Global reinsurance groups are cutting back on the cover they provide against medium-sized natural catastrophe risks due to investor pressure after several years of large catastrophe losses and improved profitability in other parts of the reinsurance market.

According to Fitch Ratings research, some reinsurance companies were already retreating from the property-casualty market in 2022 but even the strongest reinsurers have now pulled back, largely through tightening their terms and conditions to limit their aggregate covers and low layers of natural catastrophe protection.

Insured losses from major natural catastrophes in 1H2023 has estimated $23 bn, included $7 bn from the US storms during the month of June, which analysts estimate to be the largest contributor to natural catastrophe losses for the quarter.

This leaves primary insurers much less protected against secondary peril events. However, reinsurers still offer ample cover against the most severe events (see Global Insured Losses from Natural Catastrophes: Perspective & Trends).

The reinsurance market appears to have returned to its pre-soft market state of providing capital protection for cedents, rather than earnings protection.

Underwriting results global reinsurance companies

Underwriting results at global reinsurance companies should remain favourable in 2H2023 and 2024 as rate increases stay ahead of loss cost trends.

After non-life reinsurers posted slightly improved underwriting profitability in 1H2023 compared to 1H2022, with manageable losses from catastrophes.

The 18 non-life reinsurers monitored by Fitch reported strong underwriting profitability in 1H2023, with an aggregate reinsurance combined ratio (claims and expenses to premiums) of 88% (1H2022: 89.4%).

This was driven by the above-claims-inflation price increases in many business lines, as well as the lower natural catastrophe burden as cedents retained more of the losses themselves. The aggregate ratio included moderate losses of 6.7pp from natural catastrophes (see Natural Catastrophes Drivers and Lessons for Insurance Industry).

Non-life reinsurance net premiums grew by 7% in 1H2023 from 1H2022. Premium growth is likely to continue, but at a reduced pace as price increases decline and a potential recession dampens exposure growth.

However, higher inflation has boosted premiums through higher insured values. Life and health reinsurers profitability improved as interest rates rose and pandemic losses diminished.

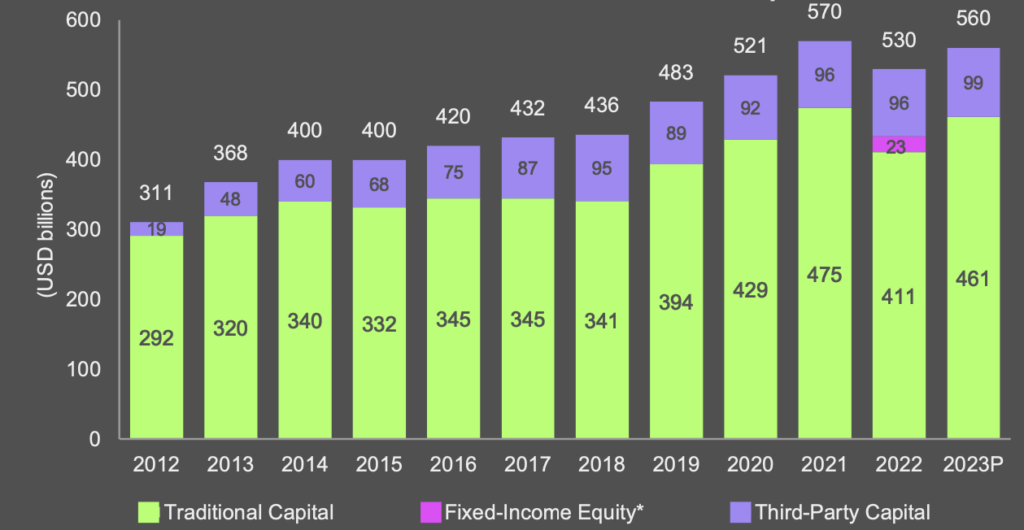

Analysis indicates that the top global reinsurance groups experienced a nearly 17% reduction in shareholders’ equity due to rising interest rates, driving their available capital down from USD 475 billion to USD 411 billion.

TOP 20 Largest Reinsurance Groups

| Rank | Reinsurers | Reinsurance GWP, mn | Reinsurance NWP, mn |

| 1 | Munich Re | $51,331 | $48,550 |

| 2 | Swiss Re | $39,749 | $37,302 |

| 3 | Hannover Re | $35,528 | $29,672 |

| 4 | Canada Life Re | $23,414 | $23,414 |

| 5 | Berkshire Hathaway | $22,147 | $22,147 |

| 6 | SCOR | $21,068 | $17,055 |

| 7 | Lloyd’s | $18,533 | $14,162 |

| 8 | China Re | $16,865 | $15,395 |

| 9 | Reinsurance Group of America | $13,823 | $13,052 |

| 10 | Everest Re | $9,316 | $8,983 |

| 11 | RenaissanceRe | $9,214 | $7,196 |

| 12 | PartnerRe | $8,689 | $7,544 |

| 13 | Korean Re | $7,804 | $5,797 |

| 14 | Arch Capital Group | $6,948 | $4,924 |

| 15 | MS&AD Insurance Group | $5,153 | N/A |

| 16 | General Insurance Corp of India | $4,519 | $4,108 |

| 17 | Sompo International | $4,119 | $3,715 |

| 18 | MAPFRE Rå | $3,849 | $3,273 |

| 19 | Assicurazioni Generali | $3,822 | $3,822 |

| 20 | Odyssey Re | $3,721 | $3,595 |

Shareholders’ equity grew 8.6% in 1H2023 from end-2022 due to increased underwriting gains and positive investment results.

Global reinsurance – estimated dedicated reinsurance capital

The decline was primarily attributed to unrealised investment losses on fixed-income holdings, which comprise over 60% of the average investment portfolio.

Although equity holdings were also impacted, constituting less than 8% of the portfolio, they have shown partial recovery in the first half of 2023.

Reinsurers are benefiting from a rebound in equity markets and higher reinvestment rates from the rise in interest rates, while unrealised investment losses on fixed maturities lessen with most bonds likely to be held until maturity.

European Reinsurers Results

The four main European reinsurers, Hannover Re, Munich Re, SCOR SE and Swiss Re, all reported very strong 1H2023 results with returns on capital significantly surpassing their cost of capital. This is in contrast with 1H2022 when higher interest rates generated significant mark-to-market losses on investments.

Price increases above claims inflation and better terms and conditions for property & casualty have led to better underwriting margins on average.

Profits in life reinsurance returned to pre-pandemic levels thanks to significantly lower excess mortality claims linked to the coronavirus pandemic. In 1H2023, investment income also recovered from comparatively low levels recorded in 1H2022 as equity markets performed well and interest rates stabilised on high levels.

Recurring investment income rose while (un)realised investment losses declined (see Global Insurance Market Premiums & Rates Forecast for 2023-2024).

TOP 20 European Re/Insurers

| Rank | Companies | Country | Turnover, mn $ |

| 1 | AXA | France | 106 340 |

| 2 | Allianz | Germany | 100 547 |

| 3 | Assicurazioni Generali | Italy | 87 041 |

| 4 | Munich Re | Germany | 71 664 |

| 5 | Zurich Insurance Group | Switzerland | 58 848 |

| 6 | Talanx (HDI Group) | Germany | 57 037 |

| 7 | Lloyd’s | United Kingdom | 56 318 |

| 8 | Chubb | Switzerland | 52 013 |

| 9 | Swiss Re | Switzerland | 47 889 |

| 10 | CNP Assurances | France | 38 483 |

| 11 | Crédit Agricole Assurances | France | 37 712 |

| 12 | BNP Paribas Cardif | France | 32 025 |

| 13 | Mapfre | Spain | 26 196 |

| 14 | Prudential | United Kingdom | 23 344 |

| 15 | Aviva | United Kingdom | 22 813 |

| 16 | Achmea B.V. | Netherlands | 22 511 |

| 17 | SCOR | France | 21 064 |

| 18 | Covéa | France | 20 367 |

| 19 | R+V Versicherung AG | Germany | 19 962 |

| 20 | Poste Italiane | Italy | 18 700 |

Life and health reinsurance operations

The group of life and health reinsurance operations tracked by Fitch reported a 24% increase in 1H23 pre-tax income driven by increased investment income from higher interest rates and lower COVID-19 claims.

Meanwhile, profits in life reinsurance returned to pre-pandemic levels thanks to significantly lower excess mortality claims linked to the pandemic, and investment performance benefited significantly from a rebound in equity markets and higher reinvestment rates as interest rates stabilised at higher levels.

Natural catastrophe reinsurance business

Natural catastrophe business has become largely loss-making in recent years as prices have failed to keep pace with increasingly frequent, severe and volatile weather-related losses due to climate change.

NatCat has reduced reinsurers’ appetite to provide natural catastrophe cover, particularly as other business lines are now benefitting from price rises that are higher than claims inflation.

Tighter terms and conditions for natural catastrophe cover are a structural improvement that should benefit reinsurers’ risk profiles in the medium term as they are unlikely to be quickly reversed even when market conditions change.

There were insured natural catastrophe costs of USD53 billion globally in 1H2023, which is 47% above the 20-year average, according to the broker Aon.

Reinsurance price rises

Reinsurance price momentum continued during the June and July 2023 renewals. US property-catastrophe markets had the largest price rises, with 30%-75% increases for loss-hit business and 10%-40% for loss-free business.

Reinsurance premium rates for casualty lines were broadly stable, reflecting the greater capacity allocated to them.

Fitch expects reinsurers to maintaining strong underwriting discipline despite higher interest rates and for reinsurance market hardening to persist into 2024.

However, price increases are likely to be more moderate than in 2023 as rate adequacy has generally been reached through several rounds of hardening since 2018.

……………………

AUTHORS: Brian Schneider, CPA, CPCU, ARe – Senior Director Fitch Ratings, Robert Mazzuoli – Director Fitch Ratings, David Prowse – Senior Director Fitch Wire