Moody’s predicts a 2024 stable outlook for the insurance brokerage sector, underpinned by constructive global economic growth, a favourable commercial property & casualty (P&C) rate environment, and stable EBITDA margins.

Organic growth is to remain in the mid-single digits or higher as economic growth stabilises and P&C rate increases moderate.

Favourable P&C pricing in most lines of business, further growth in insurable exposures, strong client retention and new business generation will also support organic revenue growth in the mid-single digits or higher in 2024.

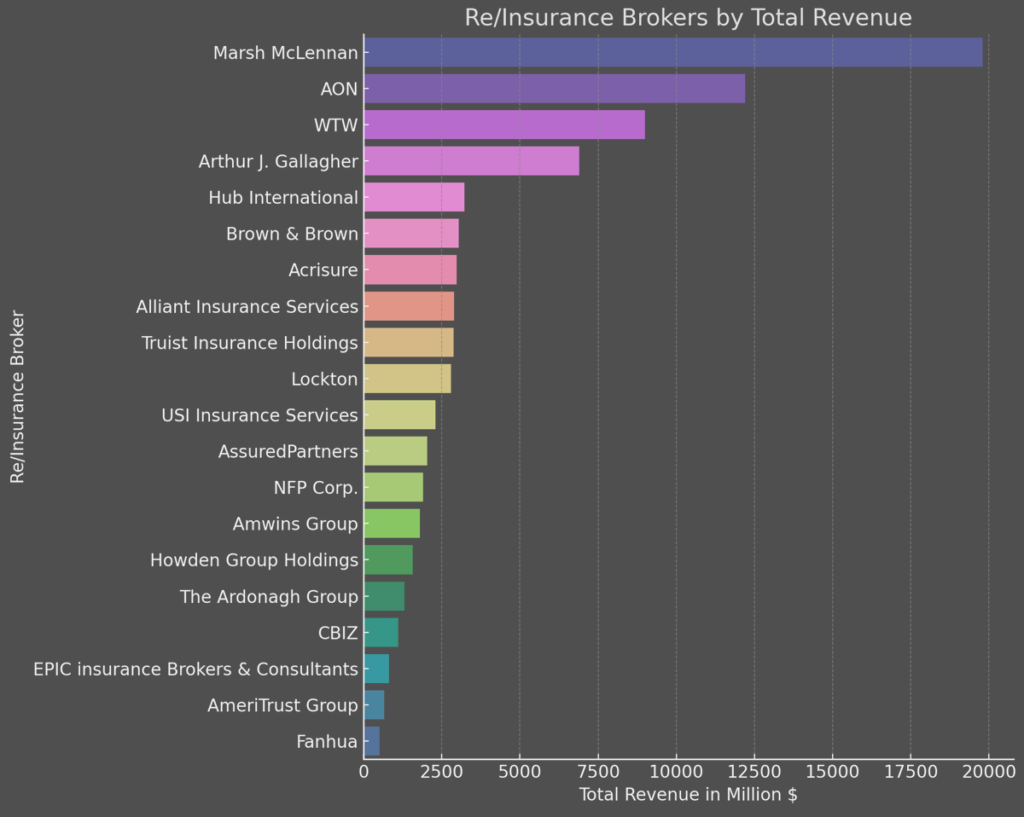

Marsh McLennan retains the #1 spot in Best’s Review’s Top Global Insurance Brokers ranking 2024 with $19.8 bn in total revenues, $7.6 bn ahead of second-place AON. The expected Aon/WTW combination deal that would have substantially affected this year’s brokers ranking was scuttled last July after regulatory involvement, according to A.M. Best data.

Global insurance and reinsurance brokers play a pivotal role in the insurance industry, serving as intermediaries that facilitate the placement of insurance and reinsurance coverages for their clients with insurers and reinsurers.

According to Beinsure Data, the value of the worldwide market for insurance broking in terms of fees and commissions earned was around USD 160.4 bn in 2023, up from around USD 152 bn in 2022, equivalent to a growth rate of almost 10.5% without adjusting for inflation, but closer to 2% as an inflation-adjusted measure.

In the ranking, the TOP 5 remained the same as last year. However, there was a shuffle in the bottom half of the top 10. Acrisure LLC moved from #9 to #7; Alliant Insurance Services Inc. jumped from 11th place to the eighth spot; Truist Insurance Holdings Inc. dropped to #9 from #7; and Lockton Inc. moved from #8 to #10.

Top 20 Global Insurance & Reinsurance Brokers by Revenue

| № | Re/Insurance Broker | Total Revenue (mn $) |

| 1 | Marsh McLennan | $19800 |

| 2 | AON | $12200 |

| 3 | WTW | $9000 |

| 4 | Arthur J. Gallagher | $6900 |

| 5 | Hub International | $3230 |

| 6 | Brown & Brown | $3050 |

| 7 | Acrisure | $2970 |

| 8 | Alliant Insurance Services | $2900 |

| 9 | Truist Insurance Holdings | $2880 |

| 10 | Lockton | $2800 |

| 11 | USI Insurance Services | $2300 |

| 12 | AssuredPartners | $2040 |

| 13 | NFP Corp. | $1900 |

| 14 | Amwins Group | $1800 |

| 15 | Howden Group Holdings | $1570 |

| 16 | The Ardonagh Group | $1300 |

| 17 | CBIZ | $1100 |

| 18 | EPIC insurance Brokers & Consultants | $806.1 |

| 19 | AmeriTrust Group | $667.6 |

| 20 | Fanhua | $513.3 |

These brokers are essential in helping clients manage risk and secure the most appropriate and cost-effective insurance solutions.

For insurance professionals and underwriters, understanding the functions, challenges, and opportunities associated with these brokers is crucial for navigating the complex landscape of the global insurance market.

Global Insurance & Reinsurance Brokers, $ mn

A bar chart illustrating the re/insurance brokers by their total revenue in millions of dollars. Each bar represents a different broker, with the length of the bar indicating the scale of their total revenue. This chart provides a clear comparison of the re/insurance brokers in terms of their financial scale in revenue.

2024 will also see brokers’ EBITDA margins hold steady through strong organic revenue growth and good expense controls.

Re/Insurance brokers will maintain solid EBITDA margins through 2024 and beyond through strong organic revenue growth and good expense controls. Interest coverage for investment-grade and speculative-grade brokers declined slightly over the past couple of years because of higher market interest rates.

Higher borrowing costs and persistently high purchase multiples will slow the pace of acquisitions. Despite a slowdown in transaction activity, insurance brokers will continue to make strategic platform and tuck-in acquisitions to enhance their product capabilities, geographic reach and economies of scale.

Ownership/management succession as well as access to industry/product specialties, better data and analytics, and more favourable terms from insurance carriers, are some causes that have prompted brokers to sell.

Another factor contributing to a stable outlook for 2024 is that insurance brokers have tapped debt markets early in the year and pushed maturities.

The aggregate debt of brokers has grown over the past decade to about $125 billion as of March 2024. Brokers have had good access to the debt markets through the recent years of rising Treasury rates and fluctuating credit spreads.

Higher Treasury rates partly offset by declining credit spreads have led to somewhat higher but manageable borrowing costs on average. Most insurance brokers have refinanced their debt and extended maturities to 2027 and beyond.

Insurance brokers’ regular investment in technology, data and analytics and cybersecurity – mainly used to enhance the quality and efficiency of their operations, particularly interactions with insurance buyers and carriers – will remain in focus this 2024.

Most of them are investing in digitization, machine learning and robotics, and shifting their businesses to the cloud to improve data quality and accessibility.

With the rise in commercialization of generative AI, Moody’s explained, brokers are exploring its potential to boost operating efficiency. Analysts stated that early adopters could gain a competitive edge if these processes are deeply integrated into risk management practices.

Among these practices, cyber risk management is a priority for management teams to protect both existing and acquired operations, the report highlighted.

Functions of Global Re/Insurance Brokers

- Risk Assessment and Management: Brokers assist clients in identifying and assessing their risk exposures. They then design and implement insurance programs that address these risks effectively.

- Market Knowledge and Access: Brokers have extensive knowledge of the insurance market and maintain relationships with a wide range of insurers and reinsurers worldwide. This allows them to access the best possible coverage options for their clients, even for the most complex and unique risks.

- Policy Placement and Negotiation: They negotiate terms, conditions, and premiums with insurers on behalf of their clients, ensuring that the coverage meets the client’s needs at the most favorable terms.

- Claims Advocacy: In the event of a claim, brokers advocate for their clients, guiding them through the claims process and working to ensure a fair and prompt settlement from the insurer.

- Consulting and Advisory Services: Beyond just placing insurance, brokers often provide additional value through consulting services, such as risk management consulting, market analysis, and compliance advice.

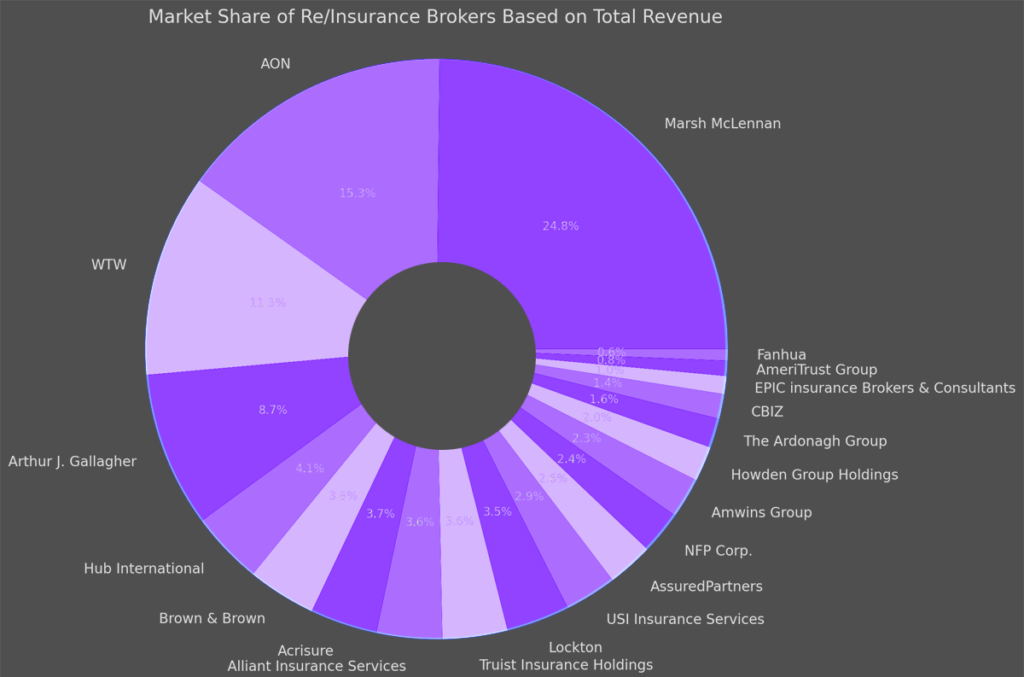

Global Re/Insurance Brokers market shares

Mergers and acquisitions activity continued to grow last year with 1,034 total deals, 30% higher than the 795 recorded in 2023, according to Optis Partners’ North American Agent & Broker Year-End Merger & Acquisition Report. Acrisure led all buyers with 122 transactions in 2021, outpacing its five-year average of 104 deals per year, the report said.

Hub International acquired 72 brokerages including an expansion into the Canadian market. Brown & Brown reports making 19 acquisitions of about $130 million in revenue. NFP closed 22 deals in North America and the United Kingdom.

The dealmaking continued in 2024, with an announcement last month that Howden Group Holdings plans to acquire TigerRisk Partners, subject to regulatory approvals.

The broking market is estimated to have broken down between around USD 68.8 bn due to commercial P&C insurance retail broking, USD 14.6 bn to private P&C retail broking, USD 50 bn to employee benefits plus life and health insurance retail broking, USD 6.4 bn to reinsurance broking and USD 11.6 bn to wholesale broking.

Noting that these data points omit tied agency and MGA / MGU activity among other elements.

Each of the segments registered a double-digit growth rate during the year apart from employee benefits plus life and health insurance retail broking; indeed, without adjusting for inflation, the top 20 broking groups together achieved an even higher aggregate growth rate of 11.7% albeit this was driven in part by M&A activity.

Challenges Facing Global Insurance & Reinsurance Brokers

- Regulatory Compliance: Navigating the complex and often varying regulatory environments across different jurisdictions remains a significant challenge.

- Technological Disruption: The rise of insurtech startups and digital platforms is changing how insurance is bought and sold, requiring traditional brokers to innovate and adapt.

- Market Fluctuations: Economic downturns, changing risk landscapes (e.g., climate change, cyber threats), and market capacity can affect the availability and cost of insurance coverage.

- Competition: The brokerage industry is highly competitive, with firms competing on service, expertise, and price. Maintaining differentiation and client loyalty is a constant challenge.

Opportunities for Re/Insurance Brokers

- Specialization: By specializing in specific industries or types of coverage, brokers can offer deep expertise and tailored solutions that add significant value for clients.

- Technology Integration: Leveraging technology to enhance service delivery, improve operational efficiency, and offer innovative solutions can help brokers stay competitive and meet evolving client expectations.

- Emerging Risks: The constant emergence of new risks, such as those associated with technology or climate change, presents opportunities for brokers to develop new insurance solutions and advisory services.

- Globalization: As businesses continue to expand globally, the need for insurance solutions that cover multiple jurisdictions grows, offering brokers opportunities to facilitate cross-border insurance programs.

For insurance professionals and underwriters, working effectively with global insurance and reinsurance brokers requires an understanding of their strategic importance, the services they offer, and the ways in which they can add value to the insurance process.

Collaboration between insurers, underwriters, and brokers is essential for developing comprehensive, innovative insurance solutions that meet the needs of today’s diverse and dynamic risk landscape.

……………………

Edited & fact-checked by Oleg Parashchak – Editor-in-Chief Beinsure Media, CEO Finance Media Holding.