Canopius, the global specialty (re)insurer with a strong Lloyd’s market presence, has entered into a strategic partnership with Kalepa, an AI-driven underwriting technology company, to supercharge its U.S. operations and accelerate growth through artificial intelligence.

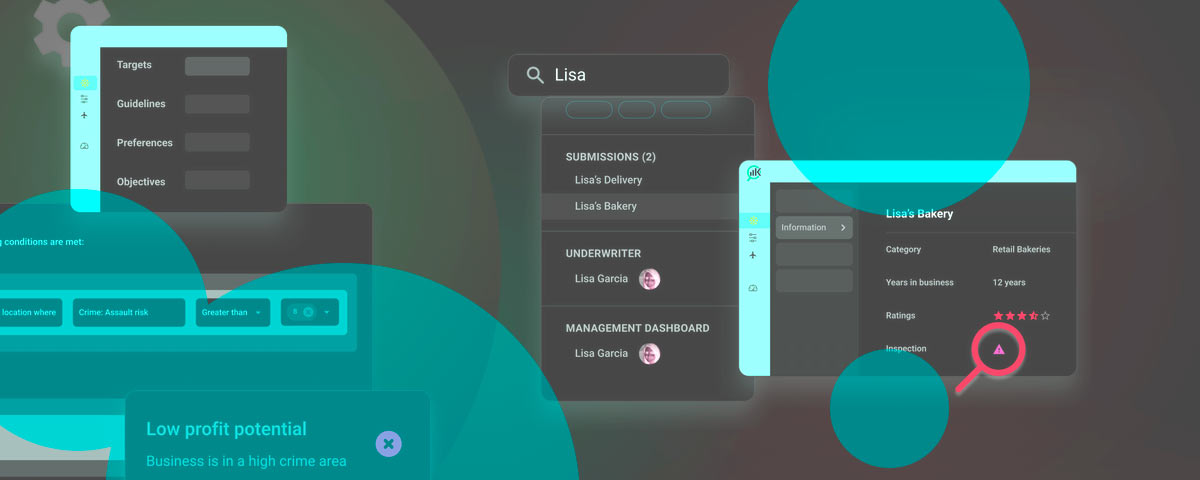

The deal gives Canopius access to Kalepa’s AI-powered underwriting platform, which is built to remove inefficiencies, automate manual processes, and provide data-driven insights for sharper decision-making.

By embedding Kalepa’s system into its infrastructure, Canopius expects to streamline workflows, strengthen risk evaluation, and unlock new opportunities across its U.S. portfolio while maintaining underwriting discipline and agility.

The partnership is closely aligned with Canopius’ broader strategy of adopting technology to support innovation across its underwriting operations worldwide.

The company is known for its expertise in specialty lines, spanning property, casualty, professional liability, marine, cyber, and equine insurance.

Kalepa’s AI-driven tools aim to enhance that expertise by transforming disparate data into actionable knowledge, supporting portfolio optimization and long-term sustainable growth.

Leadership from both firms underscored the significance of the partnership. Kalepa CEO Paul Monasterio described Canopius as a global leader that will fully leverage the breadth of Kalepa’s AI, while Adam Finkle, U.S. COO at Canopius, noted that after evaluating alternatives, Kalepa stood out as the only trusted partner to deliver measurable impact across product lines.

Group Chief Data Officer Alex Bilas added that the seamless integration will provide a frictionless user experience for underwriting teams, enabling them to focus on high-value tasks.

At its core, the partnership positions AI not as an add-on but as a central enabler of underwriting excellence, giving Canopius a scalable edge in an increasingly competitive specialty insurance market.

This partnership between Canopius and Kalepa represents more than a simple technology adoption—it signals a deeper structural shift in how specialty insurers are approaching underwriting and growth in competitive markets like the United States.

For Canopius, a company already recognized for its expertise across niche and complex lines, the integration of Kalepa’s underwriting platform has the potential to fundamentally reshape efficiency and decision-making.

By digitizing and automating processes that historically required heavy manual work, Canopius can process submissions more quickly, sharpen risk assessments, and increase capacity without needing to expand headcount at the same pace. This translates into faster time-to-quote, more accurate pricing, and the ability to serve brokers and clients at scale.

Strategically, the move positions Canopius to compete more effectively against peers who are also experimenting with technology-led underwriting. Specialty lines—especially property, casualty, marine, and cyber—are increasingly data-rich and volatile, demanding models that can keep pace with evolving risks.

Kalepa’s AI aims to bridge this gap by transforming scattered, often unstructured data into decision-ready insights, enabling underwriters to focus on judgment calls rather than administrative bottlenecks.

The timing is also significant. U.S. specialty markets are seeing heightened competition, with traditional reinsurers, MGAs, and insurtech players all vying for market share. By embedding AI directly into its underwriting workflows, Canopius is sending a signal to brokers and clients that it intends to lead on both technical expertise and operational agility.