The intensity and spread of inflation is sending insurance claims costs soaring. Strong rate hardening in commercial insurance lines and acceleration in personal lines rates support topline growth, but higher claims severity is eroding the profitability benefit.

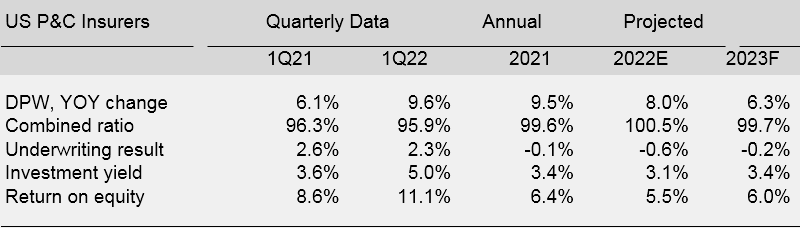

Swiss Re Institute maintain forecast for nominal direct premiums written (DPW) growth at 6.3% in 2023 and 8% in 2024.

Risks are skewed to the downside, but analytics revise up 2023 midpoint return on equity (ROE) estimate to 5.5%. Swiss Re maintain 6% ROE forecast for 2024.

Light catastrophe activityand reserve releases supported underwriting results, but we continue to expect a difficult year for the industry. According to Natural & Man-Made Catastrophe Loss Outlook, the effects of surging inflation on claims costs are only partly offset by the investment benefit from higher interest rates.

What Is Property and Casualty Insurance?

Property and casualty insurance is actually an umbrella term which includes many forms of insurance. Homeowners insurance is one type of property and casualty product, as is renters insurance, auto insurance, and powersports insurance. The term property and casualty insurance typically contains two primary coverage types: liability coverage and property protection coverage.

As it relates to a homeowners insurance policy, property and casualty insurance may cover your belongings and/or another individual’s expenses in the aftermath of an accident occurring from the result of your negligence.

For instance, if a guest suffers an injury in your home as a result of your negligence, property and casualty can cover their medical bills, pain and suffering, and loss of income. Negligence would come into play if, for instance, you have put off repairing broken stairs in your home and your guest is injured on these stairs as a result.

Property and casualty insurance may also help cover legal fees in the event you are sued by that individual. However, property and casualty insurance can also cover losses relating to your home and belongings in the event of a covered accident.

Most P&C insurance is annually renewable, so actuaries practising in this area measure risks over a relatively short time horizon, in contrast to life insurance actuaries who must assess exposures lasting several years into the future (see Global Ranking of the TOP-10 P&C (non-life) Insurer Groups).

In P&C insurance, the amount of the claim will not be known, sometimes for several years, as may be the case with liability insurance.

Again, this is in contrast to life insurance, where the amount of insurance (and benefits) is often defined contractually.

As a result, P&C actuarial training is very specific. The vast majority of P&C actuaries have written exams offered through the Casualty Actuarial Society, which specializes in topics related to P&C insurance.

For homeowners or car owners, it’s important to have casualty insurance as damage can end up being a large expense. In addition to auto and liability insurance, casualty insurance is an umbrella term traditionally used to describe many other types of insurance, including aviation, workers’ compensation, and surety bonds.

Casualty Insurance & Business

If you own a business, you should consider a few different types of casualty insurance, depending on what you do. One essential type of casualty insurance for businesses is workers’ compensation insurance, which protects a company from liabilities that arise when a worker is injured on the job.

There are also policies available for cyberfraud, employee theft, and identity thef. If you primarily do business online, check if your policies cover your website. If you depend on computers to run your business, you might want to insure the computers in a separate policy.

Most business owners need to have casualty insurance coverage because, if you produce something, the possibility exists that it may end up harming someone.

Even if you are a sole proprietor, it’s a good idea to carry insurance that is specific to your line of work. For example, if you’re a freelance auto mechanic who works from your shop, you likely won’t need workers’ compensation coverage, but you should have insurance that covers a situation in which a repair you made causes injury to a customer.

Property & Casualty Insurance Outlook

Premium growth has been resilient, but we expect a slowdown in 2023 as the US economy enters a likely recession.

Profitability: we raise 2023 estimate for US P&C ROE to 5.5% from 4.5% and continue to forecast modest improvement to 6% in 2023.

In 1Q22 industry net income was USD 29.3 billion for an 11.1% annualized ROE, or 7.1% adjusted for two large intracompany transactions. Unadjusted net investment income of USD 28.1 billion, including net realized capital gains of USD 4.4 billion, drove the quarterly result.

In addition to inflation and geopolitics, results continue to be pressured by behavioral shifts since the start of the pandemic. 2021 was the deadliest year for traffic fatalities since 2006 – a statistic that also indicates higher motor claims severities. Liability lines remain affected by social inflation, with the effects expected to become increasingly evident in paid claims.

Underwriting profitability: we revise our estimate of the 2022 US P&C combined ratio to 100.5% from 101%, improving to 99.7% in 2023.

In 1Q22, the industry’s reportedcombined ratio was 96.3%. Reserve releases of USD 5.3 billion subtracted 3.0 points from the accident period combined ratio of 99.3%. We expect favorable development to slow as inflation weakens prior year reserves adequacy, courts reopen and liability claims develop.

Catastrophe losses of USD 5.6 billion contributed 3.2 points, well below the prior-year result affected by winter storm Uri (8.4 points) and 1 point below the 1Q average. Looking forward, for the seventh consecutive year scientists expect an above-average hurricane season (which started on 1 June).

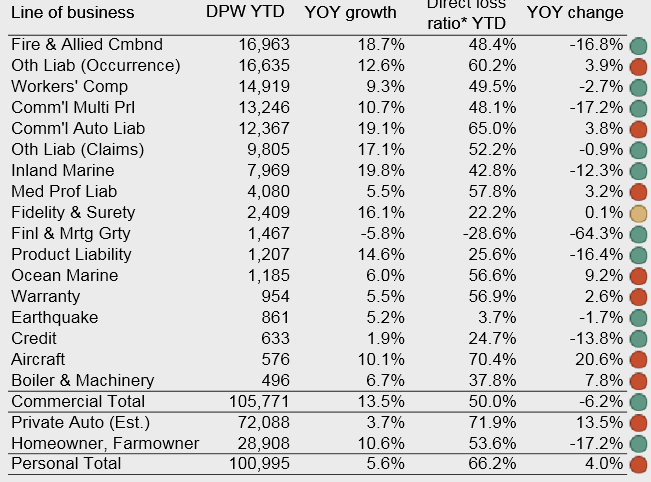

YTD premium growth and loss ratios by line of business

Broad-based inflation affects the industry across the board, with the impact especially evident in personal lines

Despite improvement in insurance property lines after a light cat quarter, the overall industry loss ratio was broadly in line with the prior year, indicating a potentially difficult result if cats are in line with historical averages. Property lines face pressure from the rising costs of materials, components and wages. We forecast construction costs to increase 9% in 2023 and 11% in 2024.

US CPI inflation data for June 2023 confirmed that auto lines face ongoing pressures as well, with yoy increases in prices of used cars and trucks (+7.1%) and the cost of motor vehicle body work (+14.4%) exceeding rises in personal auto insurance rates (+6.0%).

Commercial Insurance rate increases are generally viewed to have kept up with claims trends since 2019, while personal lines fell behind in the first year of the pandemic and are still attempting to catch up. The difference was stark in 1Q22, with commercial lines pure loss ratios 16 points below personal lines. But the industry needs strong rate increases across the board to manage inflation.

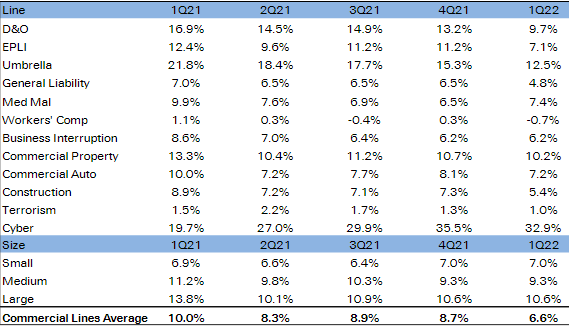

Commercial rate gains decelerated noticeably in 1Q22, but there are indications of a second-quarter pickup

Price trends: rate increases are set to continue. The latest CIAB survey reported thataverage rates for commercial lines increased by 6.6% yoy, decelerating from an 8.7% gain. Willis Towers Watson’s CLIPS index showed a similar 6% increase after a 7% increase.

Looking at more recent monthly data, the IVANS index (which is adjusted for exposure) showed accelerating premium increases. We expect rate increases through 2022 as economic inflation, social inflation and disruptions due to the pandemic raise claims and operating costs. In states such as Florida, which are affected by both climate change and adverse litigation trends, rate increases exceed the national average.

Personal lines rate increases have accelerated

Rate rises requested in personal lines rate filings have continued to accelerate in step with the spikes in material and labor costs, as well as a deteriorating claims experience from riskier driving behaviors. Based on partial statutory data, both personal auto and homeowners’ requested rate increases have accelerated to above 5%. This is the highest quarterly rate increase since before the pandemic started.

Premiums written for standalone cyber insurance policies nearly doubled

In June, top US cybersecurity officials reiterated the need for organizations to maintain extra vigilance against damaging cyber intrusions.

The Ukraine war has elevated the threat of cyberattacks globally. Known breaches in the US have not yet increased as a result, and it is unclear whether it is a result of hackers’ focus shifting to military operations, heightened cyber defense vigilance, or other factors. But nation states continue to use cyberattacks proactively and persistently.

Data from the National Association of Insurance Commissioners’ cyber insurance supplement published in May confirmed that the market has grown rapidly in response to elevated risk and awareness.

Cyber insurance direct premiums written grew 74% in 2021, and standalone policies saw a 92% increase. We expect strong growth to continue but rate gains to decelerate as recent rises lead insurers to commit more capacity to cyber risk.

Growth: we maintain our DPW growth forecast at 8% for 2023 and 6.3% for 2024. Direct premiums written grew by 9.6%, in nominal terms. Commercial lines premium. grew 13.5%, and personal lines premiums were up 5.6%. We expect strong nominal growth in 2022 as insurers attempt to achieve rate gains that keep up with or exceed loss-cost increases.

Commercial and Personal insurance rates are converging, with commercial lines increases decelerating slightly from high levels and personal auto and homeowners accelerating in an attempt to catch up with inflation.

Combined with still-strong exposure growth despite recessionary fears, we maintain our nominal growth estimate for this year at 8.0% before slowing next year with GDP growth.

US P&C Insurance Sector outlook

Source: S&P Global, statutory filings, Swiss Re Institute

Investment income: we revise up our expected investment yield for 2022 to 3.1% from 3% due to faster interest rate rises in response to inflation.

Net investment income earned by the industry in 1Q22 was USD 13.0 billion, compared to USD 13.3 billion in 1Q21. Realized capital gains of USD 4.4 billion in 1Q22 were down from USD 5.3 billion in 1Q21 but still exceeded expectations.

The total investment yield was 3.1%. This figure excludes an intracompany transfer from a noninsurance affiliate at Berkshire Hathaway that added USD 10.75 billion to the industry investment result. We continue to expect the increased yield from rising interest rates to be largely offset by a decline in realized capital gains in the near term.

Since only one-tenth of the long-term bond portfolio matures each year, the effects of interest rate increases on sector earnings accrue gradually, but strong increases in yields through 2Q22 are boosting reinvestments (see our review 7 Strong Smart Investment Strategies).

The 10-year Treasury yield reached 2.98% by 30 June, up by 0.66 percentage points in 2Q22 and by 1.50ppts YTD.

Credit spreads continue to widen as investors become more risk averse. By next year, with more of the portfolio reinvested at higher yields, we revise up our 2023 estimate for investment yield to 3.4% from 3.2%.

We estimate that the yield and spread increases have reduced the market value of the industry bond portfolio by roughly USD 100 billion. The impact is not reflected in statutory surplus (capital) and does not impact yield calculations, but it would equate to a 12% decrease in statutory surplus.

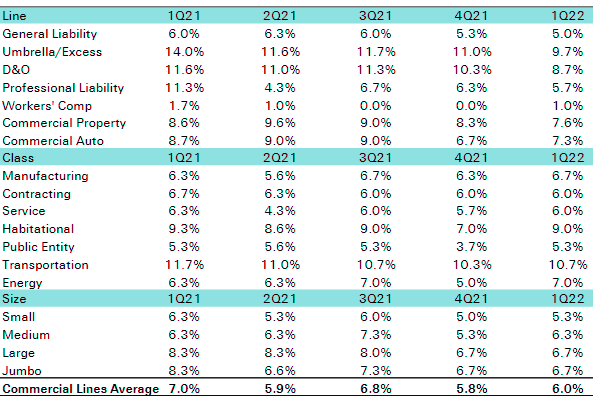

US P&C pricing trends – CIAB

According to the latest CIAB survey, commercial lines prices increased 6.6% in 1Q22, a deceleration from 4Q21.

Cyber is the fastest-increasing line, with rates up nearly 33% in 1Q22 according to CIAB.

According to D&O Insurance Insights, umbrella and D&O rate increases decelerated materially, but from a high level, as capacity responds to an extended period of rate increases.

Commercial property rates maintained their momentum, growing at a double-digit pace, while commercial auto decelerated slightly to 7.2%. Workers’ compensation rates remained effectively flat but dipped below even.

US P&C pricing trends – MarketScout

According to MarketScout, average commercial lines rates rose by 6.0% in 1Q22, accelerating toward the end of the quarter. Rates improved across all account sizes in 1Q22, with large and medium accounts seeing the strongest gains.

…………………………

AUTHORS: Thomas Holzheu – Chief Economist Americas Swiss Re Institute, James Finucane – Senior Economist Swiss Re Institute