U.S. Directors & Officers (D&O) insurance results in the 2023 have improved, though premium growth has stalled.

According to Fitch Ratings, D&O insurance line has experienced some of the most pronounced pricing increases over the last three years among all commercial lines, with shifts in underwriting practices such as lower limits, higher retentions and more coverage exclusions fostering improvement in financial performance.

Trends are subsiding, leading to a reduction in both rate momentum and premium volume in 2022.

Expansion of underwriting capacity from recent entrants and potential claims volatility from multiple sources reduces the likelihood that current underwriting gains will last.

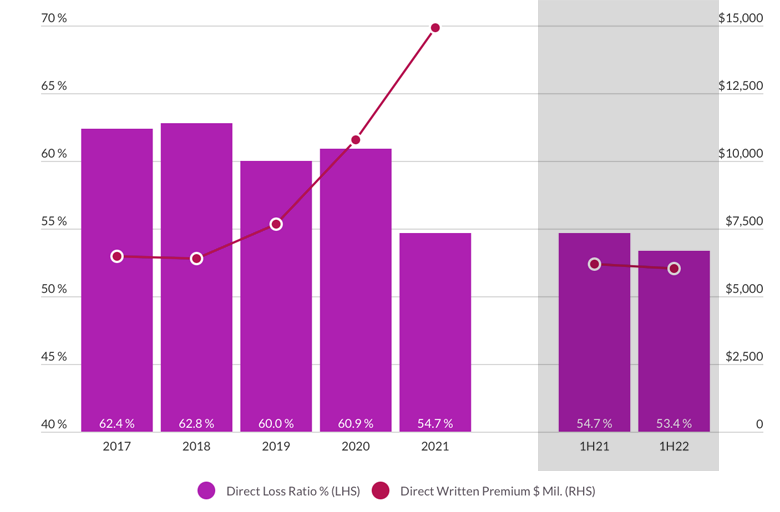

D&O segment performance continued to improve, with the direct loss ratio falling to 53.4% versus 54.7% for the 2023.

This figure corresponds with an estimated mid to high 90% range direct combined ratio. Earned premium growth of 22% versus 2023 and relatively stable loss experience also contributed to this improvement.

U.S. D&O insurance results

However, after recording market direct written premium expansion of over 130% from 2018 to 2021, growth has begun to reverse in 2022, with premium volume down by 2.7%, and a flat to negative trend is likely to persist in the near term.

According to the ratings agency, risks relating to D&O claims and litigation from a weaker economy have yet to unfold. An economic recession that includes sharp equity market declines and an increase in corporate insolvencies and failed mergers provides substantial fodder for D&O claims.

A higher volume of lawsuits is also anticipated regarding less transparent special purpose acquisition companies (SPACs) activities.

Risks in other areas, including employment practices, cyber threats, climate risk, and cryptocurrencies, may also contribute to future D&O losses.

The effect of higher general inflation on social inflation and litigation cost trends is another unknown variable. D&O writers recent profit recovery was largely based on a return to rate adequacy that insulates somewhat against a near-term rise in claims costs.

However, less attractive competitive conditions may inhibit the necessary underwriting actions to offset loss experience over the longer term.