Japanese life insurers face a series of tough challenges over the next five years because of the country’s ageing demographic and economic factors.

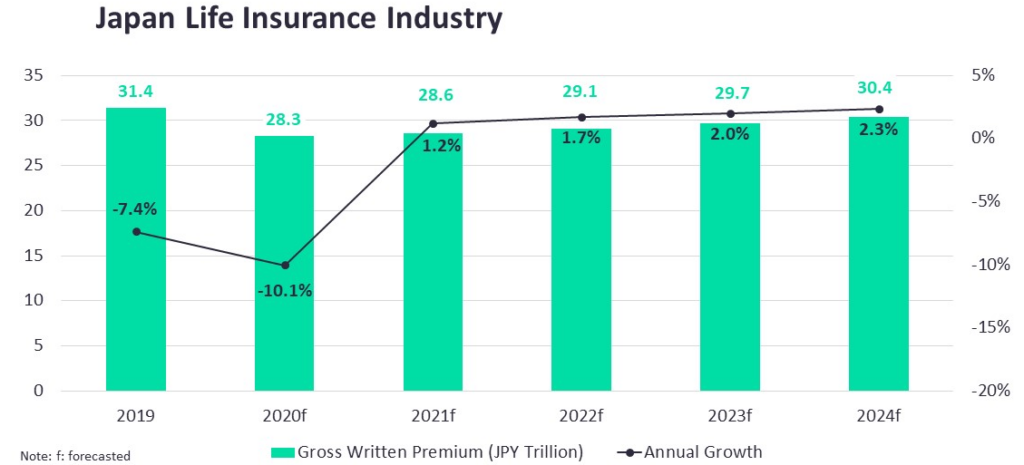

GlobalData Report has forecasted that the Japanese life insurance industry is expected to grow at a compound annual growth rate (CAGR) of 2.6% from $274.9 billion in 2021 to $313.3 billion in 2026, in terms of direct written premiums (DWP).

This CAGR is mainly due to sluggish sales of term life and savings products, and it is comparable to the 2.4% growth registered in 2021, which came after two consecutive years of decline in 2019 and 2020.

The industry growth is expected to remain sluggish in 2022 and 2023 as the term and savings products are not sought-after life insurance products among the older population.

A stagnant economy has caused a persistent low-interest rate environment since 2010. This has prompted insurers to reduce the sales of savings products offering guaranteed returns.

Another challenge for Japanese life insurers is the reliance on agency or brokers’ distribution channels, which traditionally accounted for the majority share of life insurance sales.

The market has seen a decline in sales in the last couple of years – led by a less developed digital sales channel – specifically after the disruption caused by the Covid-19 pandemic.

To avoid such disruptions in the future, the Japanese government has taken measures, including the establishment of the Digital Agency in the second half of 2021. The agency will support life insurers in reducing their dependence on traditional sales channels and moving to digital distribution.

However, insurers must continue to focus on implementing cost-effective digital distribution solutions and launching new products for growth.

by Yana Keller