Boards of management are vulnerable to a litany of business exposures, any of which could potentially derail the financial health, continued service and reputation of any company. Following are five D&O mega trends companies should watch for and guard against in 2023, according to Allianz Global Corporate & Specialty (AGCS) financial lines and D&O experts.

Macroeconomic scenarios have been adjusted repeatedly over the past months. An important consideration for 2023 is the impact state interventions will have on government budgets and whether credit ratings of government debt will remain stable.

The possibility of sovereign debt ratingdowngrades looms over firms carrying these assets on their balance sheets. This is another area of concern for underwriters in addition to the volatility on the stock markets which we forecast will remain high in 2023 (see D&O Insurance Insights: 5 Mega Trends).

1. Economic and recession risks

At the start of 2022 post-pandemic supply chain bottlenecks, higher energy and transportation costs, and shortages of labor were already contributing to higher inflation.

When the war in Ukraine started in February this further fueled global inflationary and supply chain pressures, causing price shocks for a wide range of commodities, including energy, food and construction materials.

In June 2022, inflation in the euro area hit its highest annual level since the creation of the euro currency in 1999, jumping to a record 8.6% before hitting 10.7% in October 2022. In the US, consumer price inflation reached 9.1% – a 40-year high, while in the UK in May it was also at 9.1%, again a 40-year high, before rising even further to 10.1% in September.

Inflation, the energy crisis and supply chain issues are areas of risk that D&O insurers are monitoring closely. One of the most pressing questions iswhich firms will be able to offset higher wage bills, energy costs and borrowing costs with productivity enhancement.

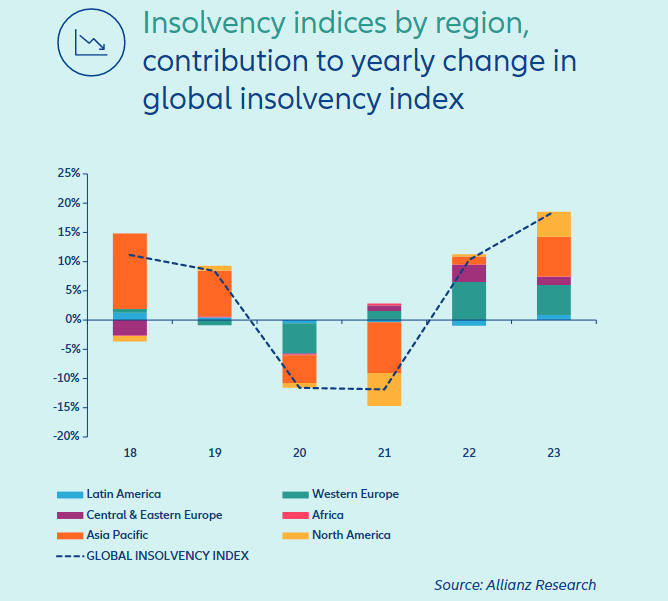

According to Allianz, the sectors most at risk of a liquidity and profitability squeeze are construction, transportation, telecoms, machinery and equipment, retail, household equipment, electronics, automotive, and textiles. Overall, insolvencies are expected to increase by +19% in 2023.

The likelihood that a public company will be sued in a securities class action increases when financial performance is poor and a company’s share price drops. In such a scenario investors might argue that the company failed to disclose the challenges it was facing to maintain its earnings guidance.

In addition to this potential increase

in insolvency-related D&O claims, increasing inflation is likely to influence future D&O claims through larger settlements and higher pre-judgement interest rates.

It could also further drive up defense costs, with higher salaries and hourly rates. Attorney fees continue to rise with somepartners’ fees as high as $1,800 per hour, compared with $1,000 just five years ago.

Growth outlook 2023

Allianz Research expects global growth to slip into negative territory in Q4 of 2022 (-0.1% q/q), followed by a slow recovery at +1.5% in 2023.

Eurozone growth is likely to plunge to -0.8% in 2023 due to soaring energy prices and negative confidence effects creating a shock on real disposable incomes and corporate margins. The US will register a -0.7% fall in GDP, mainly due to rapidly tightening monetary and financial conditions, which will significantly cool the housing market.

2. Cyber security struggles

Whether it is a ransomware, supply chain or data breach incident, companies face an evolving landscape of cyber security threats in today’s booming digital economy, ensuring the days of cyber risk being regarded as just an issue for IT are firmly in the past (see Cybersecurity Automation Adoption).

Today, issues such as data security and information protection are key C-suite concerns, with cyber security resilience increasingly seen as a vital element of any business, given the potential costs and consequences of dealing with a cyber incident together with the expansion of tougher data breach and privacy regulations around the world (see Cyber Security & Insurance Increasing).

Recent years have seen a dramatic increase in the number of incidents, with the aftermath of events such as data breaches being devastating for the companies affected, including fines, costly breach notification procedures, business interruption and intensely negative publicity.

It is little wonder that investors increasingly view cyber security risk management as a critical component of a company board’s risk oversight responsibilities and, being fiduciaries, board members are therefore expected to develop and maintain accountabilities for cyber security before, during, and after any cyber incident.

Any activities they undertake can expect to be examined and if they do not ensure that proper cyber and information security, incident escalation, and reporting measures are in place, they may be seen to have failed to fulfil their duties.

Around the world, directors have already been called to account, including in derivative and direct litigation, due to their alleged failures to institute appropriate corporate governance to protect against cyber security risk.

According to Cybersecurity and the Cyber Insurance Market, major breaches experienced by publicly traded firms have damaged investor confidence, causing rapid share price drops, and, thereby, becoming “events” which can give rise to costly class action securities litigation.

Today, board-level executives are not only expected to know what the top cyber security risks to their company are – both in the present and in the future – they are also expected to understand how theft, loss, corruption, or inaccessibility of data and systems can materially impact their business and be the driving force behind addressing and defending against these threats, rather than just responding to them.

With investors and shareholders ever more interested in taking a closer look at what has been done to limit, as well as reduce, the harm to the organization from the top level, directors and officers must keep on top of cyber security risk exposures and expected trends impacting all relevant stakeholders.

Cyber security is an enterprise-wide risk management issue and boards need to initiate and implement a cyber risk management structure that covers the entire organization from the top down to third-party vendors, ensuring there is sufficient budget and staff resources to establish such a framework (see Cybersecurity Insurance Market Size Forcast).

3. ESG disclosures and exposures

Increasing compliance requirements and the prospect of regulatory or legal action resulting from a range of issues are impacting directors and their insurance policies.

In October 2022, the EU Banking Authority (EBA) published a report on how to incorporate environmental, social, and governance

ESG risks in the supervision of investment firms – recommendations include setting out foundations for integrating ESG risk-related considerations in the supervisory process.

Identification of ESG factors and risks that could affect the risk profile of a company is a key step – it includes the business model, size, internal organization and the nature, scale and complexity of its services and activities, as well as the materiality of its exposure to ESG risks.

While there are current limitations related to data and methodologies in the assessment of ESG risks, the recognition of ESG risks in strategies, governance arrangements and internal processes and incorporating them in assessments of risks to capital and liquidity are now key priorities for institutions today.

The EBA’s communication follows that of the US Securities and Exchange Commission (SEC), which, in May 2022, proposed new disclosure rules for funds and advisers around ESG information.

The proposed amendments seek to categorize certain types of ESG strategies broadly and require funds and advisers to provide more specific disclosures in fund prospectuses, annual reports, and adviser brochures based on the ESG strategies they pursue.

Funds focused on the consideration of environmental factors generally will be required to disclose the greenhouse gas emissions associated with their portfolio investments. Funds claiming to achieve a specific ESG impact will be required to describe this impact and summarize their progress towards it. Funds that use proxy voting or other engagement with issuers as a significant means of implementing their ESG strategy will be required to disclose information regarding their voting of proxies on particular ESG-related voting matters and information concerning their ESG engagement meetings.

Implications and areas of concern for D&Os

Regulatory action due to ESG-related issues is a major concern for directors – a breach in regulations can trigger a D&O policy, subject to its terms and conditions. Although criminalfines and penalties are not covered, a policy can cover defense costs until such conduct has been established. Government oversight can pressure boards to ensure businesses are complying with legislation.

Companies and their D&Os also face the prospect of increasing litigation from environmental groups, activist investors and even disgruntled employees.

For example, companies which do not comply with international agreements such as the Paris Agreement – a legally-binding international treaty on climate change – may fall foul of activist and investor action (see box). Failure of directors to assess and mitigate the impact of climate change in their business can lead to claims that they have breached their duty of care to the company.

In a similar vein – listed companies misrepresenting ESG credentials or failing to take actions in accordance with climate goals – so-called greenwashing – can also become vulnerable to shareholder suits, potentially resulting in long-term reputational damage for the company, in addition to the cost of regulatory action and litigation.

Finally, a rise in social, diversity and inclusion issues is also being observed.

Employees who feel they have been discriminated against or constructively dismissed, particularly during the Covid-19 pandemic, may pursue directors, as well as the company, for damages (see Employment in Insurance Industry Statistics).

Similarly, D&Os who are perceived to have not taken enough action to stamp out discrimination, or are regarded as enabling such a culture to develop, may also find themselves exposed to litigation.

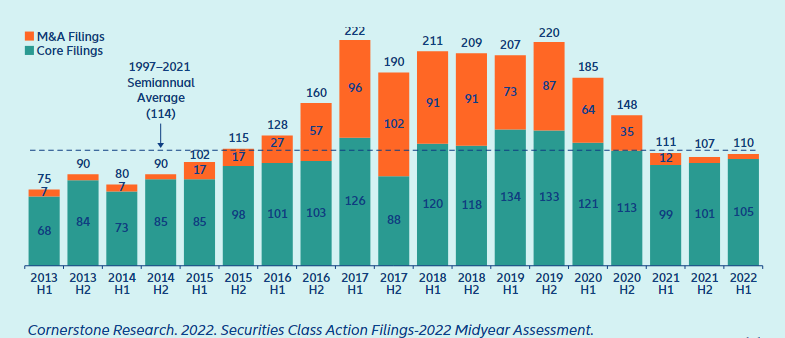

4. US class action securities litigation

The number of new filings during the first months of 2022 suggested that this would be a banner year for securities class actions against so-called Special Purpose Acquisition Companies (SPACS). These have enjoyed a surge in popularity in recent years as they represent a faster track to public markets but, at the same time, have also come under increasing regulatory scrutiny. However, new filings significantly dropped by mid-year, with only two filings in Q3 and one in October at the time of writing.

As of the beginning of November, there have been 23 SPAC-related class action filings in 2022, compared with 32 for all of 2021.

The reasons for this shift remain unclear. “Given the number of recently-completed SPAC mergers with private companies and the number of SPACS still in search of target companies for acquisition, we may yet see a large number of related class actions ahead.

Atthe same time, rules recently proposed by the US Securities Exchange Commission around SPAC Initial Public Offering (IPO) disclosures and disclosures in connection with de-SPAC transactions may significantly reduce the future attractiveness of SPACs as a going public model in comparison to traditional IPOs.

Meanwhile, the pace of new US securities class action filings overall slowed during H2 2022 after projections had suggested 2022 might break the run of year-on-year declining rates of new filings begun in 2019. With two months remaining in the year, it appeared that 2022 would continue the downward trend in new filings.

Class Action Filings Index (CAF Index) Semiannual Number of Class Action Filings 2013 H1–2022 H1

Large cases dominate losses and merger objection suits persist

While the frequency of new filings may be in decline, the aggregate quantum of damages potentially at issue has skyrocketed. That is not to say that there has been a rise in alleged investor loss valuation for all cases across the board.

This year, very large cases have represented a disproportionately higher share of aggregate alleged shareholder losses than the historical averages over the past 20 years.

By at least one measure, lawsuits filed against only three communications industry companies account for as much alleged investor loss as the aggregate of all securities class action lawsuits filed in 2021.

Corporate directors and their insurers will find little comfort seeing that new filings of merger-objection class action litigation have continued the dramatic decline begun three years ago.

Merger-objection suits persist, now commonly brought as single investor state court actions to avoid scrutiny of federal court judges who have become increasingly resistant to approving terms of settlement, including plaintiffs’ attorneys’ fees or mootness fees, where plaintiffs themselves have received little if any benefit.

Plaintiffs’ attorneys filed only one merger-objection suit as a putative class action in federal court this year through June, but new filings on behalf of discrete litigants during the same period raised objections to nearly 90 transactions.

Watch cryptocurrency and Covid-19 activity

Other trends of note include the increased targeting of cryptocurrency companies (10 suits filed in the first half of 2022 as compared to 11 for all of 2021, 13 in 2020 and four in 2019).

This may not be surprising given the recent roiling fluctuations in the valuation of digital currencies, which continued in November 2022 with the sudden collapse of the world’s second largest cryptocurrency exchange, FTX – authorities around the world are investigating for potential breaches of securities laws – and the fact that regulatory oversight has increased (see about Blockchain Technologies for Cryptocurrencies and NFTs).

From 2016 to 2019, only 8% of cryptocurrency-related cases included allegations concerning cryptocurrency exchanges. Since then 44% of such cases have had these allegations.

In addition, Covid-19 continues to be an incubator for new securities class actions on pace with 2021 (eight suits through H1 2022, compared with 17 new suits in all of 2021).

5. Antitrust and competition risks

On July 9, 2021, US President Joe Biden signed an executive order titled “Promoting Competition in the American Economy”. This order established the policy of more aggressively enforcing existing antitrust laws to combat excessive concentration in industry.

In his speech that day, the President singled out the pharma, tech and agriculture industries. He noted that 40 years ago, the government had pulled back on enforcing antitrust laws, and concluded that this “experiment” had resulted in less growth, weakened investments and fewer small businesses.

Shortly afterwards, experienced antitrust lawyer, Jonathan Kanter, was appointed as Assistant Attorney General for the Antitrust Division at the Department of Justice (DOJ).

Since that announcement, the Food and Drug Administration (FDA) has approved the sale of over-the-counter hearing aids, while the Federal Trade Commission (FTC) has pushed companies to make it easier to fix their own products. In line with this new policy, the DOJ recently won a civil antitrust lawsuit, seeking to stop publisher Penguin Random House’s proposed $2.2bn acquisition of rival Simon & Schuster.

D&O policies may be triggered to defend claims against the individual directors and officers. While most policies have criminal conduct exclusions, those exclusions do not typically go into effect in the absence of a final adjudication, and of course will not apply to civil claims arising out of antitrust enforcement actions.

Market dynamics the state of the D&O insurance sector

Billions of dollars of premiums are collected annually for D&O insurance, but the profitability of the sector has suffered in recent years, which has led to hard market conditions driven by higher premiums, tighter terms and selective deployment of capacity for both primary and excess layers.

Global insurance pricing for D&O recorded double-digit increases in all key markets in 2021, according to third party data, but has begun to stabilize in 2022 with rate softening and declining premiums during a year of continued market improvement.

The reduced number of filed securities class actions, coupled with an influx of new market entrants in this space, has created a favorable market environment for public and private D&O buyers. Buyers are seeing more competitive conditions fueled by significant capacity in excess layers and a slowdown in IPO and M&A activity creating a lack of new business opportunities.

Market risk factors

However, there is still a lot of risk facing insurers as macroeconomic issues and a potential economic slowdown loom, conditions which typically lead to an uptick in D&O claims. In addition, several other trends continue to affect the market outlook, such as social inflation, global supply chain disruptions, rising interest rates, “event-driven” securities class action litigation, as well as C-suite accountability for environmental, social, and governance (ESG) and cyber exposures. Increasing inflation is also likely to influence future D&O claims through larger settlements.

Softening conditions are prompting more discussions around these trends as the insurance market looks to anticipate the impact of any potential increase in loss activity.

More than ever, carriers will look to differentiate themselves from the competition by adding value through consistent messaging and appetite, superior products, market visibility with key trading partners and best-in-class underwriting talent.

……………………

AUTHORS: Daniel Aschoff – Central and Eastern Europe, Sabrina Glavan – North America, Hugo Kidston and Heidi Polke‑Markmann – Global, Ailsa Sayers – UK and Nordics at Allianz Global Corporate & Specialty