The cost of insuring vessels transiting the Red Sea has more than doubled over the past week as Houthi forces resumed attacks on commercial ships.

The Financial Times, citing data from Marsh McLennan — the world’s largest insurance broker — reports that war risk premiums have surged to around 1% of a vessel’s value, compared to no more than 0.4% before the latest incidents.

According to Marcus Baker of Marsh McLennan, the insurance cost for a ship valued at $100 mn has jumped from about $300 000 to approximately $1 mn per voyage.

The sharp rise was triggered by the July 6 attack on the Greek cargo vessel Magic Seas, the first such attack since December.

The ship, owned by Greece’s Stem Shipping, came under fire from small arms, rocket-propelled grenades, and explosive-laden drones, before catching fire and sinking.

Another Greek-owned vessel, Eternity C, was attacked on Monday, killing three crew members. Houthi forces have not yet claimed responsibility for the second attack.

Reuters adds that war risk premiums have already climbed to about 0.7% of a vessel’s value, more than twice last week’s level.

Some insurers have even suspended coverage for certain voyages altogether.

Underwriters are now quoting rates of up to 1% for a typical seven-day transit — matching the peak levels seen in 2024 when daily attacks occurred. This translates into hundreds of thousands of dollars in additional costs per shipment.

Munro Anderson, head of operations at marine war-risk insurer Vessel Protect, said that the targeting criteria appear to have reverted to the mid-2024 pattern — essentially any vessel with even an indirect connection to Israel. As a result, insurers are increasingly reluctant to cover such ships.

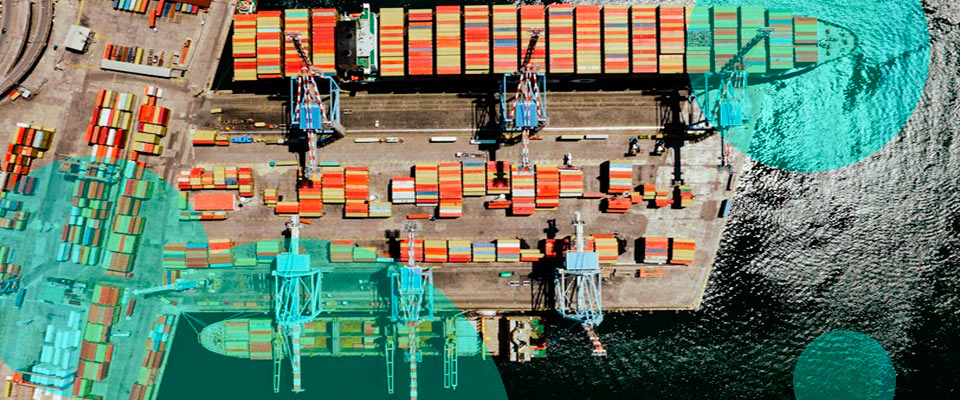

The spike in premiums highlights the deepening security crisis on one of the world’s most critical shipping lanes for energy cargoes.

Shipowners are already considering rerouting around the Cape of Good Hope, which significantly lengthens voyages and raises freight costs.

The Red Sea remains a key artery for global trade in crude oil, petroleum products, and liquefied natural gas.

Insurers warn that the escalating attacks and rising insurance costs may reduce shipment volumes through the Suez Canal and impact fuel availability and prices worldwide.

Despite intensified patrols by international naval coalitions, attacks have continued, casting doubt on the stability of supply chains for many importing countries.