Top 50 World’s Largest Reinsurance Groups — 2024 is based on global rating agency AM Best data and research. The reinsurance groups ranked by unaffiliated gross reinsurance premiums written.

Many of the reinsurance companies reported that a third to half of their premium growth could be attributed to pricing increases, as opposed to exposure growth.

Global reinsurance groups are cutting back on the cover they provide against medium-sized natural catastrophe risks due to investor pressure after several years of large catastrophe losses and improved profitability in other parts of the reinsurance market.

AM Best’s analysis indicates that the top global reinsurance groups experienced a nearly 17% reduction in shareholders’ equity due to rising interest rates, driving their available capital down from $475 bn to $411 bn.

With reinsurance gross premiums written of roughly $51.3 bn and net premiums writte of $48.6 bn, Munich Re tops the list of the world’s 50 largest reinsurers.

Swiss Re takes the 2nd spot, which the firm has held since being overtaken by Munich Re, with total reinsurance GPW of $39.8 bn and NPW of $37.3 bn. Hannover Re, remains in 3rd place with GPW of $35.5 bn and NPW of $29.7 bn, with year-on-year growth ensuring the top three has been the same for three consecutive years.

TOP 50 World’s Largest Reinsurance Groups

| Rank | Reinsurance Company | Life & Non-Life Re GWP | Life & Non-Life Re NWP |

|---|---|---|---|

| 1 | Munich Re | $51,331 | $48,550 |

| 2 | Swiss Re | $39,749 | $37,302 |

| 3 | Hannover Re | $35,528 | $29,672 |

| 4 | Canada Life Re | $23,414 | $23,414 |

| 5 | Berkshire Hathaway | $22,147 | $22,147 |

| 6 | SCOR | $21,068 | $17,055 |

| 7 | Lloyd's | $18,533 | $14,162 |

| 8 | China Re | $16,865 | $15,395 |

| 9 | Reinsurance Group of America | $13,823 | $13,052 |

| 10 | Everest Re | $9,316 | $8,983 |

| 11 | RenaissanceRe | $9,214 | $7,196 |

| 12 | PartnerRe | $8,689 | $7,544 |

| 13 | Korean Re | $7,804 | $5,797 |

| 14 | Arch Capital Group | $6,948 | $4,924 |

| 15 | MS&AD Insurance Group | $5,153 | N/A |

| 16 | General Insurance Corp of India | $4,519 | $4,108 |

| 17 | Sompo International | $4,119 | $3,715 |

| 18 | MAPFRE Rå | $3,849 | $3,273 |

| 19 | Assicurazioni Generali | $3,822 | $3,822 |

| 20 | Odyssey Re | $3,721 | $3,595 |

| 21 | AXA XL | $3,385 | $2,812 |

| 22 | R+V Versicherung | $3,158 | $3,158 |

| 23 | Validus Re | $3,080 | $2,529 |

| 24 | Pacific Life | $2,995 | $2,546 |

| 25 | The Toa Re | $2,931 | $2,397 |

| 26 | Liberty Mutual | $2,921 | $2,567 |

| 27 | Axis Capital | $2,629 | $1,885 |

| 28 | Peak Re | $2,295 | $1,758 |

| 29 | Taiping Re | $2,276 | $2,035 |

| 30 | Caisse Centrale de Reassurance | $2,206 | $2,007 |

| 31 | Qianhai Re | $1,841 | $740 |

| 32 | Aspen Insurance | $1,807 | $1,426 |

| 33 | QBE Insurance | $1,784 | $1,580 |

| 34 | Tokio Marine & Nichoda Fire Insurance | $1,656 | $1,321 |

| 35 | Deutsche Rueckversicherung | $1,610 | $1,096 |

| 36 | American Agricultural Insurance | $1,556 | $479 |

| 37 | SiriusPoint | $1,521 | $1,200 |

| 38 | IRB - Brasil Resseguros | $1,493 | $940 |

| 39 | Allied World Assurance | $1,492 | $1,388 |

| 40 | Convex Group | $1,492 | $1,139 |

| 41 | Markel Corp | $1,231 | $1,168 |

| 42 | Chubb | $1,095 | $943 |

| 43 | W.R. Berkley Corp | $1,081 | $997 |

| 44 | Core Specialty | $1,043 | $777 |

| 45 | Hiscox | $1,038 | $268 |

| 46 | Somers Re | $1,019 | $855 |

| 47 | African Re | $952 | $773 |

| 48 | DEVK Re | $848 | $759 |

| 49 | Lancashire | $842 | $629 |

| 50 | Nacional de Reaseguros | $737 | $610 |

Source: A.M. Best Company, Inc. and/or its affiliates. ALL RIGHTS RESERVED

While some reinsurers experienced pressure on their ratings due to disappointing operating performance, the overall balance sheet strength remained intact.

The prolonged period of low interest rates had previously maintained capital at comfortable levels for these reinsurers. In recent years, AM Best estimated that companies held 15% to 20% of capital above the minimum required to maintain their Capital Adequacy Ratio (BCAR) at the “strongest” level.

According to S&P Global, the largest reinsurance groups in the world, based on various financial metrics, are as follows:

- Munich Re (Germany): With net reinsurance premiums written totaling $48.7 billion, Munich Re tops the list. It also reported a pretax operating income of $1.6 billion and total adjusted shareholders’ funds of $25.3 billion.

- Swiss Re (Switzerland): Swiss Re follows closely, with net premiums of $43.9 billion, a pretax operating income of $654 million, and total adjusted shareholders’ funds of $12.7 billion.

- Hannover Re (Germany): This group recorded $32 billion in net premiums, $2 billion in pretax operating income, and $8.5 billion in total adjusted shareholders’ funds.

- Berkshire Hathaway Insurance Group (United States): Known for its diverse business operations, Berkshire Hathaway’s insurance group had net premiums of $22.1 billion and total adjusted shareholders’ funds of a staggering $272 billion.

- SCOR Group (France): With $17 billion in net premiums and $5.4 billion in total adjusted shareholders’ funds, SCOR is another major player in the reinsurance market.

- China Reinsurance (Group) (China): It reported net premiums of $15.5 billion and total adjusted shareholders’ funds of $13.7 billion.

- Lloyd’s (United Kingdom): Lloyd’s reported $14.3 billion in net premiums and holds significant total adjusted shareholders’ funds of $47.6 billion.

- Reinsurance Group of America (United States): They reported net premiums of $13.1 billion and total adjusted shareholders’ funds of $4.1 billion.

- Everest Group (Bermuda): Everest Group had net premiums of $12.3 billion and total adjusted shareholders’ funds of $10 billion.

- PartnerRe Ltd. (Bermuda): They recorded $7.5 billion in net premiums and total adjusted shareholders’ funds of $6.3 billion.

This ranking gives a snapshot of the major players in the global reinsurance market as of 2024, based on their financial performance and scale.

The reinsurance industry is dynamic, and these positions can change with new financial data and market developments.

For the most current information on the rankings and financial performance of these groups for 2024, it would be advisable to consult the latest reports and financial statements issued by these companies or relevant financial news and analysis sources.

TOP 45 World’s Largest Non-Life Reinsurance Groups

| Rank | Reinsurance Company | Non-Life Re GWP | Non-Life Re NWP |

|---|---|---|---|

| 1 | Munich Re | $36,729 | $35,290 |

| 2 | Hannover Re | $25,884 | $21,637 |

| 3 | Swiss Re | $23,763 | $22,826 |

| 4 | Lloyd's | $18,533 | $14,162 |

| 5 | Berkshire Hathaway | $16,962 | $16,962 |

| 6 | SCOR | $10,695 | $8,782 |

| 7 | Everest Re | $9,316 | $8,983 |

| 8 | RenaissanceRe | $9,214 | $7,196 |

| 9 | China Re | $7,688 | $7,207 |

| 10 | PartnerRe | $7,015 | $5,899 |

| 11 | Arch Capital Group | $6,948 | $4,924 |

| 12 | Korean Re | $6,129 | $4,195 |

| 13 | MS&AD Insurance Group | $5,153 | N/A |

| 14 | General Insurance Corp of India | $4,332 | $3,927 |

| 15 | Sompo International | $4,119 | $3,715 |

| 16 | Odyssey Re | $3,721 | $3,595 |

| 17 | AXA XL | $3,385 | $2,812 |

| 18 | MAPFRE Rå | $3,201 | $2,631 |

| 19 | R+V Versicherung | $3,158 | $3,158 |

| 20 | Validus Re | $3,080 | $2,529 |

| 21 | Liberty Mutual | $2,921 | $2,567 |

| 22 | Axis Capital | $2,629 | $1,885 |

| 23 | Peak Re | $2,113 | $1,587 |

| 24 | The Toa Re | $2,090 | $1,661 |

| 25 | Caisse Centrale de Reassurance | $2,002 | $1,813 |

| 26 | Aspen Insurance | $1,807 | $1,426 |

| 27 | QBE Insurance | $1,784 | $1,580 |

| 28 | Taiping Re | $1,763 | $1,545 |

| 29 | Tokio Marine & Nichoda Fire Insurance | $1,656 | $1,321 |

| 30 | American Agricultural Insurance | $1,556 | $479 |

| 31 | SiriusPoint | $1,521 | $1,200 |

| 32 | Deutsche Rueckversicherung | $1,517 | $1,043 |

| 33 | Allied World Assurance | $1,492 | $1,388 |

| 34 | Convex Group | $1,423 | $1,139 |

| 35 | Assicurazioni Generali | $1,372 | $1,372 |

| 36 | IRB - Brasil Resseguros | $1,284 | $758 |

| 37 | Markel Corp | $1,230 | $1,167 |

| 38 | Chubb | $1,095 | $943 |

| 39 | W.R. Berkley Corp | $1,081 | $997 |

| 40 | Core Specialty | $1,043 | $777 |

| 41 | Hiscox | $1,038 | $268 |

| 42 | Somers Re | $1,019 | $855 |

| 43 | African Re | $861 | $695 |

| 44 | Lancashire | $842 | $629 |

| 45 | DEVK Re | $841 | $752 |

Source: A.M. Best Company, Inc. and/or its affiliates. ALL RIGHTS RESERVED

Reinsurers play a fundamental role in the global insurance ecosystem by providing the necessary risk transfer solutions that help direct insurers manage their exposure and maintain solvency. The capacity, financial stability, and expertise of these reinsurance giants enable them to support insurance companies across a wide range of risks, from natural catastrophes to complex liability scenarios.

The reinsurance sector combined ratio to be about 96% for 2024, though it observes that sustained high inflation and the effects of climate change can make claims trends less predictable.

Adverse trends in loss activity have pressured reinsurers’ results the last few years, as many have failed to generate returns that meet their cost of capital, testing investors’ risk tolerance (see Reinsurance Renewal by Regions).

The property reinsurance market had benefitted from an abundance of capital and participants in recent years. Competitive forces and a lack of catastrophic events in prior periods led to lower cedent retentions and loosened up terms and conditions.

Property lines may face margin pressure if prices do not keep up with repair and construction costs while long-tail casualty lines could meet reserve deficiencies, which in severe cases could weaken reinsurers’ capital.

Premium rate increases have accelerated in 2024 after a slowdown during the January renewal, with property premiums having increased the most in response to the effects of high inflation, more frequent natural catastrophes, and the war in Ukraine.

Property premium rates to rise further in 2024 as high inflation and climate change continue to push up claims. In contrast, casualty premium rates are likely to remain stable as casualty business benefits from a higher reinsurance capital allocation. As climate change increases the likelihood of more severe natural catastrophe events, there may be rising costs for the industry and increasingly volatile earnings.

More reinsurers to reduce their property-catastrophe exposure or even to cease cover, moving the industry closer to a true hard market where demand will not be fully met.

The four main European reinsurers, Hannover Re, Munich Re, SCOR SE and Swiss Re, all reported very strong results with returns on capital significantly surpassing their cost of capital.

This is in contrast with 2023 when higher interest rates generated significant mark-to-market losses on investments.

Profits in life reinsurance returned to pre-pandemic levels thanks to significantly lower excess mortality claims linked to the coronavirus pandemic. Investment income also recovered from comparatively low levels recorded as equity markets performed well and interest rates stabilised on high levels.

High natural catastrophe claims, write-downs on equity investments and the strengthening of reserves due to high claims inflation were the drivers of the deterioration in earnings. Life and health reinsurance showed a stronger technical result at all four peers, partly due to lower Covid-19-related mortality claims.

All reinsurers benefitted from higher prices in non-life reinsurance and most reported double-digit premium growth.

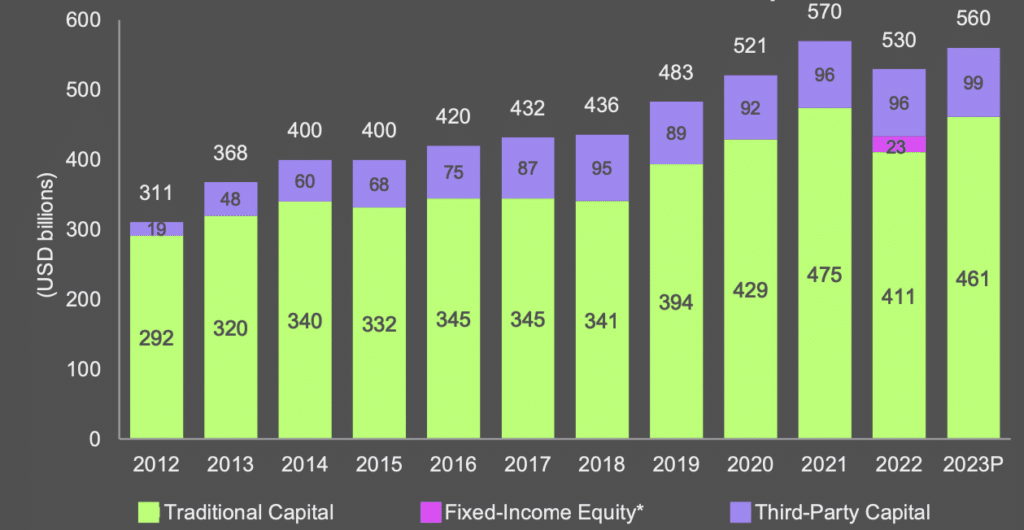

Global reinsurance – estimated dedicated reinsurance capital

Natural Catastrophe, Equity Write-Downs and Inflation Burden Earnings All four reinsurers were hit to various degrees by Hurricane Ian in the US, one of the costliest ever loss events, and reported natural catastrophe claims above budgets.

Reserve strengthening due to rising claims inflation and loss creep put additional strain on combined ratios at SCOR and Swiss Re. Write-downs on equity investments, in particular, depressed investment income at Munich Re and Swiss Re and could not be fully offset by rising reinvestment yields.

Underwriting results should remain favourable as rate increases stay ahead of loss cost trends. Non-life reinsurance net premiums written (NPW) grew by 9.8% year on year.

NPW growth is likely to continue, but at a slower pace as price increases fade and a potential recession dampens exposure growth. However, higher inflation will serve to boost premiums through increased exposure values in such lines as general liability, workers’ compensation and property.

The life and health reinsurers reported a lower USD1.6 billion of mortality losses from the pandemic. Losses were at the lowest level since the start of the pandemic as insured deaths have declined.

Life and health reinsurance net premiums earned (NPE) increased at six of the eight companies. Shareholders’ equity declined 22.2% as underwriting gains were more than offset by net unrealised investment losses on bonds as interest rates rose and equities as markets slumped.

……………………

Edited & fact-checked by Oleg Parashchak – Editor-in-Chief Beinsure Media, CEO Finance Media Holding.