UK insurance sector are likely to pass on more of the interest they earn on customer cash balances to protect their reputations as customer fairness regulation introduced last year continues to drive changes.

Fitch Ratings believe insurers will consider the extra costs negligible compared with the risk of being named and shamed by the regulator.

The Financial Conduct Authority (FCA) wrote to investment platforms and self-invested personal pension (SIPP) operators, several of which are life insurance companies.

FCA warned that retaining a high proportion of the interest earned on customer cash balances may contravene consumer duty rules introduced in July 2023, and asked firms to review their approach.

Life Insurers will consider the extra costs negligible

The FCA asked firms to explain how their approach represents fair value to customers, or set out how they will change it, by the end of January. Any changes must be implemented by the end of February.

It is becoming increasingly clear that the consumer duty rules have potentially serious reputational consequences for any firms found to be in breach.

As interest rates have risen, many companies have taken all or part of the increase on customer cash balances as profit rather than passing it on to customers.

In an FCA survey last year of 42 investment platforms and SIPP operators, 30 firms retained at least some of the interest they earned on customer cash balances – about half on average.

Some of the justifications for this, such as to discourage long-term allocations of cash in platform accounts, appear tenuous, and we do not expect companies to maintain their stance without making at least some improvement to how much interest they pass on to customers.

The cost of passing on more, or indeed all, of the interest would be immaterial for the firms’ ratings.

However, the reputational fallout for any company publicly named for underpaying customers could be credit negative as a damaged franchise may result in lower volumes of new business and the loss of existing business.

New rules requiring UK financial services companies to show that their prices represent fair value to customers will negatively affect life sector profitability.

The consumer duty rules, as well as driving insurers to pay more interest on cash balances, may lead to further reductions in customer charges to avoid potential findings of overcharging and the reputational damage that could result.

At least one insurer, St James’s Place, has reduced customer charges in response to the rules and more companies may follow. However, we generally expect reductions to be modest and do not expect any rating implications.

UK life sector outlook for 2024

UK life insurance is the only life insurance sector in Europe with an improving outlook for 2024, Fitch Ratings says, largely due to the prospect of strong profitable growth in pension risk transfers. Higher interest rates have boosted pension scheme funding levels, making it easier for corporates to offload their pension liabilities to insurers.

Several European insurance sector outlooks could move to ‘deteriorating’ if high inflation persists and interest rate rises become more significant.

Fitch analysed the potential impact of an economic scenario with mid-to-high single-digit inflation throughout 2023 and 10-year interest rates increasing by a combined 300bp in 2022 and 2023.

The results suggest that non-life insurance sectors would typically be worst affected, particularly those with a high proportion of long-tail business where higher-than-anticipated claims inflation could lead to reserve deficiencies.

High inflation could also lead to margin pressure for short-tail business in markets where strong competition or societal pressure limit insurers’ ability to increase prices.

The UK life sector outlook for 2024 is improving despite the dent to profitability due to the consumer duty rules.

Elsewhere in Europe, life sector outlooks are neutral, with the positives, such as higher investment returns, broadly in balance with the negatives, such as the muted macroeconomic backdrop.

European Life Sector Outlooks for 2024

| Market | Life Sector Outlook |

|---|---|

| UK | Improving |

| France | Neutral |

| Germany | Neutral |

| Italy | Neutral |

| Netherlands | Neutral |

| Spain | Neutral |

Higher investment returns are positive for life insurers’ earnings but new business volumes for many product lines will be dampened by slow economic growth and pressure on households’ disposable income.

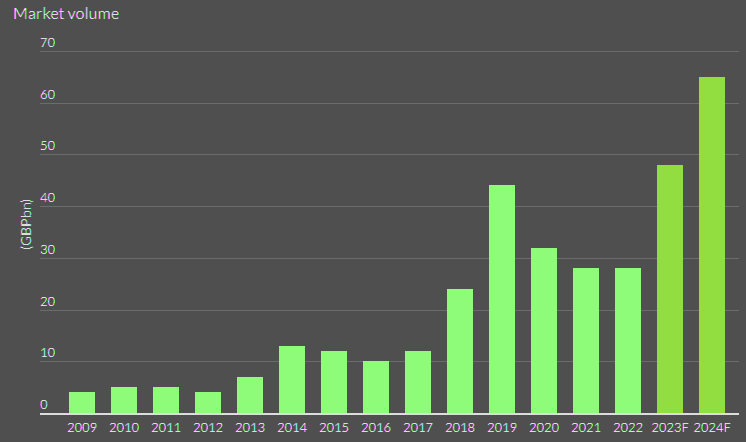

We are observing a growing trend where companies are seeking to offload the financial risk of their defined-benefit staff pension schemes.

These schemes, once prevalent in the UK, are now mostly closed to new members and future accruals, yet they still carry substantial liabilities.

To mitigate these risks, companies are increasingly turning to insurers through two main methods: buy-ins and buy-outs.

In a buy-in, the insurer receives an upfront premium to cover future pension payments on behalf of the scheme, whereas in a buy-out, the insurer directly disburses pension payments to the scheme members.

UK Life Insurance Sector – Pension Buy-Ins/Buy-Outs

Pension risk transfer business, which is much more prevalent in the UK, is an exception because it is sourced from pension schemes rather than disposable income, and volumes tend to be boosted by higher interest rates.

UK Life Insurers to pass interest to customers

The introduction of the FCA consumer duty package will prompt some insurance companies to lower customer fees. This strategic move aims to circumvent potential overcharging allegations and the ensuing damage to reputation.

While we foresee these reductions to be minimal, as firms will likely avoid significantly impacting their profits, these changes are not expected to affect our ratings.

The implementation of these rules, effective from July 31, 2023, follows a prolonged preparation period, including an FCA policy statement and final guidance issued in July 2022.

An additional year has been provided for their application to closed-book businesses.

The increased regulatory pressure to prove fair value to insurance customers

The increased regulatory pressure to prove fair value to customers is unlikely to make the UK life market significantly more competitive. The market is not commoditised and most products are not directly comparable between companies, so higher prices are not necessarily an indication of overcharging.

The need to show fair value to customers while maintaining profitability adds to the pressure for insurers to push ahead with cost-cutting, digitalisation and platform creation.

Even if there are market-wide reductions in charges, we do not expect a spate of compensation claims from customers arguing that charges were too high in the past, as happened in the Dutch life market in the 2000s due to opaque charges on unit-linked products.

The FCA has made it clear that the consumer duty regulation will not have a retrospective effect. Moreover, the notion of fair value is subjective, and it is not clear how customers could quantify losses without a directly comparable product as a reference point.

…………..

AUTHORS: Joanna Mason – Director, Insurance Fitch Ratings (London), Rishikesh Sivakumar, CFA – Associate Director, Insurance Fitch Ratings, David Prowse – Senior Director, Fitch Wire