Aave Labs is rolling out a new savings app built to stand shoulder to shoulder with banks and high yield fintech platforms. The pitch leans heavy: up to 9% returns and “insurance backed protection” on balances up to $1 mn.

For a DeFi protocol that grew up offering high rates in exchange for higher risk, this framing feels like a pivot toward mainstream finance rather than another crypto moonshot.

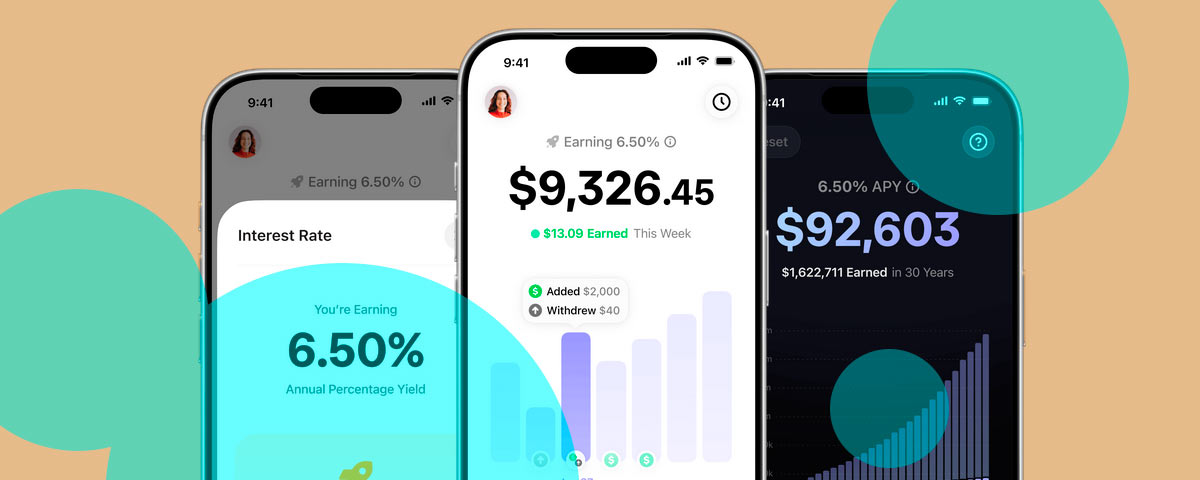

Users will be able to move money in from bank accounts or debit cards, with daily limits on those rails, plus unlimited stablecoin transfers. The site says more than 12,000 banks and cards will connect at launch.

Aave positions its new branding as a direct shot at the traditional system, offering higher returns without asking users to swallow extra risk. Whether that promise holds under stress is the real question.

Vitalik Buterin has recently argued for safer, lower yield DeFi options, which makes Aave’s timing look deliberate.

The protocol has dealt with security scares in the past, but among DeFi lenders it’s widely seen as one of the gold standard players. The app tries to turn that reputation into something mass market.

Interest accrues nonstop through the underlying Aave lending protocol. The base rate starts at 5% annually, but users can increase it with “rate boosts” by inviting friends, setting automated deposits, or completing KYC checks.

Aave’s money markets stay over secured — borrowers must post collateral greater than what they borrow, meaning deposits sit behind more than 100% collateral value.

Aave Labs earns its margin from the spread between what it pays savers and what it earns from the protocol.

The app hits the Apple App Store first, with Android on the way.

According to our analysts, Aave is trying to turn DeFi yield into something the average user can access without touching web3 complexity. Whether the broader market buys that narrative will depend on trust – and in this space, trust gets built one uneventful day at a time.