The past few years have seen a fundamental shift in focus within Private Equity (PE) when it comes to ESG strategy and implementation, says the PWC report.

Multiple crises over the past 18 months have delivered a stark wake-up call to the world. If we’re going to prevent further pandemics, reduce the risks of climate change, build a more equitable society and still generate growth, it’s clear that we’ll have to create more sustainable economies and systems.

Global Private Equity Investment

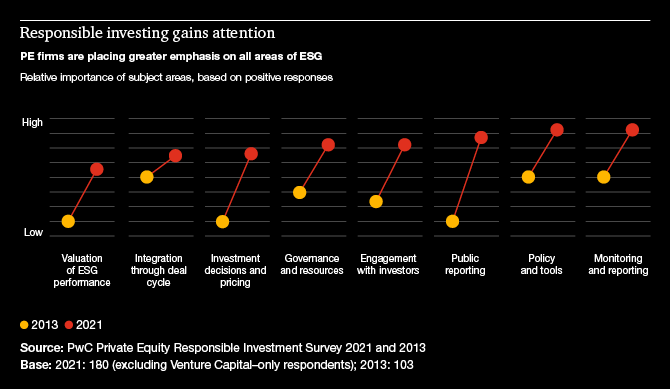

Over the past seven years, PE firms have radically reassessed the importance and value of ESG to their business. It has gone from being considered a tangential area of compliance, or a specialist product for a small minority of investors, to becoming an overarching framework that is informing the strategic thinking of the entire firm.

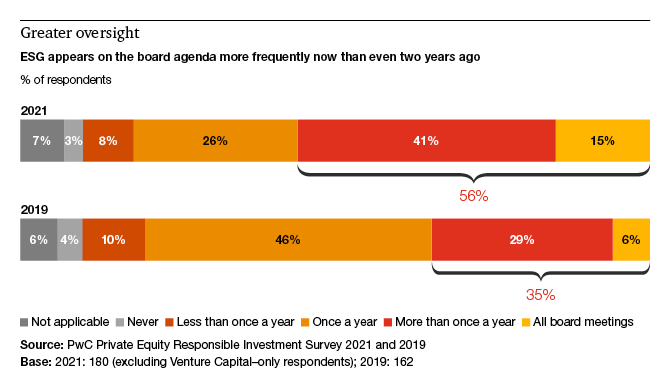

56% of respondents discuss ESG as part of executive board agenda more than once a year

Businesses all over the world are adapting, moving environmental, social and governance (ESG) issues from the periphery of strategic concern to the centre. They’re acknowledging ESG as a driver of value creation and urgently developing a proactive ESG mindset.

ESG as a driver of value creation

PwC’s latest Global Private Equity Responsible Investment Survey demonstrates that private equity (PE) is on this same journey and is well-placed to provide leadership, thanks to decades of experience prioritising a strategic, long-term, activist approach to value creation.

66% rank value creation as one of their top three drivers of responsible investing or ESG activity

The stakes are high. Sustainable investing—a category that includes ESG investing, in which ESG considerations are an overlay to the pursuit of financial performance, and socially responsible investing (RI), in which investments are selected or disqualified based on ethical considerations—already had grown to more than US$30tn globally by 2018 and has continued to grow.

ESG-focused assets under management

Just in the US, ESG-focused assets under management grew by some US$5tn from 2018 to 2020, and the global impact investing market—a segment of the sustainable investing market that focuses on positive outcomes, regardless of returns—is now estimated to be worth about US$715bn.

72% always screen target companies for ESG risks and opportunities at the pre-acquisition stage

PE firms putting ESG at the heart of their business strategy will be the game changers in the new sustainable economy. And just as there will be leaders, there will also be laggards. Those firms that fail to embrace ESG will risk value erosion.

56% have refused to enter general partner agreements or turned down investments on ESG grounds

ESG in Financial services sector

In the broader financial services sector, there has been a marked improvement in the performance of ESG-focused funds, as investors have changed their own ethical standards and become more demanding, and have also considered the financial impact of factors such as consumers’ shift to more sustainable products, potential new ESG regulations, and the reputational influence (negative or positive) of diversity and inclusion policies. One recent report by financial services firm Morningstar found that most ESG funds outperform the wider market over ten years.

ESG is commanding more attention at the board level. In our survey, 56% of firms said ESG features in board meetings more than once a year, and 15% said it was discussed at all board meetings. That represents a substantial increase from 2019, when 35% of respondents said ESG featured in board meetings more than once a year, and only 6% said it was on the agenda at every meeting.

ESG grows influence on business strategy

This figure will surely continue to increase as more firms align their investment strategies to the push to decarbonise global economies, make their businesses and supply chains resilient to disruption from climate change or future pandemics, develop more inclusive workforces, and recognise that sustainability (and purpose) is important to attracting and retaining talent. The growing movement to link executive pay to ESG performance also will help focus the attention of the board.

ESG is having a growing influence on business strategy throughout the transaction life cycle and across portfolios. Firms are using ESG criteria not just to assess risks and identify value creation opportunities, but also to manage their portfolio and ultimately deliver a better investment at exit.

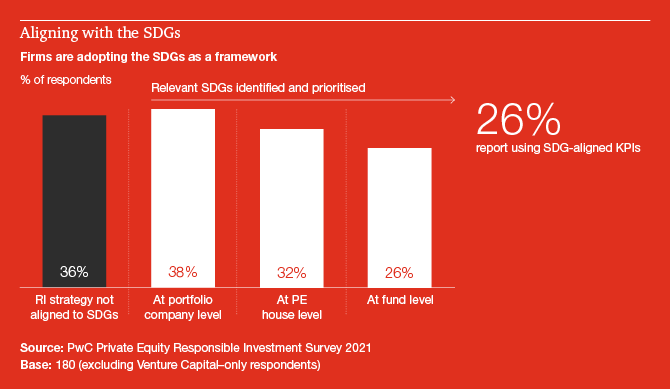

One good example is the adoption of or alignment with the SDGs as a framework. Investors and companies are finding the SDGs increasingly useful because they offer a universal approach to realising positive societal outcomes and provide a level of rigour by identifying 17 overarching goals and 169 targets. They also offer an outcomes-based framework at a time when firms and companies are trying to come to terms with many competing ESG evaluation initiatives.

17% of our respondents note that they either already have dedicated impact funds or are planning on setting up an impact fund in the next year, and an additional 14% say they are considering investing for impact in the future. Of our respondents, 45% note that although they don’t have an impact fund, they’re either already measuring and managing for impact, or are using a screening framework to seek out investment opportunities associated with positive impacts, or both.

Overall, the idea of investing for impact is becoming a mainstream strategy within PE, and this being the case, PE appears to be getting ‘impact ready’ and trying to prove to investors that they can invest for impact without sacrificing returns.

Over the past 18 months, the business world and most global governments came alive to the existential risks posed by climate change. Increasingly, the financial services sector is taking action, and that is reflected in PE firms’ concerns about climate risk.

Significant gaps remain between concerns about individual ESG issues and the actions being taken to address them. In cases where ESG issues have long been a governance concern or are mandated by regulation—such as occupational health and safety, or preventing bribery and corruption—the gap is small.

……………………..