According to a ranking published recently by Insuramore for the global commercial P&C insurance market, 145 insurer (carrier / underwriter) groups had GDPW (gross direct premiums written) in this category of more than USD 1 billion. Furthermore, at 103, just over a half of the top 200 groups recorded a double-digit increase in their commercial lines GDPW in that year (not adjusted for inflation) and ten of these groups achieved growth of more than 50%. Among these latter competitors were Convex Group, Fidelis Insurance Holdings, RenaissanceRe and Trisura Group, for example, plus Intact Financial Corporation which advanced strongly in part through its acquisition of RSA’s activities (outside of Scandinavia).

- Allianz had the highest GDPW from commercial P&C insurance, followed in descending order by AXA, PICC, Zurich and Chubb;

- together, these five largest groups had a combined global market share of commercial lines GDPW of 15.9% and the top 20 groups took a combined share of 41.6%;

- with regards to the top 20 groups, which were the same in 2021 as they had been in the previous two years (albeit with some changes to their order), this combined share was scarcely changed from 2019, when it had been 41.9%, and 2020, at 41.5%.

Overall, total worldwide GDPW in the commercial lines market seem highly likely to exceed USD 1 trillion in value for the first time in 2022.

Growth is occurring because of several factors including a buoyant commercial specialty market (particularly in North America), rising premiums brought on by the increasing incidence of severe weather events (e.g. insurance for agricultural enterprises) and, of course, inflation.

On the other hand, a deteriorating economic environment could subdue progress in standard commercial lines cover acquired by small and medium-sized businesses, in 2023 if not in 2022.

Another factor that may cause the global market value to move ahead less strongly in 2022 than might otherwise have been the case is the strength of the US dollar relative to most other major currencies.

Gross direct premiums written for commercial property and casualty (p&c / non-life) insurance, 2019-2021 ($ bn)

| Rank | Insurer group | GDPW, 2019 | GDPW, 2020 | GDPW, 2021 | CAGR, 2019/ 2021 | Approximate global market share |

| 1 | Allianz | 29,86 | 30,62 | 32,47 | 4,3% | 3,38% |

| 2 | AXA | 31,22 | 30,81 | 31,92 | 1,1% | 3,32% |

| 3 | PICC | 30,21 | 28,73 | 30,93 | 1,2% | 3,22% |

| 4 | Zurich | 22,64 | 23,90 | 28,65 | 12,5% | 2,98% |

| 5 | Chubb | 22,71 | 24,09 | 28,58 | 12,2% | 2,98% |

| All other insurer groups / insurers | 700,87 | 726,85 | 807,44 | 84,11% | ||

| Approximate global total | 837,50 | 865,00 | 960,00 | 100,00% |

Data includes acquisitions completed by end December 2021 but not ones agreed by that date but scheduled for completion in 2022. In aggregate, syndicates at Lloyd’s of London had GDPW for total P&C insurance of USD 32.71 billion in 2021 – however, most of these syndicates belong to insurer groups that already feature in the ranking hence Lloyd’s of London is not itself included in it apart from the Brussels-based and China-based companies belonging to the Society of Lloyd’s.

Insuramore’s analysis of gross direct premiums written (GDPW) for commercial P&C (non-life) insurance of insurer groups in 2021 – with comparative data also included for 2019 and 2020 – covers up to the top 200 groups worldwide by this measure.

Together, 200 groups accounted for an estimated 85.6% of total global GDPW for this line in 2021.

Commercial P&C insurance is defined as property and casualty (non-life) insurance acquired by business enterprises (including the self-employed), the public sector and not-for-profit entities comprising commercial auto (motor) insurence, liability (e.g. D&O, professional) and property insurance plus other commercial lines cover including (but not limited to) business interruption, commercial cyber, group accident (but not health), legal protection, MAT (marine, aviation and transport insurance), surety, trade credit and workers’ compensation insurance.

For insurer groups with financial year ends that occur in a month other than December, Insuramore presents data that includes a part of 2022 (e.g. end of March 2022 for many Japan-based groups).

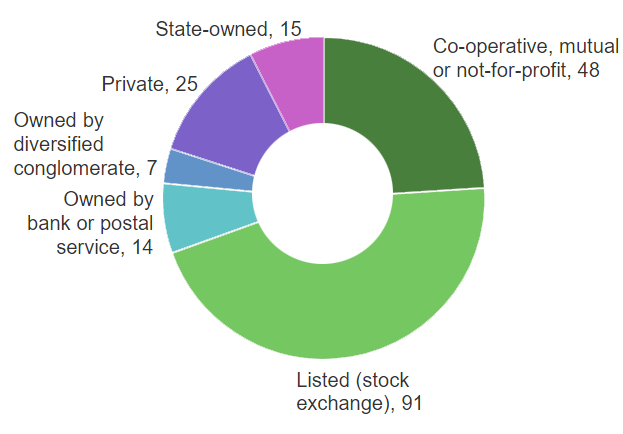

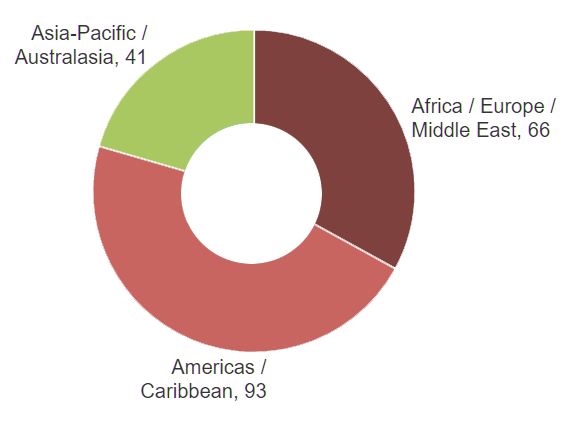

In 2021, the top 200 insurer groups by this measure segmented by type and by home region as shown in the following two charts.

Segmentation by Type and by Home Region of the Top 200 Insurer Groups Worldwide

Many insurer groups reporting results in currencies other than US dollars and with little or no exposure to the US insurance market will slip down the global ranking as their GDPW will be worth less in US dollar terms when converted; in contrast, groups headquartered in the US and Bermuda, which accounted for 78 of the top 200 commercial lines competitors in 2021, are set to become more numerous in the next ranking.

Due to its status as an insurance marketplace, note that Lloyd’s of London, which had commercial lines GDPW of around USD 32.7 billion in 2021, is not counted as a group in this analysis (although would be ranked first if it were).

While some M&A activity has been taking place in the global non-life sector, the launch and development of fast-growing commercial lines specialists, which include various fronting insurers, mean that significant consolidation has not occurred.

Moreover, another trend affecting the worldwide market structure and causing it to remain keenly competitive is the increasing propensity of groups mainly focused on reinsurance (e.g. Everest Re and Munich Re, as well as RenaissanceRe) to transact direct business.

………………………..

by

by