Optifino, the digital Brokerage General Agency (BGA) radically simplifying the life insurance experience, and Covr Financial Technologies, an award-winning provider of digital insurance solutions, have struck a merger deal they’re calling the start of “Digital BGA 3.0.”

The move fuses Optifino’s AI-driven case design and analytics with Covr’s compliance-heavy infrastructure, aiming to reset how advisors handle life insurance for mass-affluent, high-net-worth, and ultra-wealthy clients.

Covr arrives with distribution muscle, agent portals, and a tested compliance backbone.

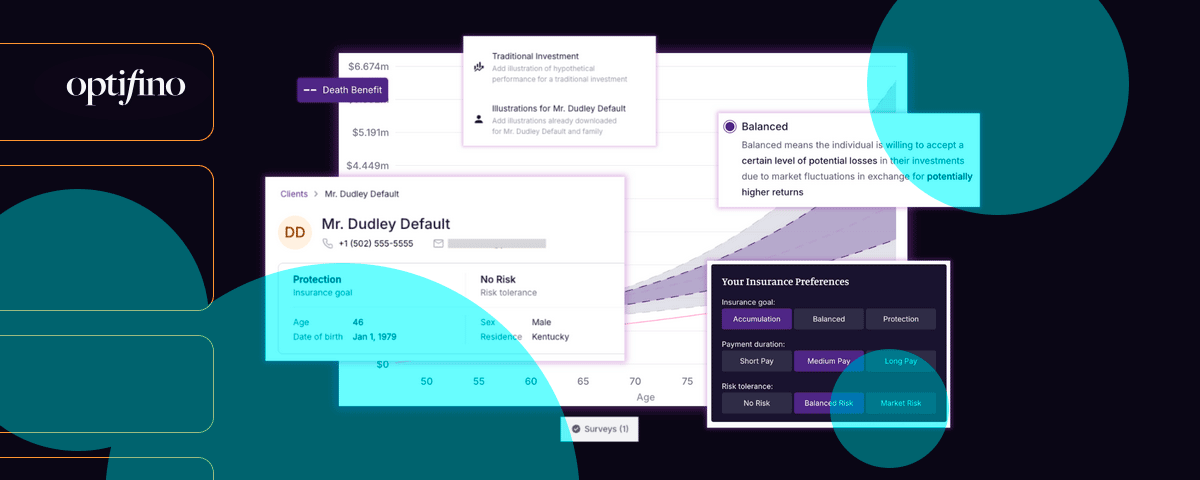

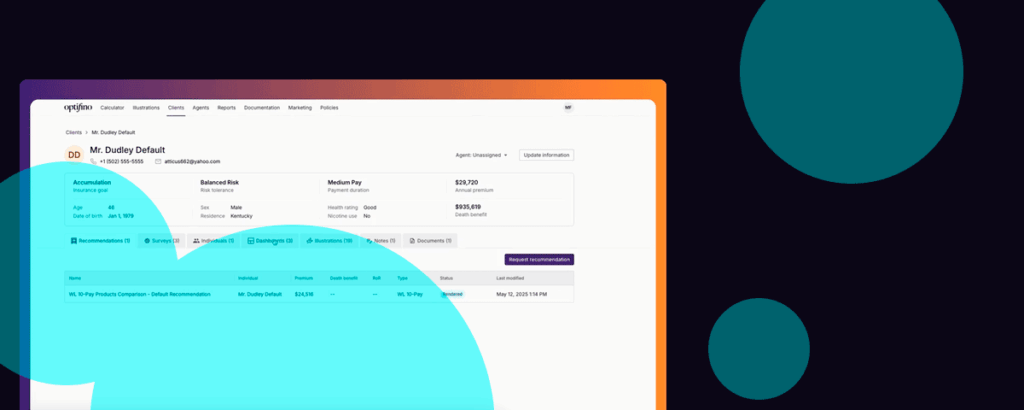

Optifino, built on speed and visualization, brings AI-powered platforms that cut the drag from case design and complex analysis.

- Optifino is a digital BGA built by accomplished financial services veterans to radically simplify the life insurance user experience. Optimizing financial and life insurance planning with cutting-edge AI to streamline portfolio management, our tools make it easier for advisors to visualize and identify the right insurance products for their clients at the right time.

- Covr is a full-service digital Brokerage General Agency (BGA), offering innovative solutions that simplify the insurance buying process, serving over 30,000 financial professionals and over 100 million customers. Covr’s solutions for life insurance, long-term care, and disability income insurance simplify the insurance purchase journey for financial advisors and clients of financial institutions.

Together, the merged company promises faster proposals, sharper insight, and better positioning for advisors tasked with serving demanding client segments.

- Founded in 2016, Covr publicly disclosed $53 mn in funding. Some of its backers include Aflac Ventures and Allianz Life Ventures.

- Optifino was founded in 2022 and last year it announced a $6.3 mn funding round.

David Kleinhandler, Optifino’s co-founder and CEO, will take the helm of the combined firm. “We’re pairing true independence with innovation, simplifying both term and permanent life experiences for advisors and families,” he said.

This begins the next chapter of life insurance distribution: one where true independence and powerful innovation come together to modernize and simplify permanent and term life insurance experiences for advisors and the families they serve.

David Kleinhandler, Optifino Co-Founder and CEO

The merger doesn’t erase existing brands. Both Optifino and Covr will maintain their names, websites, and client-facing operations. Advisors can still expect unbiased, multi-carrier comparisons — a principle leadership teams describe as non-negotiable for credibility and long-term growth.

Covr CEO Michael Kalen described the tie-up as a logical evolution. “Our platform now has greater reach. By adding Optifino’s sophistication in serving ultra-high-net-worth clients, we give financial institutions and agents a better way to deliver life insurance solutions.”

Louis Kreisberg, Covr’s co-founder, framed the merger as the outcome of a three-decade relationship.

David and I have been rivals and collaborators, but always with mutual respect. We knew what each side could contribute. Bringing these companies together is about building something bigger than either could achieve alone.

On closing, Covr will become a wholly-owned subsidiary of Optifino. Advisory teams lined up accordingly: Goodwin Proctor acted as legal advisor to Optifino; Deutsche Bank served as financial advisor to Covr; and Eckert Seamans provided Covr’s legal counsel.

The transaction, while framed as seamless for clients, marks a rare consolidation play in the BGA landscape.

Both firms are betting that a merged platform offering compliance depth and AI-driven agility will create a competitive edge in a market where advisors face growing pressure to deliver speed, precision, and independence at once.