, especially where asset values were deemed inadequate.

Continental Europe composite insurance pricing change

Terms and conditions and capacity continued to be bifurcated in areas including CAT-exposed and non-CAT-exposed; loss-hit and loss-free; and high hazard and low hazard. Insurers continued to show discipline terms and conditions including deductibles, non-physical damage, cyber, and communicable disease exclusions, as well as territorial exclusions for Russia, Belarus, and Ukraine.

Contingent business interruption (CBI) extensions were under scrutiny as supply chain disruption, higher energy costs, and labor shortages continued to drive claim costs higher.

Casualty insurance pricing increased 6% in the fourth quarter, compared to 7% in the prior quarter, marking the fourteenth consecutive quarter of increase.

The reduction in capacity from key primary markets continued. Markets increased pricing for risks with US exposure, for complex industries, and where current pricing was considered inadequate.

Continental Europe composite insurance pricing change — by major coverage line

Insurers continued to express concerns regarding social and general inflation on US auto liability exposures. Clients with large US auto fleets continued to see significant pricing increases, as well as increases in attachment points for US auto excess coverage.

Financial and professional lines pricing rose 2%, compared to 6% in the prior quarter.

D&O liability pricing was stable, with some reductions due to increased competition from insurers, entrance of additional capacity, and increased appetite to write more business given the slowdown in IPO and special purpose acquisition companies (SPAC) deals.

Underwriters continued to increase focus on environmental, social, and governance (ESG) issues. The FI space was generally stable, with some reductions and low single-digit increases, depending on risk profile and loss history.

Professional indemnity and crime coverage renewal terms began to stabilize. Cyber insurance pricing increases moderated to 13%, as new capacity entered the market.

Factors driving cyber pricing included fewer claims around privacy, a decrease in ransomware claims frequency and severity since the second half of 2021, insurers looking to maintain share and grow their cyber business in 2023, and new capacity entering the market.

Retentions tended to be stable in the quarter. Good risk profiles generated appetite from insurers, leading to increased capacity and the removal of restrictions on ransomware.