Mantissa Group initiated a Life Insurance Digital and Core Modernization survey, conducted across life Insurance technology and business leaders, and supplemented by a series of interviews to ensure proper sentiment was captured. The survey data and interviews show similarity in the challenges that life insurance companies face as they initiate their modernization journey and simultaneously strive to advance their digital priorities.

The global life insurance industry is evolving to meet the demands in the marketplace. Customer and agent expectations are driving the evolution of the industry not only with expectations for flexible product designs to meet life stage needs, but also expectations for a digital experience.

A digital experience implies several dimensions: education, product flexibility to suit individual needs, easier underwriting, and an omni-channel experiences that includes individual engagement and agent involvement.

Complicating the digital journey, however, is the fact that most life insurance companies are built on legacy technologies, requiring substantial investments in core technologies. This dynamic presents a challenge to technologists who must modernize core platforms, while deploying leading edge digital capabilities that need to integrate with these legacy platforms (see Life Insurance Industry Results).

These core modernization journeys’ will not be solved quickly, with policies dating back decades, conversion considerations, and platform implementations (see Life, Accident & Health Reinsurance Industry Activities).

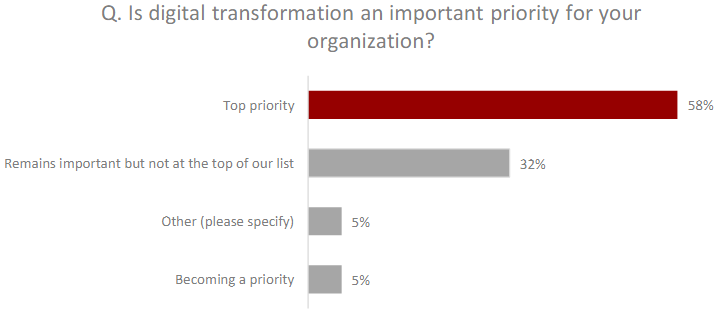

Survey data shows that life insurance companies are responding to this digital priority with 58% indicating that digital is a top priority, and 90% indicating that digital is a company priority.

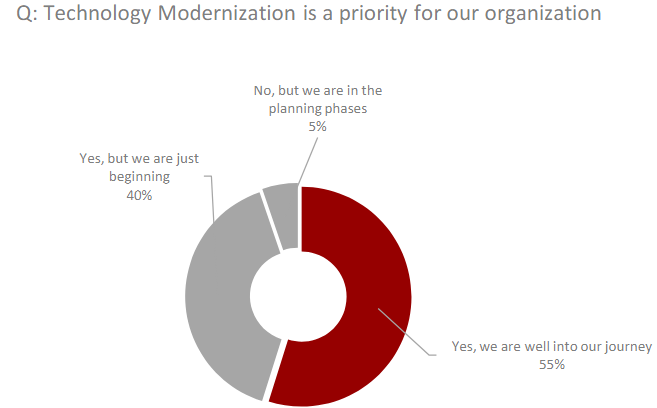

- Life companies as an industry are in various stages of core platform modernization, with 55% of the survey respondents indicating that technology modernization is a priority for our organization. Most of those who have initiated the journey have selected a future state policyadministrative platform.

- The need for core modernization is rooted in a sense of urgency related to technology that dates back decades with multiple evolutions of technology, large blocks of legacy policies, and old product types.

- Compounding the legacy issue is consumer sentiment. Consumers want a digital experience related to education on products and services, an online experience supplemented by agent advice, fluid-less underwriting, personalized experiences, and ongoing engagement including wellness, health, and finance (see Why Digital Experiences are Essential for Insurers and Agents Success?).

- A significant majority of respondents (85%) indicated that giving the end user an online digital experience is critical to the success of our organization and business strategy.

- Life insurance agents and distributors were initially reluctant to embrace digital, preferring a “personalized experience”. However, this has shifted due to consumer demands.

- With this consumer and agent demand, life insurance companies are now heavily investing in their digital strategies.

- This report focuses on the interdependence between core modernization and digital strategies, as digital initiatives are moving at a substantially faster pace than core modernizationefforts will allow. Therefore, technologists are seeking ways to execute modern digital initiatives on older, legacy technologies.

The report touches on two key aspects of the modernization journey, digital and core platform modernization. As the survey results indicate, 69% believe that while digital and core modernization are linked, it is important to decouple the two to allow for progress on the digital front (see Why Millennials Are Often Left Out of the Life Insurance?).

With this situation, modern digital engagement software vendors in the marketplace have a unique challenge – building leading edge digital technologies to meet current needs, while integrating with decades old legacy technologies.

The insurance industry is undergoing a digital transformation, and life insurance companies are no exception. Digitalization in life insurance impacts how insurers do business in several ways.

For example, insurers are leveraging digital technologies such as cloud computing, big data, data analytics, and artificial intelligence (AI) to streamline processes, improve the customer experience, and develop new products. Additionally, digital technologies such as mobile apps, video conferencing, and cloud-based services are being used to make customer interactions more efficient and effective.

Ultimately, digital solutions enable life insurance carriers to become more agile and responsive to the needs of their customers.

As the insurance industry continues to evolve, it is essential for life insurers to embrace digital transformation to remain competitive in the market.

Consumer and agent digital expectations

Consumer expectations for digital capabilities have evolved from early retail e-commerce to digital business. Corporations originated the implementation of the digital movement as a matter of operational efficiency, but the force behind digital was rapidly taken over by consumers.

After some initial discomfort and adjustment to the fast-paced digital rate of change, consumers became adept at understanding technology.

They began embracing technology and demanding more capabilities; their expectations have become the major driver in digital business.

Life insurance companies have indicated the criticality of digital priorities for both consumers and agents.

When asked if giving the end user an online digital experience is critical to the success of our organization and business strategy – 83% of the respondents indicated this as a priority. When asked the same questions about agents, the number increased to an overwhelming 91%.

Interview data exposed another dynamic as it pertains to digital priorities. Who owns digital as a business priority? Initial instincts had this capability built into technology organizations, as there are clear technical implications to digital strategies. However, life insurance companies have become concerned that initiatives became too technology centric and recognized digital as more a business model priority (see Largest Life Insurance Companies in United States).

With this shift, roles such as a Chief Digital Officer emerged, and digital become an important element of the business strategy. It is via this business lens where implications to customers, prospects, agents, and product strategy became more evident.

Once in the hands of the business, the importance of digital has become a business priority. 58% of survey respondents view digital transformation as a critical business objective.

Core modernization

The technology implications of the shift to digital as a business priority has become a challenge for the technology leaders interviewed. Core modernization objectives pose an important challenge as these programs cannot move as rapidly as needed to advance those digital priorities. It is for this reason that vendors in the marketplace have designed digital platforms that can integrate with legacy technologies.

Addressing speed of core modernization

Technology leaders surveyed indicate that the pace of core modernization cannot keep up with the digital priorities of most life insurance companies. More than half (55%) of those surveyed are well into their journey, but this journey will take years. Issues around conversion of legacy blocks, older and complex product definitions, and implementation of data strategies take time, patience, and financial commitments.

CIO’s we interviewed also pointed to complexities of policy administration platform replacements. Vendor packages have been selected in many cases, but the pace of implementation is not in line with the pace (and speed) that digital initiatives require.

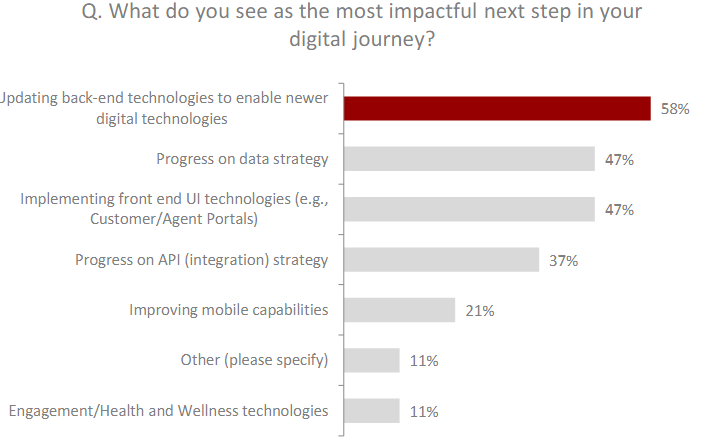

In the meantime, building a bridge between legacy technologies and digital technologies is key, with 58% of our survey respondents indicating this priority when asked What do you see as the most impactful next step in your digital journey?

SURVEY DATA INDICATES DIGITAL ENABLERS

Technology leaders surveyed and CIO’s interviewed showed remarkable consistency of opinions on the types of technologies needed to support the digital agenda. Technology leaders pointed to back-end legacy systems as the critical need, with 58% pointing to this as the most critical component. However, a correspondingly significant portion pointed to advancing the data strategy (47%), as well as a solid API (services) program (37%), to serve as the bridge between old and new.

SUPPLEMENTED BY AGENT AND CONSUMER FACING TECHNOLOGY

Survey respondents and interview data also point to the need for leading edge technologies to put in the hands of agents and consumers. This includes highly engaging mobile technologies, personalized recommendations, and ease of interaction with agents and insurance companies.

Also prioritized are fully modernized engagement technologies with 47% indicating that implementing front end and UI technologies (e.g. Consumer/Agent portals) is the most impactful nextstep in advancing the digital journey.

Data and security strategy

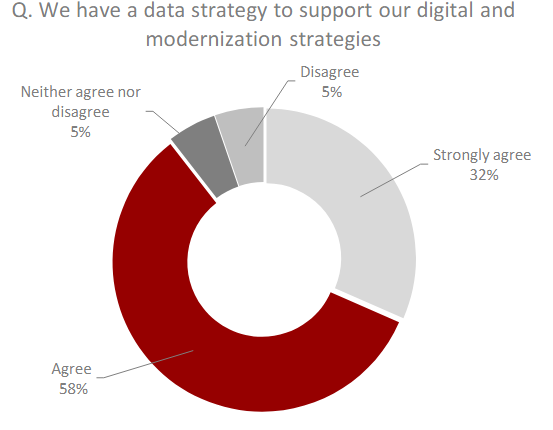

Respondents not only recognize the need for a data strategy to enable the digital and modernization strategies, but they’ve also begun what will be a long journey. 32% of the survey respondents strongly agreed to the question: we have a data strategy to support our digital and modernization strategies, whereas 58% of our survey respondents agreed.

SECURITY STRATEGY IS RECOGNIZED AS EQUALLY IMPORTANT

Interview data revealed the importance of a robust security strategy. An effective security strategy was noted as a priority for business executives and for Boards of Directors. Digital strategies put information directly into the hands of the consumer or agent, so protection and privacy is paramount.

Data shows:

- 58% of survey respondents strongly agreed that effective security strategy is in place

- 84% of the survey respondents felt comfortable with their overall security posture

- While only 16% did not have a perspective or had concerns, the need is not in dispute

Digital sentiment

58% of survey respondents view digital transformation as a critical business objective. That number approaches 90% when asked whether respondents consider digital priorities important.

68% of the survey respondents believe that their digital priorities are nascent but maturing. For life insurance companies, this is a critical perspective as the entire industry was late to the digital game.

And why is that? Interviews pointed to two reasons. First, as we showed earlier in the report, digital priorities became dependent on core platform modernizations. With the development of digital platforms designed to integrate with legacy technologies, it became possible to accelerate the digital journey. Secondly, there was an early reluctance from life companies to adopt digital strategies as they did not want to alienate their agent force, however they recognized the need to engage directly with existing customers.

Finally, the combination of shifting digital attitudes and emergence digital technology platforms has accelerated the prioritization of digital strategies. This has resulted in a focus on digital strategies at a pace unimaginable not so long ago.

Digital technologies

Survey data and CIO interviews acknowledge the delicate balance of digital strategies between agents and customers. Our survey then sought to determine whether the investment in technologies fellsubstantially greater with one audience over the other.

The answer to that question is yes – but only slightly less. 84% of the survey respondents are focusing on digital enablers for agents and distributors.

This is entirely logical as the ecosystem of tools needed to enable the sales process is substantial. Engagement tools, point of sale technologies, and marketing enablers all make up the tool chest for agent technology.

Also notable is the investment in consumer experience tools – at 68%. Consumers have long wanted an online buying process, wellness tools, rewards related to activity and health, and financial planning tools.

Technology investment priorities

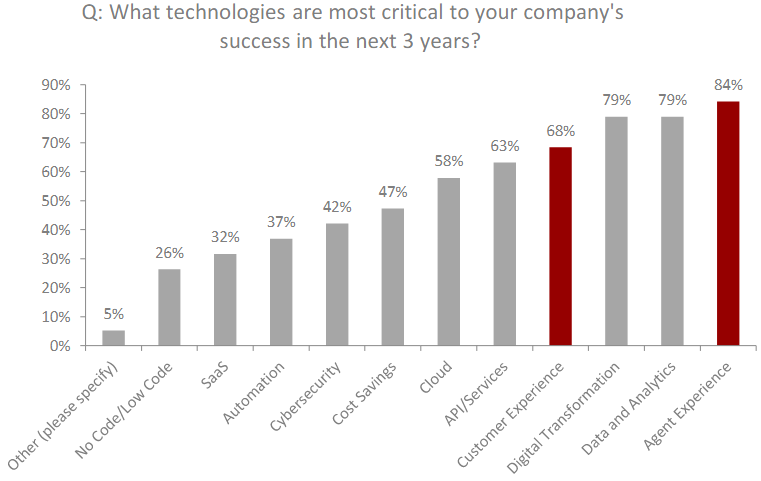

The survey inquired specifically about technologies that are critical in the next 3 years. Not surprisingly it is easy to see the connection in technologies to enable core modernization and digital strategies.

- 58% of survey respondents indicate the importance of continuing advancement in cloud technologies. This is highly aligned with both core modernization and digital strategies.

- 63% of the survey respondents noted the importance in investments in API’s. This is the lifeblood between modern technologies and legacy back-end systems.

- 42% recognize the importance of cybersecurity, particularly in the era of digital engagement.

- Data and Analytics investment at 79% knowing that core modernization and digital advancement must co-exist for a long period of time.

- Automation at 37% and Cost Savings at 47% remain important as the desire to keep technology expenses managed is paramount.

- The key enabler, according to survey results point to updating of back-end technologies, with 58% recognizing the importance. Of note is continued importance of upgrading UI technologies, at 47%, improving mobile at 21%, and engagement/health and wellness at 11%.

Other interesting facts

Survey also revealed some other noteworthy factors relative to core modernization and digital strategies:

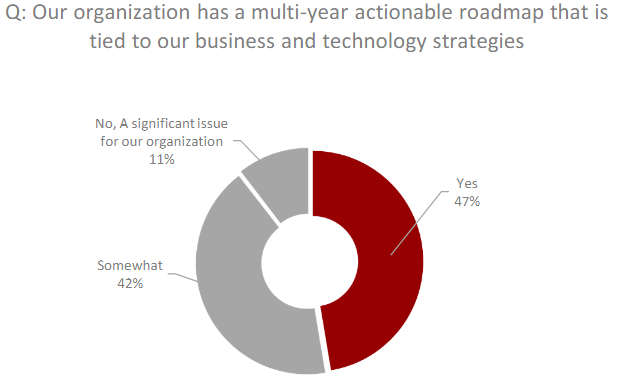

- Business and technology strategies are inseparable: Technology strategies were previouslydeemed separate but related to business strategies. This has shifted, as 47% of survey respondents recognize that business and technology strategies are inseparable. This connectivity is essential to a successful core modernization and digital strategy.

- Multi-year business driven roadmaps are essential: Of the survey respondents, 47% of those surveyed responded favorably to the question: our organization has a multi-year actionable roadmap that is tied to our business and technology strategies. We see this need asmission critical

- Agents and Customers want digital engagement. Data indicates that insurance companies areprioritizing this need with substantial desire to give each audience an online digital experience. Of those surveyed, 83% noted that they will be pursuing improvements for customer experience and 91% have a desire to advance the agent digital experience.

- Automation –37%, and Cost Savings 47%, remain important as the desire to keep technologyexpenses managed is paramount.

- Low code technologies remain important at 26% as enablers to modernization, but not as highof a priority as expected; 32% of those surveyed indicate wanting SaaS solutions, however we are noticing a significant concern over the cumulative effect of these SaaS solutions to technology budgets.

- Modernization and digital initiatives must focus on building the team. 53% of those surveyed believe these strategies require talent with different leadership and technical skills

How digitalization is improving the life insurance

Digitalization has brought significant improvements in the life insurance industry by increasing efficiency, personalization, transparency, and reducing fraud, among other benefits.

Some specific examples of how digital transformation is improving the life insurance sector include:

Accelerating Product Development:

digitalization in insurance industry makes it easier for life insurance companies to analyze customer data and better understand customer needs and preferences. This information can be used to develop tailored insurance products that meet those needs.

Digitization can also help life insurers with product development by streamlining internal processes and increasing efficiency.

Using digital tools like automation software and AI, carriers can reduce the time and cost involved in underwriting policies and managing claims, which can lead to faster product development and improved customer satisfaction.

Finally, digital transformation can help carriers innovate and experiment with new products and services. For example, leveraging emerging technologies such as blockchain and AI can help carriers create new insurance products that are more flexible, transparent, and responsive to customer needs.

Customer Consideration and Evaluation:

Using digital channels can help life insurers improve conversion and placement by making the customer acquisition process more efficient, personalized, and data driven.

Reducing Underwriting Complexity:

Digitalization helps insurers automate many of the tasks involved in underwriting, such as data collection, risk assessment, and policy issuance.

Life insurance companies are increasingly using AI and machine learning (ML) algorithms to automate their underwriting processes.

Automation reduces the complexity of manual underwriting and speeds up the overall process. It helps insurers to identify high-risk cases, offer personalized products and services, and reduce the time it takes to issue a policy.

Lastly, wearables such as smartwatches and fitness trackers provide insurers with real-time data about a customer’s health and lifestyle. Insurers can use this data to offer personalized policies and reduce the complexity of underwriting.

Easier Omni-Channel Communication:

Consumers expect a modern and easy buying experience on their own terms. This includes a seamless and integrated digital experience across multiple channels, such as websites, mobile apps, social media, email, and chatbots. Life insurers that embrace digital transformation are better positioned to improve customer satisfaction, increase retention rates, and reduce costs.

Chatbots can help customers with simple queries and escalate complex issues to human representatives as necessary. This can improve response times and reduce wait times for customers.

In addition, social media platforms such as Facebook, Twitter, and LinkedIn can be used by life insurers to engage with customers and prospects. Companies can share educational content, customer stories, and news updates on their social media pages. They can also use social media to provide customer service and address queries and complaints.

Mobile apps are also increasingly important, providing customers with easy access to policy information, claims processing, and other services. Life insurance companies use mobile apps to send notifications and alerts to customers, as well as to enable customers to file claims and track their status.

Predictive Analytics Helps Customer Retention and Cross-Selling:

Using data, statistical algorithms, and ML techniques, carriers can identify the likelihood of future outcomes based on historical data. This use of predictive analytics improves customer retention and cross-selling in several ways, including:

- Personalization of customer experience: With the help of predictive analytics, life insurers can analyze customer data to understand their needs and preferences. This allows them to offer personalized products and services, which in turn improves customer satisfaction and retention.

- Targeted marketing and cross-selling: Predictive analytics can also help life insurers to identify the best products to offer their customers based on their needs and preferences. By analyzing customer data, carriers can determine which products are likely to be of interest to a particular customer and then target them with personalized marketing campaigns. This can lead to increased cross-selling opportunities and higher customer lifetime value.

- Risk assessment and fraud detection: Predictive analytics can also help life insurance companies assess the risk associated with a particular customer and detect fraudulent activities. By analyzing customer data, life insurers can identify customers who are at a high risk of making fraudulent claims or those who are likely to lapse on their premium payments. This helps the company to take proactive measures to prevent fraud and improve risk management.

Conclusions

The digital age has generated significant change within life insurance companies. As stated in our report, complicating the digital journey is that digital technologies must integrate with legacy technologies found at most insurance companies. Most companies – 55% according to our survey, indicated that they are well into their journey, with another 40% indicating an intention to begin.

This dynamic presents a challenge to technologists who must modernize core platforms, while at the same time deploying leading edge digital capabilities that need to integrate with these legacy platforms. Agents and consumers are driving the pace of this change and are demanding a digital experience.

To meet these objectives, insurance executives should consider the following:

- Digital is a business priority. While it initially appeared to be a technical focus, insurancecompanies have come to realize that creating a digital insurance experience is a business model change, particularly given the importance of agents and distributors. Which is why the role of Chief Digital Officer emerged in prominence.

- There is a sense of urgency. A significant majority of respondents, at 85%, indicated thatgivingthe end user an online digital experience is critical to the success of our organization and business strategy.

- Business and technology strategies are inseparable: technology strategies were previouslydeemed separate but related to business strategies. This has shifted, whereas 47% of survey respondents recognize that business and technology strategies are inseparable. This connectivity is essential to a successful core modernization and digital strategy.

- Digital and core modernization programs are linked. Digital technologies must integrate withcore policy administration systems (ecosystem). As the survey results indicate, 69% believe that while digital and core modernization are linked, it is also important to decouple the two to allow for progress on the digital front. This is the challenge for technologists.

- Software vendors need to cater to complex ecosystems. The most sophisticated vendorsoffering digital solutions must have an open architecture that allows leading edge technologies to integrate with legacy technologies. This is often accomplished via API’s and allows companies to modernize the core over time but still enable leading edge digital solutions.

- Security matters. Software vendors and insurance carriers must focus on security. 58% ofsurvey respondents strongly agreed that effective security strategy is in place. 84% of the survey respondents felt comfortable with their overall security posture.

…………………..

AUTHORS: Don Desiderato – CEO and founder Mantissa Group, Mike Del Secolo – Strategic Advisor/CTO/CISO at Mantissa Group, Kevin Kelly – CIO, client services & delivery Mantissa Group