For the skeptics, it is hard to wrap one’s head around why people are paying hundreds of thousands of dollars for a cartoon jpeg, nor understand why people are spending so much time on Discord grinding for whitelist spots.

In response, we would encourage the skeptics to look at the bigger picture and try to understand the value and promise of NFTs.

NFTs have enabled the possibility of digital ownership and supported the evolution of Web 2.0 (a read-write economy) to Web 3.0 (a read-write-own economy).

In a world where people are spending a significant amount of time infront of their screens, the ability to verify scarcity of digital assets for the very first time has the potential to spearhead a generational shift from physical to digital ownership.

In this section, we will review the NFT market activity, fundraising activity, as well as trends and outlook for the sector.

NFTs have a lot of potential in the metaverse. They provide a way to represent ownership of assets, create scarcity, and monetize content. While some challenges need to be considered, such as how to represent ownership and prevent inflation, there are already several projects working on solutions. However, if these challenges can be overcome, then NFTs could play a big role in the future of virtual worlds.

NFT Market

Despite a sharp decline in trading volume in June, the NFT market has had an overall resilient first-half. 2023 started strong for NFTs as trading activity surged, contributed by the launch of the LooksRare and X2Y2 marketplaces and the corresponding trading rewards offered by them both.

NFT sales recorded approximately $17.7B in 2023, which is similar to sales recorded in 2021. This is also a nearly 10x growth on a year-on-year basis

The bulk of the trading volume was front-loaded, with most sales being logged. Trading volume in June was approximately US$678M, a sharp drop of over 80% compared to the average monthly trading volume of US$3.4B from January to May.

A deeper look at underlying drivers reveals that the relatively resilient first-half was contributed by healthy growth in terms of unique buyers and number of transactions, but offset by a fall in average sale price.

The intuitive as cryptocurrency prices have been on a downtrend over the past few months which translates into lower NFT sale prices in USD terms.

The Metaverse NFT market refers to the buying and selling of non-fungible tokens (NFTs) within virtual worlds or immersive digital environments. The market has been gaining significant attention lately due to the growing interest in the Metaverse, a term used to describe a shared virtual space that merges the physical and digital worlds.

NFT market size to cross usd 342.54 billion by 2032, with an 27.6% cagr by 2032 – report by market research future (mrfr) nft market is growing due to the increasing global demand for digital art and cryptocurrency usage.

The global Metaverse Market size is expected to grow steadily over the anticipated frame, recording a CAGR of 47.2% during 2023 to 2027. The metaverse industry spending value will increase from $61.8 bn in 2022 to rise around $426.9 bn by the end of 2027.

The scope of the Metaverse NFT market is vast, and it includes a variety of digital assets such as virtual real estate, avatars, art, and even virtual fashion. The growth drivers of this market are numerous, including the increasing adoption of blockchain technology, the rising popularity of gaming and virtual worlds, and the growing demand for unique and scarce digital assets.

Additionally, the Metaverse NFT market presents new opportunities for creators, artists, and gamers to monetize their digital creations and for investors to diversify their portfolios by investing in these unique assets.

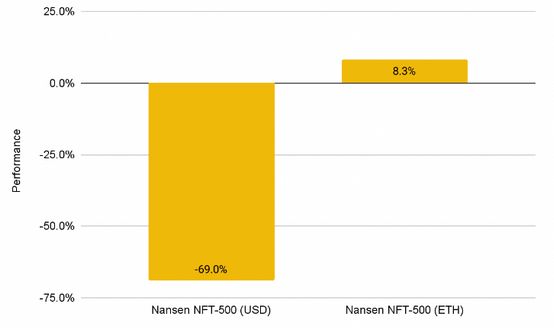

NFTs Price Performance

NFTs had a negative performance year-to-date when measured in USD terms primarily due to a fall in ETH prices. The Nansen NFT-500 index which consists of the top 500 Ethereum NFT collections, weighted by market capitalization, is used in our analysis to track broad NFT market activity.

Admittedly, it is not a perfect representation of the NFT market given that not all NFT collections are based on Ethereum.

Ethereum NFTs command a dominant market share (>80% of secondary trading volume) and can be used as a barometer of the NFT market.

The NFT-500 index returned -69% in USD terms. This is primarily contributed by the fall in ETH prices by -71% in the same period. Isolating the effects of the fall in ETH price, the asset class returned +8.3% when denominated in ETH.

This is noteworthy considering the overall bearish market environment. If you had put your ETH to work by investing in NFTs instead of holding ETH, NFTs would have offset some of the losses of your portfolio.

People can usually make perfect copies of digital entities. Any reproduction of a text file will be identical to the original.

But NFTs, or non-fungible tokens, are one-of-a-kind digital items. NFTs are tied into the blockchain as a unique entity (see about NFT Thefts).

NFTs are used in a wide variety of crypto projects. For example, Decentraland is a metaverse virtual world where NFT land sales are a thriving industry. And Axie Infinity even ties virtual animals into unique NFTs so that they can be cultivated or sold.

NFT performance was negative in USD terms and but positive in ETH terms

The positive returns in ETH terms could have been contributed by positive investor sentiments due to NFT-specific events in the second half of June such as the NFT.NYC conference, as well as several notable acquisitions and fundraises. Prior to these events, the performance of the NFT index was in negative territory but started picking up momentum in the latter part of the month.

NFT Marketplace

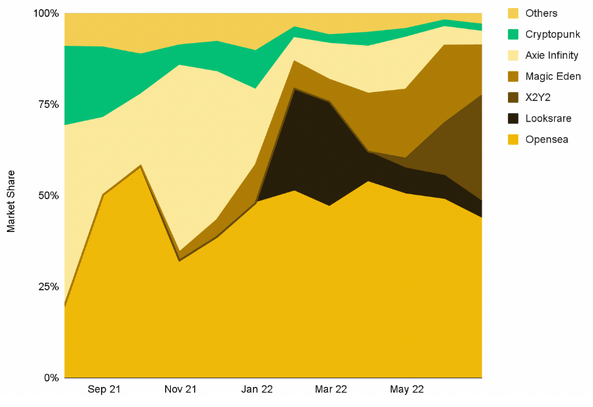

NFT marketplaces play an important role in facilitating trading activity by connecting buyers and sellers. OpenSea remains the leading NFT marketplace by trading volume and has approximately 50% market share.

While OpenSea has largely maintained its market share over the past year, competition is fierce. New entrants such as LooksRare, X2Y2, and Magic Eden have demonstrated strong performance.

The Rise of NFT Aggregators

2022-2023 witnessed the rise of NFT aggregators which allow traders to buy and sell NFTs across different marketplaces from a single platform (think of it as Skyscanner for NFTs). Such a functionality is coherent with and well-suited to fit general trading behaviors.

At the end of the day, most NFT traders are inherently marketplace-agnostic. They typically do not mind which platform they are using as long as they are able to secure their ideal NFT at the lowest possible price. In this sense, NFT aggregators are able to capitalize on such user behaviors by consolidating listings across different marketplaces and presenting the listings in one unified interface.

NFT aggregators also bring additional value in terms of allowing traders to sweep the floors of collections by buying a bunch of lowest-priced NFTs without having to visit every single marketplace individually.

The top aggregators Gem and Genie have seen significant growth with over 511,000 ETH in trading volume so far this year. That represents an approximately 21x increase compared to 2021.

Market share of NFT aggregators has also grown from slightly over 1% at the end of 2021 to around 5% today. Note that the chart represents end-of-month snapshots which could result in some fluctuations depending on trades on that particular day.

While market share of NFT aggregators is still small, the recent acquisitions of Gem by OpenSea, and Genie by Uniswap are evidence of the strong interest that incumbents have in NFT aggregators and are also an affirmation of the value proposition of NFT aggregators. NFT aggregators look poised to play a pivotal role in shaping the NFT trading landscape in the long run.

The incentive to use NFT aggregators will likely rise if and when competition between NFT marketplaces heats up further and as liquidity becomes increasingly fragmented.

Overall, given the better user experience and ease of finding the cheapest NFTs all through one platform, the shift to using NFT aggregators is likely to continue gaining momentum. However, this shift might take some time to play out. Most NFT listings today originate from a small number of marketplaces (e.g. OpenSea, X2Y2, LooksRare) and it does not take much for a trader to check one or two exchanges before executing the trade.

NFT market will undergo significant transformations in 2024

The NFT market is expected to undergo significant transformations in 2024, with various emerging trends shaping the landscape.

Here are some of the key trends and developments:

- Metaverse Integration: NFTs are anticipated to become a cornerstone of the Metaverse, with a surge in adoption for virtual real estate and in-game assets. The collaboration between NFT creators and Metaverse platforms is set to redefine digital interactions, offering immersive experiences that bridge the physical and virtual worlds

- Dynamic NFTs: The trend is moving beyond static images to dynamic NFTs. These NFTs will evolve over time, offering changing visuals, adaptive functionalities, and evolving narratives. This evolution will create a more dynamic and participatory ecosystem

- Social Tokenization: This involves creators and influencers tokenizing their presence, offering exclusive content and experiences, and even governance rights to their communities. Social tokens will empower creators to cultivate loyal communities and enable fans to have a stake in their favorite projects

- AI-Generated NFTs: AI is expected to play a significant role in the creation of NFTs, with machine creativity producing unique digital assets. This integration of human creativity and AI innovation will lead to novel digital art pieces

- Cross-Chain NFTs: Interoperability will be a key theme, with cross-chain NFTs enabling the movement of digital assets across different blockchain networks. This will enhance liquidity and expand market reach

- Environmental Consciousness: The NFT community is moving towards eco-friendly solutions, with a focus on blockchain technologies that have reduced energy consumption and carbon footprints

- AR and VR Enhancements: Augmented and virtual reality technologies will be increasingly integrated with NFTs, offering collectors immersive experiences to interact with their digital assets in both real-world and virtual environments

- Marketplaces and Aggregators: NFT marketplaces, both scratch and white-label, are gaining attention from businesses and investors as lucrative platforms for revenue generation and brand presence

- Fractional NFTs: These subdivided tokens aim to broaden user participation and facilitate fund redistribution across various assets, inspired by shared ownership models in real estate and stocks

- NFT Memberships: NFTs are being used for memberships, offering benefits like exclusive access and voting rights, and enhancing user experiences by leveraging blockchain security

- NFT Gaming: NFTs have significantly impacted the gaming industry by introducing unique methods to convey ownership and scarcity of in-game assets

- Layer-2 NFT Solutions: Addressing the challenges of network congestion, these solutions are built atop Layer-1 blockchains to enhance scalability, security, and reduce transaction costs

- Carbon Credit NFTs: Representing a novel approach to environmental sustainability, these NFTs verify offsetting carbon emissions and are gaining traction for demonstrating environmental impact mitigation

These trends suggest a dynamic and evolving NFT market in 2024, with advancements in technology and a growing emphasis on sustainability, interoperability, and enhanced user experiences.

……………