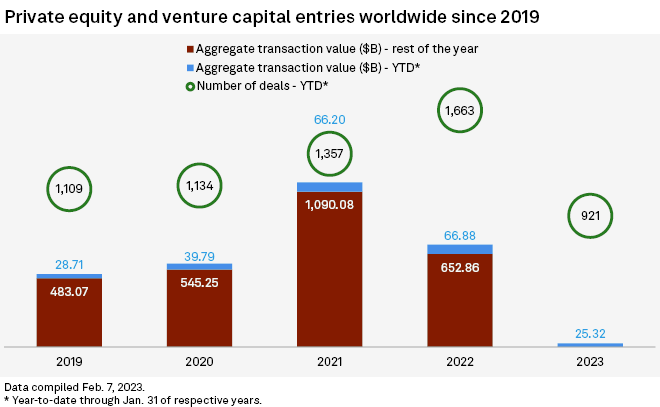

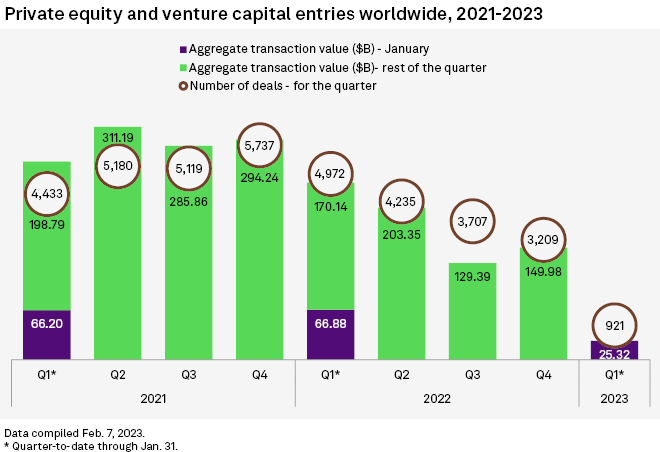

The volume and value of global private equity and venture capital entries got off to something of a weak start in January 2023, according to S&P Global Market Intelligence data.

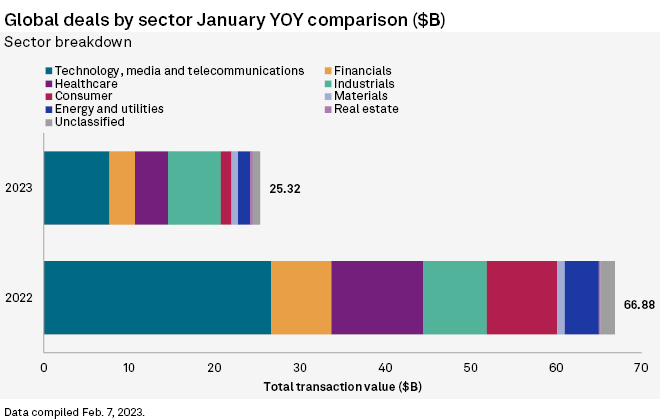

Deal value stood at $25.32 billion, down 62.1% year over year from $66.88 billion. Total entries were 921, representing a 44.6% decrease from 1,663 in January 2022.

Companies looking to raise capital can take out loans, issue stock or sell bonds. The private equity market offers an alternative to these more conventional methods of raising capital. In the past, the private equity market was often considered murky and difficult to access, but today the lure of private equity is attracting qualified businesses and investors alike.

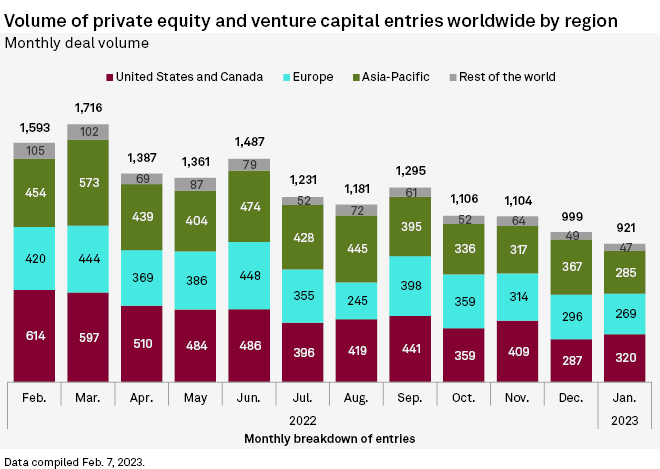

North America recorded the highest deal volume in January with 320 transactions, followed by Asia-Pacific with 285 deals and Europe with 269.

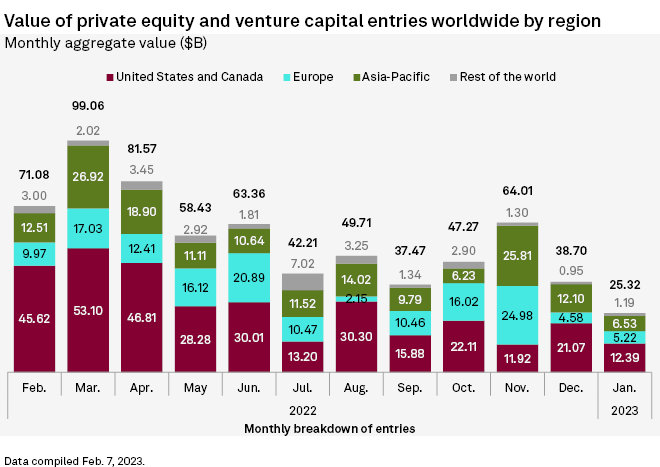

Monthly aggregate value for private equity and venture capital entries was also the highest for North America with $12.39 billion. Asia-Pacific ranked second with $6.53 billion, and Europe entries totaled $5.22 billion.

Top January deals

The largest private equity transaction for the month was Vista Equity Partners Management LLC’s agreement to acquire insurance technology provider Duck Creek Technologies Inc. from an investor group for $2.63 billion.

The investor group includes private equity firms Insight Venture Management LLC, Temasek Holdings Ltd., Dragoneer Investment Group LLC and Apax Partners LLP, along with Accenture PLC and Accenture LLP. The transaction is expected to close in the second quarter.

The second-largest announced deal was an offer made by Triton, through its buyout fund Triton Fund V LP, to acquire Finland-based service company Caverion Oyj for €1.1 billion. The offer period will expire on or about April 11, and the offer is expected to complete in the third or fourth quarter.

Cross-sector impact

Technology, media and telecommunications was the top sector by deal value in January, accounting for 30.4% of the total. The industrial and healthcare sectors followed, comprising 24.5% and 15.2% of the total, respectively. Deal value declined across nearly all sectors, except for real estate.

What is a private equity and venture capital?

Private equity (PE) is capital invested in a company that is not publicly listed or traded. Venture capital (VC) is funding provided to startups or other young businesses that show strong potential for long-term growth.

What is private equity in simple words?

Private equity (PE) refers to capital investment made into companies that are not publicly traded. Most PE firms are open to accredited investors or those who are deemed high-net-worth, and successful PE managers can earn millions of dollars a year.

Another way to define private equity is as a form of financing where public or private companies accept investments from a PE fund. Typically, private equity invests in mature businesses in more conventional industries in exchange for an equity stake in the company.

In the past, private equity funds haven’t always been regulated in the same way as other market participants. These days, however, they tend to be scrutinized more rigorously.

What is private equity vs venture capital vs hedge fund?

Private equity is for those who want to be more involved with their investments from a strategic / operational point of view. Hedge funds are for those introverts who love reading about the market and analyzing stocks. Venture capital is for those interested in tech / entrepreneurship.

How does private equity make money?

Private equity firms invest the money they collect on behalf of the fund’s investors, usually by taking controlling stakes in companies. The private equity firm then works with company executives to make the businesses — called portfolio companies — more valuable so they can sell them later at a profit.

How Does Private Equity Work?

PE funds often target a specific type of company based on where that company is in its lifecycle. For example, different private equity funds may specialize in younger firms with promising futures, well-established companies with reliable cash flows, or failing companies that need to be restructured.

In the latter scenario, a PE fund might buy out all the shares in a weak company with the goal of delisting the company, changing the management and improving its financial performance. The goal would be to sell it to another company or take it public again in an initial public offering (IPO).

Is private equity the same as M&A?

The two acquirer types operate along different and distinct approaches toward ownership: in acquisitions, private equity players act as professional investors, whilst industrial buyers operate in M&A transactions as organizational integrators.

Is private equity same as investment banking?

Private equity firms collect high-net-worth funds and look for investments in other businesses. Investment banks find businesses and then go into the capital markets looking for ways to raise money from the investment crowd.

…………………………

AUTHORS: Muhammad Hammad Asif, Annie Sabater – S&P Global Market Intelligence data

Fact checked by Oleg Parashchak