Worries about capital and adverse variable investment income are expected to be the focal points of discussion as life insurers report Q4 2022 earnings, according to S&P Global Market Intelligence analysis.

Capital concerns have emerged

Lincoln sustained a $2.6 billion net loss in the third quarter of 2022, driven by an approximately $2 billion charge related to updated lapse assumptions in its guaranteed universal life block.

Another potential area of focus may be life insurers’ interest maintenance reserves, or IMRs, where statutory accounting treatment of negative IMR balances has put downward pressure on industry capital and surplus in a rapidly rising rate environment.

The share of individual entities in the industry that reported a negative IMR balance could hit the highest levels since the global financial crisis based on developments through the third quarter and an expectation that interest rate hikes led to a similar result in the fourth quarter.

Meanwhile, investment income is likely to have been a headwind for life insurers in the fourth quarter of 2022 as well, it was driver of below-consensus earnings estimates for the period.

New accounting standard

Life insurance companies are also expected to reveal more about the impacts of a new accounting standard that many companies had to transition to as of Jan. 1, 2023.

The long-duration targeted improvements, or LDTI, accounting standard will significantly amend the accounting and disclosure requirements for long-duration insurance contracts.

Companies will be required to review and update cash flow assumptions used to measure the liability for future policy benefits for traditional and limited-payment contracts at least on an annual basis.

Some insurers have already released limited information about how LDTI will affect them. Prudential Financial, for instance, in its third-quarter 2022 Form 10-Q, said it expects the standard to have a “significant financial impact” on its consolidated financial statements (see about Impact of Inflation & Rising Interest Rates on Insurance Industry).

As of June 30, 2022, Prudential Financial said the new accounting standard would result in a decrease in retained earnings of between $2 billion to $3 billion and an increase to accumulated other comprehensive income, or AOCI, of approximately $3 billion to $8 billion.

More capital market intensive variable annuity writers will feel larger impacts to AOCI from LDTI than other life insurers.

In the U.S., Jackson Financial Inc., Equitable Holdings Inc. and Lincoln pulled in the largest amount of individual variable annuity sales through the first nine months of the year, according to LIMRA data.

Aflac Inc., Globe Life and Reinsurance Group of America are companies that will have higher earnings emergence under LDTI and have provided more disclosures than others.

Earnings set to slide YOY

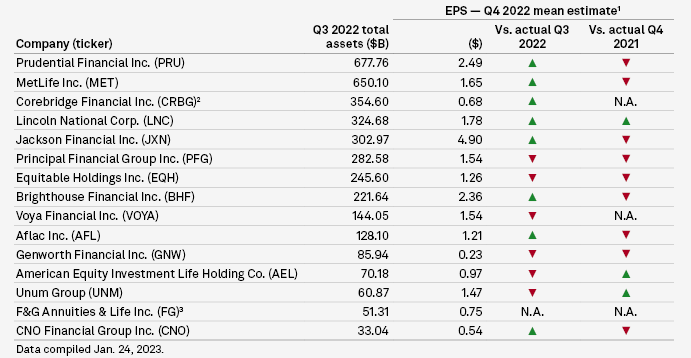

A majority of the top 15 publicly traded U.S. life insurers are projected to book year-over-year decreases in earnings for the fourth quarter of 2022, according to analyst estimates compiled by S&P Global Market Intelligence.

Only a small number of companies, including Unum Group, American Equity and Lincoln, are expected to record year-over-year earnings growth for the period (see Largest Life Insurance Companies in United States).

Analysts expect higher EPS sequentially for most US life insurers

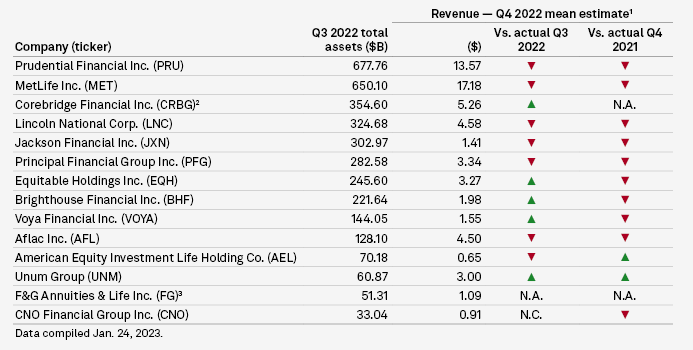

Most insurers in the group are also expected to post weaker revenue figures on a year-over-year basis, with the exception of Unum and American Equity Investment Life Holding.

US life insurers expected to log lower revenue

Investors and analysts will be watching American Equity closely this earnings season after it rejected a takeover bid from Prosperity Group Holdings LP and Elliott Investment Management LP in late December 2022, saying the $45-per-share proposal undervalued the company.

…………………..

AUTHORS: Hailey Ross and Kris Elaine Figuracion – S&P Global Market Intelligence’s Global Insurance team

Fact checked by Oleg Parashchak