Total UK Motor Insurance premiums written in the United Kingdom approx £16 bn. While over a 1000 companies sell car insurance in the UK, the 10 largest auto insurers make up around 70.5% of the UK car insurance market or £11.3 bn of insurance premiums.

The cost of UK motor insurance has soared to an all-time high heaping extra pressure on households already confronting a cost of living crisis.

The UK motor insurance market achieved an underwriting profit, largely due to post-pandemic factors, including low levels of commuting resulting in fewer claims.

Motor insurers last year recorded a Net Combined Ratio (NCR) of 96.6%, according to UK Motor Insurance Results, which followed a NCR of 90.3% – the industry’s best ever result.

Admiral Group, which includes Admiral, Bell, Diamond, elephant.co.uk, Veygo, and Gladiator, had the highest market share at 14%. This was followed by Direct Line Group at 10.8% market share. After Germany and France, the UK is the third biggest motor insurance market in Europe.

These companies also control 85% of the market. But despite the auto insurance market being dominated by only a handful of leading industry players, the products, services, and benefits these firms provide vary significantly.

TOP 10 UK Car Insurers 2023

| № | Car Insurers | Gross Premiums Written, £ mn | Market Share, % |

|---|---|---|---|

| 1 | Admiral Group | 2,237 | 14.0% |

| 2 | Direct Line Group | 1,730 | 10.8% |

| 3 | Aviva | 1,677 | 10.5% |

| 4 | Hastings | 1,112 | 7.0% |

| 5 | AXA | 969 | 6.1% |

| 6 | LV= | 932 | 5.8% |

| 7 | esure | 679 | 4.2% |

| 8 | RSA | 661 | 4.1% |

| 9 | Ageas | 654 | 4.1% |

| 10 | NFU Mutual | 626 | 3.9% |

To identify the leading car insurance providers in the UK, NimbleFins compiled data on each company’s GWP by sifting through SFRC regulatory reports, press releases, annual financial statements, and risk management reports. The website also gathered financial strength ratings from Fitch, Moody’s, and Standard & Poor’s (S&P) and looked at complaints data from the Financial Conduct Authority (FCA) and Financial Ombudsman Service (FOS).

The rising cost of UK motor insurance has added to the cost-of-living pressure experienced by Britons. With average premiums now costing £877, price rises in car insurance have outstripped inflation for the wider economy at 10.7%. The surge has been expected following the ban on price walking.

Best car insurance for cheaper rates

The average motor insurance premium rose by nearly 8% during the 2023, to hit £786, according to recent analysis by research firm Consumer Intelligence. This makes it even more important to shop around. The cheapest policy for one driver might not be cheapest for another, because insurers price risk in different ways (risk is calculated using your driving history and personal details). But some providers tend to offer good rates.

UK’s favourite car brands

| № | Car brand in UK | % of registered vehicles in the UK |

| 1 | Volkswagen | 8.92 |

| 2 | Audi | 7.10 |

| 3 | BMW | 7.03 |

| 4 | Ford | 6.98 |

| 5 | Toyota | 6.47 |

| 6 | Mercedes | 5.96 |

| 7 | Vauxhall | 5.51 |

| 8 | Kia | 5.40 |

| 9 | Nissan | 4.30 |

| 10 | Hyundai | 4.11 |

| 11 | Peugeot | 3.60 |

| 12 | Škoda | 3.31 |

| 13 | Land Rover | 3.25 |

| 14 | Volvo | 2.94 |

| 15 | Mini | 2.76 |

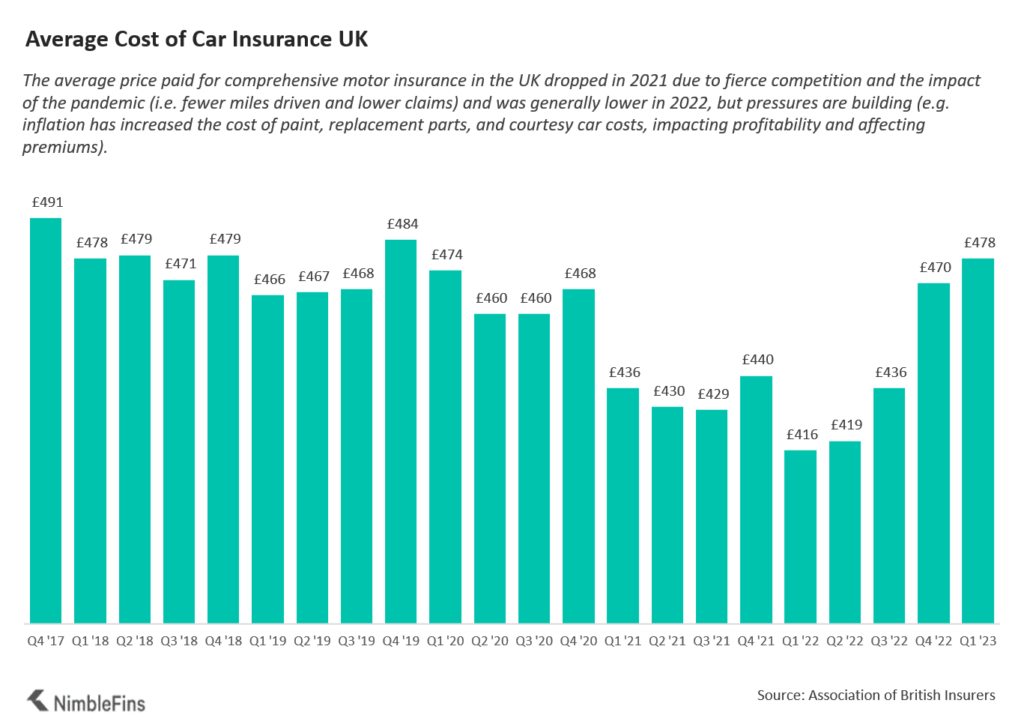

Average Cost of UK Motor Insurance

Consumers were facing price hikes from every direction, including essential services. Rising costs have eviscerated profits for UK car insurers (see UK Motor Insurance Results).

The average cost of UK comprehensive car insurance was £478 between January and March 2023—up 16% from £412 a year earlier (Q1 2022).

Interestingly, average costs vary depending on whether you’re renewing or buying a new policy. The average price paid for a renewal was £436 while the average premium for a new policy was £545.

Inflationary pressures are to blame for the rise, with paint and materials rising 16%. And courtesy car costs are up 30%.

Average Car Insurance Cost UK, 2020-2023

| Q1 2020 | £474 |

| Q2 2020 | £460 |

| Q3 2020 | £460 |

| Q4 2020 | £468 |

| Q1 2021 | £436 |

| Q2 2021 | £430 |

| Q3 2021 | £429 |

| Q4 2021 | £440 |

| Q1 2022 | £416 |

| Q2 2022 | £419 |

| Q3 2022 | £436 |

| Q4 2022 | £470 |

| Q1 2023 | £478 |

Source: NimbleFins

The charity has estimated that one million people cancelled their car insurance last year as bills piled up, with those on universal credit especially likely to do so.

……………………………

Fact checked by Oleg Parashchak – CEO Finance Media & Editor-in-Chief at Beinsure Media