Importantly, we are witnessing a fundamental departure from the last decade’s policies: the strike price of the “central bank put” is very low and it is far from clear that interest rate policies will ease at the start of the next recession, says the report “Goodbye to all that: central banks” Swiss Re.

- Significant central bank tightening is under way. We expect another 200bps of tightening by the Fed this year to tackle high inflation and catch up to more adequate policy levels.

- Even with aggressive tightening globally, most central banks remain well behind the curve on tackling inflation.

- Central banks now favour the reverse of last decade: higher policy rates, stronger currencies and hence need to accept higher capital market volatility.

- As a result, the strike price of the “central bank put” is much lower and it is not clear that central banks would ease policy early in a recession if inflation were significantly above target.

A seismic shift in global policymaking is happening at last: one of the most significant monetary tightening cycles in decades is unambiguously under way. Advanced economy central banks are finally closing the door on the ultra-low interest rate policies in place since the global financial crisis as they face down high inflation.

The US Fed, the Swiss National Bank and the Bank of England have all recently tightened policies and the European Central Bank intends to follow suit shortly. Our updated central bank policy forecasts reflect the urgency of interest rate hikes as inflation soars. We believe central banks will press ahead with policy tightening even as growth slows, until there is a significant decline in inflation momentum.

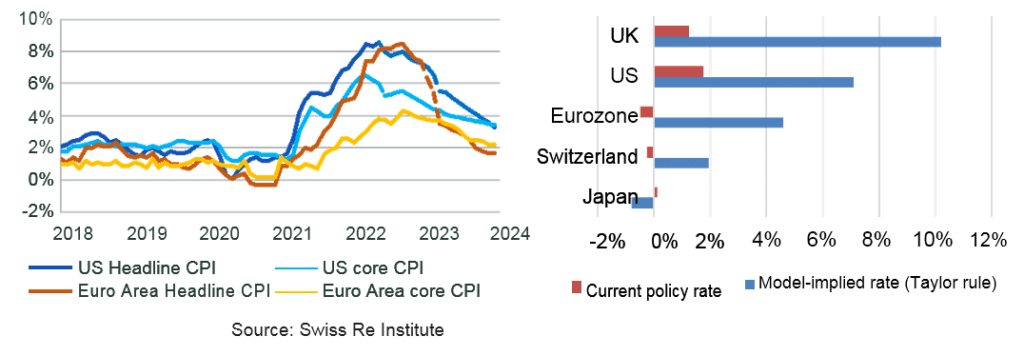

An aggressive new cycle of central bank tightening is needed. We expect inflation rates, especially in the euro area and in the US, to stay elevated for longer (see Figure 1), suggesting inflation persistence that requires a forceful monetary response. While central banks are normalising policy quickly, they remain well behind the curve. Approximations of an adequate interest rate policy, proxied by our estimates of the Taylor rule, suggest that almost all major advanced economy central banks are at least 2ppts below interest rate levels that would be warranted given the current economic environment. In the case of the Fed, the current environment would imply policy interest rates of around 7%, compared with 1.75% at present.

Importantly, one needs to appreciate that conditions today are the reverse of the last decade: central banks need to contain inflation rather than push it upward. This has fundamental and wide-ranging implications.

A hallmark of post-global financial crisis monetary policy was a de facto competitive devaluation in currencies and an associated race to the bottom in yields through zero and negative interest rate policies as well as quantitative easing programmes. Now the opposite may be playing out. So far most central banks appear unwilling to accept currency weakness, which adds to inflationary pressure.3 Since foreign exchange rates are also driven by interest rate differentials across economies, this implies a lower bar for central banks to enforce a tighter monetary stance. Central banks may also need to accept higher financial market volatility as a result of higher interest rates and less capital market intervention.

Estimated adequate policy rate across economies vs current policy rate

For capital markets, the implication of higher and more persistent inflation is that the central bank backstop for financial market volatility and price declines – often referred to as the central bank “put” option – is far away, unless systemic risks arise. By extension, this can also mean that even if economies enter recession – which is our basecase for the euro area and the US in the next 18 months – central banks could be hesitant to cut interest rate and deploy quantitative easing programmes if inflation remains significantly above central bank targets. Potentially, this could mean deeper or longer-lasting recessions.

……………………..