Though the risks posed by climate change are many and multifaceted, research into the effects on the insurance industry has mostly focused on property and casualty (P&C) lines of business. The implications for health and life insurers are less well understood, according to The Geneva Association Report.

Climate change adversely affects human health, as well as its social determinants, in numerous ways. Extreme weather events cause injuries and fatalities; nature and biodiversity loss contributes to the spread of vector-borne diseases; and climatic shifts exacerbate many chronic morbidities and can lead to displacement, according to Insurers’ Survey about ESG Strategy.

In the insurance industry, understanding of the risks related to climate change is mostly concentrated in P&C business lines as well as investments.

While the short-term consequences for health and life (H&L) insurers have so far been modest, it may be erroneous to assume that it will remain that way in the longer-term considering the increasing frequency and severity of climate events and shifts underway (see how NatCat Insured & Economic Losses Increases Due to Climate Change).

H&L insurers’ climate-related risk exposure

Quantifying H&L insurers’ climate-related risk exposure comes with many challenges. This report attempts to dissect the current landscape by reviewing emerging global evidence on epidemiological shifts induced by climate change and mapping it against the current experience and insights of H&L insurers (see Cyber Risks, Climate Change & ESG – Main Challenges for Insurance).

The impacts of climate change on health and life insurers have been modest so far but may escalate as climate events become more frequent and severe

Based on these observations, the report puts forward the following three recommendations for H&L insurers:

- Assemble data prospectively: To improve understandingof future risks, H&L insurers must draw from a wider set of stakeholders to assemble multi-sectoral data to understand areas of vulnerabilities. This may include assessing not only the likelihood of heatwaves in a given region, but the number of elderly, frequency of power cuts and existing morbidities to develop forward-looking climate and health scenarios.

- Invest in innovation: The innovative use of parametricinsurance has garnered attention and holds valuable lessons for the future. But parametric initiatives would require H&L insurers to homogenise the risk and quantify its volume and frequency to decide whether shouldering the risk of a mass ‘trigger’ event is within their appetite, without making premiums unaffordable. Regulatory considerations would also be critical, considering the novelty of innovative approaches.

- Play a bigger role in the policy environment: Insurerscan play an important role in strengthening public understanding of the full spectrum of health risks related to climate events and implement simple and accessible messaging in their communications with customers. There is also a need to broaden understanding of climate-related health impacts within the insurance industry that goes well beyond Nat Cat and other climate-linked shock events.

Insurers can expand their contributions in this space by building the stock of data on climate-related health risks, developing innovative products and strengthening public understanding.

Public-private collaborations can be stepped up to create an ecosystem of preventative strategies and related actions to implement them. Examples include teaming up to build EWS and evacuation protocols, or strengthening clinical professionals’ training on climate-sensitive health diagnoses (see how Climate Change Impacts on the Re/Insurance Industry).

Insurers can also make and incentivise greener investments in health- and care-related assets that would reduce health-related risks; these may include creating green spaces and roofs to reduce overheating of buildings.

Climate change will exert a huge toll on human health

While increasing climate impacts have sharpened the focus on climate action within the scientific and policymaking communities, it has also given increased impetus for healthcare professionals to study its human toll.

While it is plausible that climate adaptation strategies or, in some cases, climate patterns them-selves may reduce mortality and morbidity in certain regions, some cohorts such as the elderly, young children, pregnant women and those who are socio-economically disadvantaged, are highly vulnerable.

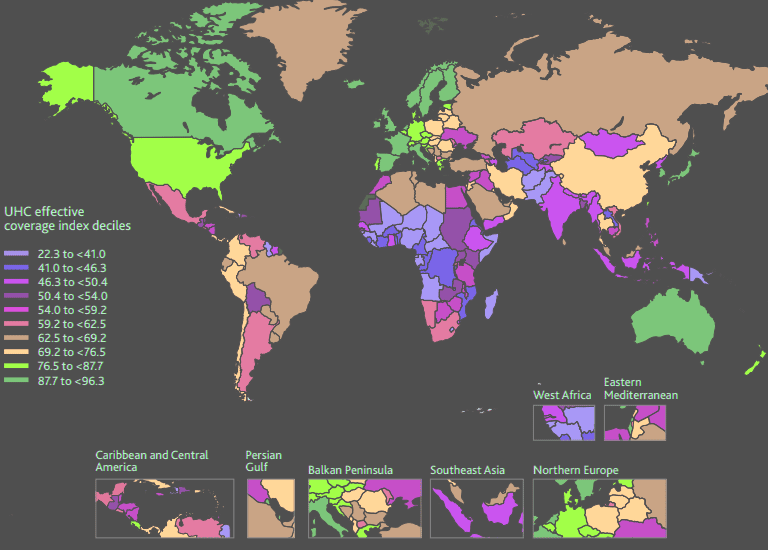

In a global study of all deaths related to climate change, the numbers were strikingly disparate, with 130, 75 and 92 deaths per million occurring in low, lower-middle- and upper-middle-income countries, respectively, compared to just 18 deaths in high-income nations. The lower mortality in high-income countries reflects, in part, the level of investments in early warning systems (EWS) and emergency preparedness, combined with relatively resilient health systems.

Now, more than ever, the science of climate change and its associated risks have become pivotal considerations for societal welfare and economic prosperity, as well as for the insurance industry, given that climate-related risks are increasing at an unprecedented rate.

By the middle of 2023, insured losses from climate events amounted to USD 50 billion, compared to an annual average of USD 18 billion over the past decade.

Until now, most focus on the effects of climate change, nature and biodiversity loss on the insurance industry has been directed towards property and casualty (P&C) business lines. While the short-term consequences for health and life (H&L) insurers have been modest so far, it may be erroneous to assume that this will continue in the longer-term for the reasons discussed above.

Climate changeand health systems

Earth’s intricate climate system is complex and chaotic and can pose risks to human health. These risks manifest through the emergence of new diseases, both directly and indirectly, as well as the exacerbation of existing health burdens.

Understanding the far-reaching impacts of climate change on health requires not only an examination of global warming, but also of its effects on the natural environment and the ecosystems that sustain human life.

Climate change leads to adverse health outcomes, some of which are immediate and others more long term.

These encompass injuries and fatalities resulting from extreme weather events; infectious diseases (including air, water and vector borne); heat-related illnesses; respira-tory conditions; chronic diseases; malnutrition stemming from climate -induced disruptions to food systems; mental health issues after extreme weather events; and anxiety related to the long-term consequences of unmitigated climate change.

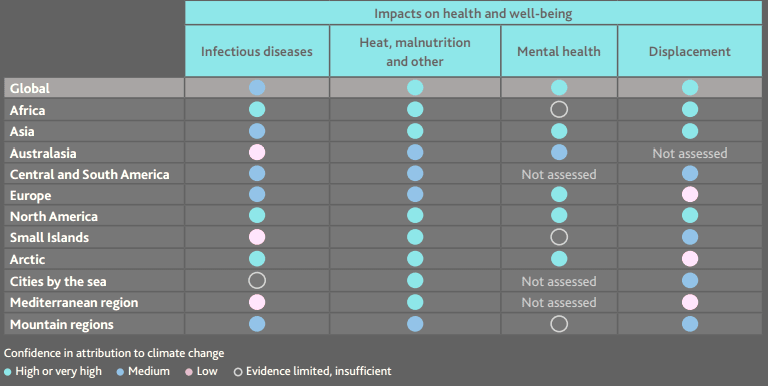

Observed impact of climate change on health and well-being by region

The worsening of heat-related perils and displacements in Asia and Africa and of health pros-pects across all categories in North America indicate that vulnerability transcends regional boundaries and levels of development, and the worse may be yet to come. While it is plausible that economically affluent groups will have better capacity to adapt, the poor, old and vulnerable population remain at risk in all regions.

Implications for health & life insurance

Having explored the influence of climate change on broader epidemiological trends, this section focuses on the specific implications for H&L insurance.

Unlike the population-level evidence presented in section 3, academic and grey literature addressing the impact of climate change on H&L insurance liabilities remains limited.

To overcome this limitation, this section relies on a combination of available literature and data obtained from interviews with 41 key informants representing 17 global re/insurance companies, as well as affiliated experts in North America, Europe and Asia.

Progress towards universal health coverage

The interviews were conducted using an open-ended topic guide, allowing for a thorough exploration of issues and the identification of opportunities and challenges associated with H&L insurers.

Impact of climate change on H&L insurance products

Most interviewees do not perceive climate change as exerting any immediate impact on the liabilities associated with H&L insurance products, nor do they anticipate short-term consequences for their insurability and affordability. Nevertheless, there is consensus that this situation might change over the long term. This expectation arises from the increasing scale, intensity and frequency of climate events, particularly with global temperatures likely to surpass the 1.5°C threshold by 2027.

The current impact of climate change on health and life insurance is perceived as limited but there is consensus that this may change in the long term

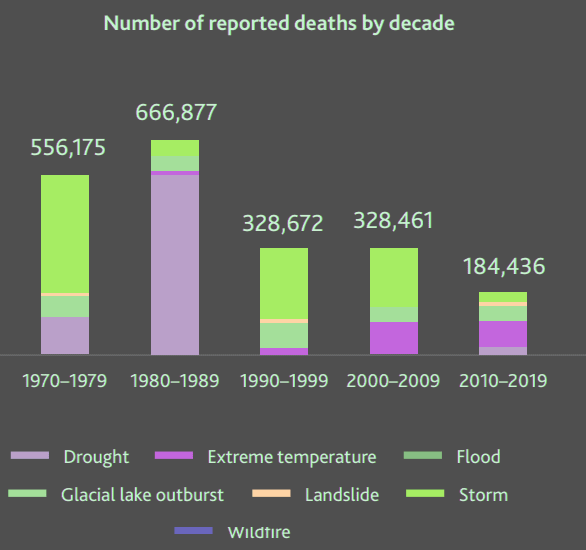

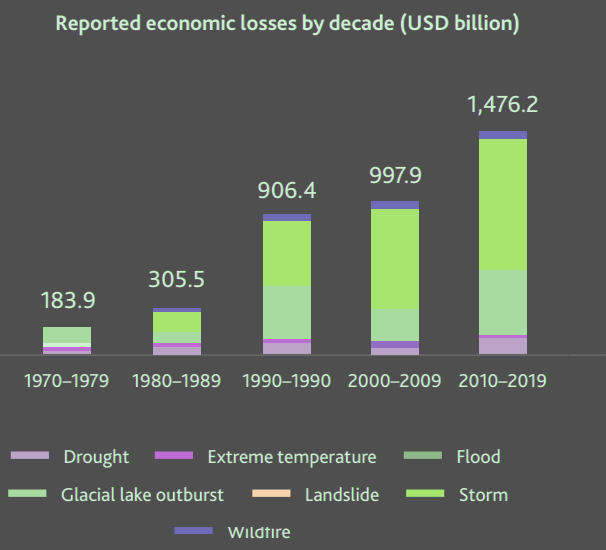

An analysis by the WMO supports these assertions, estimating that extreme climate events have caused more than 2 million deaths in the last 50 years and incurred economic losses of USD 4.3 trillion. On the one hand, it is reassuring to observe that mortality rates have decreased over time with greater adaptability and warning measures. On the other hand, 90% of the burden of death has disproportionately fallen on developing countries where populations continue to grow, making the outlook for future risk exposure concerning.

Mortality and economic losses from weather, climate and water extremes

Availability, structure and pricing of H&L insurance products

Having established that H&L insurability is not currently a matter of concern, interviewees were then asked to discuss specific considerations that may affect the insurability and, consequently, the availability, structure and pricing of products in the future.

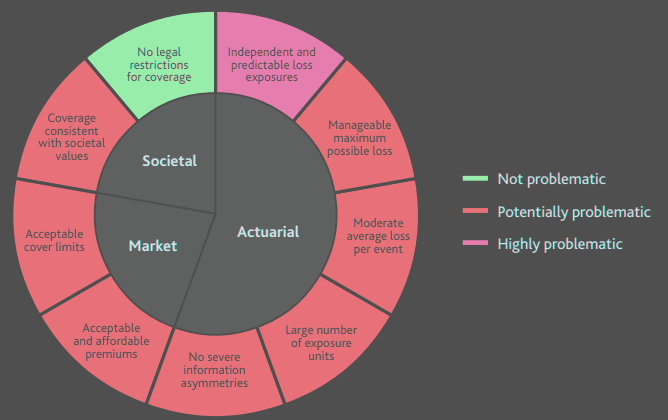

The aggregated findings are presented below, taking into account a well-established insurability framework.

While the novelty of the topic may limit a granular analysis, the subsections below attempt to map the key informant observations against some customary actuarial, market and societal criteria of insurability to understand the issues at hand. The vast majority are actuarial considerations.

Criteria of insurability

Given such intricacies, it is challenging to predict a clear-cut impact of climate change on H&L products. For longevity products, this may manifest as a slowing in improvements in life expectancy, allowing life insurers to release reserves due to reduced longevity risks.

The effects on morbidity and long-term care products are harder to predict. On the one hand, certain risks may increase due to the rising cost of care as chronic conditions are worsened by climate change.

The unpredictability of loss is further compounded by the incompleteness of data and lack of standardised methodol-ogies for interpreting it (elaborated further in point B).

For instance, attributing injuries and some fatalities to extreme events like hurricanes is not always possible, making it harder to form a global perspective of the nature and quantity of potential risk exposure.

Similarly, for chronic risks, indicating that the patient’s cause of death was exacerbated by many years of exposure to rising levels of beyond-safe air pollution, for example, is seldom observed. In the absence of coherent data analytics, predicting the level of future exposure remains highly problematic.

Regional risk-based underwriting

Regional risk-based underwriting generated mixed opinions among key informants. In some cases insurers may be able to supply insurance affordably in riskier places because of some diversification and cross-subsidy operating within the system.

Some believe that more explicit region-based underwriting could lead to unfair discrimination and might attract regulatory interventions.

They argue that access to risk reduction and preventive measures is unevenly distributed, disproportionately impacting the poor or vulnerable. Others perceive regional risk-based underwriting as a viable option, citing examples where this is already underway.

Nonetheless, they do concede that implementing a region-based strategy comes with chal-lenges, primarily due to resistance from local populations.

Insurers in the U.S., for instance, are engaging with local communities to construct water reservoirs in flood-prone areas, thereby ensuring that affected populations have access to clean water.

Despite the benefits, landowners in these regions have been reluctant to participate, fearing that their properties may be devalued if designated as prone to flooding.

……………..

AUTHOR: Adrita Bhattacharya-Craven – Director Health & Demography at Geneva Association

Contributing authors: Maryam Golnaraghi – Director Climate Change & Environment; Madeleine Thomson – Head of Impacts and Adaptation, Wellcome; Talia Caplan – Research Manager, Wellcome