Pennsylvania regulators fired back at Rep. Lloyd Smucker, telling him the state didn’t inflate or twist ACA premium numbers. According to Beinsure, Rep. Lloyd Smucker from Pennsylvania isn’t buying the state insurance department’s story about “skyrocketing” Affordable Care Act premiums.

They say the math he questioned isn’t a scare tactic, it’s the real cost spike coming for 2026 without enhanced premium tax credits. And they backed that claim with a thick slab of district level data straight out of Pennie’s system.

Commissioner Michael Humphreys and Pennie executive director Devon Trolley responded after Smucker’s November letter accused the department of exaggerating “skyrocketing” premiums.

His letter said the state grabbed an outlier example and misled consumers about what’s actually happening. The department saw that as a misread of how Pennie works and who gets hit hardest.

They started with a reminder: Pennsylvania runs its own marketplace, not Healthcare.gov. Pennie tracks nearly 500,000 enrollees directly, including roughly 27,000 in Smucker’s district.

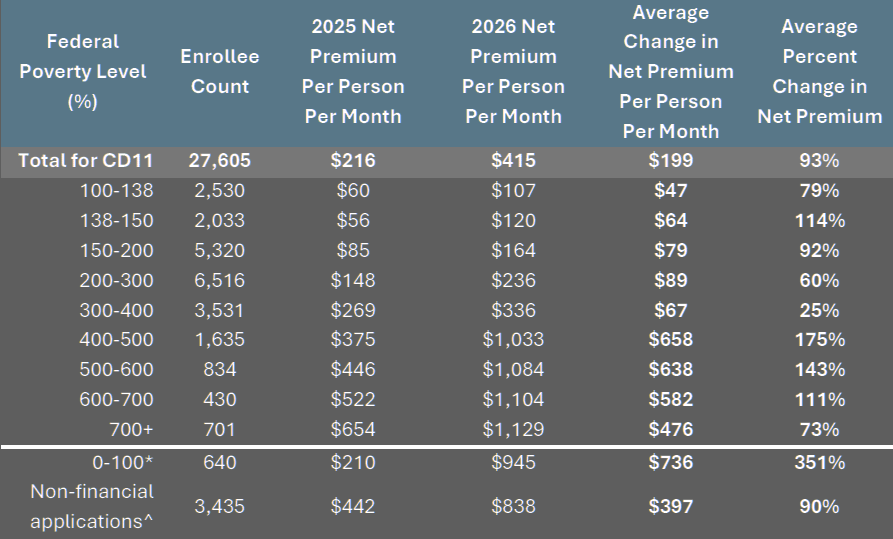

According to their numbers, people in his district face a 93 percent increase in 2026 if Congress lets the enhanced credits expire.

A typical enrollee pays $199 more each month. Couples see nearly $400 extra. A family of four gets close to $800 tacked on. Pennie already sent these updated amounts to households at the end of October.

The department then tackled the York County couple that sparked the whole dispute. Smucker called the scenario “an outlier.” Pennie says it isn’t. Both spouses are 60, live in ZIP code 17402, and earn just over 400 percent of the federal poverty level, about $84,601 for 2026.

They currently pay $581 a month for their benchmark silver plan. Without the enhanced credits, their 2026 cost jumps to $3,703 each month.

The department recalculated after receiving Smucker’s letter and found the increase is even worse than earlier estimates. A 532% jump. Half their income gone to premiums. And Pennie insists thousands of older households sit in that band.

Smucker’s letter suggested almost none of his constituents land above the 400% income cliff. The department countered with Pennie’s direct numbers: 13% of enrollees in District 11 fall above that line, higher than the state’s 9.2% average.

They added that people using Pennie typically cannot access employer plans, so the suggestion that these households can just switch to employer coverage doesn’t fit marketplace eligibility rules.

Lower income households get hit too, just differently. Pennie’s updated breakdown shows enrollees earning up to 150% of poverty will pay $108 to $120 more each month to keep their current plan.

The biggest group in Smucker’s district sits between 200 and 300% of poverty. Their average after tax premium rises from $148 to $236. A 60% jump. A chunk of households under 100% poverty lose every dollar of tax credit because of federal policy changes, and their average net premium shoots from $210 to $945 each month.

Officials also flagged a drop in tax credit eligibility that’s about to reshuffle the entire market. While enhanced credits were active, nine out of ten Pennie enrollees qualified.

For 2026, only 73% qualify. Average monthly premiums jump from $180 in 2025 to $345 for 2026, a 102% weighted increase.

According to our analysts, that’s a huge year over year shift, the kind that rattles small business owners and older buyers especially.

2026 Enrollee Income Information and Price Increases for PA Congressional District 11

Humphreys and Trolley reminded Smucker that Pennie’s enrollment grew 50 percent after enhanced credits were introduced in 2021. The credits pulled healthier people into the system, kept risk pools stable, and kept base rates lower.

The department told him an extension could deliver a 3.5 to 5% base rate reduction per insurer because improved morbidity assumptions would hold.

Without an extension, they expect younger and healthier enrollees to peel away as premiums spike.

Smucker urged the state to expand short term limited duration plans, association plans, and catastrophic options. Regulators didn’t hide their skepticism.

They said short term products lean on medical underwriting, often exclude mental health and pre existing conditions, and rarely offer anything resembling comprehensive coverage.

Association plans sit under heavy state and federal guardrails because previous abuses forced regulators to tighten the screws.

Catastrophic plans exist statewide, but officials warned that low upfront costs mask high out of pocket exposure once people actually need care.

The department ended its response with a clear pitch to Congress: extend the enhanced credits. They see no alternative that can match the affordability gains Pennsylvanians experienced since 2021.

And they nudged Smucker to use Pennie’s direct data more often, pointing out that they’ve offered his office district specific analysis multiple times.

All of this unfolds while national insurers, state regulators, and market analysts keep warning about what 2026 looks like without congressional action.

Pennie’s letter sticks to that line: the threat isn’t hype, it’s in the numbers. Pennsylvanians can already see the new 2026 prices in their renewal notices, and the jump isn’t abstract. It’s in their budgets.

Pennie’s leadership basically said: look at your district’s data, not the DC talking points.