Property reinsurance rates rose significantly at the January 2023 renewals. The losses from Hurricane Ian last year were a contributory factor, but signals for a market correction had already been mounting.

According to Swiss Re sigma records, the re/insurance industry has experienced poor underwriting results following the step-up in natural catastrophe loss severity since 2017, new risk drivers and fallouts from the pandemic and war in Ukraine, including inflation raising the value of insured property assets.

The elevated natural catastrophe insured losses of the past six years reaffirm the 5‒7% uptrend in average annual losses established over the last 30 years. We expect the trend to continue.

The growth has been and will be largely driven by rising loss severity of individual catastrophes. This is the result of rising exposures that comes alongside economic development, urbanisation, and population growth, often in areas exposed to natural hazards.

Demand for catastrophe-related insurance has risen on evidence of more peril activity since 2017. This is one factor behind today’s hard market in re/insurance.

So too are the geopolitical and economic storms the world faces. In particular, fallout from the decade long zero-to-negative interest rate environment, the pandemic, and war in the Ukraine has included high inflation and rising costs in the construction sector in 2022.

This has increased the value of insured property assets and associated claims for damage caused by weather and other events. High inflation rates have also had financial market impacts given the need for central banks’ to hike policy rates rapidly.

Uncertainties around modeling discipline and the adequacy of premium levels to deal with increasing loss costs and emerging secondary perils have led to reduced risk appetite on the part of providers of capital.

So too have the recent interest rate hikes, which have increased the cost of capital. When higher exposures encounter shrinking risk appetite, rising prices, higher retentions and tighter terms and conditions result. But even with the market reset in January, some reinsurers and investors in the sector will likely wait for signs of improved industry profits before materially replenishing capacity again.

Re/insurance underwriting cycle

Reinsurance rates have been rising since 2018. The momentum picked up at the January 2023 renewals, with global risk-adjusted property catastrophe rates up 20‒50% for loss-free portfolios and up to 100% for loss-hit.

The re/insurance underwriting cycle is characterised by periods of soft (falling/stable premium rates, coverage readily available) and hard (rising rates, cover less available) market conditions.

The driver is re/insurer competition, affected by claims trends, interest rates, industry capital and catastrophe losses. Swiss Re attribute most of the current step up in prices to uncertainty around claims trends and the effect of inflation and interest rates on industry capital and demand.

Risk appetite and alternative sources of capital affect overall capacity and the speed with which prices adjust to updated risk assessments (see Why US Property Catastrophe Reinsurance Rates Up?).

Recent underwriting experience affects the supply of existing industry capital and also influences expectations of future profits, both of which affect capacity decisions.

Main drivers of the underwriting cycle

The current hard market is a textbook case of shifting demand and supply, with the market seeking a new equilibrium.

Demand for coverage had risen on evidence of increased natural catastrophe activity since 2017 and because of higher insurable values of buildings and other fixed assets.

At the same time, natural catastrophe claims pay outs have reduced supply of capital. Supply has also fallen in response to rising interest rates and lower financial asset values.

Lending further momentum to the supply-demand dynamic, risk appetite has decreased due to poor property re/insurance underwriting results in recent years, and widely held perceptions that risk assessments are underestimating actual loss experience.

This is – apart from financial market uncertainty and rising interest rates – leading to hesitation on the part investors in insurance-linked securities (ILS) and traditional reinsurers to commit new funds to replenish industry capital.

After six years of weak underwriting results, property re/ insurance capacity providers have become more cautious.

Some traditional players have reduced cat exposures, and alternative capital providers are waiting for evidence that pricing better aligns with loss experience.

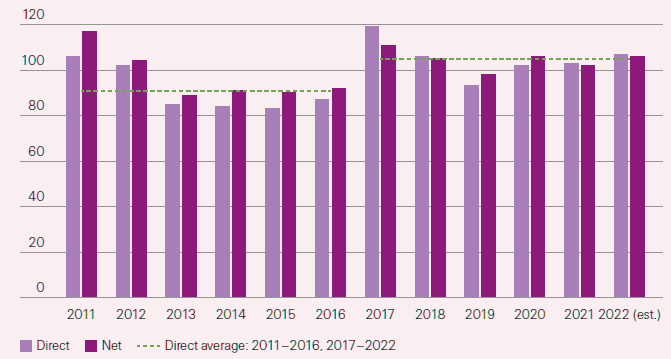

Premium income in property catastrophe has lagged exposure growth

Since 2017, the re/insurance industry has paid out USD 650 billion (in 2022 prices) for weather-related natural catastrophes claims. However, premium income has not kept pace with events or exposure growth – whether proxied by GDP or more targeted measures – the result being steadily declining profits.

Natural catastrophe losses affect industry capacity directly; while making societies financially more resilient, the payments to policyholders reduce profitability and capital supply.

They also have indirect impact as re/insurers and investors update risk assessments. Perceptions about whether risks are priced adequately is key in determining the supply of capital and capacity available for underwriting.

The historically elevated catastrophe and claims activity since 2017 has created doubts on the part of re/insurers and investors, and slowed the capital supply response.

Profitability (return on equity) of primary insurers vs reinsurers

The increases in loss severity in recent years and new risk drivers had a strong impact on the recent renewals. Accurately quantifying and pricing for shifts in the exposure landscape and underlying loss distributions is key to maintaining the insurability of natural catastrophe risks.

After six years of elevated losses and with gaps in exposure data, however, there is scepticism that existing models fully capture the risks.

The wide range of loss drivers, uncertainties and macroeconomic pressures described in Section 2 must be better understood if the re/insurance industry is to collect sufficient premiums for the risks it assumes.

The re-pricing of property risks at the January 2023 renewals is a clear sign that past prices did not capture the recent loss dynamic.

New risk drivers has materially affected exposure values

The unanticipated surge in economic inflation over the last two year to levels not seen in four decades was a catalyst for the step-up in prices at the latest reinsurance renewals. Inflation has the effect of raising the value of insurable assets and in turn, also claims.

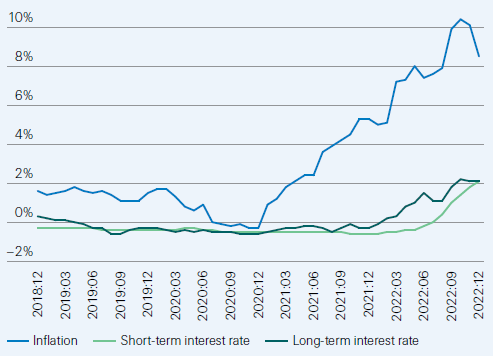

After rarely passing the 2% threshold targeted by most monetary authorities in the previous decade, in 2021 inflation in advanced markets rose to 3.1%, driven by pandemic-related issues such as supply chain disruptions.

In 2022, it averaged 7.1%, with the war in Ukraine driving food and energy prices to new highs. In emerging markets, inflation reached 9% last year, also driven by food and energy prices.

Inflation, 2011‒2024

Since the start of the pandemic, property insurance exposures – the nominal value of buildings, motor vehicles, and other fixed assets that insurers cover – have grown faster than headline inflation and real GDP growth.

The fastest rising prices have been in sectors such as construction and vehicle sales, directly impacting claims costs in some of the largest lines of insurance.

In the US, for instance, the replacement cost of all privately-owned structures increased by an estimated 40% between year-end 2019 and 2022, well above a near-20% increase in nominal GDP.

Increases in litigation-driven social inflation indicate the applicable inflation rate for claims costs could be even higher than the relevant economic indices.

Rising costs in the construction sector

One of the first indications of surging inflation was in the construction sector when lumber prices rose in the summer of 2020 because of supply-chain disruptions and rising demand for new homes, renovations and do-it-yourself projects during lockdowns.

From May to September 2020, lumber prices in the US were up 57% and they remained volatile over the following two years. They settled at a level around one third higher than before the first price surge.

The share of lumber and other materials in property claims varies significantly by line of business, geography and catastrophe exposure, but the overall cost of construction has risen significantly.

For instance, today construction materials in the US are more than 40% higher since the beginning of 2020, and 20% higher in Europe. The increase in the cost of materials, components and also labour is driving property replacement costs higher, which in turn feeds through into higher homeowner and commercial property claims.

Price inflation in the construction market has caused difficulties for property underwriters, and the general surge in economic inflation of the last two years started by the pandemic has extended uncertainties around risk assessment to more lines of business.

Swiss Re Institute forecasts ongoing elevated inflation in cost components relevant for property insurers, and that this could lead to a marked increase in claims in 2023 and, in turn, reinsurance rates.

Even if inflation abates in 2024, cost levels will not go back to pre-pandemic times but remain at elevated levels.

US property insurance exposure, claims and premiums

US property insurance business is under earnings pressure. Annual natural catastrophe property claims averaged USD 83 billion in 2017‒2022, a more-than-doubling of average annual pay outs in the previous six years.

The average share of natural catastrophe-related losses of all property claims rose from 20% to 35%, mainly driven by a step-up in annual loss severity since 2017.

Since 2019, so too has been an increase in the replacement value of buildings and equipment sparked by the pandemic-induced surge in inflation (see Impact of Social Inflation for P&C Insurance & Commercial Auto Insurance). The replacement value of the net stock of private structures in the US was an estimated USD 53.5 trillion in 2022, up around 40% from 2019.

Since 2011 the replacement cost of private structures has grown by 6% annually compared to 5% for property lines premiums. The outcome is that even with market hardening in primary commercial property since 2019, premiums have lagged replacement cost increases.

Exposure and premium growth, US property

Underwriting experience indicates that pricing has also lagged natural catastrophe losses and replacement values.

Between 2011 and 2016, the combined ratios for US property lines averaged 91%, while from 2017‒2022 they averaged 105%.

Based on 2022 US property premiums of USD 200 billion, the profitability gap amounts to extra annual losses of nearly USD 30 billion, or 3‒5% of industry ROE. Returning to underwriting profitability in US property will require continued underwriting discipline alongside a reassessment of the underlying risks.

Combined ratios, US property lines (Fire, Allied, Homeowners)

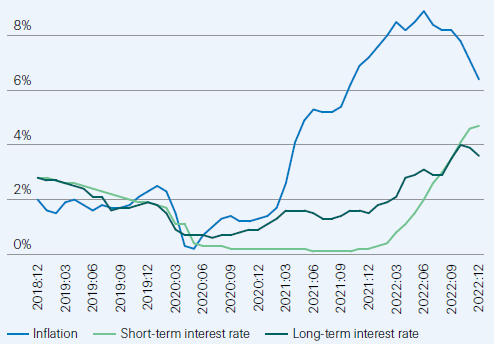

High economic inflation has impacted exposures and demand for coverage directly. The supply-side impact has been indirect. Rising prices led to decisive monetary policy action by the US Federal Reserve (Fed) and many other central banks.

In 2022, the Fed, Bank of England (BoE), European Central Bank (ECB) and other central banks raised short-term policy rates from zero (or near-zero) to 4.375% (Fed), 3.5% (BoE) and 2.5% (ECB). Long-term interest rates also moved up considerably.

Inflation and interest rates in the US

Inflation and interest rates in the Germany

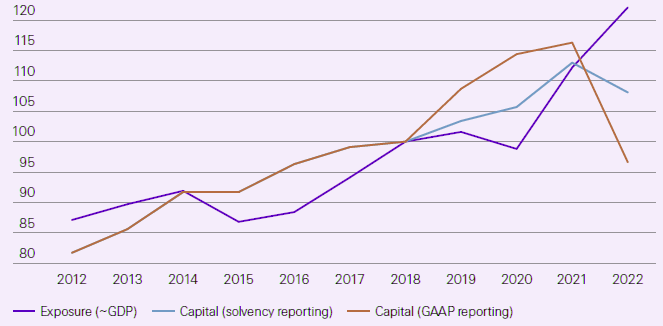

One effect of the higher interest rates has been a decline in financial asset values and more specifically shareholder equity. This has had immediate impact on re/insurers, whose fixed income portfolios have suffered significant mark-to-market losses.

The global bond index was down 16% in 2022, and global equity markets also declined. The combined effect on reinsurer balance sheets – where invested assets are typically 3-4 times equity – was significant.

By the end of 2022, reinsurance capital (traditional and alternative) had declined by around 20‒25% from year-end 2021.

Global reinsurance capital vs exposure growth

Hurricane Ian did not spark a significant influx of capital

Historically, large catastrophe events have sparked a significant influx of fresh capital. But this did not happen after Hurricane Ian.

As of January 2023 an estimated USD 3.3 billion (ie, less than 1% of current reinsurance capital of more than USD 400 billion) of capital had been raised after Hurricane Ian.

This is much lower than in 2020, when reinsurers and a few new players raised close to USD 15 billion of capital as prices rose, or the surge of alternative capital (AC) between 2012 and 2018 in the phase of benign natural catastrophe years.

ILS and other forms of AC offer a quick supply response and now provide most of the retrocession market.

However, growth in AC has stalled since 2018 after the high claims that hurricanes Harvey, Irma and Maria in 2017 sparked, and above-average catastrophe loss years since.

ILS structures have become more exposed to loss creep and coverage disputes, and investors are hesitant to commit fresh capital to natural catastrophe risks ahead of what could be another heavy-loss year, with economic inflation adding to valuation and pricing uncertainty.

Reinsurers and investors will likely wait for signs of improved sector profitability

When higher exposures encounter shrinking risk appetite, the expected outcome is rising prices, higher retentions and tighter terms and conditions.

The pricing correction in January 2023 is a source of optimism for the re/insurance industry.

However, the prospect of still-elevated catastrophe losses and constrained capacity come as geopolitical, economic and environmental uncertainties remain omnipresent.

These include loss uncertainty in specialty lines related to the war in Ukraine, the threat of a systemic cyber event, and the prospect of a renewed surge in COVID-19.

With risks still elevated and higher interest rates raising returns elsewhere, we expect some reinsurers and ILS investors will wait to see proof in re/insurance industry profits before materially increasing capacity.

The January 2023 renewals saw a long overdue re-pricing of risks before the background of increasing challenges to correctly capture the fast-moving risk landscape, capacity constraints and higher hurdle rates in a new interest rate environment.

Market discipline is required for pricing to remain oriented to long-term exposure developments. With this, the insurance industry is best placed to fulfil its role as enabler of economic growth and financial resilience.

Reinsurance Underwriting FAQs

What is the result of reinsurance?

Reinsurance reduces the net liability on individual risks and catastrophe protection from large or multiple losses. The practice also provides ceding companies, those that seek reinsurance, the capacity to increase their underwriting capabilities in terms of the number and size of risks.

What is the objective of reinsurance underwriting?

The purpose of reinsurance is to spread large risks and catastrophes over as large a base as possible. It is the assumption by one insurance company (the reinsurer) of all or part of a risk undertaken by another insurance company (the cedent).

How does reinsurance underwriting work?

Reinsurance occurs when multiple insurance companies share risk by purchasing insurance policies from other insurers to limit their own total loss in case of disaster. By spreading risk, an insurance company takes on clients whose coverage would be too great of a burden for the single insurance company to handle alone.

What are the objectives of reinsurance?

Distribution of risk to ensure the coverage of a claim. It provides a great level of stability for underwriting in the period of the claim. The financial obligation out of the capacity of the insurance company is outsourced to another company having such capacity.

What is the nature of reinsurance risk?

Reinsurance risk refers to the inability of the ceding company or the primary insurer to obtain insurance from a reinsurer at the right time and at an appropriate cost. The inability may emanate from a variety of reasons like unfavourable market conditions, etc.

What are the 5 importance of reinsurance?

Several common reasons for reinsurance include: 1) expanding the insurance company’s capacity; 2) stabilizing underwriting results; 3) financing; 4) providing catastrophe protection; 5) withdrawing from a line or class of business; 6) spreading risk; and 7) acquiring expertise.

…………………

AUTHORS: Lucia Bevere – Senior Catastrophe Data Analyst Swiss Re Institute, Thierry Corti – Climate Change Lead Swiss Re Institute, James Finucane – Senior Economist Swiss Re Institute, Roman Lechner – P&C Economic Research Lead Swiss Re Institute