Despite experiencing a downward trend in 2023, the crypto market has shown resilience, maintaining a steady pace of deals and investments. A substantial share of this sustained growth can be attributed to gaming and infrastructure projects, according to Exploring Crypto Fundraises Report by Binance Research.

As the traditional VC share increased to 45% since the start of the year, the gap between traditional and Web3 investors has gradually narrowed.

For the last four quarters, infrastructure projects have been the leading recipients of funds, with a steady rise in total quarterly funding from 26% in Q4’2022 to 44% in Q3’2023.

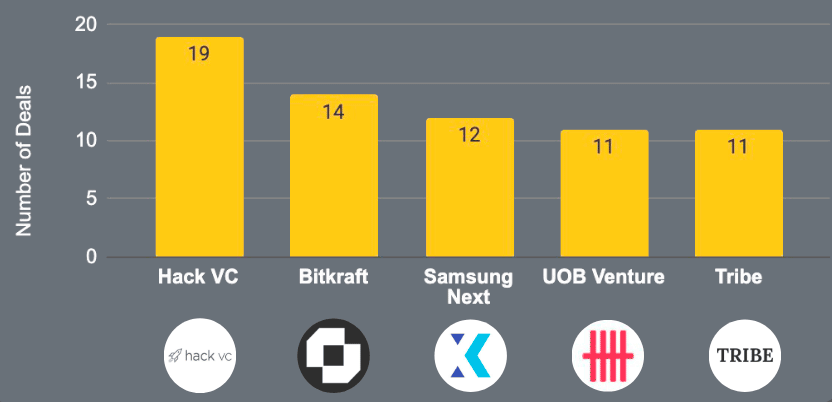

Hack VC is at the forefront among traditional VCs, diversifying its investments across sectors such as gaming and infrastructure.

General Crypto Market Trends

- Signs of optimism as fundraising stabilises. Despite experiencing a downward trend in 2023, the market has shown resilience, maintaining a steady pace of deals and investments. A substantial share of this sustained growth can be attributed to gaming and infrastructure projects.

- Traditional VCs dive into Web3. As the traditional VC share increased to 45% since the start of the year, the gap between traditional and Web3 investors has gradually narrowed. Hack VC is at the forefront among traditional VCs, diversifying its investments across sectors such as gaming and infrastructure.

- Infrastructure remains the top funded category. For the last four quarters, infrastructure projects have been the leading recipients of funds, with a steady rise in total quarterly funding from 26% in Q4’2022 to 44% in Q3’2023.

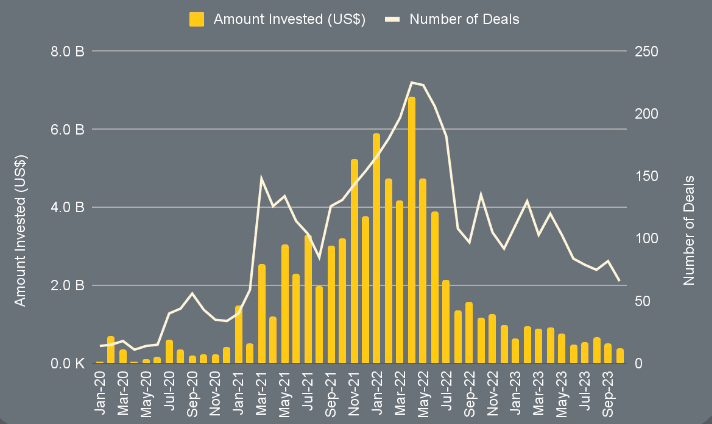

Crypto funding trends

In the thriving bull market of 2021 and early 2022, total funding consistently grew. Funding peaked in Apr 2022 at $6.8 bn, a 361.8% increase from Jan 2021.

However, in the aftermath of the FTX contagion, funding dropped significantly between the second and third quarter of 2022, with Q3 having only $2.4 bn of total capital invested. Following this decrease, funding levels have since stabilized.

Additionally, the number of deal funds saw an uptick in Jan and Feb 2023, with Infrastructure and Gaming largely driving this growth.

Number of deals and capital invested over time

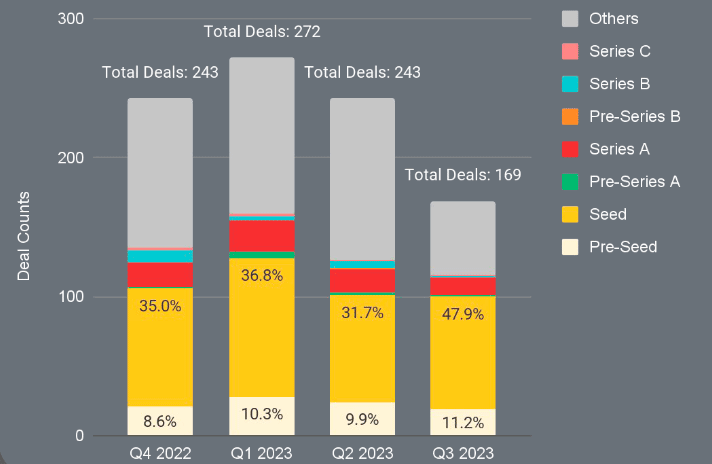

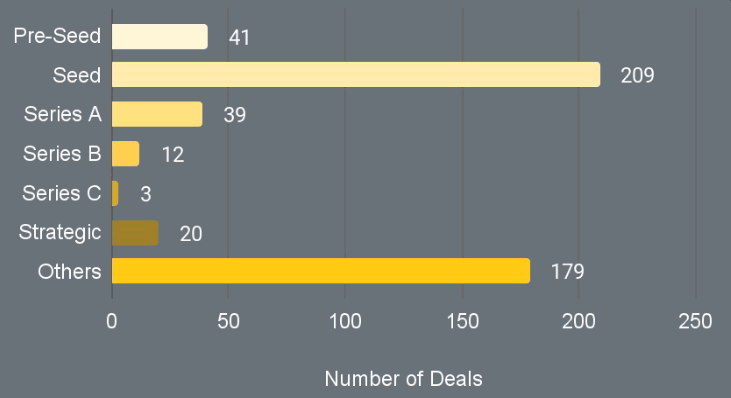

Seed funding constitutes over 30% of investment in crypto

Total overall deals peaked in Q1’2023 at 272, with a 37.9% decline to 169 by Q3 2023. Seed funding soared 47.9% last quarter. Despite fewer deals overall, seed-funded projects increased from 77 to 81 between Q2’2023 and Q3’2023.

The prevalence of seed funding may be attributed to the many untested technologies in today’s market.

Although this phase of investment carries substantial risk – as it often backs ideas that lack established products or consumer bases – its comparatively lower valuations afford investors the opportunity to spread risk across multiple projects.

Pre-Seed funding, the second most common, albeit riskiest stage, is vital for conducting research and developing a Minimum Viable Product (“MVP”) within the crypto sector.

Quarterly deal counts based on funding rounds

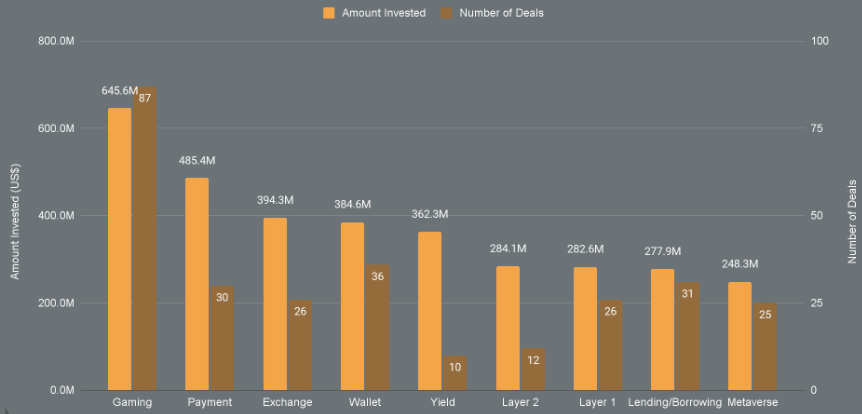

Crypto Gaming, Payment, & Exchanges lead in funding

Despite having only 10 deals, the yield category has drawn the highest average funding. This is primarily due to Amber Group, a CeFi company that centers on asset management, securing a $300 mn Series C funding.

While gaming boasts the highest cumulative funding, it also has the smallest average investment per deal, at $7.42 mn.

This suggests that investors see opportunities in the gaming industry. However, considering the early stages of development in Web3 gaming, investment amounts remain conservative.

Top 10 funded categories in the last four quarters

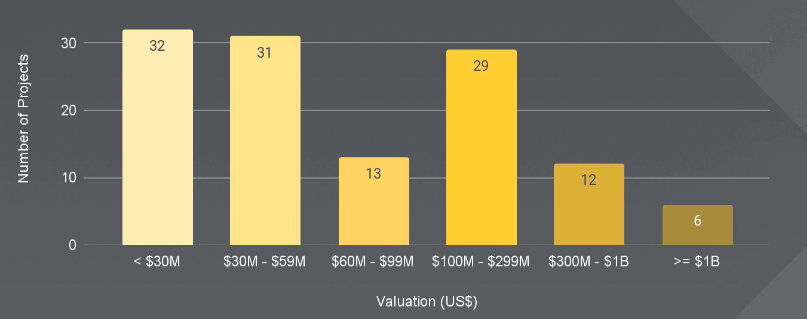

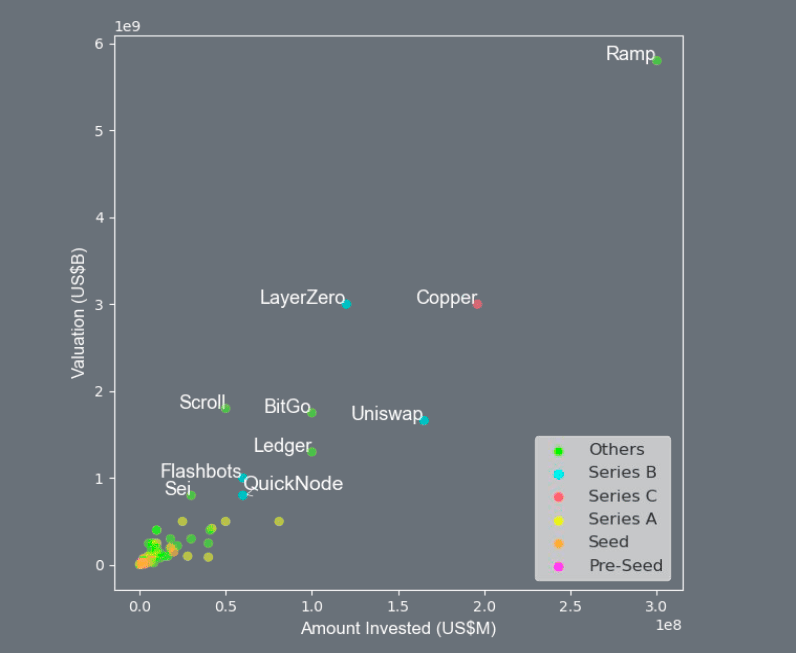

Project valuations and fund raising in crypto

Total of six crypto unicorn projects (valued over $1 bn). Project counts are similar across these three valuation brackets – below $30 mn, $100 mn – $299 mn, and $30 mn – $59 mn.

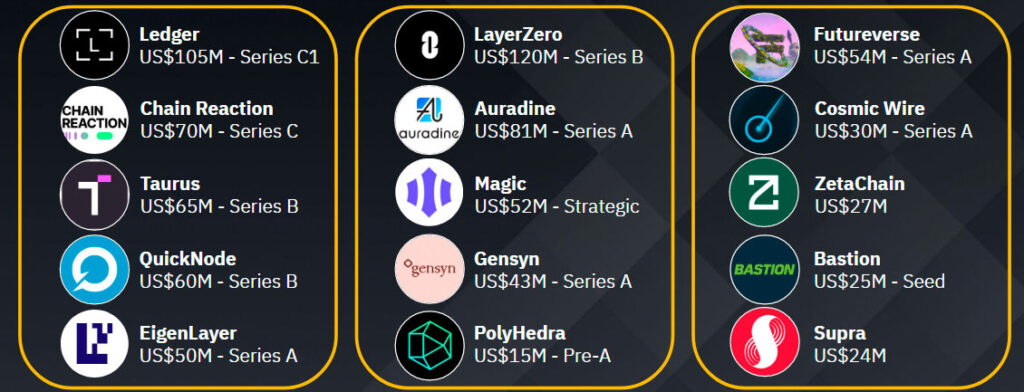

Ramp, a payment solution, tops the chart with a valuation of $5.8 bn. Following behind is the omnichain interoperability protocol, LayerZero, and the institutional-focused infrastructure provider, Copper, each valued at $3 bn.

Number of crypto deals by valuation

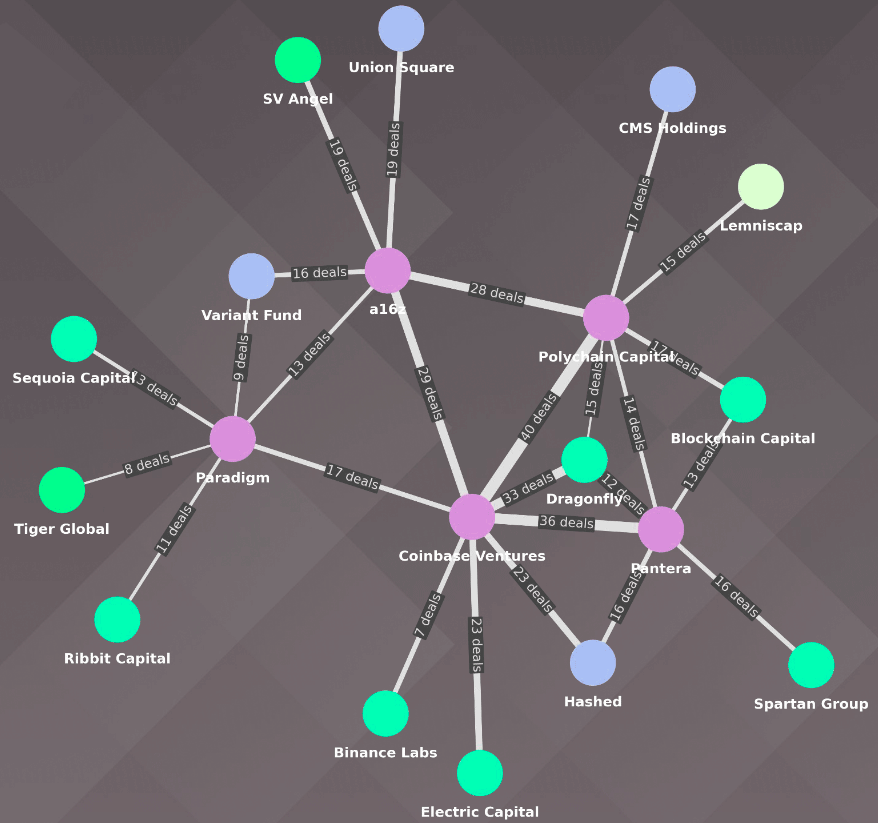

Crypto Venture Capitals

Leading active VC secured 51 deals. The reputation and involvement of other investors may constitute a factor in the investment decision-making process of many VCs, implying potential importance of “social proof”.

The network graph illustrates how renowned VC firms like Pantera Capital, Dragonfly, Coinbase Ventures, a16z, and Polychain Capital frequently co-invest in projects together.

In the featured graph, Polychain Capital and Coinbase Ventures have the highest number of joint investments (40). This may be because Polychain’s founder, Olaf Carlson-Wee, was the first employee of Coinbase, as well as their former Head of Risk.

Crypto VC Investment Dynamics

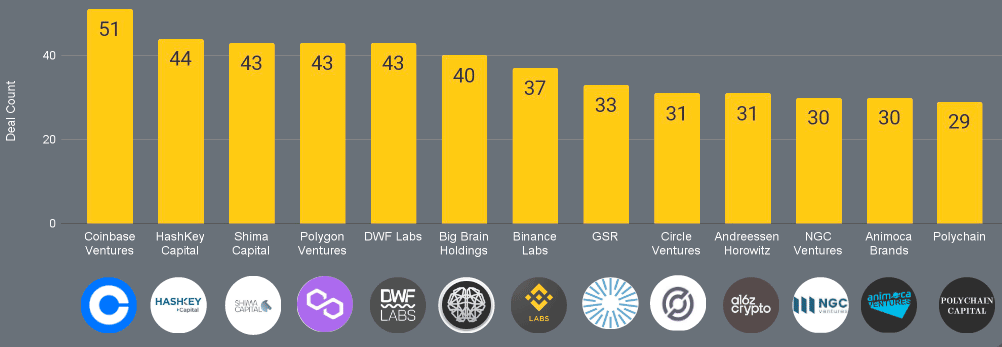

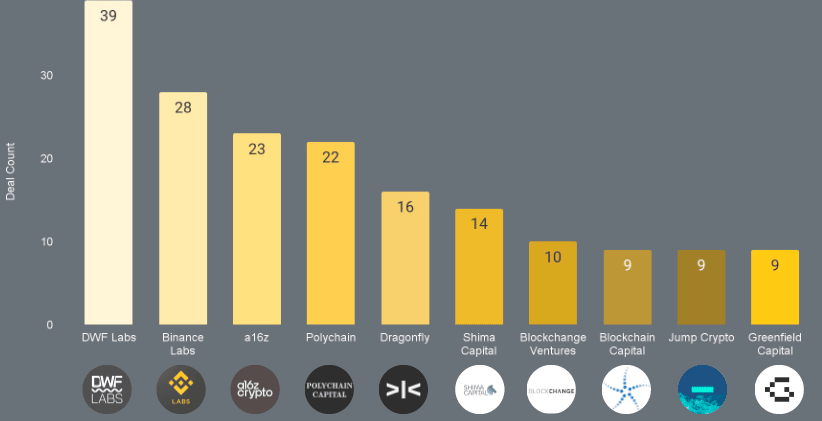

Top active VC crypto investors

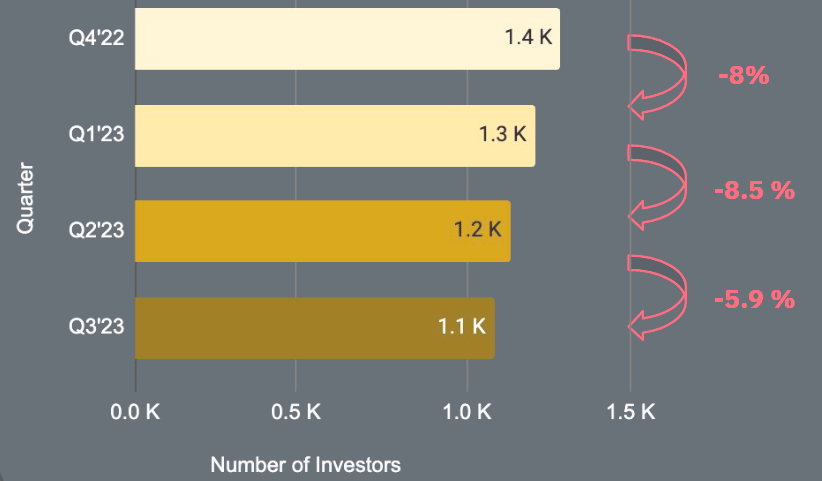

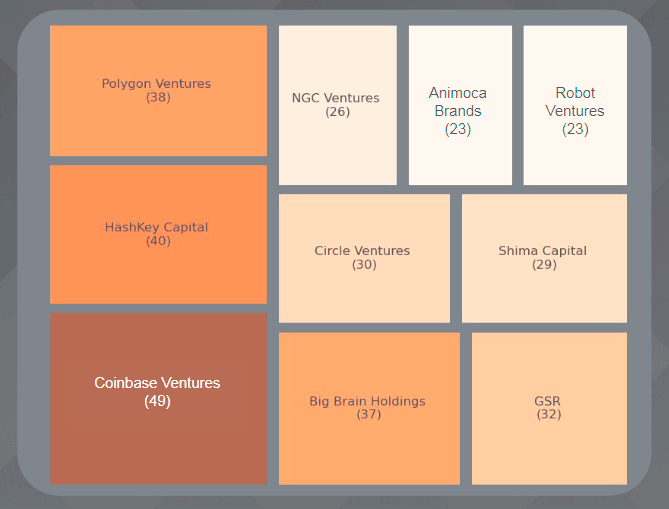

Despite a decreasing numbers of unique investors on a quarterly basis, the decline slowed to 5.9% last quarter. In particular, Coinbase Ventures led the number of deal counts for the past four quarters, with 33.3% allocated to DeFi and another 39.2% in infrastructure.

DWF Labs, a relatively new entrant on the list, began its investment activity in October 2022 (see how Millions of dollars worth of crypto were stolen from DeFi platforms).

Number of deals participated by investors

Unique investors quarterly

Lead investors are defined as those who provide the most capital or those who have solely funded an investment round.

DWF led 39 investments, most of them being single-funded ventures that amass to a total of over $323.8 mn.

Binance Labs has also independently funded several projects such as Xterio, Helio Protocol, and Radiant, involving game development, LSTFi protocol, and lending respectively.

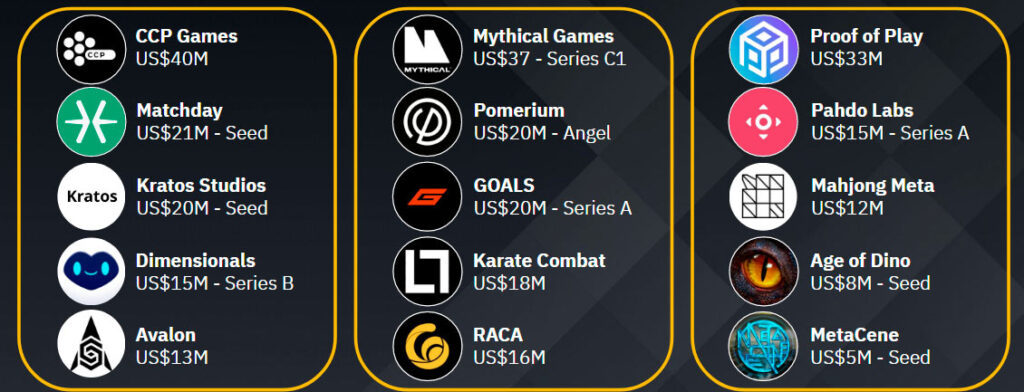

a16z is a lead investor in around 74% of its total investments. Its recent undertakings in September include IYK, a Near-Field Communication (“NFC”) tokenization, and Proof of Play, a gaming studio.

Top 10 lead blockchain investors

Top 10 non-lead blockchain investors

As a top non-lead investor, Coinbase Ventures’ strategy appears to be diversifying its portfolio, allocating smaller investments across more projects. This contrasts with others, such as a16z, who instead opt for larger lead-investments in fewer projects. Recent Coinbase Ventures co-investments are cross-chain oracle Supra and yield-bearing stablecoin Mountain Protocol.

Non-lead investors are those that participate in funding rounds without setting the terms

Hashkey Capital, ranked second, allocates 22% of its portfolio to infrastructure projects. This includes self-custody solution platform PrimeVault, and metaverse/gaming project Aethir, suggesting a rise in demand for infrastructure within the gaming industry.

Count of non-lead investors’ deals

VCs like Binance Labs and NGC Ventures exhibit a bullish outlook, ramping up their deal activity despite tough market conditions. Notably, Binance Labs led the pack with the most significant uptick in deal volume, securing 23 investments over the past two quarters.

Meanwhile, a reduced number of deals from firms like Coinbase Ventures and Shima Capital may reflect a strategic pivot toward more selective investing. Despite this, both remain engaged in the market, with Coinbase Ventures closing 19 deals and Shima Capital completing 17.

Type of funding rounds and leading traditional VCs

41.6% of traditional VC firms participated in seed round investments. Among the top 5 traditional VCs, only Bitkraft primarily focused on gaming.

Hack VC has the highest deal count, and has diversified its investments across various sectors, including gaming and infrastructure.

Notable projects include GRVT, a hybrid derivatives exchange, and DeGame, a GameFi platform utilizing a Proof of Contribution mechanism

Type of deals among all traditional VCs

Despite a downward trend in the total number of deals over the recent four quarters, the percentage of deals involving traditional investors has remained fairly constant.

Top 5 Traditional VCs

Zooming in to the details, there’s been a slight uptick in traditional venture capital’s share over recent quarters, from 39.8% to 45.3%, following an initial drop in Q4’2022. This narrowed the gap with Web3 investors, possibly reflecting the latter’s steadfast commitment to the industry.

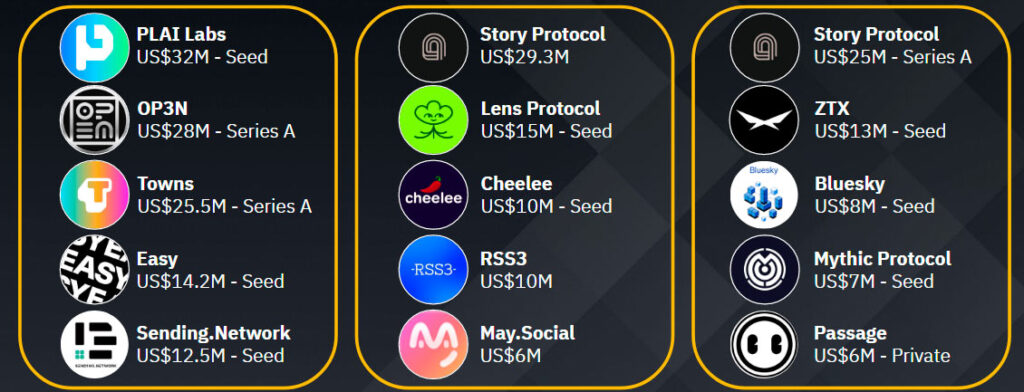

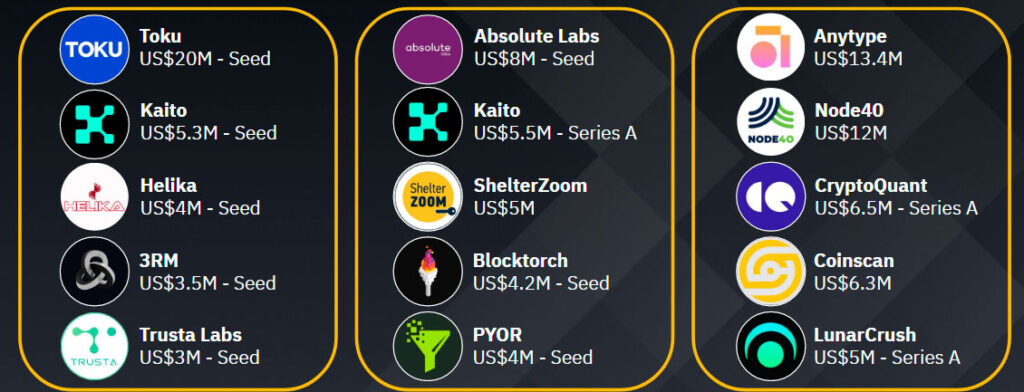

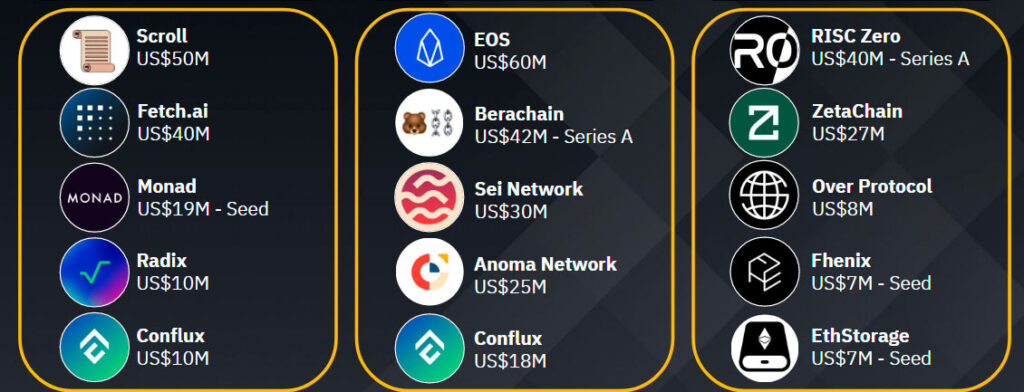

Top 5 Fundraise Rounds 2023 Quarterly

Infrastructure-related projects appear to be favoured among traditional VCs, followed by DeFi and Gaming. Interest in NFT projects has declined, with the deal share decreasing from 11.4% in Q4’2022 to 4.6% in Q3’2023.

However, traction for tool-related projects has increased significantly, with their share of deals surging from 4% in Q4’2022 to 14.9% in Q3’2023.

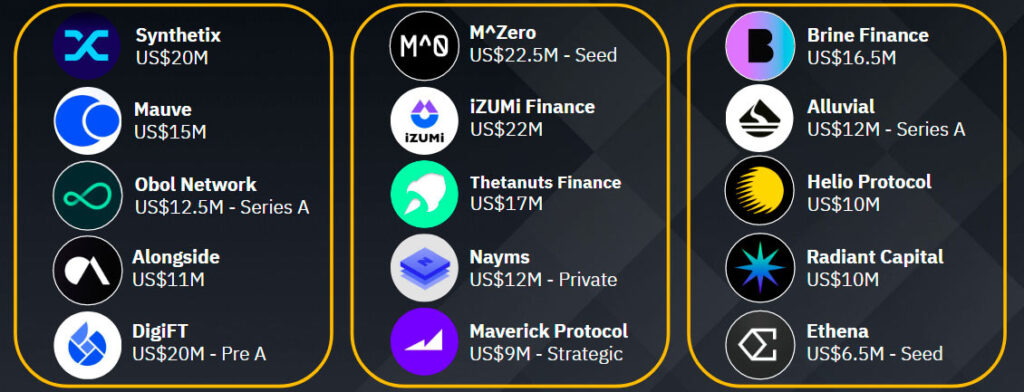

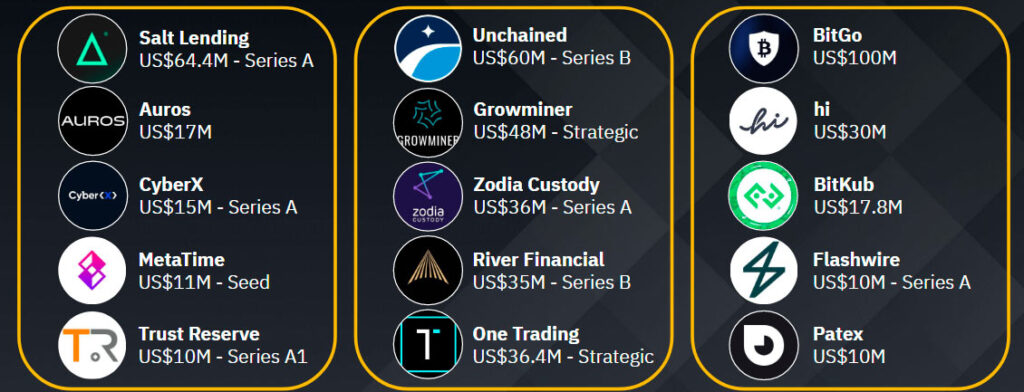

DeFi Category

CeFi Category

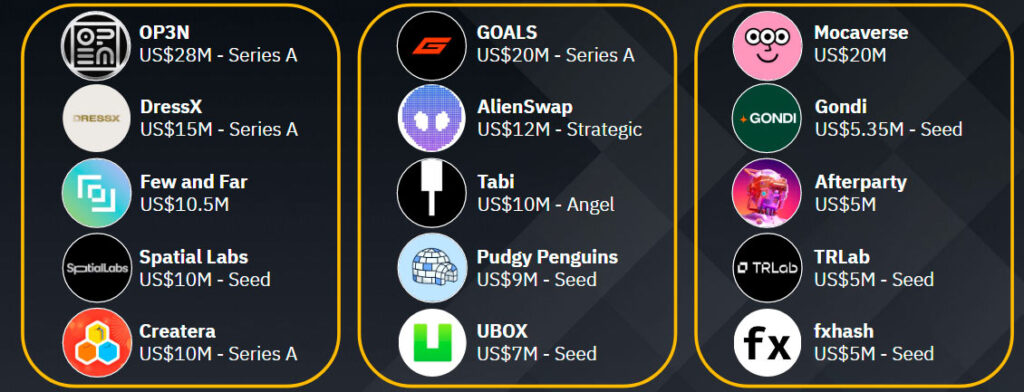

NFT Category

Gaming Category

Social & Entertainment Category

Tools and Information Category

Layer 1 / Layer 2 Category

Infrastructure Category

…………….

AUTHORS: Keng Ying Sim – Research Data Analyst at Binance, Nicholas Tan Yi Da – Research Data Analyst at Binance’s Research Data Team

Reviewed by Oleg Parashchak

Oleg Parashchak