Investors lined up for Axon Therapies’ oversubscribed $32mn Series A. Earlybird Venture Capital and Santé Ventures co-led, with Deerfield Management returning and CD Capital plus KOFA Healthcare joining.

The company simultaneously appointed co-founder Zoar Engelman, PhD, as CEO, tasking him with pushing an implant-free, catheter-based therapy toward pivotal development.

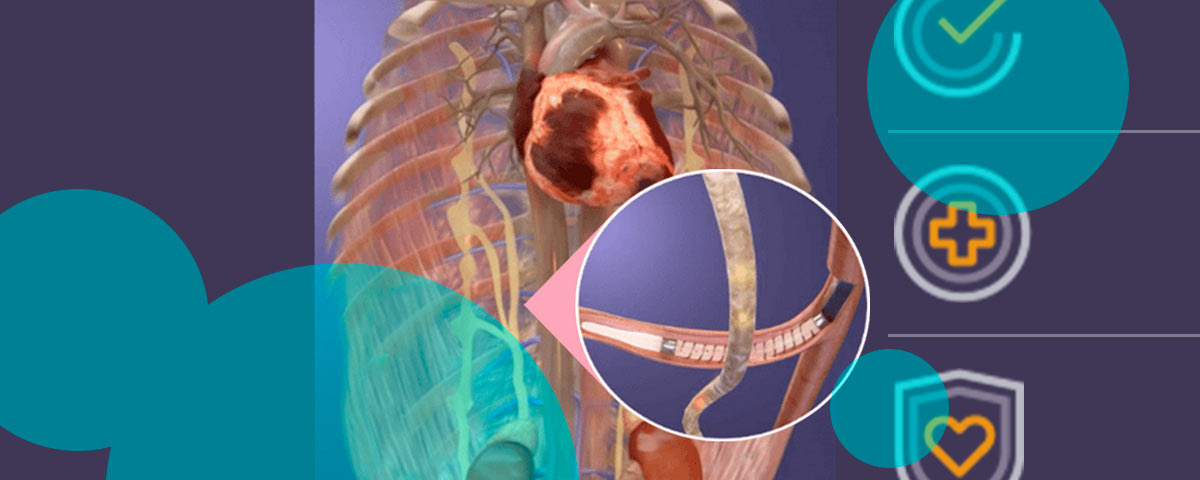

The pitch is clear. Splanchnic Ablation for Volume Management, branded as the Satera system, taps a catheter to target overactive sympathetic tone in the splanchnic circulation.

By altering blood distribution, the procedure aims to reduce fluid congestion and pressure loads that worsen symptoms and drive hospital visits. No pacemaker. No defibrillator. No ventricular assist device. Just a catheter procedure investors think could scale.

Heart failure remains one of the priciest chronic diseases worldwide, with repeated hospitalizations eroding budgets. HFpEF patients live with congestion and very few effective disease-modifying therapies, aside from diuretics and newer SGLT2 inhibitors.

Heart failure is one of the leading causes of hospitalization and death worldwide, yet patients still face a lack of effective treatment options

Dr. Engelman, CEO of Axon Therapies

“Our implant-free, minimally invasive therapy is designed to address a core physiological driver of the disease. This funding positions us to advance to pivotal trials and bring hope to patients who urgently need new solutions,” said Dr. Engelman.

HFrEF patients fare better with guideline-directed drugs and devices, but disease progression and quality-of-life deterioration persist. Both groups experience acute decompensations that swamp providers.

Axon says its implant-free approach goes upstream, modulating physiology rather than adding hardware. Early feasibility results suggested positive hemodynamic shifts and symptom relief.

Now, two double-blinded randomized studies—HFpEF and HFrEF—will test whether those signals stand up. Success there means moving to pivotal trials, with endpoints like pressure metrics, six-minute walk distance, patient-reported outcomes, and hospitalization rates.

Oversubscription is more than a vanity metric. It shows limited-partner appetite for cardiovascular innovation holds strong, especially when a therapy comes with a mechanistic rationale and scalable workflow.

Some analysts quietly put the potential addressable market in multi-bn terms if SAVM proves safe, durable, and effective across both heart failure populations.

Strategically, the company also set up Axon Vascular Europe in the United Kingdom. That decision isn’t just window dressing.

A UK headquarters speeds multi-center enrollment, links the company with world-class cardiology hubs, and positions Axon for early conversations with regulators and health technology assessors.

The European system, under pressure to cut readmissions and costs, is hunting for non-implant interventions. Investors read this as a signal of dual-continent intent and commercial optionality.

Execution now matters. Feasibility data will shape pivotal design and investor appetite for a Series B or potential tie-up with a larger cardiovascular player.

Regulatory agencies will scrutinize chosen endpoints. Payors will demand proof of sustained benefit against optimized drug therapy. Providers will calculate case times, workflow integration, and cath-lab logistics. Patients want something simpler: symptom relief that lasts.

Engelman stepping in as CEO is logical. Scientist-founders often carry the clinical hypothesis forward with continuity and credibility, which reassures both trial investigators and investors.

With $32mn in hand and momentum on both sides of the Atlantic, Axon has runway to deliver disciplined randomized studies.

The company isn’t publicly traded, so market watchers won’t see share price swings. Even so, private sentiment looks constructive. Specialist funds and growth investors tend to put money into device startups only after deep diligence on biology, trial design, and market size.

Observers view this round as evidence that capital still flows to heart failure innovations with platform potential—if the data justify it.

“The opening of our new European headquarters in the UK provides a focused hub to accelerate our clinical trial efforts and strategically positions us for future entry into the large European heart failure market,” noted Dr. Engelman.

“Our investment in Axon Therapies was driven by a clear vision to address a large unmet clinical need and improve the lives of patients with heart failure,” said Dr. John Yianni, Partner at Earlybird Venture Capital. “With Dr. Engelman’s leadership and the team’s groundbreaking technology, we are excited to support Axon as they advance solutions that can make a real difference for patients and their families.”

Axon’s technology represents a first-in-class solution poised to capture a multi-billion-dollar market, making it a highly attractive asset for any major cardiovascular player.

Dr. James Eadie, Managing Director and Partner at Santé Ventures

“These randomized feasibility studies are designed to significantly de-risk the therapy and establish a strong foundation ahead of a pivotal trial, creating what we believe will be a cornerstone technology for the right strategic partner,” added Dr. James Eadie.

If Axon delivers strong randomized feasibility results, the path to pivotal trials, reimbursement negotiations, and possible strategic deals could accelerate. Heart failure remains stubborn, outcomes uneven, and solutions scarce.

An implant-free, physiology-targeted intervention that clinicians can replicate across sites without hardware burden would hit a nerve: practical for providers, tolerable for payors, and—if it works—transformational for patients.